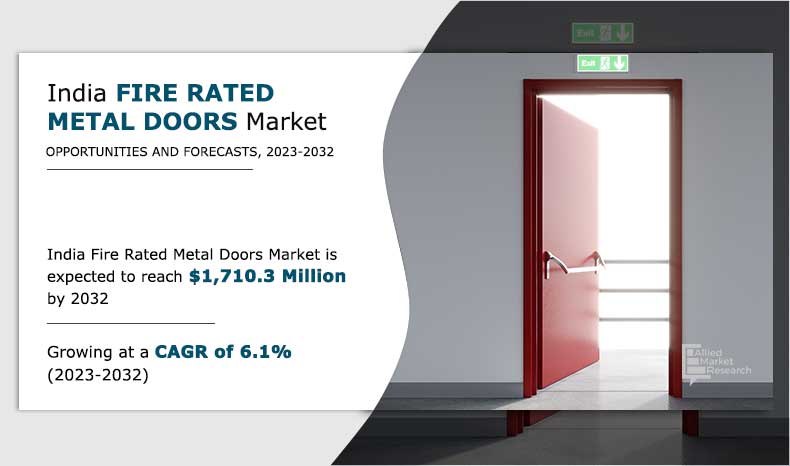

The India fire-rated metal doors market size was valued at $851.58 million in 2020 and is projected to reach $1,710.32 million by 2032, registering a CAGR of 6.7% from 2023 to 2032. Fire-rated metal doors are specialized doors designed to resist the spread of fire and smoke within a building, providing a barrier that helps contain the flames and protect occupants. These doors are constructed with materials that have fire-resistant properties, including a metal core, rockwool core, and honeycomb core, which enhances their durability and ability to withstand the harsh conditions of a fire. Fire-rated doors are tested and certified to withstand fire for a specified period. Common ratings include 20 minutes, 60 minutes, 90 minutes, and above. These doors provide integrity i.e., preventing the passage of flames and hot gases, and insulation capabilities to limit the transfer of heat. To ensure effective performance, fire-rated doors are equipped with intumescent seals that expand when exposed to heat, creating a barrier against smoke and flames. Automatic door closers are often installed to ensure that the door closes and latches securely in the event of a fire.

“The India fire-rated metal doors market is anticipated to grow with a considerable CAGR in the coming decade, owing to increase in industrialization and urbanization in the country. However, the market is negatively impacted by the lack of skilled workforce in industrial sector which includes construction and manufacturing.”

Market Dynamics

The market for fire-rated metal doors is growing with an increase in construction rate in India, primarily driven by urbanization and industrialization. India's population has experienced significant growth, with projections indicating a further increase to 1.52 billion by 2036. Additionally, the urban landscape is expected to witness a 70% surge, with an estimated 39% of the population residing in urban areas by 2036, a substantial rise from the 31% recorded in 2011.

This population growth is a key driver for the demand for residential buildings. As per the India Brand Equity Foundation (IBEF), the demand for residential properties has seen a notable upswing in recent years, positioning India among the top 10 internationally appreciated housing markets. Notably, the Indian real estate sector attracted $5 billion in institutional investments in 2020 and accumulated $55.18 billion in Foreign Direct Investment (FDI) from April 2000 to September 2022Moreover, the Investment Information and Credit Rating Agency (ICRA) reports a remarkable 11% year-on-year growth in the residential real estate sector in the fourth quarter of 2022. This surge in residential buildings is expected to propel the demand for both interior and exterior doors.

However, over the past few years, the prices of these raw materials have been fluctuating owing to a range of economic and political aspects, including mismatches in supply & demand. Government-led stringent laws, tariffs, and regulations against deforestation, metals, and other materials used in fire rated doors have declined the revenues and profits of the manufacturers to a greater extent. For instance, India alleges that China has been employing trade malpractices by availing raw materials such as glass and steel at an extremely non-competitive low cost, known as ‘dumping’. Therefore, in December 2020, India extended the anti-dumping duty on steel products from China, which was first imposed in 2015. Furthermore, owing to the lockdowns in China, and the Ukraine-Russia war, the prices of raw materials are fluctuating heavily. Hence, the unstable, and rise in prices of raw materials are anticipated to restrict the India fire rated metal doors market growth during the forecast period.

Moreover, technological advancements in fire-rated metal doors are marked by innovative features and materials that enhance their effectiveness in providing fire resistance and overall safety. A notable example is the integration of advanced materials, such as intumescent compounds, which enable doors to expand when exposed to heat. This expansion creates a protective barrier, sealing off openings and preventing the penetration of fire and smoke. Such technology significantly enhances the door's ability to withstand fire conditions, contributing to increased safety in buildings.

