In-Space Manufacturing, Servicing, And Transportation Market Research, 2040

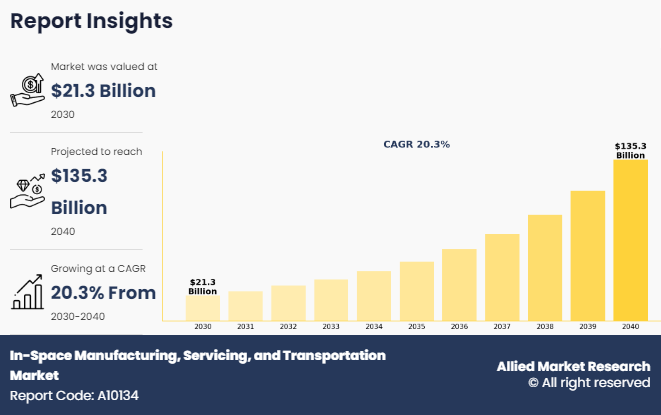

The global in-space manufacturing, servicing, and transportation market size was valued at $21.3 billion in 2030, and is projected to reach $135.3 billion by 2040, growing at a CAGR of 20.3% from 2030 to 2040.

In-Space Manufacturing, Servicing, and Transportation refers to the development and deployment of technologies that enable the production, maintenance, and movement of materials and equipment in space. This market exists to enhance the efficiency, cost-effectiveness, and capabilities of space missions. Key benefits include the reduction of dependency on Earth-based resources, the ability to repair and upgrade satellites and other space assets in orbit, and the facilitation of sustainable long-term space exploration and habitation. In-space manufacturing, servicing, and transportation aims to support various space activities by providing on-demand manufacturing, extending the lifespan of space assets, and ensuring reliable transportation between different space locations, thereby driving the future of space infrastructure and exploration.

The in-space manufacturing, servicing, and transportation industry encompasses the emerging sector focused on the development, deployment, and operation of technologies and systems designed to perform various functions in space. This includes manufacturing processes conducted in microgravity, such as 3D printing and the production of advanced materials, the servicing and maintenance of satellites and other space assets, including refueling, repairs, and upgrades, as well as the transportation of goods, materials, and personnel between Earth, orbit, and deep-space destinations.

For instance, in January 2024, NASA announced the successful launch of the Made In Space Archinaut One, which aims to demonstrate autonomous robotic manufacturing and assembly in orbit. This project marks a significant step towards reducing the dependency on Earth-based supply chains for spacecraft components. Moreover, in March 2024, Northrop Grumman completed the acquisition of Astroscale U.S. to enhance their capabilities in satellite servicing and debris removal. This strategic move aims to bolster their position in the rapidly growing in-space servicing sector.

The rise in the commercial space sector is significantly driving demand for the in-space manufacturing, servicing, and transportation market trends. As private companies like SpaceX, Blue Origin, and others invest heavily in space exploration and infrastructure, the need for in-space services, such as satellite maintenance, refueling, and advanced manufacturing capabilities, is growing. These companies aim to reduce costs, extend the lifespan of space assets, and ensure the sustainability of space operations, creating a robust market for in-space services. The expansion of space tourism and commercial missions further accelerates the need for efficient transportation and in-space support systems. Furthermore, advancement in space technologies, and government and international support have driven the demand for in-space manufacturing, servicing, and transportation market size.

However, high initial costs are significantly hampering the demand for the in-space manufacturing, servicing, and transportation market growth. The complex and fragmented nature of space regulations across different jurisdictions creates compliance difficulties and increases operational costs. Unclear or inconsistent legal frameworks regarding space traffic management, debris mitigation, and licensing can lead to delays and uncertainties. Issues related to space property rights, liability for space debris, and intellectual property protections further complicate the regulatory landscape. These challenges create barriers for companies, deterring investment and slowing market growth by increasing financial and operational risks. Moreover, regulatory and legal challenges, and limited market maturity are major factors that hamper the growth of in-space manufacturing, servicing, and transportation market share.

