IGBT and Super Junction MOSFET Market Research, 2032

The Global IGBT and Super Junction MOSFET Market was valued at $11.1 billion in 2021, and is projected to reach $33.1 billion by 2031, growing at a CAGR of 11.4% from 2022 to 2031

According to Himanshu Jangra, Lead Analyst, Semiconductor and Electronics, at Allied Market Research, the IGBT and super junction MOSFET market are expected to showcase remarkable growth during the forecast period of 2022 to 2031. The report contains a thorough examination of the market size, trends, key market players, sales analysis, major driving factors, and key investment pockets. The report on the IGBT and super junction MOSFET market provides an overview of the market as well as market definition and scope. The rise in demand for electric vehicles and aggrandized need in high power operating devices is significantly driving the growth of IGBT transistors and Insulated-Gate Bipolar Transistors in the automotive and consumer electronics sectors. In addition, the report provides a quantitative and qualitative analysis of the IGBT and super junction MOSFET market, as well as a breakdown of the pain points, value chain analysis, and key regulations.

IGBT commonly known as the insulated-gate bipolar transistor is a bipolar transistor with an insulated gate terminal designed to be used in various electronic devices and applications such as electric vehicles, consumer electronics, and more. Further, IGBT combines a control input with a MOS structure and a bipolar power transistor that serves as an output switch in a single piece of hardware. IGBT and super junction MOSFET is suitable for high voltage, high-current applications.

Metal Oxide Silicon Field Effect Transistors (MOSFET) are electronic components used in circuits to switch or amplify voltages. Further, the Si-MOSFETs can be classified as planar MOSFETs and super-junction MOSFETs according to the manufacturing processes used. Simply said, the super-junction structure was created in the field of power transistors to overcome the limitations of planar architectures.

The global IGBT and super junction MOSFET market is expected to witness notable growth during the forecast period, owing to increase dependence on electrical equipment and machinery. Moreover, aggrandized need for high voltage operating devices, which majorly drives the IGBT and super junction MOSFET market. Furthermore, an increase in emphasis on power saving is projected to shape the future of manufacturing industries by standardizing the processes.

However, limited operations and the high overall cost are one of the prime factors that restrain the IGBT and super junction MOSFET market growth. Further, the rise in government initiatives to establish HVDC and smart grids are projected to provide a lucrative opportunity to expand the IGBT and super junction MOSFET market during the forecast period.

Segment Overview

The IGBT and super junction MOSFET market is segmented into Type and Application.

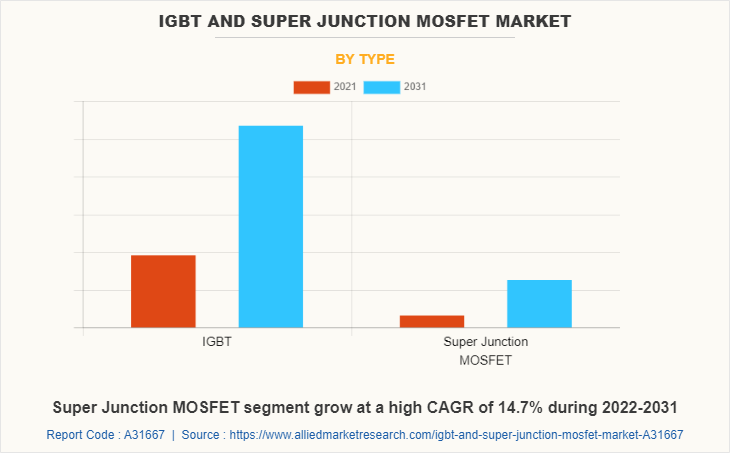

On the basis of type, the market is divided into IGBT (Discrete IGBT and IGBT Module) and Super Junction MOSFET. In 2021, the IGBT segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the super junction MOSFET segment is expected to emerge as the fastest-growing segment of the market during the forecast period 2022-2031.

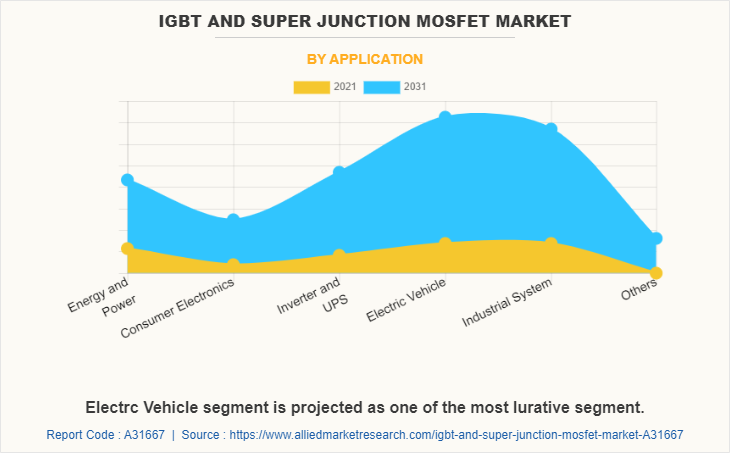

By application, the IGBT and super junction MOSFET market overview is classified into energy & power, consumer electronics, inverter & UPS, electric vehicles, industrial systems, and others. The industrial system segment dominated the market in 2021 in terms of revenue and is expected to dominate the market during the forecast period.

