Industrial Carbon Nanotubes Market Overview

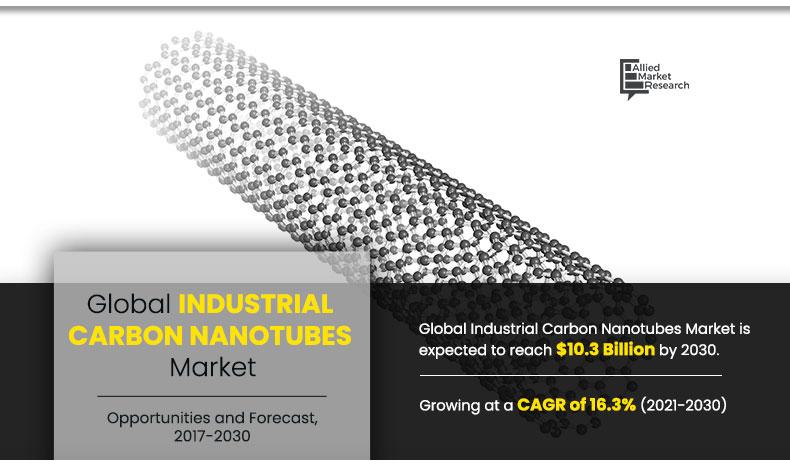

The global industrial carbon nanotubes market size was valued at $2.3 billion in 2020, and is projected to reach $10.3 billion by 2030, growing at a CAGR of 16.3% from 2021 to 2030.

The global industrial carbon nanotubes market is presently driven by factors such as a consistent demand for lightweight structural composites and additives. Carbon nanotubes-based ESD materials are used in fuel pumps, fuel filter housings, connectors, reservoirs, line clips, and electronic housings. In the electronics industry, CNTs are used to produce electromagnetic interference (EMI) shielding composites and antistatic packaging materials. CNTs are slowly replacing other additives such as carbon black particles, carbon fibers, or metallic fibers. The demand for CNTs is on a significant rise in the aerospace & defense industry, owing to its superior properties and capability to facilitate designing of lightweight parts. Wind turbine blades (WTBs) can be enhanced using CNTs that are embedded in a polymer matrix. Rise in environmental concerns due to increase in use of petroleum products and coal as a major energy source have increased the adoption of renewable energy sources. Therefore, government organizations in various countries offer subsidies and funds to promote the usage of renewable energy sources such as wind, solar, and others.

Industrial carbon nanotubes are a sub-segment of carbon nanotubes, which are less pure when compared with other CNT products. On the basis of number of graphene sheets used, CNTs are classified into two types—single-walled CNTs (SWCNTs) and multi-walled CNTs (MWCNTs). MWCNTs also consist of double-walled CNTs. They are used as structural polymer composites for automotive and aerospace components due to their superior mechanical properties, such as strength and flexibility. CNT reinforced fibers are stiffer when compared with steel and resistant to external wear & tear. CNTs have high electrical conductivity, which makes them ideal for use in conductive polymer composites. They are used as conductive fillers in ESD materials, EMI shielding, and electronics packaging. Further, as they have high aspect ratio, lower addition of CNT is enough to obtain the desired electrical conductivity. CNTs are good electron field emitters for use in flat panel displays, touch screens, and various sensors. In addition, CNTs offer high charge carrying capacity and high surface area. They are the preferred material for use as electrodes in capacitors and batteries.

High costs of manufacturing lead to a restricted investment opportunity, thus hampering the setup of a new CNT manufacturing plant. Hence, only companies capable of investing huge capital are seen as potential new players. Moreover, scaled-up CVD process faces challenges such as slow growth, poor yield, inconsistent material quality, and lack of real-time process control. During the forecast period, advancements in nanotechnology in terms of manufacturing process and reinforcing with diverse materials are expected to lead the novel CNT applications. Carbon nanotube manufacturers and academic organizations are actively pursuing this sector to find new ways to incorporate nanoparticles. Such activities are anticipated to be opportunistic for industrial carbon nanotubes market growth.

Segment Overview

The industrial carbon nanotubes market analysis is done by type, technology, application, and region. On the basis of type, the global industrial carbon nanotubes industry is classified into single-walled carbon nanotubes (SWCNT) and multi-walled carbon nanotubes (MWCNT). On the basis of technology, the global industrial carbon nanotubes market is divided into arc discharge, laser ablation, CVD, catalytic CVD, high pressure carbon monoxide, CoMoCAT, floating catalyst, and others. On the basis of application, the market is segmented into electronics & semiconductor, energy storage, structural composites, chemical materials, medical & pharmacy, and others. The electronics & semiconductor is further sub-segmented into display, integrated circuits, transistors, industrial sensors, superconductors, and others.

The energy storage segment consists of Li-ion battery, lead acid battery, fuel cells, solar PV cells, hydrogen storage, and electrochemical. Structural composites include aerospace, defense, sporting goods, wind turbine, automotive, construction, rubber & tires, and others. Chemical materials include coatings, adhesives and sealants, catalyst, water filtration, polymers, fire retardants, and others. Medical & pharmacy consists of transdermal drug delivery, cancer treatment, proteomics, and others. On the basis of region, the industrial carbon nanotubes market is studied across North America, Europe, Asia-Pacific, Middle East, Africa, and South America. Presently, Asia-Pacific accounts for the largest share of the market, followed by Europe and North America.

