Immunohematology Market Research, 2033

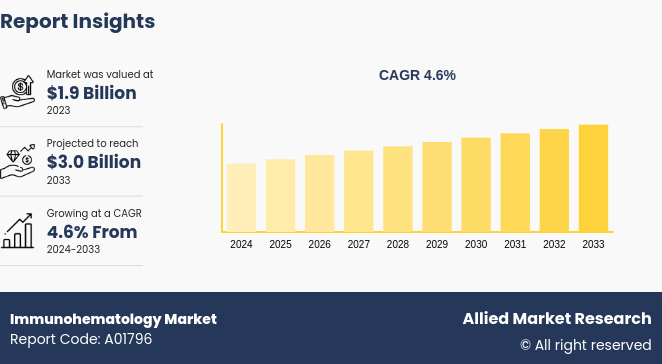

The global immunohematology market size was valued at $1.9 billion in 2023, and is projected to reach $3.0 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033. The rising prevalence of chronic diseases and increasing number of surgeries and trauma cases have led to rise in the demand for blood transfusions are the major factors which drives the market growth.

Market Introduction and Definition

Immunohematology, also known as blood banking or transfusion medicine, is a specialized branch of laboratory medicine that focuses on the study of blood groups and antibodies associated with blood transfusion. It involves the identification and characterization of blood group antigens on the surface of red blood cells and the corresponding antibodies present in the plasma. The main goal of immunohematology is to ensure safe and compatible blood transfusions by matching the blood type of the donor with that of the recipient to prevent adverse reactions. This field plays a crucial role in transfusion therapy, organ transplantation, and managing various hematologic disorders. Immunohematologists use a combination of serological techniques and molecular methods to perform blood typing, crossmatching, and antibody screening, contributing to the overall safety and effectiveness of blood transfusion practices.

Key Takeaways

The immunohematology market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major immunohematology industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The global immunohematology market size is driven by growing prevalence of chronic diseases and the rising number of surgical procedures have significantly boosted the need for accurate blood typing and cross-matching, which are crucial for safe transfusion practices. In addition, the aging population has led to a higher incidence of conditions such as anemia and leukemia, further escalating the demand for immunohematology products. Furthermore, technological innovations, such as the development of automated and digital platforms for blood testing, have enhanced the efficiency and accuracy of immunohematology diagnostics and driving growth during the immunohematology market forecast period. Moreover, heightened awareness and stringent regulations regarding blood safety and donor compatibility are contributing to the expansion of immunohematology market growth.

Collaboration between healthcare institutions and diagnostic laboratories, along with substantial investments in research and development, are also playing a pivotal role in driving the global immunohematology market forward. However, the high cost associated with advanced immunohematology instruments and reagents, which can limit their adoption, especially in developing regions with constrained healthcare budgets. Additionally, the complexity and technical expertise required for operating advanced immunohematology equipment can act as a barrier, particularly in low-resource settings where skilled personnel may be lacking thereby hinders market growth.

On the other hand, the adoption of automated and digital blood testing platforms offers significant potential for improving diagnostic accuracy and efficiency, catering to the growing demand for rapid and reliable blood typing and cross-matching. The rise in personalized medicine and the increasing focus on individualized patient care which provide immunohematology market opportunity.

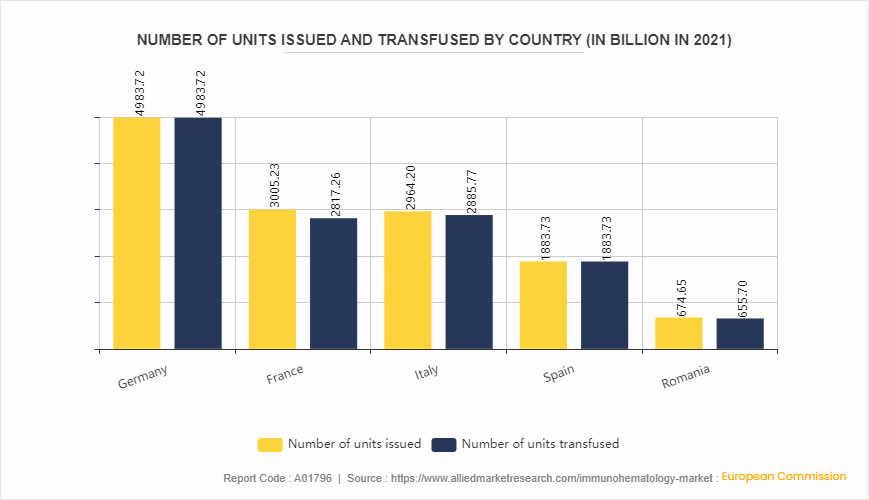

Blood Units Issued and Transfused Across Various European Countries

In 2021, the European Commission reported significant activity in blood transfusion units across European countries. Germany led with 4, 983.72 billion units issued and transfused, highlighting robust demand and operational efficiency in its healthcare system. France followed with 3, 005.23 billion units issued and 2, 817.26 billion units transfused, indicating a slightly lower transfusion rate possibly due to improved medical practices reducing unnecessary transfusions. Italy reported 2, 964.20 billion units issued and 2, 885.77 billion units transfused, showcasing a strong infrastructure for handling blood products. Spain maintained a balance with 1, 883.73 billion units both issued and transfused, reflecting stable healthcare delivery. Romania, with 674.65 billion units issued and 655.70 billion units transfused, demonstrated consistent demand amidst healthcare system challenges. These figures emphasize the vital role of immunohematology in the European healthcare market. Immunohematology, which encompasses blood transfusions and blood banking, is crucial for managing conditions requiring transfusions and ensuring safe blood supply. The data suggests ongoing advancements in medical practices and technologies, influencing transfusion practices and market dynamics across these countries.

