Identity As A Service Market Insights, 2032

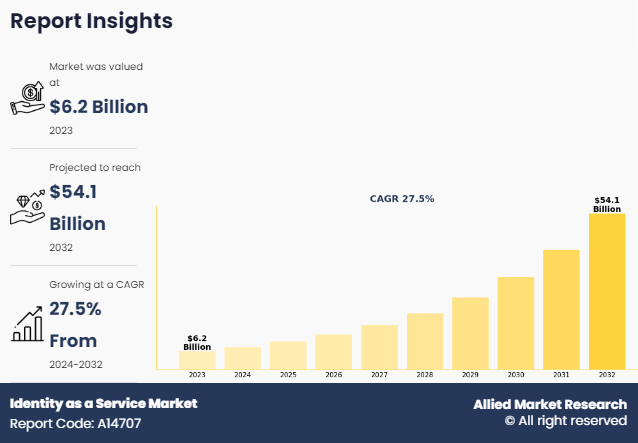

The global identity as a service market size was valued at $6.2 billion in 2023, and is projected to reach $54.1 billion by 2032, growing at a CAGR of 27.5% from 2024 to 2032.

Identity as a service (IDaaS) is the term used to describe identity and access management (IAM) services that are offered via the cloud and are paid for via subscription. IDaaS offers administrators protection from security problems due to its ability to automate a variety of user account-related operations. It reduces company risk and saves time and money by standardizing and automating crucial identity, authentication, and permission management components.

The global identity as a service market is currently experiencing significant growth, primarily driven by the growing number of cybersecurity breaches and identity-related fraud. As The outbreak of COVID-19 prompted a considerable proportion of routine activities and businesses to shift their operations online. This resulted in organizations and individuals throughout the world beginning to rely increasingly on digital media and communication networks. Cybercriminals started taking advantage of the situation to cause damage around the globe. The adoption of identity as a service solutions for compliance is further fueled by the increasing adoption of cloud computing and other connected technologies.

However, a significant challenge in this market is the lack of awareness regarding IAM solutions. The shortage of trained and well-observed employee force in organizations is mostly viewed in small & medium size organizations. In addition, concerns regarding the unavailability of skilled professionals, and minimizing the ability of organizations to implement and maintain effective cybersecurity solutions, these measures are likely to limit market growth. Consequently, the expertise factor impedes the wider adoption of these solutions, particularly among organizations with limited labor means.

Additionally, the major challenge to the growth of the global identity as a service market is the complexity of advanced threats and the fluctuating regulatory landscape. The increasing employment of advanced techniques such as polymorphic malware, zero-day exploits, and social engineering, is certainly restraining the adoption of identity-as-a-service solutions across the globe. However, the growing popularity of cloud-based IAM solutions and services and the rising adoption of emerging technologies such as AI, biometrics, and others is anticipated to emerge as a lucrative opportunity for the identity as a service market growth.

The report focuses on growth prospects, restraints, and trends of the identity as a service market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the identity as a service market.

