Identity Theft Insurance Market Outlook - 2030

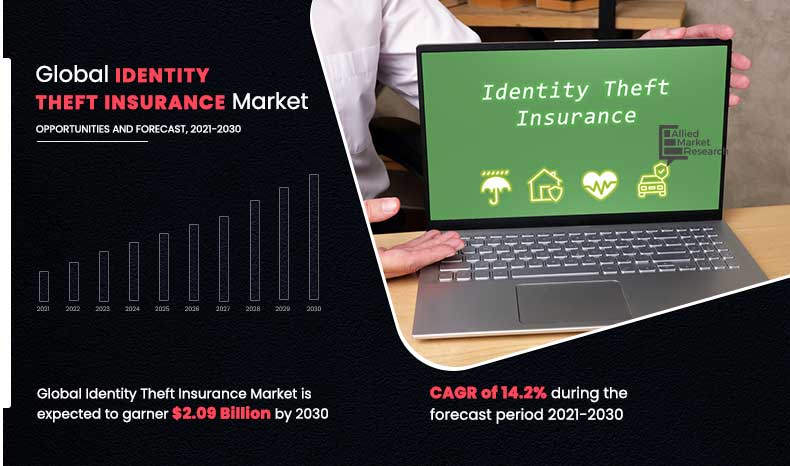

The global identity theft insurance market size was valued at $0.57 billion in 2020, and is projected to reach $2.09 billion by 2030, growing at a CAGR of 14.2 % from 2021 to 2030.

Identity theft insurance provides a coverage for such thefts and ensures that the damage caused due to the identity theft can be refurbished. The fraudsters & hackers have an ability to take the user's name and address, credit card or bank account details, social security number, and medical insurance account numbers. Moreover, identity theft insurance protects sensitive information of the customers from hackers, thus ensuring the customer is protected from fraudsters and scammers on the internet.

Increase in number of users on online platform owing to advancement in technologies and rise in adoption of electronic identification act as major drivers in the market. In addition, increase in crimes and frauds on digital platforms and misuses of digital credit cards are accelerating the identity theft insurance market growth. However, lack of awareness along with less features offered in insurance cover hamper the growth of the market.

On the contrary, developing economies offer significant opportunities for identity theft insurance companies to expand their offerings, owing to factors such as growth in the middle-class segment, rapid urbanization, rise in literacy level, and increase in awareness for online platforms among youth generation. Moreover, increase in identity theft and data breaches is anticipated to provide a potential growth opportunity for the market.

The report focuses on growth prospects, restraints, and trends of the identity theft insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the identity theft insurance market outlook.

Segment Review

The identity theft insurance market is segmented into type, application, and region. By type, the market is differentiated into credit card fraud, employment or tax-related fraud, phone or utilities fraud, bank fraud and others. Depending on application, it is fragmented into individuals and business. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific would exhibit the highest CAGR of 17.8% during 2021-2030

Competitive Analysis

The key players operating in the global identity theft insurance market include Allstate Insurance Company, Aura, Chubb, Experian, GEICO, IdentityForce, Inc., IDShield, McAfee, LLC, NortonLifeLock Inc., and Nationwide Mutual Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the identity theft insurance industry.

COVID-19 Impact Analysis

COVID-19 pandemic has a significant impact on the identity theft insurance, owing to increase in usage and adoption of online & digitalized platforms among consumers globally. Identity theft insurance cost are experiencing massive growth as consumers are getting familiar with the risks related with electronic identification technologies in the market. Moreover, fraudsters have been engaged to steal information for abuse as a result of the speedy deployment of new programs and alterations in tax-date extensions and direct stimulus payments in response to COVID-19. Hence, the identity theft insurance market has experienced a negative impact during the global health crisis.

Top impacting factors

Increase in the Number of Credit Card Users

Credit card fraud accounts for the vast majority of market share, as demand for credit card-related protection services has increased with the number of credit card consumers. Furthermore, due to rise in demand for online financial transactions, bank fraud is expected to rise at the highest rate. In addition, hackers have seized on utility customers by using growing energy and phone bills to obtain financial and personal information. Therefore, as the number of credit card holder increase, the need for identity theft insurance simultaneously rises. This is a major factor for the market growth.

