Impact Investing Market Overview

The global impact investing market was valued at $2.5 trillion in 2021, and is projected to reach $6 trillion by 2031, growing at a CAGR of 9.5% from 2022 to 2031. Growing demand for socially and environmentally responsible investments, increase in awareness of global social and environmental concerns, and the emergence of entrepreneurs creating new business models and products that generate positive social or environmental outcomes, contribute to the growth of the market

Market Dynamics & Insights

- The impact investing industry in North America held a significant share of 43% in 2021.

- The impact investing industry in India is expected to grow significantly at a CAGR of 17.0% from 2022 to 2031.

- By sector, the energy segment is one of the dominating segment in the market, accounting for the revenue share of 32% in 2021.

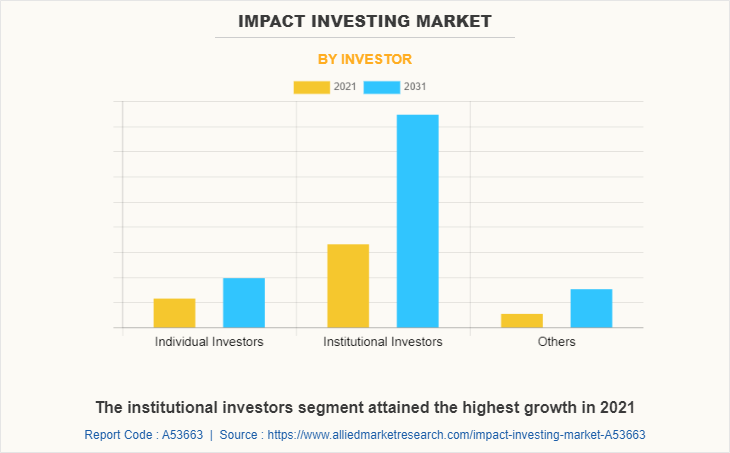

- By investor, the institutional investor segment dominated the industry in 2021 and accounted for the largest revenue share of 66%.

Market Size & Future Outlook

- 2021 Market Size: $2500 Billion

- 2031 Projected Market Size: $5986.5 Billion

- CAGR (2022-2031): 9.5%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

What is Meant by Impact Investing

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending on investors' strategic goals. Impact investors generally fund businesses or nonprofits that aim to address social or environmental issues, such as reducing carbon emissions, improving access to healthcare and education, promoting sustainable agriculture, or aiding underprivileged areas. Impact investors measure their success not only by the financial returns they earn, but also by the positive social or environmental outcomes they help to achieve.

Growing demand from investors seeking both financial returns and social or environmental impact is a major driving factor for the impact investing market as investing in renewable energy can help reduce greenhouse gas emissions and mitigate climate change, while investing in affordable housing can help address the issue of homelessness. Furthermore, increase in awareness of the need to address social and government support and policies to promote impact investing are the major driving factors for the impact investing market.

However, impact investing challenge in achieving both financial returns and social or environmental impact is a major factor hampering the growth of the impact investing market as it requires balancing the need for profitability with the desire to generate positive social or environmental outcomes. Furthermore, limited understanding of impact investing among investors and the general public is a major restraining factor for the impact investing market growth. On the contrary, rise in demand for impact investment products from institutional investors and high-net-worth individuals is projected to provide major lucrative opportunities for the market growth.

The report focuses on growth prospects, restraints, and trends of the impact investing market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the impact investing industry.

Impact Investing Market Segment Review

The global impact investing market is segmented on the basis of sector, investor, and region. On the basis of sector, it is divided into education, agriculture, healthcare, energy, housing and others. On the basis of investor, it is classified into individual investors, institutional investors and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on investor, the institutional investors witnessed the highest growth segment in the impact investing market in 2021. This growth can be attributed to the increasing interest among institutional investors, such as pension funds and endowments, to allocate a portion of their assets to impact investments. Institutional investors are increasingly recognizing the importance of social and environmental factors in investment decision-making, and impact investments provide a way to achieve both financial returns and social and environmental benefits.

