India Floor Coatings Market Overview:

The India floor coatings market accounted for $56,000.0 in 2017 and is anticipated to reach $91,129.8 by 2025, registering a CAGR of 6.0% from 2018 to 2025.

Floor coatings are used in slip resistance applications. They are anti-static, anti-vibration, and waterproof and provide attractive finish to floor and bare concrete. These coatings also offer different options related to styles and colors, thus increasing their adoption in houses, hotels, offices and warehouses. Use of floor coatings helps in the reduction of cracking of concrete and maintenance cost. Use of floor coatings help clean the floors easily and make manufacturing units, factories, and offices attractive delivering lustrous appearance on the floor. They are used across educational institutes, restaurants, aviation & transportation, medical & healthcare facilities, and commercial retail stores.

The Indian floor coatings market is driven by increase in demand from end users such as commercial, industrial, and residential. This market majorly consists of epoxy and polyurethane-based products and gain popularity in the Indian market as they exhibit abrasion, slippage, spillage, heat, and chemical resistance. The surface on which epoxy floor coatings is applied remains seamless, antistatic, and is easy to maintain. Growth in competition from substitutes is anticipated to hinder the growth of the floor coating market. The Asia-Pacific market experiences growth due to favorable government initiatives such as housing projects that boosts the development in construction industry which correspondingly increases the demand for floor coatings in the market.

The India floor coatings market is segmented based on binder type, coating component, floor structure, end use, and region. Based on binder type, the market is divided into epoxy, thermoplastic, thermoset, and others. Based on coating type, the market is classified into one component (1k), two component (2k), and three component (3k). Based on floor structure, the market is categorized into wood, terrazzo, mortar, others. Based on end use, the market is fragmented into residential, commercial, and industrial. Based on region, the market is analyzed across North India, East India, West India and South India.

The major key players operating in the India floor coatings market include Akzo Nobel N.V., Akema S.A., Asian Paints Ltd., Berger Paints India Limited, and DowDuPont, Flowcrete India Pvt. Ltd., Indigo Paints, Kansai Nerolac Paints Limited, Sika Industries Ltd., 3M. Other players operating in the floor coating market include the Sherwin-Williams company, PPG Industries, Conpro Chemicals, Carbolink India Pvt. Ltd.

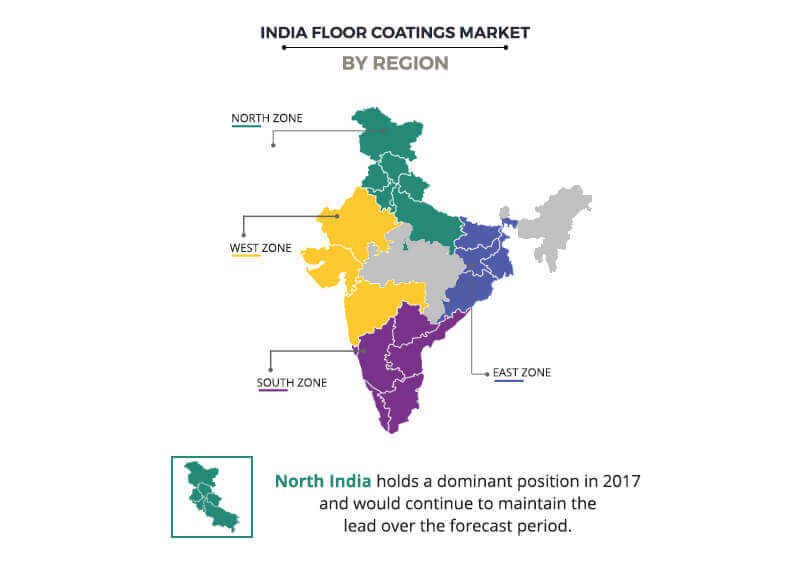

India Floor Coatings market share, by region

Based on region, North India accounts for major share in the India floor coatings market. Favorable governmental initiatives such as Make in India and rise in investment in infrastructural development increase the importance of floor coatings. In addition, economic development drives urbanization and industrialization, which has positive impact on the floor coatings market. Growth in commercial activities, such as construction of new hotels and restaurants provide significant growth opportunities for the floor coating market in India.

