Industrial Ceramics Market Research: 2031

The Global Industrial Ceramics Market was valued at $6.7 billion in 2021, and is projected to reach $12 billion by 2031, growing at a CAGR of 5.9% from 2022 to 2031. Industrial ceramics in general are characterized as inorganic, nonmetallic materials with beneficial characteristics like high strength and hardness, high melting temperatures, chemical inertness, and low thermal and electrical conductivity, but also with weak points like brittleness and sensitivity to defects.

Market Dynamics

The global industrial ceramics market size was valued at $6,697.10 million in 2021 and is estimated to reach $12,027.30 million by 2031, exhibiting a CAGR of 5.9% from 2022 to 2031. Industrial ceramics in general are characterized as inorganic, nonmetallic materials with beneficial characteristics like high strength and hardness, high melting temperatures, chemical inertness, and low thermal and electrical conductivity, but also with weak points like brittleness and sensitivity to defects.

Increase in substitution of metal and plastic products with industrial ceramic products is one of the main factors propelling the growth of the industrial ceramics market. The material's high hardness, high wear resistance, high compressive strength, massive electrical resistance, and strong corrosion resistance are all improved by industrial ceramics. Some ceramics offer added advantages by allowing for both some electrical conductivity and comparatively high heat conductivity, such as silicon carbide made by chemical vapor deposition (CVD). In addition, the market is projected to experience growth as advanced ceramics are increasingly used in a variety of applications, including automotive, power & energy, and telecom.

In addition, the growing need for durable and dependable materials in the automobile industry, ceramic materials are frequently used in vehicle designs. Ceramic materials can be employed in a variety of sensors, mechanical seals, ceramic bearings, and valves because of their advantageous thermal and electrical qualities. Ceramics are more durable than plastic and more affordable than metal. Furthermore, Sensors, lights, LEDs, laser lighting systems, high-intensity discharge lamps, and antenna components of unpowered gliders all make use of electronic ceramics. The electrical & semiconductor product is also widely used in a variety of consumer electronics, such as computers, smartphones, and controllers for voice and signal transmission.

The market is also growing as lightweight, high-performance electronic ceramics are created that are tough, hard, resistant to chemicals, and have enhanced density, resilience to thermal shock, toughness, and hardness. For instance, on January 29, 2020, Murata, a giant in electrical components worldwide, extended its brand-new facility in Vantaa, Finland. About $45 million are being invested for roughly 16,000 square meters new plant. As a result, the market is expanding due to the expanding use of electronic ceramics in robotic surgical tools and diagnostic imaging equipment that need precise functionality. The market is anticipated to increase even more due to other factors, such as increased product demand in the electronics industry drives industrial ceramics market outlook.

Comparing industrial ceramics to metal and alloy, they are more expensive. The labor-intensive production process, which includes inspection, sintering, diamond grinding, and raw material processing, is the cause of the high costs. This technique demands the production of expensive stones and specialized machinery, raising the cost of the product overall. This lowers the demand for goods in a variety of sectors, such as electronics, and chemicals, restraining market growth. Additionally, alumina, silicon carbide, and many other materials are employed in production.

The demand for industrial ceramic decreased in the year 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shut-down production of various industrial ceramic end-users, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the industrial ceramic market significantly during the pandemic. The major demand for industrial ceramic was previously noticed from giant manufacturing countries including China, U.S., Germany, Italy, and the UK which was badly affected by the spread of coronavirus, thereby halting demand for industrial ceramic. This is expected to lead to re-initiation of the manufacturing industry at their full-scale capacities, which is likely to help the industrial ceramics industry to recover by end of 2022.

Thermal expansion is a common issue that causes component breakage in a range of energy and power applications because of high temperatures and unpredictable environmental conditions. As a result of increased voltage and the resulting breakdown of ceramic components, this helps prevent accidents. For instance, in 2022 Ceram Tec unveiled its brand-new AIN (aluminum nitride) HP, a high-performance substrate that is ideal for power converters due to its outstanding thermal conductivity. When advanced ceramics are exposed to the same environmental conditions as other conventional alloys and metals, they exhibit much less thermal expansion. Industrial ceramics are employed in a range of end-use, including the power and energy sectors, as a result of this factor. Therefore, a product like that might stimulate the industrial ceramics market growth.