Market Segmentation

The immunohematology market is segmented into product, application, end user, and region. On the basis of product, the market is categorized into analyzers and systems and reagents. On the basis of application, the market is categorized into blood-related diseases, HIV, and others. On the basis of end user, the market is divided into hospitals, diagnostic Laboratories, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America, particularly the U.S. holds a significant immunohematology market share in 2023. The region's dominance is attributed to well-established healthcare infrastructure, high awareness about blood-related diseases, and robust investment in R&D. The presence of key market players and extensive use of advanced immunohematology techniques in hospitals and blood banks further boosts the market. Europe is another leading region in the immunohematology market. Germany's efficient blood management system and France's large-scale blood transfusion practices highlight the region's strong market potential. The Asia-Pacific region is projected to witness substantial growth in the immunohematology market. Countries such as China, India, and Japan are key players due to their large populations and increasing healthcare investments. Rapid urbanization, rising incidences of chronic diseases, and improving healthcare infrastructure are driving the market. Government initiatives to enhance blood transfusion services and increasing awareness about blood donation further propel market growth.

- According to the Leukemia & Lymphoma Society, in 2023, 59, 610 people were expected to be diagnosed with leukemia.

Industry Trends

In February 2024, the 13th edition of standards for Immunohematology Reference Laboratories implemented on April 1, 2024, with significant changes from previous editions. Organizations can access this edition in electronic or print format, and interested parties can participate in a complimentary two-week trial of the electronic version.

In the year 2022-23, 51, 726 Blood/Blood components were prepared. A total of 17, 052 units of blood components were issued free of cost to the patients admitted in Government Hospitals, Thalassemic and Hemophilic Patients.

American Society of Hematology (ASH) continued to expand its global programs and services in 2023 through awards, training programs, and initiatives that help hematologists worldwide conquer blood diseases. The Consortium on Newborn Screening in Africa (CONSA) continued to grow in 2023. CONSA helps institutions in seven African countries diagnose and link children with Sickle Cell Disease (SCD) into care. Through this program, over 100, 000 babies have been screened, and babies identified with SCD have been enrolled in a clinical protocol to receive critical follow-up care. In 2023 alone, over 31, 000 babies were screened across all sites.

Competitive Landscape

The major players operating in the immunohematology market include Bio-Rad Laboratories, Inc, Werfen, Grifols, S.A., Danaher Corporation, Siemens, Thermo Fisher Scientific Inc., Abbott Laboratories, Merck KGaA, F. Hoffmann-La Roche Ltd, Cardinal Health. Other players in immunohematology market includes MTC INVITRO and so on.

Recent Key Strategies and Developments in Immunohematology Industry

In April 2024, Grifols, one of the world’s leading producers of plasma-derived medicines and innovative diagnostic solutions announced it has launched its leading blood-typing technology – the fully automated Erytra Eflexis – in the Chinese market following regulatory approval.

In May 2023, Bio-Rad Laboratories, Inc. announced the launch of the IH-500TM NEXT System, a fully automated system for ID-Cards. The IH-500 NEXT System is used with Bio-Rad's ID-Cards, offering a broad portfolio for both routine testing (type and screen) and specialized testing, including single antigen determination and newborn screening.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global immunohematology market analysis from 2024 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the global immunohematology market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global immunohematology market trends, key players, market segments, application areas, and market growth strategies.

Immunohematology Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.0 Billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 233 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Cardinal Health, Grifols, S.A. , Bio-Rad Laboratories, Inc, Merck KGaA, Abbott Laboratories, Siemens , Thermo Fisher Scientific Inc., Werfen , F. Hoffmann-La Roche Ltd, Danaher Corporation |

The global immunohematology market was valued at $1.9 billion in 2023, and is projected to reach $3.0 Billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

The leading application of the immunohematology market is blood transfusion medicine. This includes blood typing and cross-matching to ensure compatibility between donor and recipient blood, thereby reducing the risk of transfusion reactions.

North America is the largest regional market for immunohematology. This is attributed to advanced healthcare infrastructure, high healthcare expenditure, and robust adoption of advanced medical technologies.

Upcoming trends in the immunohematology market include increasing demand for blood transfusions, advancements in molecular testing technologies for blood typing, growing adoption of automation and robotics in blood bank operations, and expanding applications in personalized medicine and oncology treatments.

Key drivers include increasing demand for blood transfusions, advancements in molecular testing technologies, rising prevalence of chronic diseases, and stringent regulatory standards for blood safety.

Immunohematology, also known as blood banking or transfusion medicine, is the branch of medicine concerned with the study of blood groups and antibodies, particularly related to blood transfusions and compatibility testing.

Loading Table Of Content...