In-App Purchase Market Research, 2032

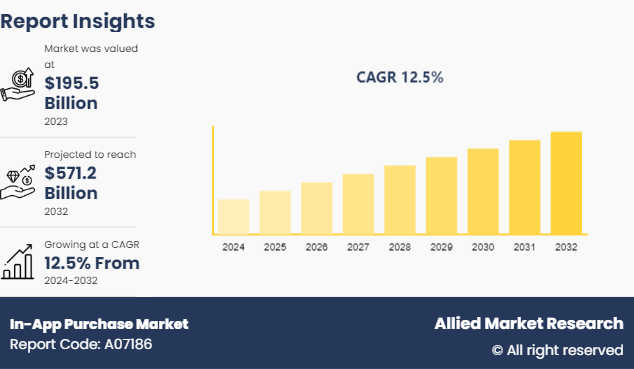

The global in-app purchase market size was valued at $195.5 billion in 2023, and is projected to reach $571.2 billion by 2032, growing at a CAGR of 12.5% from 2024 to 2032.

In-app purchases (IAPs) are one of the primary model’s app publishers use to monetize their apps. An in-app purchase is any fee in addition to the cost to download the app on a smartphone or tablet. IAPs allow users to buy additional features, content, or services within an app. These purchases are made through the relevant app store or another payment system, using real money (as opposed to in-app currency or rewards) .

There are four types of in-app purchases such as consumables, non-consumables, auto-renewal subscription and non auto-renewal subscription. Consumables are products that can be used (‘consumed’) once and then repurchased multiple times. Non-consumables are products that are purchased once, have no expiry date, and remain permanently available within the app.

Key Takeaways

The in-app purchase industry study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major in-app purchase industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends:

In January 2024, Apple sparked outrage in the U.S. by introducing a 27% fee on all in-app purchases made through external platform. The company updated its App Store policy to allow the use of external payment methods.

In April 2024, the U.S. government approved at a Cabinet meeting a new bill requiring companies such as Apple and Google to open up the app stores to competition. The government aims to pass the bill during the current Diet session. If approved, the bill is expected to be fully implemented by the end of 2025.

In June 2023, the Japanese government unveiled its intention to enforce new regulations on Google and Apple. These rules will mandate the tech giants to allow developers to utilize alternative payment systems, distinct from their own.

Key market dynamics

The global in-app purchase market is growing due to several factors such as the widespread adoption of smartphones and high-speed internet access, the popularity of games with free-to-play models, and the increasing adoption of digital solutions. However, the regulatory and legal issues act as restraints for the in-app purchase market growth. On the other hand, advancements in payment technology and the integration of in-app purchases into a variety of industries will provide ample opportunities for the in-app purchase market forecast development during the forecast period.

Mobile gaming is a major segment where in-app purchases are prevalent. The popularity of games with free-to-play models that monetize through IAPs, such as cosmetic items, extra lives, or game currencies, is a significant driver. Apps that focus on user engagement and retention strategies often incorporate in-app purchases. Features like exclusive content, additional functionalities, and customization options incentivize users to spend within the app.

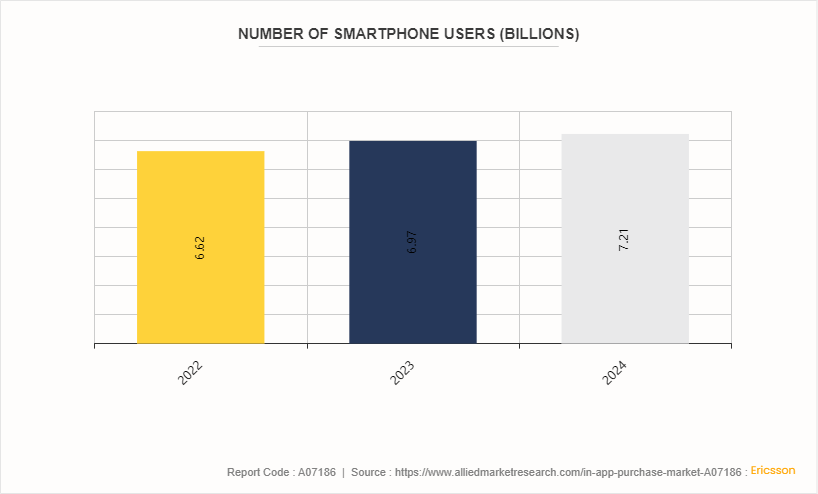

Number of Smartphone Users

As more people gain access to smartphones and the internet, the potential audience for mobile apps grows. This expansion provides a larger user base that can be monetized through in-app purchases. In addition, smartphones make it easy for users to access apps anytime and anywhere. The convenience of making purchases directly within an app encourages more frequent transactions compared to traditional methods. According to Ericsson, the number of smartphones in the world in 2024 is 7.21 billion. This figure is a considerable 28.98% increase from five years ago when it was estimated that there were 5.59 billion smartphones globally. 60.42% of the world’s population owns a smartphone.