However, the others segment including NGOs and government is forecasted to be the fastest-growing segment during the forecast period. This can be attributed to the growing interest among non-governmental organizations (NGOs) and government agencies in using impact investing as a tool for achieving social and environmental goals. NGOs and governments are increasingly partnering with impact investors to mobilize private capital for impact-driven projects and initiatives. The others segment presents a significant opportunity for impact investors to collaborate with NGOs and governments to address some of the world's most pressing social and environmental challenges while generating meaningful returns.

Based on region, in 2021, North America was the highest growth region in the impact investing market, driven by the increasing interest among investors to align their investments with social and environmental values. The region has a mature impact investing ecosystem, with a well-established network of impact investors, intermediaries, and impact-driven enterprises in impact investing policy. However, on the other hand, the Asia-Pacific region is forecasted to be the fastest-growing region during the forecast period. This can be attributed to the region's increasing focus on sustainable development and social impact, along with the growth of impact-driven enterprises. The Asia-Pacific region presents a significant opportunity for impact investors to make a difference while generating attractive returns, given the region's large and rapidly expanding population, growing middle class, and significant development challenges. As such, impact investors are expected to increasingly focus on the Asia-Pacific region in the years to come.

The report analyzes the profiles of key impact investing companies operating in the impact investing market such as Morgan Stanley, Leapfrog Investments, Omidyar Network, Bridges Fund Management Ltd., Vital Capital, blueorchard finance ltd, Manulife Investment Management., Reinvestment Fund, Goldman Sachs and Bain Capital. These players have adopted various strategies to increase their market penetration and strengthen their position in the impact investing market share.

Impact Investing Market Landscape and Trends

The impact investing market has witnessed significant growth in recent years, as more investors seek to align their financial goals with their social and environmental values in impact investing domain. Environmental, social, and governance (ESG) criteria have become increasingly important in impact investing service, with investors seeking to invest in companies that have a positive impact on the environment and society. The impact investing market is becoming increasingly global, with investments being made in developing countries as well as developed countries. Impact investors are active in a wide range of sectors, including renewable energy, sustainable agriculture, affordable housing, healthcare, education, and financial inclusion. There is a growing trend towards collaboration and standardization in the impact investing market, with investors and organizations working together to establish common standards and metrics for measuring impact. These developments demonstrate the growing popularity and versatility of impact investing, and are likely to continue shaping the impact investing market in the upcoming years.

What are the top Impacting Factors in Impact Investing Sector

Surge in Demand from Investors Seeking both Financial Returns and Social or Environmental Impact

There has been a growing demand from investors seeking both financial returns and social or environmental impact in recent years, which has led to the rise of impact investing. Impact investing has become an increasingly popular way for investors to align their values with their financial goals. Impact investments can take many forms, including investments in renewable energy projects, sustainable agriculture, affordable housing, and community development initiatives.

Moreover, investing in renewable energy can help reduce greenhouse gas emissions and mitigate climate change, while investing in affordable housing can help address the issue of homelessness. Therefore, the surge in demand for impact investing adoption is a positive development that reflects a shift in investor priorities towards socially and environmentally responsible investing. These features have contributed to the growing popularity of impact investing market and their increasing demand.

Increase in Awareness of the need to Address Social and Environmental Challenges

In recent years, there has been a growing awareness of the need to address social and environmental challenges, and this has led to increased attention and action from individuals, businesses, and governments around the world. In addition, societal concerns including wealth inequality, poverty, and access to healthcare and education are gaining popularity which drives the growth of the impact investing market. People are recognizing that these issues are interconnected and that addressing them requires a more holistic approach that takes into account both social and environmental factors.

Furthermore, investors are increasingly looking to invest in climate-friendly and sustainable projects that address climate change, such as renewable energy, clean technology, sustainable agriculture, and green infrastructure, due to rise in climate change issues. These investments not only generate positive social and environmental impacts but can also offer attractive financial returns. Therefore, increase in awareness of the need to address social and environmental challenges is driving the growth of the impact investing market size.

Government Support and Policies to Promote Impact Investing

Governments around the globe have recognized the potential of impact investing to drive social and environmental progress, and many have implemented policies and initiatives to promote this form of investing. Governments have also introduced social impact bonds and green bonds which are financial instruments that allow investors to fund social programs or initiatives. For instance, green building mandates in large American cities have spurred the development of sustainable property investment strategies, and indirectly supported mission-oriented green developers and investors by increasing the market for their activities. In addition, governments are providing support to build the capacity of impact investing intermediaries, such as impact funds or social enterprises. This, in turn, helps strengthen the impact investing ecosystem and make it easier for investors to identify and invest in impactful projects. Therefore, government support and policies are driving the growth of the impact investing market.

