IGCT Market Research, 2032

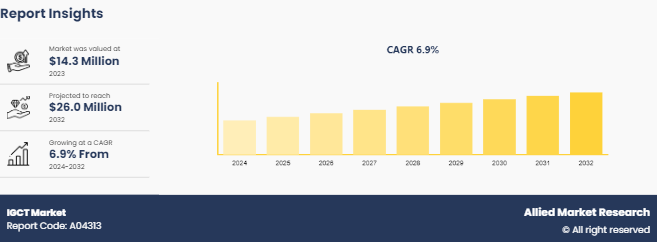

The Global IGCT Market was valued at $14.3 million in 2024, and is projected to reach $26.0 million by 2032, growing at a CAGR of 7% from 2025 to 2032.

Market Introduction and Definition

An IGCT transistor is a gate-controlled turn-off switch, which performs similarly to a thyristor with the lowest conduction losses. IGCT in power electronics is a power semiconductor used for medium to high-voltage applications ranging from 0.5 MVA up to several 100 MVA. IGCT enables a robust series connection between high-power turn-off devices used for high-power applications.

Low conduction loss as compared to GTO and IGBT, increased usage of power electronics in renewable energy sources, better performance at high temperatures, and low prices are the factors that drive the market expansion. In addition, the use of power semiconductor devices in hybrid vehicles and the invention of a high-power technology (HPT) platform are expected to boost the growth of the IGCT market. However, the bulky structure of thyristor and the complex manufacturing process restrict the growth of the market

Key Takeaways

By type, the asymmetric IGCT segment dominated the IGCT industry report in terms of revenue in 2023 and is anticipated to grow at a high CAGR during the forecast period.

By application, the drive segment dominated the IGCT market insights in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, the IGCT sector analysis is dominated by Asia-Pacific in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

In March 2024, in a move to further accelerate its green energy transition, the Chinese government announced a new round of subsidies aimed specifically at manufacturers of Insulated Gate Commutated Thyristors (IGCTs) . These devices are crucial for high-voltage power conversion in renewable energy sources like wind and solar power, as well as in industrial applications. The subsidies aim to lower production costs, incentivize research and development of more advanced IGCTs, and increase domestic production capacity. This initiative is part of China's broader strategy to become a global leader in renewable energy technology and reduce its reliance on fossil fuels.

In November 2023, the German government's stringent energy efficiency regulations for industrial equipment have indirectly spurred increased demand for IGCTs. These regulations require industries to adopt more energy-efficient technologies, and IGCTs are a key component in high-performance motor drives that significantly improve energy efficiency in manufacturing and other processes. As a result, companies are increasingly upgrading their existing equipment with IGCT-based systems, leading to a surge in demand for these devices.

In July 2023, recognizing the strategic importance of IGCT technology for its growing renewable energy sector, the Indian government announced a significant investment in research and development (R&D) initiatives focused on IGCTs. The funding is expected to support research projects aimed at developing next-generation IGCTs with higher efficiency, lower losses, and improved reliability. In addition, the government is promoting collaborations between research institutions, universities, and industry players to accelerate the development and commercialization of cutting-edge IGCT technology within the country.

Key Market Dynamics

IGCT transistor growth has been significant, and this is driven by various elements. The increasing need for energy efficiency is among the key drivers. Organizations globally are focusing more on saving power and improving their operations, which in turn leads to the adoption of IGCTs due to their high-efficiency levels and ability to handle high currents and voltages. Furthermore, the growth of renewable energy infrastructure acts as a key driver for the market. These components are important in power conversion and management for green energies such as wind or solar energy necessitating them in the ongoing shift towards sustainable sources of power.

The rise in industrial automation also fuels the IGCT industry. The demand for solid-state power electronics increases as industries adopt advanced automation technologies to improve productivity and reduce labor costs. In any automated system, there must be proper operation which requires good performance, hence consistent flow of electricity using efficient tools like IGCTs. Innovations in power electronics and semiconductor technology are creating new business opportunities. These improvements continue to produce efficient IGCTs that may be offered at reasonable prices, allowing for new applications and markets.

However, the IGCT market size by country aces challenges due to high initial expenditure and the technological complexity associated with its applications, making it a capital-intensive sector. Developing and implementing IGCTs requires substantial investments and extensive technical expertise, which may not be accessible to all potential users. Despite these challenges, the future of the IGCT market remains promising, driven by strong underlying trends such as the demand for energy efficiency, the expansion of renewable energy sources, and the rise of industrial automation.