On the contrary, partnerships with space agencies offer a lucrative opportunity for the in-space manufacturing, servicing, and transportation market by providing access to critical resources, expertise, and infrastructure. Collaborating with established agencies like NASA, ESA, and others grants private companies valuable support, including funding, technical knowledge, and opportunities for joint research and development. These partnerships facilitate the integration of cutting-edge technologies and enable companies to leverage space agencies' existing facilities, such as the International Space Station, for testing and operational deployment.

Market Overview

Rise in the Commercial Space Sector

The rise in the commercial space sector is significantly driving the demand for the in-space manufacturing, servicing, and transportation market by creating new opportunities and requirements for space-based operations. As private companies like SpaceX and Blue Origin expand their space activities, including satellite deployment, space tourism, and deep-space exploration, there is a growing need for robust in-space infrastructure. Commercial ventures necessitate advanced in-space manufacturing capabilities to produce high-quality materials in microgravity and to support long-term space missions. For instance, in May 2024 Maxar Technologies expanded its business by launching the Dragonfly mission, focusing on in-situ resource utilization (ISRU) on the Moon. This mission aims to demonstrate the feasibility of using lunar materials for construction, reducing the cost of lunar infrastructure development.

In addition, the increase in satellite constellations and space stations drives demand for servicing solutions, such as satellite repairs, refueling, and upgrades. The expansion of private space missions also boosts the need for reliable transportation systems to move goods and personnel between Earth and space. Overall, the commercial sector’s rapid growth is fueling investments and innovations in these areas, propelling the market forward. Therefore, rise in the commercial space sector is driving the demand for in-Space manufacturing, servicing, and transportation industry.

Advancement in Space Technologies

Advancements in space technologies are significantly driving the demand for the in-space manufacturing, servicing, and transportation market by enabling more complex and efficient operations in space. Innovations such as robotics, artificial intelligence, and automation have revolutionized in-space manufacturing, allowing for precise and scalable production of materials and components in microgravity. These technologies facilitate the development of advanced manufacturing processes that were previously unfeasible. For instance, in February 2024 Made In Space, a subsidiary of Redwire, successfully tested its Archinaut One system in orbit, a robotic platform capable of manufacturing and assembling large structures in space. This innovation marks a significant milestone in advancing in-space manufacturing technology, enabling the construction of satellites and other structures directly in orbit, thus reducing launch constraints and costs.

In addition, improvements in spacecraft design and propulsion systems enhance the capability to transport goods and personnel to and from space with greater efficiency and reliability. Enhanced satellite servicing technologies, including autonomous repair and refueling systems, extend the lifespan of space assets and reduce the need for costly replacements. Together, these technological advancements lower operational costs, increase the feasibility of space missions, and drive the demand for integrated in-space services and infrastructure, thereby accelerating market growth. Therefore, advancement in space technologies is driving the demand for in-space manufacturing, servicing and transportation market.

Government and International Support

Government and international support are crucial drivers of demand for the in-space manufacturing, servicing, and transportation market. Government agencies, such as NASA, ESA, and others, provide substantial funding and resources for space exploration and technology development, fostering innovation and expanding market opportunities. International collaborations, such as the International Space Station (ISS) partnership, promote shared technological advancements and the development of in-space infrastructure. These partnerships often involve joint ventures, research initiatives, and the deployment of advanced systems that require in-space servicing and manufacturing capabilities. For instance, in May 2024 Northrop Grumman expanded its space logistics capabilities by launching the MEV-3 (Mission Extension Vehicle-3), designed to extend the life of aging satellites by docking and providing propulsion and attitude control. This follows the success of MEV-1 and MEV-2, demonstrating Northrop Grumman's leadership in space servicing and sustainability.

Moreover, favourable policies and incentives for private sector investments in space encourage commercial enterprises to develop new technologies and services. This support not only reduces financial risks but also accelerates the implementation of in-space operations, driving demand for specialized services and infrastructure. The combined effect of government and international backing is a robust and growing market for in-space activities. Therefore, government and international support is driving the growth of the in-space manufacturing, servicing and transportation market.

High Initial Cost

High initial costs are a significant barrier to the growth of the in-space manufacturing, servicing, and transportation market. Developing the technologies and infrastructure required for space operations involves substantial capital investment, including the costs of research and development, manufacturing specialized equipment, and launching payloads into space. The financial burden extends to establishing and maintaining operational facilities in space, which can be prohibitively expensive. These high costs create a considerable financial risk for both startups and established companies, deterring potential investors and slowing market entry.