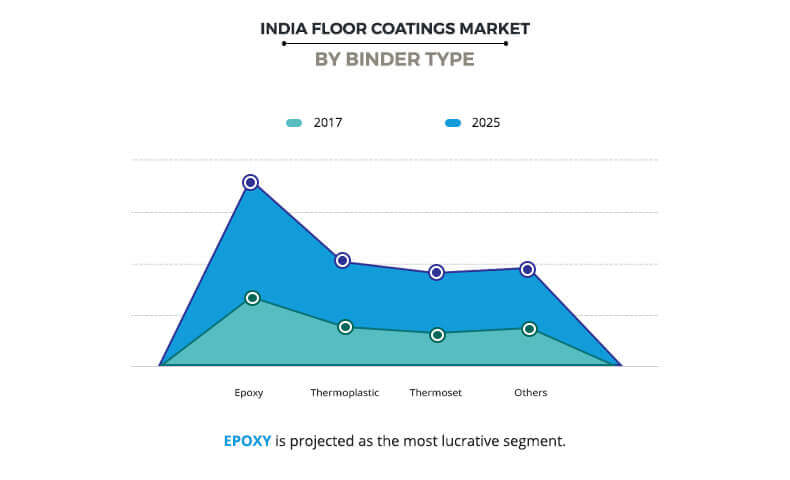

India Floor Coatings market, by Binder Type

Based on binder, the epoxy segment dominated the market in 2017, owing to physical properties such as resistant to water, saline, organics, acids, temperature, and mechanical damages, which make them a preferred material for floor coatings.

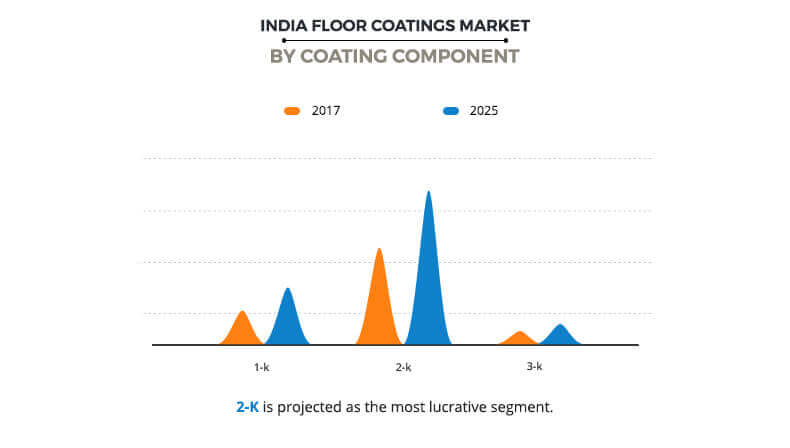

India Floor Coatings market, by Coating Component

Based on coating component, the two component (2K) segment dominated the market in 2017, owing to unique mechanical properties, superior weather resistance, high chemical resistance, and enables rapid curing. It can withstand high temperatures when cured and thus can be applied at nearly any temperature. This in turn increases the adoption of two component coating in residential, commercial, and industrial applications.