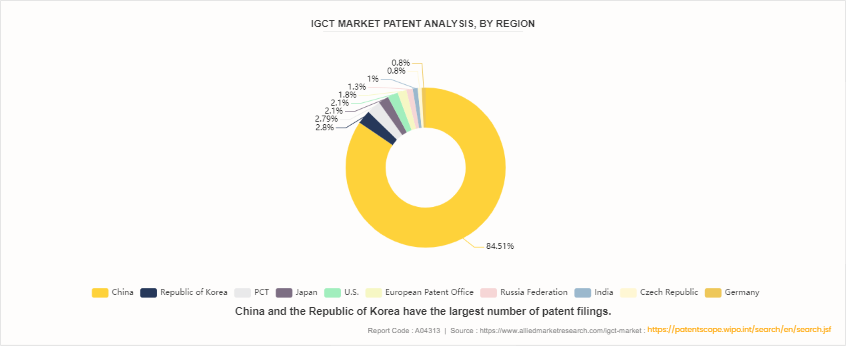

Patent Analysis of Global IGCT Market

The global IGCT market data is segmented according to the patents filed in China, the Republic of Korea, PCT, Japan, the U.S., the European Patent Office, the Russian Federation, India, the Czech Republic, and Germany. China and the Republic of Korea have the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, these two regions have a maximum number of patent filings.

Market Segmentation

The IGCT market forecast is segmented into type, application, and region. On the basis of the type, the market is divided into asymmetric IGCT, reverse blocking IGCT, and reverse conducting IGCT. By Application, the market is segmented into drive, traction, converter, and other. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Market Segment Outlook

In 2023, the asymmetric IGCT segment dominated by type segment of IGCT and had the largest size in terms of revenue, and it is expected to have a high CAGR during the forecast period because of its greater efficiency and capability to handle higher currents and voltages. Asymmetric IGCTs operate without reverse blocking functionality, making them more efficient for applications that do not involve reverse voltage. This simple configuration enhances the performance of high-power systems by reducing conduction losses and increasing efficiency. Their ability to manage high-power loads makes asymmetric IGCTs ideally suited for demanding industrial applications such as heavy machinery, power grid systems, and renewable energy systems. Besides, ongoing improvements in industrial automation, as well as rising demand for energy-efficient power conversion technologies, further underline these advantages, so that asymmetric IGCTs ride on dominant trends within this market space. These factors combined ensure that asymmetric IGCTs are always preferable for high-power applications requiring maximum efficiency. Notably, leading IGCT companies, such as those on the IGCT Company List, play a significant role in advancing these technologies.

The drive segment accounted for the largest IGCT market size in terms of revenue in 2023, owing to the critical function that IGCTs play in motor drive systems. Variable Frequency Drives (VFDs) and other motor control systems that demand precise and efficient power management include IGCTs as components. Industrial motor drives are in high demand in manufacturing processes, robotics, and other applications due to their high-power handling capability and fast switching speed. It is stated that IGCTs are energy efficient, showing significant energy savings for enterprises; thus, this is highly desired by industries because it lowers operating expenses. Besides, there is an increased demand for sophisticated motor drive systems because of industry automation, and smart manufacturing technologies adoption which necessitates more use of IGCTs accordingly. For optimal performance, energy efficiency, and lower operational costs in drive applications integration of IGCT should be done to continue consolidating their dominant position in this market segment.

Regional/Country Market Outlook

The drive segment accounted for the largest IGCT market size in terms of revenue in 2023, due to its position as a global manufacturing hub. Industrial manufacturing in China, Japan, South Korea, and India has demanded the use of high-power, energy-efficient semiconductor devices such as IGCTs. These countries' robust industrial infrastructures and rapid industrialization necessitate the use of modern power electronics for a variety of applications such as motor drives, renewable energy systems, and power grids. Furthermore, the growth of the IGCT market in the Asia-Pacific region is majorly driven by government initiatives as well as policies aimed at promoting energy efficiency and embracing smart grid technologies. Asia-Pacific holds the largest market share of the IGCT industry due to the major presence of IGCT manufacturers alongside continuing advancements in power electronics technology. Additionally, the IGCT for US market is experiencing growth due to increasing demand for high-performance power solutions in industrial and energy sectors. All these factors combined ensure that Asia-Pacific continues to lead in terms of adoption and growth of IGCT technology

Competitive Landscape

The IGCT market share by companies are analysized across the top players includung ABB Group, Mitsubishi Electric Corp., Infineon Technologies, Fuji Electric Co., Hitachi Energy, Siemens Energy, Danfoss, CRRC Corporation Limited, Semikron, and IXYS Corporation. The other IGCT company list of pllayers includes MacMic Group, CG Power and Industrial Solutions Limited, and so on.

