In-Game Advertising Market Insights, 2030

The global in-game advertising market was valued at USD 6.8 billion in 2021, and is projected to reach USD 17.6 billion by 2030, growing at a CAGR of 11% from 2022 to 2030.

Growing interest in social and mobile gaming is expected to have a positive impact in-game advertising market share growth. Advertisements can be integrated into desktop and mobile games via commercials, cut-scenes, billboards, and background displays with in-game advertising. Furthermore, these advertisements are non-interruptive, allowing players to have a more seamless experience. In-game advertisements are expected to have a greater audio-visual impact, leaving viewers with favorable and long-lasting product impressions.

In-game advertising appears in computers and video games. According to IGA, advertisements are being integrated into mobile and computer games. Examples include pop-up messages, on-screen advertisements, cut-scenes, billboards, and background displays. Static (non-changeable) ads, dynamic (changeable ads), and advergaming are all types of in-game advertising (a game built as an advertisement). One of the major factors driving in-game advertising market size is the increasing global internet penetration.

Various benefits such as lower advertising costs, increased reach and ROI, rapid integration, and simple configuration of adverts in social gaming are supposed to drive the in-game advertising market. Furthermore, the integration of effective gaming payment schemes reduces fraud, which might also propel the market over the forecast period. The growing availability of free smartphone games that generate revenue through in-game advertising is expected to drive market growth.

The increasing time and cost of developing new games, combined with a shorter product lifecycle, are expected to stymie market growth. The increasing reluctance of gaming companies as a result of declining advertising revenues is expected to pose a challenge to the in-game advertising market growth. Furthermore, the need to limit poorly designed advertisements with low consumer impact may impede market growth. An increase in the number of unrelated and distracting advertisements for online and social gaming is expected to have a negative impact on market growth.

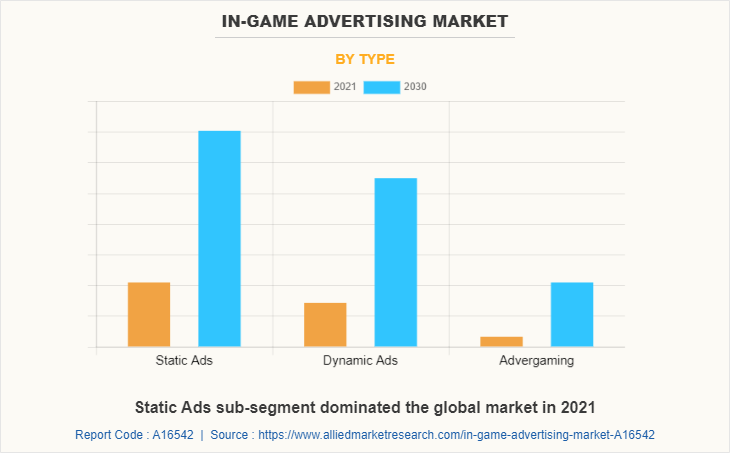

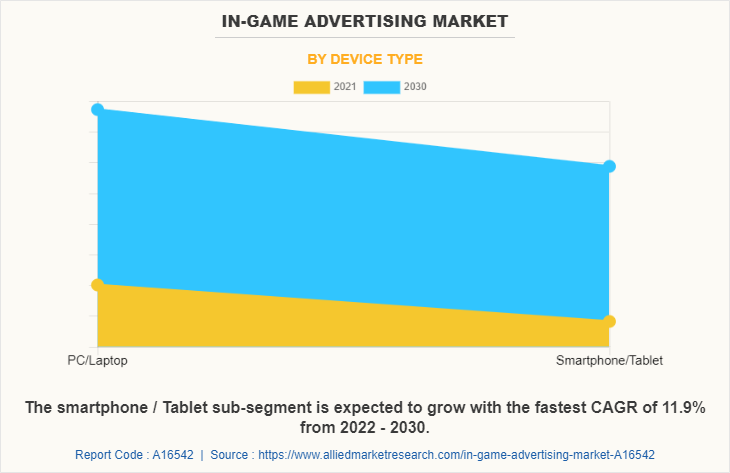

The global in-game advertising market is segmented on the basis of type, device type, and region. By type, the market has been divided into static ads, dynamic ads, and advergaming. By device type, the analysis has been divided into PC/laptop and smartphone/tablet. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include Alphabet Inc., Anzu Virtual Reality Ltd., Blizzard Entertainment Inc., Electronic Arts Inc., MediaSpike Inc., ironSource Ltd., Motive Interactive Inc., Playwire LLC, RapidFire Inc., WPP Plc.

By type, the market has been divided into static ads, dynamic ads, and advergaming. The static ads sub-segment is expected to have the largest share in in-gaming market. Static advertisements are those that do not change. Simply put, static ads are used by promoters when they want to raise brand awareness and reach a large audience. When a static ad includes a banner or ads in video games, it can be mistaken for a dynamic ad.