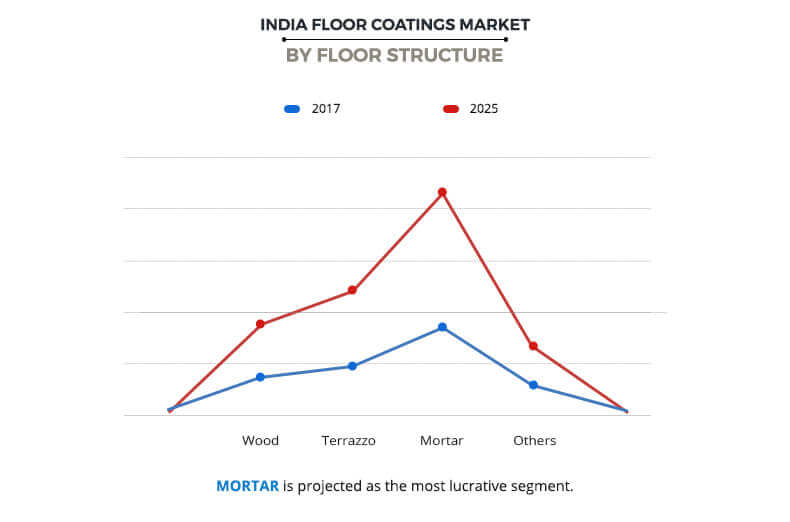

India Floor Coatings market, by floor structure

Based on floor structure, the mortar segment dominated the market in 2017, owing to its low cost and high strength. This in turn increased the adoption of mortar floor structure for outdoor walls.

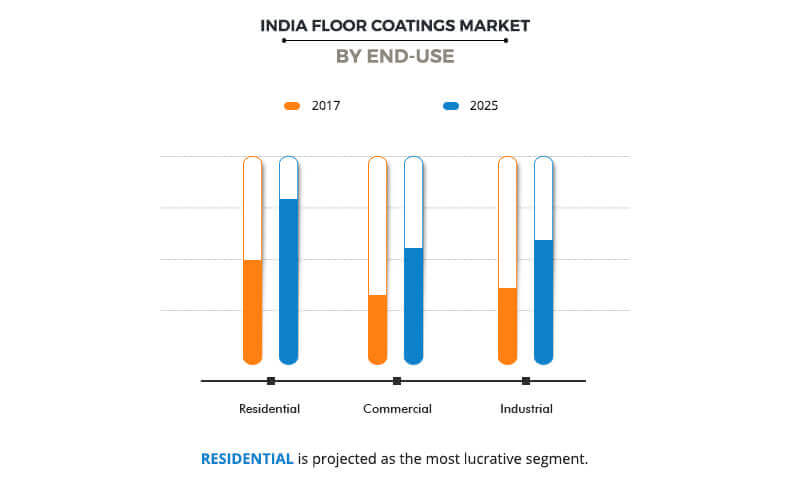

India Floor Coatings market, by End Use

Based on end use, the residential segment dominated the market in 2017, owing to construction of new residential spaces. This in turn increased the adoption of floor coatings for residential construction.

Key Benefits for India Floor Coatings Market:

- The report provides an in depth analysis of the India floor coatings market with current and future trends

- The major states in each region have been mapped according to their individual revenue contribution to the regional market.

- Porters five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current trends and future scenario of the market from 2018 to 2025 to understand the prevailing opportunities and potential investment pockets.

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study.

- The profiles of key players along with their key strategic developments are enlisted in the India floor coatings report.

India Floor Coatings Market Report Highlights

| Aspects | Details |

| By Binder Type |

|

| By Coating component |

|

| By Floor Structure |

|

| By End Use Vertical |

|

| By Region |

|

| Key Market Players | DOWDUPONT, BERGER PAINTS INDIA LIMITED, FLOWCRETE INDIA PVT. LTD., SIKA INDUSTRIES LTD., ARKEMA S.A., INDIGO PAINTS, KANSAI NEROLAC PAINTS LIMITED, AKZO NOBEL N.V., 3M, ASIAN PAINTS LTD. |

Analyst Review

According to the CXOs, increase in economic strength of India is propelling rapid urbanization & industrialization, which is expected to drive the growth of the India floor coatings market during the forecast period.

In addition, with an aim to improve the quality of life and attract investments to the city, the government of India has launched several urban development schemes, such as smart cities mission and Pradhan Mantri Awas Yojana- housing for all. These are expected to have a significant impact on the growth of the India floor coatings industry. However, stringent environmental regulations implemented to reduce the volatile organic compounds (VOC) content in floor coatings to minimize environmental hazards is the factor expected to hamper the growth of the floor coatings market.

Loading Table Of Content...