Segment review

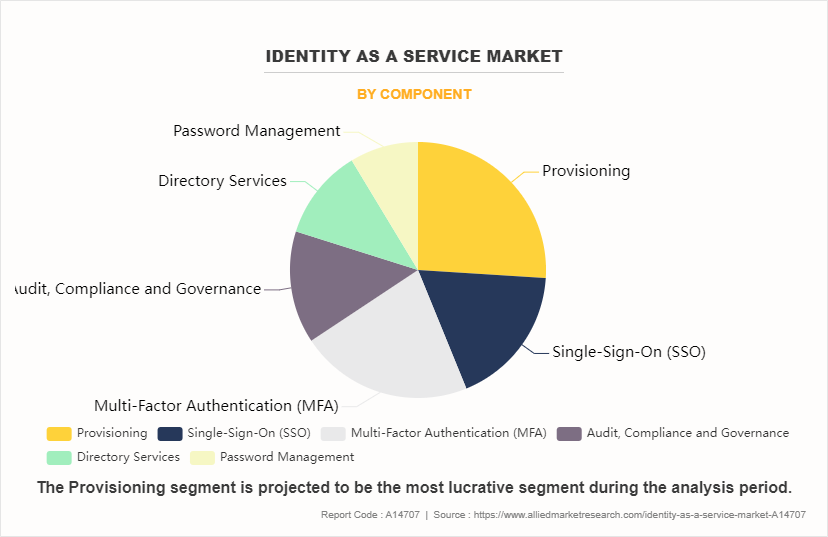

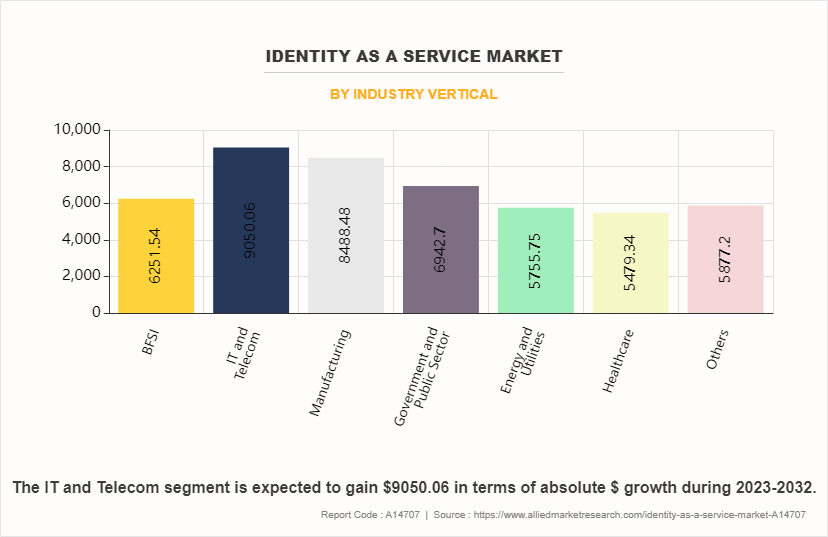

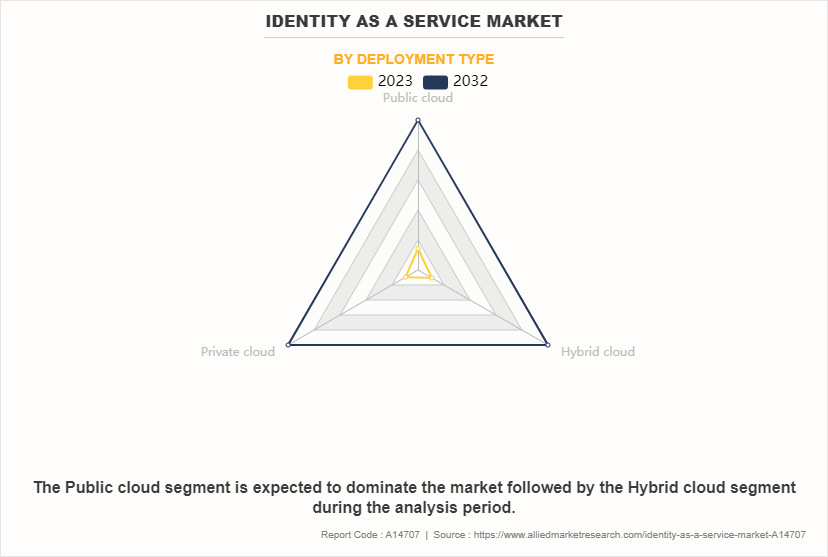

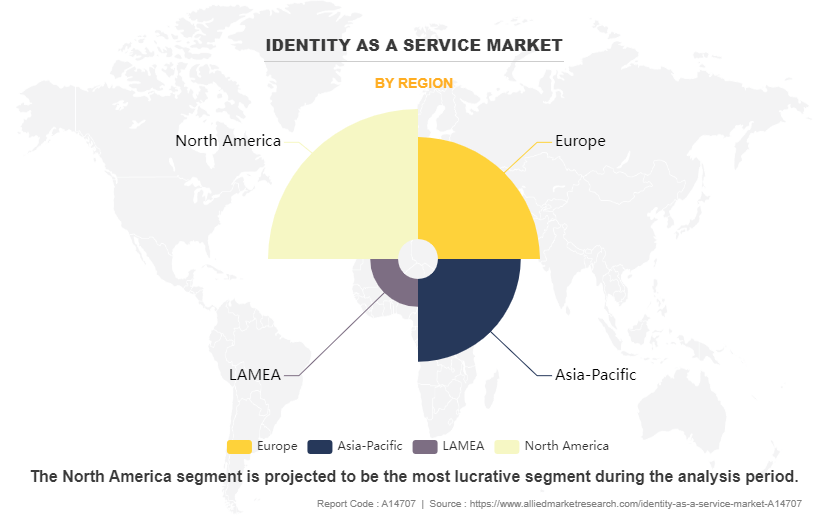

The global identity as a service market size is segmented on the basis of component, enterprise size, deployment type, industry vertical, and region. On the basis of component, it is segregated into provisioning, single-sign-on, advanced authentication, audit, compliance and governance, directory services, and password management. On the basis of enterprise size, it is segregated into large enterprises and SMEs. On the basis of deployment type, it is segregated into public cloud, private cloud, and hybrid cloud. On the basis of industry vertical, it is segregated into BFSI, IT and telecom, energy and utilities, government, manufacturing, healthcare, retail and consumer goods, and others. On the basis of region, it is divided into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of deployment type, the global identity as a service market share was dominated by the public segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to the optimal deployment paradigm for managed services like business services, network services, and data center services is growing in popularity, which leads to market growth. However, the private cloud segment is expected to witness the highest growth, the private cloud strategy allows enterprises more flexibility by distributing workloads across the cloud and on-premises which leads to market expansion.