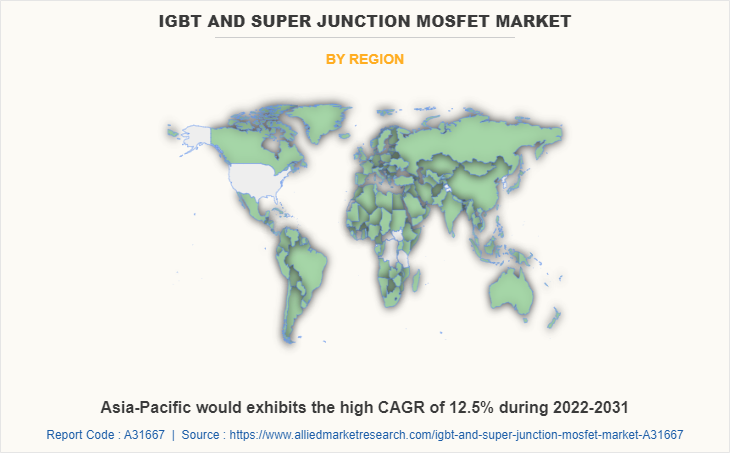

Region-wise, the IGBT and super junction MOSFET market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific, Specifically China, remains a significant participant in the IGBT and super junction MOSFET industry. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced electronics solutions driving the growth of the IGBT and Super junction MOSFET industry in the Asia-Pacific.

Competitive Analysis

Competitive analysis and profiles of the major global IGBT and super junction MOSFET market players that have been provided in the report include ABB Ltd., Infineon Technologies AG, STMicroelectronics, Toshiba Corporation, Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Renesas Electronics, NXP Semiconductors, Semikron International GmbH, and IXYS Corporation.

Country Analysis

Country-wise, the U.S. acquired a prime share in the IGBT and super junction MOSFET market in the North American region and is expected to grow at a high CAGR of 9.2% during the forecast period of 2022-2031. The U.S. holds a dominant position in the IGBT and super junction MOSFET market, owing to the rise in investment by prime vendors to boost automation and consumer electronics solutions.

In Europe, the UK dominated the IGBT and super junction MOSFET market in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. Furthermore, Germany is expected to emerge as the fastest-growing country in Europe's IGBT and super junction MOSFET with a CAGR of 12.3%, owing to a significant development in Industrial IoT, in the country.

In Asia-Pacific, China is expected to emerge as a significant market for factory automation, owing to a significant rise in investment by prime players in next-generation automation solutions to boost the IGBT and super junction MOSFET market. However, Japan is expected to emerge as a dominant country in IGBT and super junction MOSFET market in the Asia-Pacific region.

In LAMEA, Latin America garnered significant IGBT and super junction MOSFET market share in 2021 owing to the presence of prime vendors such as ABB Ltd, STMicroelectronics, Renesas Electronics, and others are significantly investing in IGBT and super junction MOSFET in Latin America. Moreover, the Latin America region is expected to grow at a high CAGR of 11.0% from 2022 to 2031.

Top Impacting Factors

Due to the rise in emphasis on power saving, the IGBT and super junction MOSFET market size is anticipated to expand significantly over the course of the forecast period. Additionally, increased dependence on electrical equipment and machinery significantly fuels the IGBT and super junction MOSFET market. Moreover, the aggrandized need for high-voltage operating devices is acting as a significant growth factor for the IGBT and super junction MOSFET market forecast. However, limitations in operations and high overall costs are acting as prime barriers to early adoption, which hampers the growth of the market. On the contrary, the rise in government initiatives to establish HVDC and smart grids is expected to offer potential growth opportunities for the Automation & Controls market during the forecast period.

Historical Data & Information

The IGBT and super junction MOSFET market analysis are highly competitive, owing to the strong presence of existing vendors. Vendors of IGBT and super junction MOSFET machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Infineon Technologies AG, Fuji Electric Co. Ltd., Mitsubishi Electric Corp., Semikron International GmbH, and Toshiba Corporation are the top 5 companies holding a prime share in the IGBT and super junction MOSFET market. Top market players have adopted various strategies, such as product launches, partnerships, diversification, product upgrade, and product development, to expand their foothold in the IGBT and super junction MOSFET market.

In September 2021, Infineon Technologies AG launched current ratings for its EconoDUAL 3 portfolio with TRENCHSTOP IGBT7 chips. With the broad range of current classes from 300 A up to 900 A, the portfolio offers inverter designers a high degree of flexibility while also providing increased power density and performance.

In October 2022, Infineon Technologies AG opened a factory in Cegléd, Hungary. The factory is dedicated to the assembly and testing of high-power semiconductor modules to drive the electrification of vehicles, which is key in the improvement of the world’s CO 2 balance.