Recent Key Strategies and Developments

In December 2023: ABB a leading IGCT manufacturer announced the launch of a new generation of high-power IGCTs designed to enhance the efficiency and reliability of renewable energy systems, particularly in wind and solar power generation. These advanced IGCTs offer improved switching performance, reduced power losses, and increased power density, enabling the development of more compact and efficient power converters. The new IGCTs are also designed to withstand harsh environmental conditions, making them suitable for a wide range of renewable energy applications.

In October 2023: Infineon Technologies and Siemens Energy announced a strategic partnership to develop next-generation IGCT modules for high-voltage direct current (HVDC) transmission systems. This collaboration aims to leverage the expertise of both companies to create cutting-edge IGCT modules that can handle higher voltages and currents, enabling the efficient transmission of large amounts of power over long distances. The partnership is expected to accelerate the development of innovative HVDC solutions that contribute to the decarbonization of the energy sector.

In August 2023, Mitsubishi Electric launched a new series of high-efficiency IGCT modules designed for industrial motor drives. These modules feature improved switching performance, reduced power losses, and enhanced thermal management, resulting in increased energy efficiency and reliability for industrial applications. The new IGCT modules are targeted towards industries such as manufacturing, mining, and oil & gas, where efficient and reliable motor control is crucial for operational success.

In April 2023: Danfoss announced a collaboration with Vestas, a leading wind turbine manufacturer, to optimize the design and performance of IGCT-based power converters for wind turbines. The collaboration aims to develop power converters that are more efficient, reliable, and cost-effective, contributing to the wider adoption of wind energy. The two companies will leverage their combined expertise in power electronics and wind turbine technology to create innovative solutions that address the specific challenges of wind power generation.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the igct market analysis from 2025 to 2032 to identify the prevailing igct market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the igct market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global IGCT Market trends, key players, market segments, application areas, and market growth strategies.

IGCT Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 26.0 Million |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 270 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | IXYS Corporation., Fuji Electric Co, Hitachi Energy Ltd., ABB Group, Mitsubishi Electric Corp, Infineon Technologies AG, CRRC Corporation Limited, Siemens Energy, Siemens Energy |

Analyst Review

Integrated Gate Commutated Thyristor (IGCT) is a power semiconductor, which can be used for medium to high-voltage applications ranging from 0.5 MVA up to several 100 MVA. At present, there is an increase in demand for the IGCT devices from the developed countries such as the U.S, Canada, and others. Companies in this industry adopt various techniques to provide customers with advanced and innovative product offerings.

Benefits such as better performance of IGCT at higher temperature (temperature ranges from -40 to 125 °C) support the growth of the market. IGCT is used in industrial appliances and steel mills to control high power AC motors and AC grid interface, as well as the PWM switching. Therefore, this feature adds value to drive the IGCT market.

However, bulky structure of the thyristor and complex manufacturing process impede the growth of the market. In future, rise in use of power semiconductor devices in hybrid vehicles, and invention of high-power technology (HPT) platform are expected to create lucrative opportunities for the key players operating in the IGCT market.

Among the analyzed geographical regions, Asia-Pacific is expected to account for the highest revenue in the global market throughout the forecast period (2018-2024) followed by North America, Europe, and LAMEA. However, LAMEA is projected to grow at a higher CAGR, predicting a lucrative market growth for IGCT devices.

ABB, Infineon Technologies, Mitsubishi Electric, Tianjin Century Electronics, CSR Zhuzhou Institute Co, Ltd. (CRRC), General Electric, Xiamen Hidins Technology Co. Ltd., Jiangyin City Saiying Electron Co. Ltd., AmePower, Inc., and Shenzhen CTW Semiconductor Co., Ltd are the key market players that occupy a significant revenue share in the IGCT market.

Major companies in the IGCT market include ABB, Siemens, General Electric, Mitsubishi Electric, and Hitachi, which are leaders in IGCT technology and applications.

The Asia-Pacific region is the largest market for IGCTs, driven by industrial manufacturing and advancements in power electronics in countries like China and India.

The leading application of IGCTs is in high-power industrial drives, including motor drives, renewable energy systems, and power grids.

The global IGCT market was valued at approximately $14.3 million in 2023 and is expected to grow steadily in the coming years.

The IGCT market is seeing trends toward increased efficiency and power handling, with a growing focus on applications in renewable energy and smart grids.

Loading Table Of Content...