In addition, the economic uncertainty associated with space missions and the potential for mission failures add to the financial challenges. As a result, many companies are hesitant to commit to large-scale in-space projects, limiting market expansion and delaying the widespread adoption of in-space manufacturing, servicing, and transportation technologies. Therefore, high initial cost is hampering the growth of the in-space manufacturing, servicing, and transportation market.

Regulatory and Legal Challenges

Regulatory and legal challenges are significant obstacles hampering the demand for the in-space manufacturing, servicing, and transportation market. The space industry operates within a complex framework of national and international regulations, which can be unclear and vary widely between jurisdictions. Compliance with these regulations involves navigating intricate legal requirements related to space traffic management, debris mitigation, and licensing for operations.

In addition, the lack of a unified regulatory framework across different countries can lead to inconsistent standards and increased compliance costs. Legal uncertainties regarding property rights in space, liability for space debris, and intellectual property protections further complicate the landscape. These regulatory hurdles create barriers for companies seeking to invest in or expand their space operations, slowing market growth and deterring potential entrants. Addressing these challenges is essential to create a more predictable and supportive environment for in-space activities. Therefore, high cost of fuel cell technology is hampering the demand for the in-space manufacturing, servicing and transportation market.

Partnership with Space Agencies

Partnerships with space agencies represent a lucrative opportunity for the in-space manufacturing, servicing, and transportation market. Collaborating with prominent agencies such as NASA, ESA, and other national space organizations provides private companies with access to significant resources, including funding, technical expertise, and established infrastructure. These partnerships often involve joint research and development initiatives, where space agencies offer invaluable insights and support for developing advanced technologies and systems. For instance, in August 2024 Exolaunch and Impulse Space have announced a strategic partnership aimed at enhancing satellite launch and in-space transportation services. This collaboration combines Exolaunch's expertise in providing reliable and cost-effective launch services with Impulse Space's innovative in-space transportation solutions.

In addition, space agencies can provide access to their facilities and platforms, such as the International Space Station, for testing and operational deployment. The endorsement and backing from these agencies enhance the credibility of commercial ventures, attracting further investment and market interest. Furthermore, such collaborations can lead to long-term contracts and opportunities for expansion into new space missions and projects, thereby accelerating market growth and driving innovation in space manufacturing, servicing, and transportation. Therefore, partnership with space agencies is lucrative opportunity for in-space manufacturing, servicing and transportation market.