Market Segmentation

The in-app purchase market is segmented into operating system, type, application, and region. On the basis of operating system, the market is divided into android, iOS and others. As per type, the market is segregated into consumable, non-consumable, auto renewable and non-renewing subscription. On the basis of application, the market is divided into gaming, entertainment and music, health and fitness, travel and action, finance and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

The global in-app purchase market is experiencing substantial growth, with the U.S. playing a pivotal role in this expansion. In the U.S., high smartphone penetration, widespread internet access, and a tech-savvy population have created a fertile ground for in-app purchases. Moreover, Japan's high smartphone penetration rate, coupled with a robust digital infrastructure and a culture of mobile gaming, fuels the expansion of in-app purchases. Japanese consumers, known for their willingness to spend on digital entertainment, particularly in mobile games, drive substantial revenue through in-app purchase market forecast period.

In December 2023, Japanese Finance Ministry, officially announced its intention to extend Value Added Tax (VAT) collections to app stores starting January 2025. Notably, major platforms such as Google and Apple will be tasked with collecting a 10% Consumption Tax from third-party providers selling to Japanese consumers through their platforms.

In September 2023, China’s technology giants have reportedly begun enforcing new rules governing app publishers. Mobile app stores operated by companies like Tencent and Xiaomi have begun blocking app publishers from debuting new apps if they have not made proper disclosures to the authorities.

Competitive Landscape

The major players operating in the in-app purchase market include Apple Inc., Disney, Google LLC, King.com Ltd., Netflix, Inc., Creative Clicks, AdMaven, POCKETGUARD, PubMatic, Roblox, InMobi, Brainly, Recurly, Propeller Ads and Tango.

Recent Key Strategies and Developments

In January 2024, Spotify announced to launch in-app purchases. The company is hoping to implement full in-app payment functionality that will allow users to upgrade their subscription or buy an audiobook with a tap.

In August 2023, TikTok launched its initial ‘Trendy Beat’ showcase in the UK, which is an in-app showcase of products made by TikTok itself. The concept here is that TikTok’s looking to inject itself into the consumer supply chain, by offering popular products, made by Chinese suppliers, based on TikTok trends.

In September 2021, StoreKit launched a powerful new Swift-based APIs that make supporting in-app purchases and subscriptions easier than ever. Customer can now easily determine product entitlements and eligibility for offers, quickly get a user’s history of in-app purchases, find out the latest status of a subscription with one simple check, provide a way to request refunds and manage subscriptions from within the app, and more.

Key Sources Referred

Tizen Developers

Apple Developer

GeeksforGeeks

Wordpress

GSM Association

Key Benefits For Stakeholders

This report provides a quantitative analysis of the in-app purchase market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market share opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the in-app purchase market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global in-app purchase market size statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global in-app purchase market trends, key players, market segments, application areas, and market growth strategies.

In-App Purchase Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 571.2 Billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Operating System |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Creative Clicks, POCKETGUARD, King.com Ltd., Recurly, InMobi, Google LLC, Propeller Ads, Netflix, Inc., Roblox, PubMatic, Brainly, Disney, AdMaven, Apple Inc. |

Subscription-based in-app purchases are becoming increasingly popular, especially in sectors like gaming, fitness, and media streaming.

Gaming is the leading application of In-App Purchase Market as of 2023.

North America is the largest regional market for In-App Purchase in 2023.

Apple Inc., Disney, Google LLC, King.com Ltd., Netflix, Inc., Creative Clicks, AdMaven, POCKETGUARD, PubMatic, Roblox, InMobi, Brainly, Recurly, Propeller Ads and Tango are the top companies to hold the market share in In-App Purchase

$571.2 billion is the estimated industry size of In-App Purchase by 2032.

Loading Table Of Content...