By device type, the market has been divided into PC/laptop and smartphone/tablet. The PC/laptop sub-segment is expected to have a dominant share of global in-game advertising market. Steam, the PC game platform, has several times reported breaking global concurrent user records. Due to online games having high graphic resolutions and being available on PC/laptop, there is a large number of PC/laptop games being played by players all over the world with enhanced users' experience, which is one of the reasons of the PC/laptop sub-segment to be dominant.

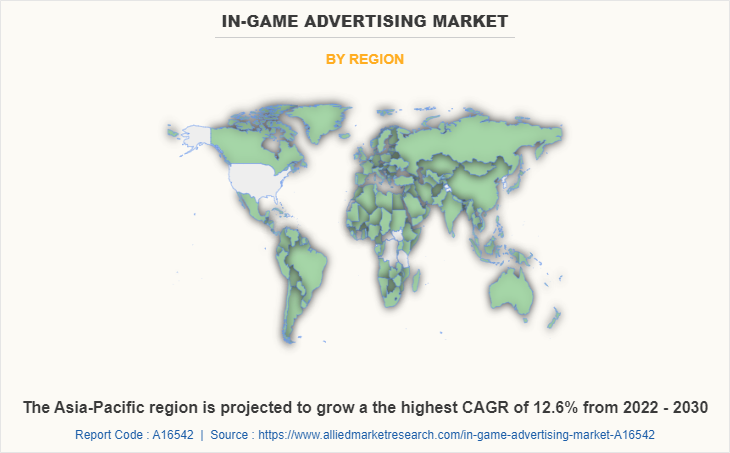

By region, North America dominated the global in-game advertising market in 2021 and is forecasted to remain the dominant region during the forecast period. The North American region is expected to expand due to the rapid sales of smartphones, PCs, laptops, and other electronic devices. The release of high-quality new games for smartphones, tablets, and consoles is increasing as developers increasingly use games as a medium of advertisement. Several developers use in-game advertising because it is non-intrusive and can be displayed while the game is being played. Developers can reach a large number of users and increase their market presence by using in-game advertising. Such factors are likely to accelerate the growth of in-game advertising market size in the anticipated time frame.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the in-game advertising market analysis from 2021 to 2030 to identify the prevailing in-game advertising market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the in-game advertising market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global in-game advertising market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global in-game advertising market trends, key players, market segments, application areas, and market growth strategies.

Imapct of Covid-19

- The coronavirus pandemic has had a significant impact on many people's lives in nearly every country. The COVID-19 pandemic is causing havoc in a variety of industries, including digital advertising. With the COVID-19 pandemic, business owners are reconsidering their marketing strategies and debating whether now is the best time to run online ads.

- The impact of COVID-19 on the in-game advertising market is positive because most end users are now operating online with digital devices, and with the end of the pandemic uncertain, many organizations are planning to shift their advertising investment to digital platforms.

- The in-game advertisement market is expected to be driven by increasing technological advancements, as well as increased consumer time spent on internet gaming.

In-Game Advertising Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 17.6 billion |

| Growth Rate | CAGR of 11% |

| Forecast period | 2021 - 2030 |

| Report Pages | 176 |

| By Type |

|

| By Device Type |

|

| By Region |

|

| Key Market Players | Motive Interactive Inc., Blizzard Entertainment Inc., Playwire LLC., WPP Plc., Electronic Arts Inc., ironSource Ltd., MediaSpike Inc., RapidFire Inc., Alphabet Inc., Anzu Virtual Reality Ltd. |

Analyst Review

According to the CXOs of the leading companies, the global in-game advertising market possesses a substantial scope for growth in the future. Automation technologies are rapidly gaining traction in the advertising industry. This is advantageous for the growth of the global in-game advertising market because automated internet advertising has provided benefits to advertising such as efficiency, scale, and low cost. Automation technology adoption is increasing across various advertising platforms, including Google and Facebook. Google, for example, has incorporated advertising automation via automated bidding strategies, automated ad copy, and automated PPC reporting. All such factors and initiatives will drive the global in-game advertising market growth. According to the CXOs, Asia-Pacific is projected to register faster growth as compared to North America and European markets.

The global in-game advertising market was valued at $6.8 billion in 2021, and is projected to reach $17.6 billion by 2030

The in-game advertising market is projected to grow at a compound annual growth rate of 11% from 2022 to 2030.

Alphabet Inc., Anzu Virtual Reality Ltd., Blizzard Entertainment Inc., Electronic Arts Inc., MediaSpike Inc., ironSource Ltd., Motive Interactive Inc., Playwire LLC, RapidFire Inc., WPP Plc. are the leading market players active in the in-game advertising market.

North America market registered the highest market share in 2021 and is projected to maintain the position during the forecast period.

The growing availability of free mobile games that generate revenue through in-game advertising is expected to drive market growth. This service may also generate additional revenue for game developers, fueling market growth. In-game advertisements incorporated with smartphone games as well enable location as well as tracking features that can be used to provide customers with location-specific advertisements, resulting in greater customer impact. The growing number of smartphone users in Asian economies such as India and China, combined with an increase in the number of energetic online users, may provide an opportunity for expansion from the in-advertising market. All such aspects will ultimately accelerate the global in-game advertising market growth in the next few years.

Loading Table Of Content...

Loading Research Methodology...