Challenges in Achieving both Financial Returns and Social or Environmental Impact

Achieving both financial returns and social or environmental impact can be challenging in impact investing, as it requires balancing the need for profitability with the desire to generate positive social or environmental outcomes. For impact investing to scale, products must be capable of addressing a range of institutional needs, including the ability to absorb large pools of capital, adequate liquidity and robust risk management practices while generating measurable return and impact. In addition, impact investment is riskier than traditional investment, as it often involves investing in new or untested business models or technologies. Thus, it can be challenging to manage these risks while still generating positive social or environmental outcomes. Furthermore, it is difficult to measure the social or environmental impact of an investment, and there may be a lack of standardization in impact measurement and reporting. Therefore, challenges in achieving both financial returns and social or environmental impact is a major restraining factor for the growth of the impact investing industry.

Limited understanding of impact investing among investors and the General Public

Limited understanding of impact investing among investors and the general public is a challenge that impacts the growth and development of the field. Impact investing market is a relatively new and evolving field that seeks to generate both financial returns and positive social or environmental outcomes. However, many investors and members of the public are not aware of the concept of impact investing and the opportunities it presents. This can make it difficult to attract investors to impact investing, as well as to generate support for impact investing more broadly. In addition, the field of impact investing also lacks a standardized framework and vocabulary for measuring and reporting impact, which can further complicate understanding. Furthermore, confusion between impact investing and other terms such as socially responsible investing (SRI) or environmental, social, and governance (ESG) investing can lead to negative impact on the market. Therefore, lack of understanding can be a major factor hampering the impact investing market outlook.

Rise in Demand for Impact Investment Products from Institutional Investors and High-net-worth Individuals

There has been a growing demand for impact investment products from institutional investors and high-net-worth individuals in recent years. This is driven by a number of factors, such as the desire to connect investments with values and impression, the understanding that impact investing has the potential to produce competitive financial returns, and the growing accessibility of impact investment products and services in impact investing market.

Moreover, high-net-worth individuals are also increasingly interested in impact investing, as they have the ability to make significant investments and are often motivated by the desire to create positive social or environmental impact. In addition, institutional investors, such as pension funds and endowments, have been particularly active in impact finance, as they have a long-term investment horizon and a focus on sustainable and responsible investment practices. Therefore, the growing demand for impact investment products from institutional investors and high-net-worth individuals is a positive development, which is projected to provide an opportunity to scale up impact investing and drive positive social and environmental outcomes.

Collaboration between Impact Investors, Government, and other Stakeholders to address Social and Environmental Challenges

Collaboration between impact investors, social enterprises, and other stakeholders can create new opportunities for impact investing. Moreover, government plays a critical role in creating an enabling environment for impact investing to thrive. This includes developing policies and regulations that support impact investing, providing incentives for social impact investing, and investing in public goods and infrastructure that are critical to achieving social and environmental outcomes. In addition, other stakeholders, such as government agencies, philanthropic organizations, impact investing companies and NGOs, can also play important roles in supporting impact investing. For instance, government policies and regulations can create a supportive environment for impact investing, while philanthropic organizations can provide funding and support for social enterprises. Therefore, collaboration between impact investors, social enterprises, and other stakeholders can help create a robust and effective impact investing ecosystem, which can drive positive social and environmental change, such factors drive the growth of the impact investing market.

Report Coverage & Deliverables

Type Insights

Detailed examination of impact investing, a strategy that aims to generate financial returns alongside positive social and environmental outcomes. The report covers various types of impact investing, including equity, debt, and real asset investments, focusing on their role in driving sustainability and ethical business practices.

Technology Insights

Analysis of impact investing growth through the use of digital platforms, fintech innovations, and data-driven ESG (Environmental, Social, Governance) tools. The integration of technology has improved transparency, accountability, and scalability, leading to a wider adoption of impact investing.