Moreover, continuous developments in door hardware and locking systems have led to the creation of more sophisticated and secure fire-rated metal doors. These doors not only meet stringent fire safety requirements but also incorporate enhanced security features. The growth potential in this sector is expansive, driven by the ongoing evolution of technology. As smart building technologies become more prevalent, there is an opportunity to integrate fire-rated metal doors into interconnected building management systems. These systems can enable real-time monitoring of door conditions, automatic activation of fire-resistant features, and seamless integration with emergency response systems. Additionally, the increasing demand for sustainable and eco-friendly building solutions creates opportunities for the development of fire-rated doors using environment-friendly materials and incorporating energy-efficient features. In the context of evolving building designs that are more complex and diverse, customization becomes a viable option. Manufacturers can tailor fire-rated metal doors to specific architectural requirements while upholding the highest standards of fire protection. Technological advancements present promising growth opportunities, aligning with the rise in emphasis on safety, security, and sustainability in modern construction practices. These factors are expected to create lucrative prospects for the expansion of the fire-rated metal doors market.

The India fire-rated metal doors market witnessed challenges in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for tooling from construction and industrial sectors in India as well. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in global inflation which is a result of Ukraine and Russia war has affected the global economy is expected to impact the Indian exports, including exports of fire rated metal doors.

Segmental Overview

The India fire-rated metal doors market is segmented into fire resistance rating, application, end-user, infill type, mechanism, and region. By fire resistance rating, the market is divided into 30 minutes, 60 minutes, and 90 minutes and above. By application, the market is divided into interior and exterior. Based on end user, the market is bifurcated into institutional, and non-institutional. By mechanism, the market is categorized into swinging fire doors, folding fire doors, and others. By region, the market is divided into, four regions of India, such as east, west, north, and south.

By fire resistance rating: The India fire-rated metal doors market is divided into 30 minutes, 60 minutes, and 90 minutes and above. In 2020, the 90 minutes and above segment dominated the India fire-rated metal doors market, in terms of revenue, and the 30 minutes segment is expected to witness growth at a higher CAGR during the forecast period. The demand for fire-rated metal doors with a rating of 90 minutes and above is driven by a combination of stringent safety regulations, increased awareness of fire safety, and the recognition of the role these doors play in protecting lives and property. The major drivers include the need to extend the fire resistance in buildings with complex designs, high occupancies, or located in areas with specific fire risks. Fire-rated metal doors with a 30-minute rating are designed to withstand fire exposure for a specified duration, typically 30 minutes, providing crucial time for evacuation and limiting the spread of flames. These doors are commonly used in various interior applications where a moderate level of fire resistance is required.

By Fire Resistance

The 30 Minutes segment is projected to grow at a significant CAGR during the forecast period.

By application: The India fire-rated metal doors market is divided into interior and exterior. In 2020, the exterior segment dominated the India fire-rated metal doors market, in terms of revenue, and the interior segment is expected to witness growth at a higher CAGR during the forecast period. The interior doors are installed inside the building in locations such as in corridors, stairwells, utility rooms, offices, and areas where protection is required from the fire. The exterior segment includes fire rated metal doors that are commonly utilized on the exterior faces of warehouses, and commercial spaces such as malls, hotels, offices, industrial facilities, and others.

By end user: The India fire-rated metal doors market is divided into institutional, and non-institutional. In 2020, the non-institutional segment dominated the India fire-rated metal doors market, in terms of revenue, and the institutional segment is expected to grow at a higher CAGR during the forecast period. Fire-rated metal doors play a crucial role in ensuring the safety and security of institutional buildings. These doors are specifically designed and constructed to withstand the challenges posed by fire emergencies, providing a reliable barrier against the spread of flames, smoke, and heat. According to part 4 of the national building code of India, a horizontal exit shall be through a fire door of 120 min rating in a fire-resistant wall. Fire-rated metal doors for non-institutional buildings are specifically designed to withstand and limit the spread of fire, providing valuable time for occupants to evacuate the premises.

By infill type: The India fire-rated metal doors market is divided into honeycomb and rockwool. In 2020, the rockwool segment dominated the India fire-rated metal doors market, in terms of revenue, and the honeycomb segment is expected to grow at a higher CAGR during the forecast period. Rockwool is 100% fire resistant, classified as CLASS I, and has extremely low K-Value, also termed thermal conductivity; thus, it does not contribute to the fuel load in case of a fire. This characteristic enhances the overall fire safety of the door. Moreover, it can endure temperatures of up to 1000 degrees Celsius and maintain size and dimension stability for up to 2 hours. Honeycomb structures are renowned for their excellent strength-to-weight ratio. This property allows for the creation of lightweight yet strong doors. Moreover, the hexagonal cells of honeycomb infill distribute impact forces, making the door more resistant to dents and damage.

