Immunology Market Research, 2033

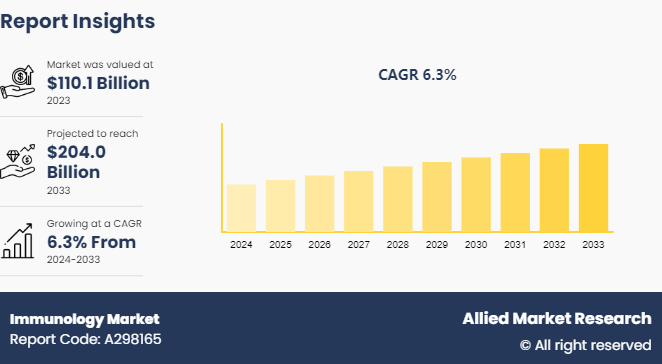

The global immunology market size was valued at $110.1 billion in 2023, and is projected to reach $204.0 Billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033. The rising prevalence of autoimmune diseases, advancements in biotechnology and drug development, increasing healthcare expenditure and supportive government policies are the major factors which drive the market growth.

Market Introduction and Definition

Immunology is the branch of biomedical science that focuses on the study of the immune system, which is the body's defense mechanism against infections, diseases, and foreign substances. It encompasses a broad array of products, technologies, and services designed to understand, diagnose, treat, and prevent diseases related to the immune system. This includes the development and commercialization of immunotherapies, vaccines, diagnostic tools, and research equipment.

Key Takeaways

The immunology market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major immunology industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The major factors for immunology market growth include increase in prevalence of autoimmune diseases and other immune-mediated conditions, which heightens the demand for effective treatments and therapies. Advances in biotechnology and pharmaceutical research led to the development of novel biologics and biosimilars, enhancing the therapeutic options available for patients. In addition, heightened awareness and early diagnosis of immune-related disorders are prompting more individuals to seek treatment, further fueling market expansion. Investments in healthcare infrastructure and favorable government policies supporting research and development in immunology also play a crucial role. Furthermore, the aging global population, which is more susceptible to chronic and immune-related diseases, adds to the market's growth momentum. Overall, these factors collectively drive the continued development and expansion of the immunology market forecast, promising improved patient outcomes and innovative treatment solutions.

However, stringent regulatory requirements and lengthy approval processes for new drugs and therapies can delay market entry and increase development costs while limited awareness and understanding of immunological disorders in underdeveloped regions may limit the market growth. Conversely, advances in biotechnology and precision medicine are paving the way for targeted therapies and personalized treatment approaches, which provide lucrative immunology market opportunity. In addition, the rise in investment from both public and private sectors into immunology research is accelerating the discovery and development of new drugs and biologics further contributing towards the market growth.

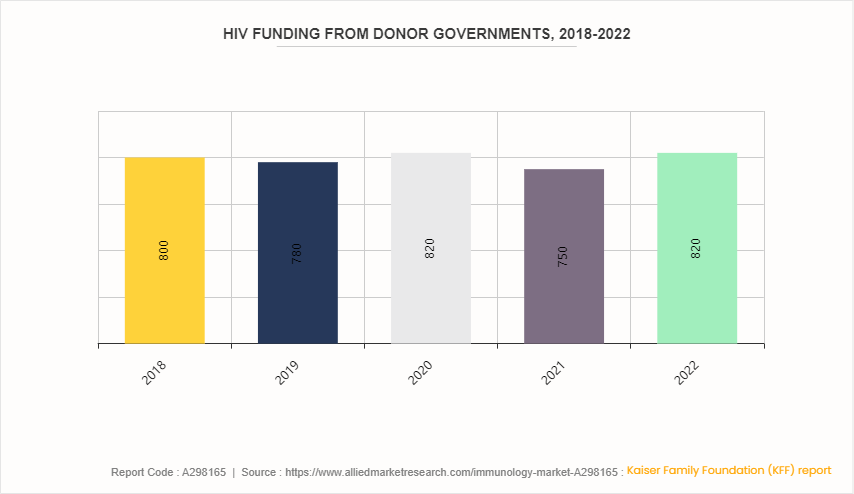

HIV Funding from Donor Governments Implications for the Immunology Market

The funding landscape for HIV research and treatment by donor governments witnessed fluctuating trends from 2018 to 2022, as per a report from the Kaiser Family Foundation (KFF) . In 2018, funding stood at $800 million, showing a slight decline to $780 million in 2019. However, 2020 saw a modest increase to $820 million before a dip to $750 million in 2021. Notably, funding rebounded to $820 million in 2022. These variations reflect the dynamic nature of global health priorities and resource allocation. Within the broader context of the immunology market, fluctuations in HIV funding underscore the interconnectedness of funding streams and research areas. While HIV remains a significant focus, shifts in funding levels can impact the development of treatments and interventions not only for HIV but also for other infectious diseases and immunological conditions, shaping the trajectory of the immunology market.