Application Insights

Assessment of impact investing share across sectors like clean energy, healthcare, education, and affordable housing. The report highlights the growing influence of impact investing in these sectors, contributing to solving global challenges and creating long-term value.

Regional Insights

Overview of impact investing value in different regions, including North America, Europe, Asia-Pacific, and emerging markets. This section analyzes regional trends, regulatory support, and investor behavior, with emphasis on where impact investing is gaining momentum.

Key Companies & Market Share Insights

Profile of major impact investing companies and funds, showcasing their market share, investment strategies, and impact outcomes. The report also covers competitive positioning, key partnerships, and how leading firms are shaping the future of impact investing.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the impact investing market forecast from 2021 to 2031 to identify the prevailing impact investing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the impact investing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global impact investing market trends, key players, market segments, application areas, and market growth strategies.

Impact Investing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6 trillion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 338 |

| By Sector |

|

| By Investor |

|

| By Region |

|

| Key Market Players | Goldman Sachs, Bain capital, Manulife Investment Management., Reinvestment fund, Blueorchard finance ltd, Bridges fund management ltd., Morgan Stanley, Vital Capital, Omidyar network, Leapfrog investments |

Analyst Review

The impact investing market has experienced significant growth in recent years and is expected to continue to grow. Impact investing is no longer seen as a niche investment strategy, but rather as a mainstream approach to investing. Institutional investors, such as pension funds and insurance companies, are increasingly incorporating impact investing into their investment strategies. Impact investors are increasingly seeking investments that can demonstrate measurable impact on social or environmental outcomes. This is driving the development of standardized impact measurement and reporting frameworks, such as the GIIN's Impact Reporting and Investment Standards (IRIS). In addition, investors are increasingly recognizing the importance of diversity, equity, and inclusion (DEI) in their investments. They are seeking to invest in companies and initiatives that prioritize DEI, and are working to ensure that their own organizations and investment processes are inclusive. Furthermore, impact investors are increasingly looking to invest in emerging markets, particularly in Africa, Asia, and Latin America, where there is a significant need for investment in social and environmental infrastructure. Therefore, the impact investing industry is expected to continue to evolve and adapt to changing consumer preferences and technological advances.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, In November 2022, BlueOrchard Finance Ltd, a pioneer in impact investing and member of the Schroders Group, has launched a listed impact strategy for Japanese investor, Daido Life Insurance of the T&D Insurance Group. The USD 135 million strategy seeks a stable income in consideration of a target yield at inception by investing in impact bonds that meet BlueOrchard’s impact investment criteria. Through its investments, the strategy contributes to the achievement of the UN Sustainable Development Goals (SDGs) and qualifies as an Article 9 fund under the EU SFDR regulation. These strategies adopted by the market players operating at a global and regional level are projected to foster the market growth during the forecast period.

Some of the key players profiled in the report include Morgan Stanley, Leapfrog Investments, Omidyar Network, Bridges Fund Management Ltd., Vital Capital, blueorchard finance ltd, Manulife Investment Management., Reinvestment Fund, Goldman Sachs and Bain Capital. These players have adopted various strategies to increase their market penetration and strengthen their position in the impact investing market.

Environmental, social, and governance (ESG) criteria have become increasingly important in impact investing, with investors seeking to invest in companies that have a positive impact on the environment and society. The impact investing market is becoming increasingly global, with investments being made in developing countries as well as developed countries. Impact investors are active in a wide range of sectors, including renewable energy, sustainable agriculture, affordable housing, healthcare, education, and financial inclusion. There is a growing trend towards collaboration and standardization in the impact investing market, with investors and organizations working together to establish common standards and metrics for measuring impact.

North America is the largest regional market for Impact Investing

The global impact investing market was valued at $2,487.21 billion in 2021, and is projected to reach $5,986.47 billion by 2031, growing at a CAGR of 9.5% from 2022 to 2031.

The report analyzes the profiles of key players operating in the impact investing market such as Morgan Stanley, Leapfrog Investments, Omidyar Network, Bridges Fund Management Ltd., Vital Capital, blueorchard finance ltd, Manulife Investment Management., Reinvestment Fund, Goldman Sachs and Bain Capital. These players have adopted various strategies to increase their market penetration and strengthen their position in the impact investing market.

Loading Table Of Content...