By Type

Bank Fraud segment will grow at a highest CAGR of 18.6% during 2021 - 2030

Rise Digitalization in Developing Countries

The increased penetration of smartphones and other devices has aided the digitalization of the developing economies. Moreover, the adoption of digital payments and e-commerce has provided lucrative opportunities for the growth of the identity theft insurance market. Furthermore, rise in cybercrimes and data breaches due to rapid digitalization will be a key factor for the growth of identity theft insurance market in developing economies. This factor is anticipated to provide opportunities for the growth of the market in the coming years.

Rising Cybercrimes

The global identity theft insurance market is projected to be driven ahead by factors such as the growing frequency of cybercrime and identity theft, as well as the expanding usage of electronic identification and other advanced technologies. Furthermore, growing concerns about cybercrime and identity theft, as well as the fear of data exploitation, are likely to drive the global identity theft insurance industry ahead.

Moreover, the insurance providers are also collaborating with firms to strengthen the identity theft protection systems. For instance, Nationwide, an insurance and financial services firm, had introduced personal cyber security services as part of its identity theft protection programme in October 2020, in collaboration with Generali Global Assistance (GGA). These services were made available to Nationwide customers in order to help them protect themselves from an increasing number of cyberattacks and threats. This is a major driving factor for the growth of the market.

By Application

Individuals segment accounted for the highest market share in 2020.

Key Benefits For Stakeholders

- The study provides in-depth analysis of the global identity theft insurance market share along with current trends and future estimations to illustrate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the global identity theft insurance market size are provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the identity theft insurance market.

- An extensive analysis of the key segments of the industry helps to understand the identity theft insurance market trends.

- The quantitative analysis of the global identity theft insurance market forecast from 2021 to 2030 is provided to determine the market potential.

Identity Theft Insurance Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

With enabling data security and preventing data breaches, the identity theft insurance market is expected to grow in the upcoming years. Moreover, consumers continue to buy identity theft insurance to protect their digital identity. In addition, several key players are enhancing & providing additional features, options and offerings by directing customers to buy a better plan for their coverage. Furthermore, with the rise in digitalization, the cybercrime rate has increased significantly and instances of identity theft has also grown rapidly. Therefore, demand for identity theft insurance is anticipated to grow tremendously in the upcoming years.

The COVID-19 outbreak has a significant impact on the global identity theft insurance market, and has increased the growth of the market. Moreover, during this global health crisis, the digitalization has increased rapidly, simultaneously the cases of identity theft have also increased as large number of people are using digital technologies to do their everyday work such as banking, shopping and others. Therefore, hackers are stealing their identity to gain access to the customers banking and personal details. Furthermore, these instances have rapidly grown during the pandemic. Thus, the demand for identity theft insurance has grown during the COVID-19 pandemic.

The identity theft insurance market is fragmented with the presence of regional vendors such as Chubb, Experian, and McAfee, LLC. Some of the key players profiled in the identity theft insurance market report include Allstate Insurance Company, Aura, GEICO, IdentityForce, Inc., IDShield, NortonLifeLock In, and Nationwide Mutual Insurance Company. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for identity theft insurance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The Identity Theft Insurance Market is estimated to grow at a CAGR of 14.2 % from 2021 to 2030.

The Identity Theft Insurance Market is projected to reach $2.09 billion by 2030.

To get the latest version of sample report

Factors such as Increase in number of users on online platform owing to advancement in technologies and rise in adoption of electronic identification drives the growth of the Identity Theft Insurance market

The key players profiled in the report include Allstate Insurance Company, Aura, Chubb, Experian, GEICO, IdentityForce, Inc., IDShield, McAfee, LLC, NortonLifeLock Inc., and Nationwide Mutual Insurance Company, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Identity Theft Insurance Market is segmented on the basis of type, application, and region.

The key growth strategies of Identity Theft Insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

subsegments of application are individuals and business.

Bank Fraud segment will grow at a highest CAGR of 18.6% during 2021 - 2030.

Loading Table Of Content...