The industrial ceramics market is segmented into Material, Product and End-User. Based on material type, the market is divided into oxide and non-oxide. Based on product type, the market is divided into composite ceramics and monolithic ceramics. Based on end user, the market is divided into automotive & aerospace, energy & power, and Other.

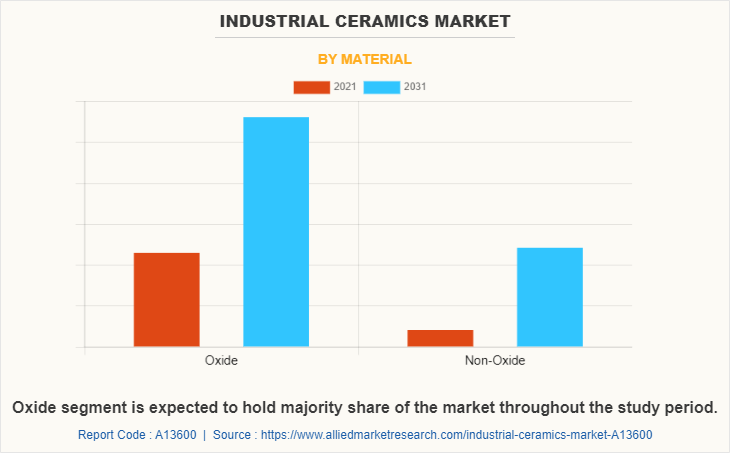

By Material Type:

The industrial ceramic market is categorized into oxide and non-oxide. Ceramics constructed from oxides are known as oxide ceramics. Ceramics are important because they are used in a variety of fields, including as the automotive, aerospace, and energy sectors. Oxide ceramic is expected to exhibit largest revenue contributor during forecast period. Non-oxide ceramics are non-metallic and inorganic materials. Non-oxide ceramics are typically composed of boron, silicon, and aluminum, which have a covalent bond. Non-oxide ceramics is expected to exhibit highest CAGR in material type segment in industrial ceramics market share during forecast period.

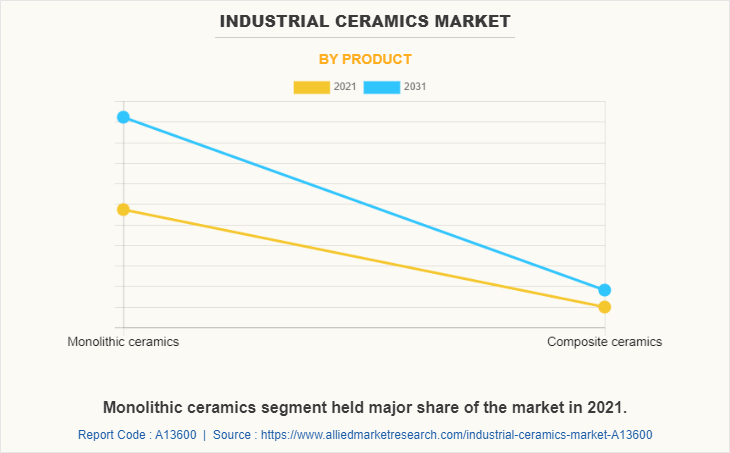

By Product Type:

The industrial ceramic market is classified into composite ceramics and monolithic ceramics. Composite ceramics are a group of composite materials which consist of ceramic fibers, suspended in ceramic matrix of any ceramic material. Carbon fibers and carbon is also considered as ceramic material. It exhibits properties like crack resistance, corrosion stability, elongation, thermal shock resistance, dynamical load properties, and anisotropic properties. Composite ceramics is expected to exhibit highest CAGR share in type segment in industrial ceramic market during forecast period.

Monolithic Ceramics are those types of ceramics that are used for fabrication and polycrystalline microstructure without reinforcement. It is one of the most advanced and technical products of ceramic. The monolithic ceramics have special features such as reliability, durability, and resistance to high temperatures. These features make them indispensable in some of the more demanding applications. Monolithic Ceramics is expected to exhibit largest revenue during forecast period.