Market Segmentation

The immunology market size is segmented into product type, application, and region. On the basis of product type, the market is categorized into diagnostic testing equipment, biomarkers, and biopharmaceuticals. On the basis of application, the market is divided into allergy and hypersensitivity, autoimmune disease, infectious disease, HIV and AIDS, and others. On the basis of end user, the market is classified into hospitals and clinics, pharmaceutical and biotechnology companies, research institutes and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America, particularly the U.S., remains a major contributor in immunology market share due to substantial healthcare expenditure, robust R&D infrastructure, and high adoption rates of advanced therapeutics. Europe follows closely, with countries such as Germany, France, and the UK investing heavily in biotechnology and innovative immunology therapies. The Asia-Pacific region is witnessing rapid growth, fueled by a large patient population, increasing healthcare expenditure, and improving access to advanced therapies in countries such as China and India.

The Victorian government in Australia granted $100, 000 in 2022 to the Hudson Institute of Medical Research to fund research into RNA-based treatments for autoimmune diseases. This highlights the potential of RNA therapeutics to revolutionize treatments for autoimmune conditions.

In February 2022, the National Institute of Health (NIH) hosted a webinar that spotlighted autoimmune diseases and women's health.?Women are disproportionately affected by autoimmune diseases, with nearly 80% of people with a chronic autoimmune condition being female in U.S.

The World Health Organization (WHO) is taking action to extend access to care for rheumatoid arthritis (RA) in different ways, including through the Rehabilitation 2030 Initiative and the UN Decade of Healthy Ageing. These efforts aim to promote healthy ageing and address the diverse needs of older people with RA.

Industry Trends

The BSI and CEI have seen remarkable growth, with CEI achieving its highest-ever impact factor of 5.732 in June 2022.

The Department of Biotechnology (DBT) , an attached office of the Ministry of Science & Technology, Government of India, supported 22, 128 scientists and 48, 502 research personnel in ongoing biotech projects in 2022.?Biotechnology is considered a frontline area of science and technology in India.

The U.S. President's Emergency Plan for AIDS Relief (PEPFAR) continued its efforts to address the HIV/AIDS in 2022. As of September, 2022, PEPFAR has provided HIV testing services for more than 64.7 million people and supported lifesaving antiretroviral therapy (ART) for nearly 20.1 million men, women, and children globally.

The National HIV/AIDS Strategy for the U.S. (2022–2025) was published in December 2021, providing stakeholders across the nation with a roadmap to accelerate efforts to end the HIV in the country by 2030. The strategy sets bold targets for a 75% reduction in new HIV infections by 2025 and a 90% reduction by 2030.

In July 2021, the Centers for Disease Control and Prevention (CDC) , awarded $117 million to state and local health departments to help rebuild and begin to expand HIV prevention and treatment efforts as the U.S. continues to respond to COVID-19. The awards are part of the federal Ending the HIV Epidemic in the U.S. (EHE) initiative.

In October 2022, National Institute of Health (NIH) funded research presented at the IDWeek Conference found that starting antiretroviral treatment (ART) early in the course of HIV infection results in better long-term health outcomes compared with delaying ART.

Competitive Landscape

The major players operating in the immunology market include AbbVie Inc., Johnson & Johnson, Pfizer Inc., Novartis AG, Merck & Co., Inc., Bristol-Myers Squibb Company, Amgen Inc., Eli Lilly and Company, Gilead Sciences, Inc., Sanofi. Other players in immunology market includes Biogen, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, UCB S.A. and so on.

Recent Key Strategies and Developments in Immulogy Industry

In February 2024, AbbVie Inc. and Tentarix Biotherapeutics announced a multi-year collaboration focused on the discovery and development of conditionally-active, multi-specific biologic candidates in oncology and immunology. The collaboration will integrate AbbVie's expertise in oncology and immunology with Tentarix's proprietary Tentacles platform.

In February 2024, AbbVie Inc. and OSE Immunotherapeutics SA, a clinical-stage immunotherapy company announced a strategic partnership to develop OSE-230, a monoclonal antibody designed to resolve chronic and severe inflammation, currently in the pre-clinical development stage.

In June 2023, Merck, known as MSD outside of the U.S. and Canada announced the completion of the Prometheus Biosciences, Inc. acquisition. Prometheus is now a wholly-owned subsidiary of Merck and the common stock of Prometheus will no longer be listed or traded on the Nasdaq Global Market. The Prometheus acquisition accelerates the company’s growing presence in immunology, augments diverse pipeline and increases ability to deliver patient value.

In June 2023, Eli Lilly and Company and DICE Therapeutics, Inc. announced a definitive agreement for Lilly to acquire DICE. DICE is a biopharmaceutical company that leverages its proprietary DELSCAPE technology platform to develop novel oral therapeutic candidates, including oral IL-17 inhibitors currently in clinical development, to treat chronic diseases in immunology.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the immunology market analysis from 2024 to 2033 to identify the prevailing immunology industry opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the immunology market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global immunology market trends, key players, market segments, application areas, and market growth strategies.

Immunology Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 204.0 Billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 231 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bristol-Myers Squibb Company, AbbVie Inc., Sanofi , Gilead Sciences, Inc., Merck & Co., Inc., Amgen Inc., Pfizer Inc., Eli Lilly and Company , Novartis AG, Johnson & Johnson |

Loading Table Of Content...