By region, North America dominated the market share in 2023 for the identity as a service market. The region has increased adoption of advanced technologies, innovations, and infrastructure, which is further anticipated to propel the growth of the identity as a service market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. The region is experiencing a rise in demand for digitalization and high internet penetration, which is expected to provide lucrative growth opportunities for the market in this region.

Competition Analysis:

Competitive analysis and profiles of the major players in the CyberArk, Google LLC, IBM Corporation, Microsoft Corporation, Okta, OneLogin, Inc., Oracle Corporation, JumpCloud, Inc., SailPoint Technologies, and Thales. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the identity as a service market globally.

Top Impacting Factors -

Increase in the number of identity frauds

The emergence of COVID-19 caused a significant number of regular activities and enterprises to relocate their operations online. This resulted in organizations and individuals throughout the world beginning to rely increasingly on digital media and communication networks. Cybercriminals started taking advantage of the situation to provoke cybercrime around the globe. According to the FBI’s‐¯Internet Crime report 2023, 880,418 complaints of cybercrime were reported to the FBI by the public, which was a 10% increase from 2022. The potential total loss increased to $12.5 billion in 2023, up from $10.3 billion in 2022. California, Texas, and Florida had the highest number of cybercrime victims.

Such instances further increase the awareness about cybersecurity solutions, which in turn contribute to accelerating the growth of the global market. In addition, the supportive government policies and increase in investment by public and private authorities in security standards are positively impacting the market growth. Several regional governments are making strategic investments in expanding security operations. Governments around the globe are recognizing the importance of cyber security and data protection in the digital age and integrating proactive measures to safeguard end-users and businesses from cyber threats. Therefore, identity as service solutions gained wider traction among end-users, which in turn, is expected to fuel robust market growth.

Data privacy issues involving consumer information

Security and privacy maintenance of data have become complex owing to an increasing amount of data in several industries. In addition, concerns regarding the security of sensitive data are on the rise due to increase in volume of data generation on IoT devices. Further, the increased use of IoT and other digital technologies, in particular for networking a large number of projects, has given rise to new threats and hazards associated with IT security. These threats include infiltration of malware through removable media and external hardware, human error and sabotage, social engineering and phishing, distributed denial of service (DDoS) attacks, technical malfunction, and force majeure, among others.

These threats cause data operations to be restricted in an unplanned manner, which negatively impacts punctuality and allocation of resources in the identity as a service. Moreover, to avail routine inspection services, it is mandatory to provide financial details to some extent. Thus, security and privacy concerns about consumer details and other confidential information cause unethical privacy, which is hindering the growth of the market. IDaaS is a cloud-based authentication architecture that delivers all the advantages of the cloud, including better management, a wider variety of integration choices, and a smaller on-site infrastructure.

However, it presents compliance and control challenges for businesses. Compliance configurations can significantly reduce a company's effort, but they also imply that security and compliance are not entirely within the company's control. This means that in the event the provider runs into any technical or security problems, it could have a negative impact on the business in the form of a security breach, a non-compliance fine, or even worse.

The traditional firewalls no longer shield the identity management service requirements when it is migrated to the cloud, making it accessible to the public on the internet. If a business plans to employ an IDaaS system, it must ensure the security of the network and its data.

Moreover, when identity management is transferred to the cloud, a number of problems arise with regard to auditing, assuring regulatory compliance, and the potential for leakage. No laws exist that outline how an identity supplier must offer security measures to prevent data breaches. Most cloud providers' terms, conditions, and SLAs differ from those seen in an office environment. Adopting IDaaS solutions through cloud migration is a challenge in terms of regulatory compliance and may lead to a significant increase in risk. This can hinder the market growth.

The integration of evolving technologies

The increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies in the identity as a service market has proliferated the demand for the global identity as a service industry. Advanced AI technology is used to offer personalized outcomes that are appropriate for the needs and preferences of the consumers. AI systems that are more sophisticated target specific audiences on the basis of previous interactions and customer data. In addition, technical developments accelerate the digital transformation initiatives to recover lost time, reduce the cost of customer service, and de-risk traditional business models. Thus, technological breakthrough in the development of security infrastructure led to a surge in demand for AI and ML to improve efficiency for real-time monitoring and control. These factors are expected to propel the identity as a service industry growth.