By Infill Type

The Rockwool segment is expected to hold a majority share of the market throughout the study period

By mechanism: The India fire-rated metal doors market is divided into swinging fire doors, folding fire doors, and others. In 2020, the swinging fire door segment dominated the India fire-rated metal doors market, in terms of revenue, and the folding segment is expected to grow at a higher CAGR during the forecast period. As fire-rated swing doors are highly durable, easily accessible, and deliver better fire protection, they are largely adopted by consumers. Most of the doors present in a home are swing doors. In addition, these fire doors are extensively used in residential buildings, shops, hospitals, retail outlets, hotel rooms, and salons; thereby, delivering a convenient walk in and walk out. An increase in consumer and government focus on enhancing fire security and fire prevention of infrastructural and human damage during fire incidence is expected to boost the growth of fire-rated folding doors during the forecast period.

By region: The market is divided into, four regions of India, such as east, west, north, and south. The west region accounted for a larger market share in terms of revenue in 2020. The East region is anticipated to grow at a higher CAGR during the forecast period. The cities in west region, such as Mumbai, Ahmedabad, and Pune are among the most urbanized cities in India, and have many high-rise buildings, which drives demand for fire rated metal doors.

Competition Analysis

Competitive analysis and profiles of the major players in the India fire-rated metal doors market are provided in the report. Major companies in the report include SHAKTI HORMANN PVT. LTD., NAVAIR International Pvt Limited, Godrej Industries Limited, Astral Windoors Private Limited, Motorolls, Nitsui India Pvt Ltd, Adiba Fire Doors, Tata Steel Limited (Tata Pravesh), JSW Steel Coated Products Ltd., and Avians Innovations Technology Pvt. Ltd. Major players offer a wide range of tooling and constantly innovate their products to remain competitive.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging India fire-rated metal doors market trends.

- In-depth India fire-rated metal doors market analysis is conducted by constructing market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the India fire-rated metal doors market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The India fire-rated metal doors market revenue and volume forecast analysis from 2023 to 2032 are included in the report.

- The key players within the India fire-rated metal doors market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the India fire-rated metal doors industry.

Analyst Review

The India fire rated metal door market has witnessed significant growth in the past few years owing to a surge in spending on building construction activities. The growing awareness of fire safety in buildings among the occupants is also a major driving factor for the market growth. Furthermore, rise in industrialization, which is driving the growth of warehouses and industrial facilities is eventually having a positive impact on the market.

The west region, which includes cities such as Mumbai, Pune, and Ahmedabad, having high-rise buildings is the major destination for fire-rated metal doors. For example, Mumbai, which leads a significant presence on India's skyline, boasting approximately 77% of the country's tall buildings. The city is home to over 100 structures exceeding 150 meters in height, and an additional 90 towers are in the development process, as outlined in the CII-CBRE report. Similarly, Pune is experiencing a notable increase in high-rise constructions surpassing 100 meters. Officials note a departure from the usual rate of one or two proposals annually to a substantial 17 approvals for such buildings in 2022-23, with 10 more proposals awaiting consideration. Thus, witnessing such growth, major companies are focused on offering innovative products. Such factors are driving the growth of the market.

Key factors driving the growth of the India fire-rated metal doors market include surge in number of commercial and residential buildings, growth in industrialization in India, and growth in awareness regarding safety from fires.

The latest version of the India fire-rated metal doors market report can be obtained on demand from the website.

The India fire-rated metal doors market size was valued at $950.6 million in 2022.

The India fire-rated metal doors market size is estimated to reach $1,710.3illion by 2032, exhibiting a CAGR of 6.1% from 2023 to 2032.

The forecast period considered for the India fire-rated metal doors market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

Exterior application of the fire-rated metal doors is the largest application.

Key companies profiled in the India fire-rated metal doors market report Include Shakti Hormann Pvt. Ltd., NAVAIR International Pvt Limited, Godrej Industries Limited, Astral Windoors Private Limited, Motorolls, Nitsui India Pvt Ltd, Adiba Fire Doors, Tata Steel Limited (Tata Pravesh), JSW Steel Coated Products Ltd., and Avians Innovations Technology Pvt. Ltd.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...