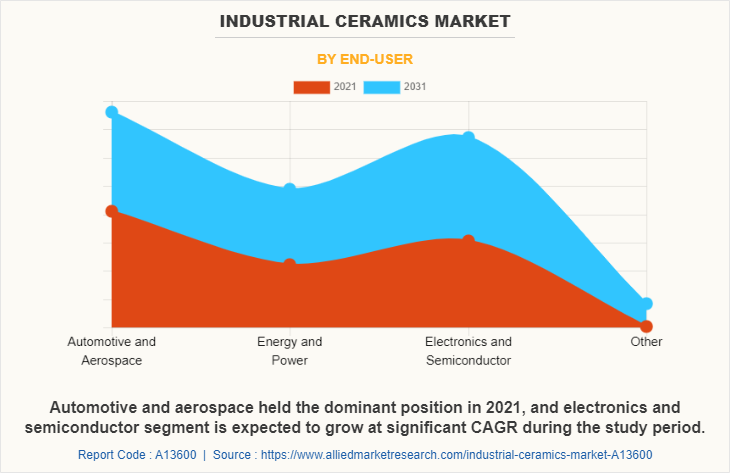

By End User,

The industrial ceramic market is divided into automotive & aerospace, energy & power, and Other .This segment includes automotive & aerospace applications. Ceramics are hard materials that are used to manufacture a variety of automotive components such as valve systems, superchargers, knock sensors, actuators, oxygen, fluid level, and fuel level sensors. They are primarily made of titanate, alumina, and zirconia oxide, which adds an extra layer of protection to the vehicle by repelling mud and dirt and protecting against ultraviolet (UV) rays, scratches, and chemical contaminants.

Automotive & aerospace is expected to exhibit largest revenue share in type segment in industrial ceramic market during forecast period. The other segment of industrial ceramic market includes military & defense and medical. Ceramic amours are extensively used in the military and security sectors to produce different equipment such as body armor, aircraft armor, and vehicle armors. Ceramic armors can absorb kinetic energy released from the bullets, which are fired from shotguns. Other segment expected to exhibit largest CAGR during forecast period.

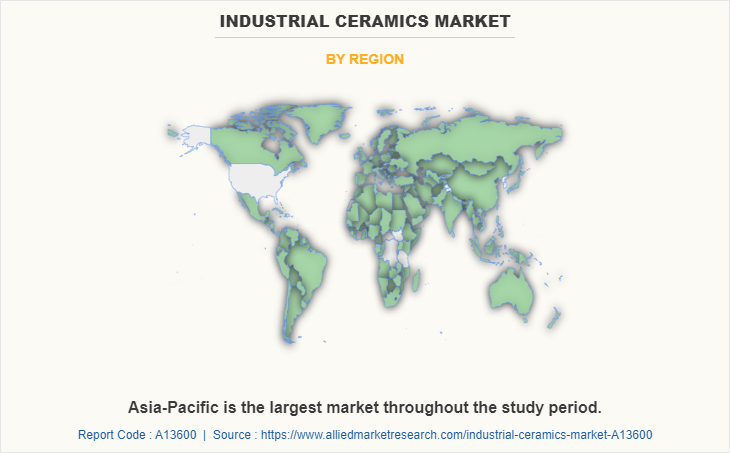

By Region:

The industrial ceramic market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest revenue in industrial ceramic market share. And LAMEA is expected to exhibit highest CAGR during forecast period.

Competition Analysis

The major players profiled in the industrial ceramic market include Kyocera, Anderman Industrial Ceramics, Elan Technology, Khyati Ceramics, Industrial Ceramic Products, Inc., AGC Ceramics Co., Ltd., Carborundum Universal Limited, CM Cera Co Ltd., LSP Industrial Ceramics, Inc., Schaefer Industrial Ceramic.

Major companies in the market have adopted acquisition, product launch and business expansion as their key developmental strategies to offer better products and services to customers in the industrial ceramic market.