Further, implementation of AI and ML technologies helps determine specific inefficiencies and thereby avoid them by simulating business processes in different scenarios. It also prevents the anticipated process inefficiency through predictive simulation. Hence, several companies and government authorities are leveraging advanced technologies intending to improve the maintenance and efficient monitoring of personalized content. For instance, in April 2023, Arista Networks launched a cloud-delivered, AI-driven network identity service for enterprise security and IT operations. Based on Arista’s flagship CloudVision platform, Arista Guardian for Network Identity (CV AGNI) expands Arista’s zero-trust networking approach to enterprise security. CV AGNI helps to secure IT operations with simplified deployment and cloud-scale for all enterprise network users, their associated endpoints, and Internet of Things (IoT) devices. These technical developments in improved identity as a service solution are expected to offer numerous opportunities for market growth.

Recent Partnerships in the Identity as a Service Market:

For instance, in July 2022, Delinea partnered with Authomize, to provide the comprehensive security necessary to enforce least privilege across cloud environments. Thus, such strategies are further expected to propel numerous growth opportunities for the global identity as a service market.

Recent Product Launches in the Identity as a serviceMarket:

For instance, in December 2022, CloudIBN launched its identity as a service offering. This suite of IAM products is expected to help businesses ensure that the data remains secure, while also providing an efficient way to manage user access control across the organization. Therefore, such strategies adopted by market players are increasing market competition and leading the growth of the Identity as a service market.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the identity as a service market forecast from 2024 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of identity as a service market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the identity as a service market segmentation assists in determining the prevailing Identity as a service market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global identity as a service market trends, key players, market segments, application areas, and market growth strategies.

Identity as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 54.1 billion |

| Growth Rate | CAGR of 27.5% |

| Forecast period | 2023 - 2032 |

| Report Pages | 337 |

| By Component |

|

| By Deployment Type |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | IBM Corporation, JumpCloud Inc., Okta, OneLogin, Inc., SailPoint Technologies, Inc., CyberArk Software Ltd., Oracle Corporation, Microsoft Corporation, Thales Group, Google LLC |

Analyst Review

Analyst’s Review: Identity as a Service Market

As the identity as a service market continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. Businesses recognize that security solutions may contribute to the integration and analysis of varied datasets from both internal and external sources. This may offer useful insights and promote data-driven decision-making, resulting in increased operational efficiency and a competitive edge. In addition, security technologies allow for the creation of personalized consumer experiences, customized product suggestions, and targeted marketing campaigns. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, adopting this security technology can help an enterprise establish itself as an industry innovator. Businesses recognize that by embracing these technologies, their companies may gain a competitive advantage by providing more intelligent and contextually appropriate goods and services. However, businesses also recognize the challenges associated with identity as a service solution. One potential risk is the complexity of implementation challenges, which can be complicated to deploy and use. This may require technical knowledge, which is further challenging for organizations to enhance their product offerings. In addition, identity as a service requires significant investment in software infrastructure and technological expenses, which can hamper the growth of the global industry.

Furthermore, interoperability issues between the network devices must be addressed. There can be incompatibilities between the software and hardware used by various identity as a service solutions, which is further expected to hamper the market growth. Businesses must integrate software or applications based on specific standards and protocols.

By addressing these challenges, companies can unlock the full potential of identity as a service to transform their business operations, create value, and gain a competitive advantage in their industry. For instance, in October 2023, Okta, Inc. launched Identity Threat Protection with Okta AI (Identity Threat Protection), a new product for Okta Workforce Identity Cloud that delivers real-time detection and response for identity-based threats. This allows admins and security teams to continuously assess user risk throughout active sessions, and automatically respond to Identity threats across their entire ecosystem.

The Zero Trust security model, which assumes that threats can come from both inside and outside the network, will see greater adoption. IDaaS solutions will increasingly focus on continuous verification of user identities, rather than a one-time authentication process.

Signle sign-on, multifactor authentication, access management, cloud identity management are the leading application of market.

North America is the largest regional market for Identity as a Service.

$54,082 million is the estimated industry size of Identity as a Service by 2032.

CyberArk, Google LLC, IBM Corporation, Microsoft Corporation, Okta, OneLogin, Inc., Oracle Corporation, JumpCloud, Inc., SailPoint Technologies, and Thales are the key companies in Identity as a Service market

Loading Table Of Content...

Loading Research Methodology...