Industrial Carbon Nanotubes Market, by Region

The Asia-Pacific industrial carbon nanotubes market size is projected to grow at the highest CAGR of nearly 17.5%, in terms of revenue during the forecast period. Presence of a vast manufacturing base in countries, such as China, Japan, Australia, and India, is expected to drive the demand for CNTs during the forecast period.

By Region

Asia-Pacific would exhibit a CAGR of 17.5% during 2021-2030

Industrial Carbon Nanotubes Market, by Type

The single-walled carbon nanotube segment is projected to grow at a high CAGR of 20.9%, owing to its comparatively superior electronic properties, thereby making it ideal for ESD materials.

By Type

Single-Walled Carbon Nanotubes (SWCNT) is projected as the most lucrative segment.

Industrial Carbon Nanotubes Market, by Technology

CVD method accounted for the largest market share, owing to commercial adoption of various CVD methods by key players. Other technology segment is projected to be the fastest growing segment, owing to proactive research and development in alternative techniques for synthesizing CNTs in larger quantities

By Technology

Other technology segment is projected as the most lucrative segment.

Industrial Carbon Nanotubes Market, by Application

Structural composites segment accounted for the largest share in the global industrial carbon nanotubes market, owing to the adoption of CNTs in automotive and aerospace sectors for structural composites. The medical & pharmacy segment is projected to grow at the fastest CAGR of 18.86%, owing to the increasing use of CNTs in drug delivery and biosensing applications

By Application

Medical & Pharmacy segment is projected as the most lucrative segment.

Major Industry Players

The major companies profiled in this report include Arkema SA, Cabot Corporation, CHASM Advanced Materials Inc., CHEAPTUBES, Hyperion Catalysis International, Jiangsu Tiannai Technology Co. Ltd., Klean Industries, Kumho Petrochemical, LG Chem, Nano-C, Nanocyl SA, Nanostructured & Amorphous Materials Inc., Nopo Nanotechnologies, OCSiAl, Ossila Ltd., Raymor Industries, Showa Denko K.K., Thomas Swan and Co. Ltd., Tokyo Chemical Industry Co. Ltd., and Toray Industries.

Key Benefits for Stakeholders

Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

It outlines the current industrial carbon nanotubes market trends and future estimations from 2017 to 2030 to understand the prevailing opportunities and potential investment pockets.

The major countries in the region have been mapped according to their individual revenue contribution to the regional industrial carbon nanotubes market.

The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

The profiles of key players and their key strategic developments are enlisted in the report.

Industrial Carbon Nanotubes Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | SHOWA DENKO K.K., OCSiAl, ARKEMA S.A., OSSILA LTD., NANOSTRUCTURED & AMORPHOUS MATERIALS INC., JIANGSU TIANNAI TECHNOLOGY CO. LTD., RAYMOR INDUSTRIES INC., THOMAS SWAN AND CO. LTD., CHEAP TUBES, NANOCYL SA, KUMHO PETROCHEMICA, LG CHEM, TORAY INDUSTRIES INC., .KLEAN INDUSTRIES INC., CHASM ADVANCED MATERIALS INC., TOKYO CHEMICAL INDUSTRY CO. LTD., NOPO NANOTECHNOLOGIES, HYPERION CATALYSIS INTERNATIONAL, NANO-C, CABOT CORPORATION |

Analyst Review

There is an expected increase in the demand for industrial grade CNTs during the forecast period, which is projected to surge the production capacity to meet the growing demand. Applications such as plastics & polymers, paints, and epoxies will rely on less pure grades of CNTs for producing structural composite materials.

The present production capabilities are expected to create a major supply demand gap in the future, paving the way for high prices of CNTs. Moreover, R&D in nanotechnology in the long run will benefit the growth of the global industrial carbon nanotubes market via production boost ups and quality improvements. Commercial synthesis of carbon nanotubes to suit individual application is also estimated to increase the product demand.

The industrial carbon nanotubes market is segmented on the basis of type, technology, application, and region. The single walled carbon nanotubes segment is expected to grow at the fastest CGAR of 20.9%.

Demand for structural composites, CNT-based plastics, and ploymers are some of the factors boosting adoption of industrial carbon nanotubes

The global industrial carbon nanotubes market is projected to reach $10.3 billion by 2030, growing at a CAGR of 16.3% from 2021 to 2030.

Arkema SA, Cabot Corporation, CHASM Advanced Materials Inc., CHEAPTUBES, Hyperion Catalysis International, Jiangsu Tiannai Technology Co. Ltd., Klean Industries, Kumho Petrochemical, LG Chem, Nano-C, Nanocyl SA, Nanostructured & Amorphous Materials Inc., Nopo Nanotechnologies, OCSiAl, Ossila Ltd., Raymor Industries, Showa Denko K.K., Thomas Swan and Co. Ltd., Tokyo Chemical Industry Co. Ltd., and Toray Industries. are the main companies operating in the global industrial carbon nanotubes market

Electronics, automotive, aerospace, and medical industries are projected to increase the demand for industrial-grade carbon nanotubes during the forecast period

The global industrial carbon nanotubes market covers carbon nanotubes based on type, technology, application, and regjon

Factors such as improving economic viability by optimizing & developing production techniques, and finding new applications for carbon nanotubes will greatly influence the growth of carbon nanotubes

The electronics, structural composites, and medical segments is expected to drive the adoption of carbon nanotubes

Being a capital intensive technology, the COVID-19 has severely hit the demand for carbon nanotubes

Loading Table Of Content...