Some examples of acquisition in the market

In September 2021, SCHOTT AG has acquired Applied Microarrays Inc. to expand its diagnostic business and further research on glass ceramic usage in the healthcare domain.

In April 2021, Bodycote has acquired of Ellison Surface Technologies. This acquisition led to the creation of the largest engineered coating surface technology and thermal spray services in the world.

Business expansion and partnership in the market

In April 2021, Oerlikon Balzers has expands its first customer center in Vietnam, expanding its coating operations in Asia. The company has made strategic investments to increase its footprint in the booming Asian market.

In December 2022, AGC Ceramics Co., Ltd. has collaborated with AMSKY Technology Co., Ltd., in order to expand sales of the 3D printing material BRIGHTORBTM 1 , etc. in China

Product launched and devlopment in the market

In February 2022, Kyocera, the world leader in Fine Ceramics, has launched its latest high-speed ceramic packages and substrates for optoelectronic devices at OFC.

In July 2022, AGC Si-Tech has Launched Integrated Silica Product Brand RESIFATM for Expanding Eco-friendly Silica Products such as Microplastic Substitutes throughout the Nordic region.

In April 2021, Ceram Tec developed a ceramic power module for drive inverters for e-mobility solutions. Ceram Tec and the Fraunhofer Institute for Integrated Systems and Device Technology collaborated to develop cooling solutions for power electronics in e-mobility drive trains.

In February 2021, Ceram Tec has launched a new 3D printing process named ROCAR 3D to produce construction elements made from technical ceramic materials. This process is a fast, cost-effective 3D printing process.

In October 2022, Kyocera Corporation has developed three new solution prototypes in Japan for human augmentation a Walk Sensing and Coaching System, a Physical Avatar, and an Auditory Augmentation Device.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial ceramics market analysis from 2021 to 2031 to identify the prevailing industrial ceramics market forecast and opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial ceramics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial ceramics market trends, key players, market segments, application areas, industrial ceramics market overview and growth strategies.

Industrial Ceramics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 210 |

| By Material |

|

| By Product |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Khyati Ceramics, Carborundum Universal Limited, AGC Ceramics Co., Ltd., Schaefer Industrial Ceramic, Elan Technology, Anderman Industrial Ceramics, CM Cera Co Ltd., Kyocera, LSP Industrial Ceramics, Inc., Industrial Ceramic Products, Inc. |

Analyst Review

Industrial ceramics possess properties such as corrosion resistance and long life, thereby making it suitable for various high-performance applications. Thus, industrial ceramics are gaining popularity as a substitute of metal and plastic products. This is one of the key reasons for driving the growth of the industrial ceramics market. Industrial ceramics improve the material's high hardness, high wear resistance, high compressive strength, enormous electrical resistance, and strong corrosion resistance. In addition, surge in need for durable and dependable product in the automobile industry, has fueled the use of ceramics components. Furthermore, industrial ceramics are more cost effective as compared to metal and alloy. Moreover, ceramics are appealing to a wide range of end user industries, including aerospace, energy and power, automotive, electronics, and military and defense. Thermal expansion is a common defect that occurs in various energy and power due to high temperatures and varying environments, resulting in component breakage. This factor has influenced the use of these industrial ceramics in various end-use industries such as power & energy. Such instances are expected to offer lots of opportunities during the forecast period.

The growth of the automotive industry and the growth of the energy and power sector are major trends positively influencing the growth of the market.

Industrial ceramics are extensively used in automotive manufacturing, energy transmission and electronics industry.

Asia-Pacific is the largest regional market for Industrial Ceramics.

$6,697.1 Million is the estimated industry size of Industrial Ceramics in 2021.

Kyocera, Anderman Industrial Ceramics, Elan Technology, Khyati Ceramics, Industrial Ceramic Products, Inc., AGC Ceramics Co., Ltd., and Carborundum Universal Limited are some of the top companies to hold the market share in Industrial Ceramics

The Industrial Ceramics market is projected to reach $12,027.3 million by 2031.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Latest version of global Industrial Ceramics market report can be obtained on demand from the website.

Loading Table Of Content...