Segment Overview

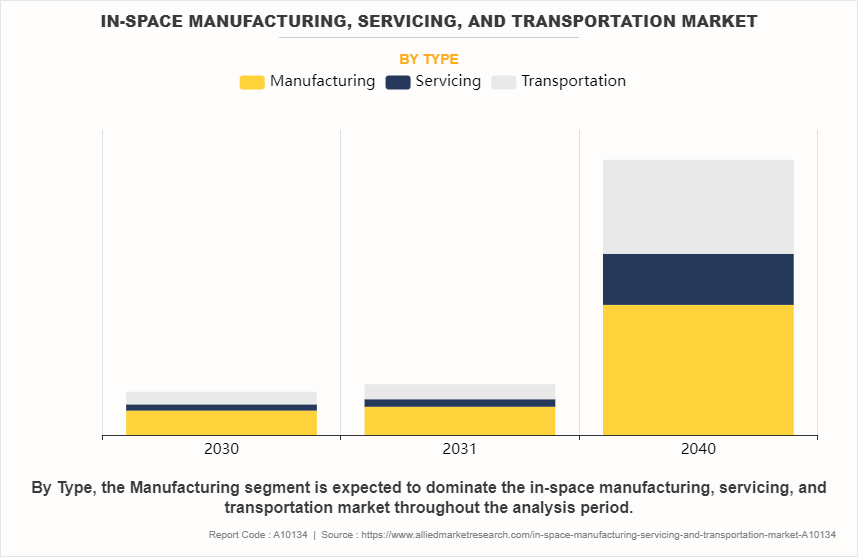

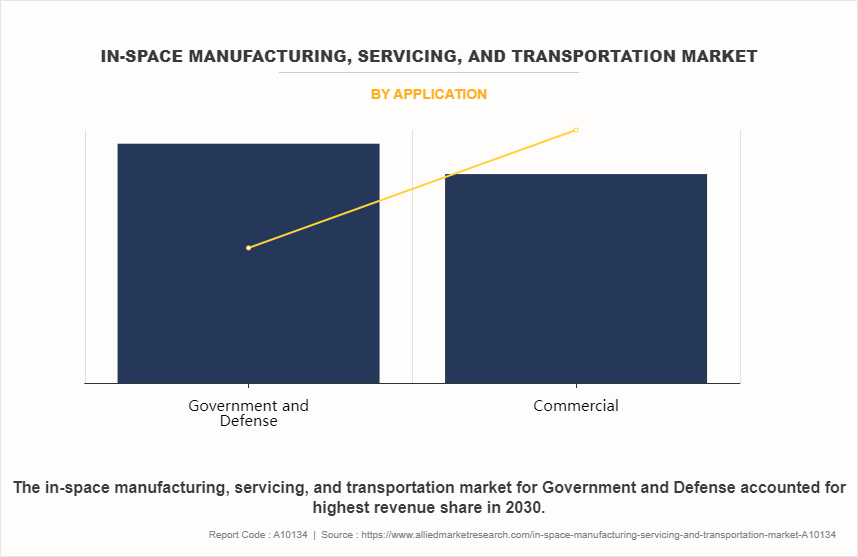

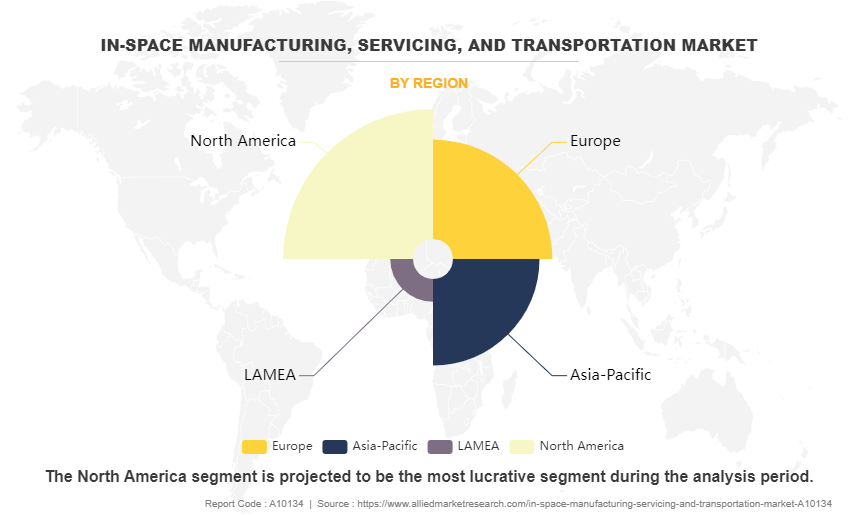

The in-space manufacturing, servicing and transportation market is segmented into type, application, and region. On the basis of type, the market is divided into manufacturing, servicing, and transportation. As per application, the market is segregated into government and defense, and commercial. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

On the basis of type, the manufacturing segment attained the highest market share in 2023 in the in-space manufacturing, servicing and transportation market. Due to the unique advantages of microgravity for producing high-value materials and products. Manufacturing in space allows for the creation of advanced materials, such as high-purity optical fibers and pharmaceuticals, that are difficult or impossible to produce on Earth. These products can command premium prices due to their superior quality and potential applications in various industries. Meanwhile, the servicing segment is projected to be the fastest-growing segment during the forecast period due to due to the increasing demand for satellite maintenance, repair, refuelling, and debris removal. As the number of satellites in orbit rises, the need for in-orbit servicing to extend their operational life and ensure sustainability has driven rapid growth in this sector.

By Application

On the basis of application, the government and defense segment attained the highest market share in 2023 in the in-space manufacturing, servicing and transportation. Due to the strategic importance of space for national security and technological leadership. Governments and defense agencies are heavily investing in space-based capabilities, such as satellite communications, Earth observation, and surveillance, which require regular maintenance, upgrades, and new infrastructure. These entities have the financial resources and long-term vision to support large-scale in-space projects. Meanwhile, the commercial segment is projected to be the fastest-growing segment during the in-space manufacturing, servicing, and transportation market forecast period due to the rise in private investments, satellite deployments, space tourism, and partnerships with government space agencies. Growing interest from commercial players to develop infrastructure for long-term space activities has further accelerated demand, driving significant growth in this sector.