In March 2021, Toshiba launched 650V super junction power MOSFETs, TK065U65Z, TK090U65Z, TK110U65Z, TK155U65Z, and TK190U65Z, in its DTMOSVI series that are housed in a TOLL (TO-leadless) package. TOLL is a surface-mount package that has an approximately 27% smaller footprint than the usual D2PAK package. It is also a 4-pin type package that allows Kelvin connection of its signal source terminal for the gate drive. This reduces the influence by the inductance of the source wire in the package to bring out the high-speed switching performance of the MOSFETs.

In March 2020, Toshiba launched eight 650 V super junction N-ch power MOSFET products in the DTMOSVI series: 'TK110N65Z', 'TK110Z65Z', 'TK110A65Z', 'TK125V65Z', 'TK155A65Z', 'TK170V65Z', 'TK190A65Z' and 'TK210V65Z' for switching power supplies of industrial equipment such as data centers and power conditioners of photovoltaic generators to expand the lineup in terms of packages and On-resistance. The DTMOSVI series has reduced the values of 'drain-source On-resistance x gate-drain charge'-a figure of merit by about 40%.

In December 2022, Mitsubishi Electric Corporation launched its new SLIMDIP-Z power semiconductor module, which features extra-high 30A rated current for use in inverter systems of home appliances.

In January 2022, Fuji Electric Co., Ltd. announced that it made a decision to carry out capital investment in Fuji Electric Tsugaru Semiconductor Co., Ltd., one of the power semiconductor production bases, for an increase in the production of SiC power semiconductors. Mass production planned to begin in fiscal 2024

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IGBT and super junction MOSFET market analysis from 2021 to 2031 to identify the prevailing IGBT and super junction MOSFET market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the IGBT and super junction mosfet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global IGBT and super junction mosfet market trends, key players, market segments, application areas, and market growth strategies.

IGBT and Super Junction MOSFET Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 33.1 billion |

| Growth Rate | CAGR of 11.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 348 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mitsubishi Electric Corporation, STMicroelectronics, Renesas Electronics, Ixys corporation, NXP Semiconductors, Fuji Electric Co. Ltd, Toshiba Corporation, Semikron Danfoss, Infineon Technologies AG, ABB Ltd. |

Analyst Review

Insulated-Gate Bipolar Transistor (IGBT) and super junction MOSFET is a high-voltage switching device used for switching applications in electric vehicles, inverters, and power supplies. It is also known as a minority carrier device with high input impedance and large bipolar current-carrying capability that allows a faster switching rate and provides greater efficiency. Currently, it is used in renewable energy plant systems and electric vehicles to improve switching speed and avoid power loss. An increase in demand for electric vehicles and aggrandized need for high voltage operating devices have led to the higher adoption of IGBT and super junction MOSFET in energy & power, automotive, consumer electronics, and other industries. Ultra-low loss and rugged SPT, smooth switching SPT, and industry-standard package in IGBT are expected to provide massive opportunities to the market players during the forecast period,

The global IGBT and super junction MOSFET market is highly competitive, owing to the strong presence of existing vendors. IGBT and super junction MOSFET vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in the market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The rise in demand for smart grid solutions across the industrial and commercial sectors globally is driving the need for the next generation to enhance IGBT and super junction MOSFET solutions. Moreover, prime economies, such as the U.S., China, Germany, and Japan, plan to develop and deploy next-generation IGBT and super junction MOSFET solutions across various sectors such as automotive, manufacturing, healthcare, and hospitality, which is anticipated to provide lucrative opportunities for market growth.

Among the analyzed geographical regions, Asia-Pacific exhibits the highest adoption of IGBT and super junction MOSFET and has been experiencing a massive expansion of the market. On the other hand, North America is expected to grow at a faster pace, predicting lucrative growth due to emerging countries such as U.S. and Mexico investing in these technologies. Regions such as the Middle East and Africa are expected to offer new opportunities for the growth of the IGBT and super junction MOSFET market in the future.

The key players profiled in the report include ABB Ltd., Infineon Technologies AG, STMicroelectronics, Toshiba Corporation, Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Renesas Electronics, NXP Semiconductors, Semikron International GmbH, IXYS Corporation are provided in this report.

Asia-Pacific, Specifically China, remains a significant participant in the IGBT and super junction MOSFET market.

Due to the rise in emphasis on power saving, the IGBT and super junction MOSFET market is anticipated to expand significantly over the course of the forecast period.

Infineon Technologies AG, Fuji Electric Co. Ltd., Mitsubishi Electric Corp., Semikron International GmbH, and Toshiba Corporation are the top 5 companies holding a prime share in the IGBT and super junction MOSFET market.

The industrial system segment dominated the market in 2021 in terms of revenue and is expected to dominate the market during the forecast period.

The global IGBT and super junction MOSFET market was valued at $11.09 billion in 2021, and is projected to reach $33.07 billion by 2031, registering a CAGR of 11.4%.

Loading Table Of Content...