By Region

On the basis of region, North America attained the highest market share in 2023 and emerged as the leading region in the in-space manufacturing, servicing and transportation market due to its strong presence of leading space companies and extensive government support. The region is home to major players like SpaceX, Blue Origin, and Lockheed Martin, which are driving innovation and commercialization of space activities. Robust funding and strategic initiatives from NASA and the U.S. Department of Defense have accelerated the development of advanced in-space technologies. The well-established space infrastructure, coupled with a highly skilled workforce and supportive regulatory environment, positions North America as a dominant force in this rapidly growing market.

Meanwhile, Asia-Pacific is projected to be the fastest-growing region for the in-space manufacturing, servicing and transportation during the forecast period. This is due to rapid advancements in space technology and increasing investments from both government and private sectors. Countries like China, India, and Japan are significantly expanding their space programs, focusing on satellite development, space exploration, and infrastructure. The region's growing commercial space industry, driven by emerging space companies and ambitious space missions, further contributes to this growth. Favourable government policies, rising technological capabilities, and strategic partnerships are accelerating the development of in-space services, positioning Asia-Pacific as a key player in the global space market.

The report focuses on growth prospects, restraints, and trends of the in-space manufacturing, servicing and transportation analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the in-space manufacturing, servicing and transportation market.

Competitive Analysis

The report analyzes the profiles of key players operating in the in-space manufacturing, servicing and transportation such as Airbus, Arianespace SA, Astrobotics, Blue Origin Enterprises, L.P., Boeing, Mitsubishi Heavy Industries Ltd., Northrop Grumman, Rocket Lab USA, Spacex, and Thales. These players have adopted various strategies to increase their market penetration and strengthen their position in the In-space manufacturing, servicing and transportation market.

Key Takeaways

- On the basis of type, the manufactures segment held the largest share in the in-space manufacturing, servicing and transportation in 2023.

- By Application, the government and defense segment held the largest share in the market in 2023.

- On the basis of region, North America held the largest market share in 2023.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the In-space manufacturing, servicing and transportation analysis from 2023 to 2033 to identify the prevailing in-space manufacturing, servicing, and transportation market analysis.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the In-space manufacturing, servicing and transportation segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global In-space manufacturing, servicing and transportation trends, key players, market segments, application areas, and market growth strategies.

In-Space Manufacturing, Servicing, and Transportation Market Report Highlights

| Aspects | Details |

| Market Size By 2040 | USD 135.3 billion |

| Growth Rate | CAGR of 20.3% |

| Forecast period | 2030 - 2040 |

| Report Pages | 266 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | BLUE ORIGIN LLC, SpaceX, Northrop Grumman, Boeing, Astrobotic Technology, Thales, Arianespace, MITSUBISHI HEAVY INDUSTRIES, LTD., ROCKETLAB, Airbus |

Upcoming trends in the in-space manufacturing, servicing, and transportation market include advancements in on-orbit 3D printing for satellite repairs, the rise of autonomous servicing vehicles for satellite maintenance and refueling, and increased private sector participation in space logistics. There is also growing interest in space debris management technologies and in-space construction for future habitats. The commercialization of space stations and collaborative government-private missions will further drive market innovation and expansion?

The leading application of the In-Space Manufacturing, Servicing, and Transportation Market is in the government and defense sector. This includes satellite maintenance, repair, refueling, and space-based surveillance systems crucial for national security and intelligence operations?

North America is the largest regional market for In-Space Manufacturing, Servicing, and Transportation

$21,260.1 million is the estimated industry size of In-Space Manufacturing, Servicing, and Transportation in 2030

SpaceX, Northrop Grumman, Boeing, BLUE ORIGIN LLC, Airbus, ROCKETLAB, Thales, MITSUBISHI HEAVY INDUSTRIES, LTD., Arianespace, Astrobotic Technology

Loading Table Of Content...

Loading Research Methodology...