Industrial Coatings Market Research, 2033

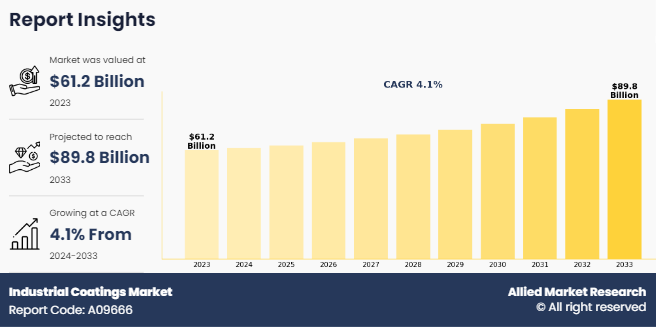

The global industrial coatings market size was valued at $61.2 billion in 2023, and is projected to reach $89.8 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033. The expansion of construction and infrastructure projects significantly drives the demand for industrial coatings. These coatings are essential for protecting surfaces in harsh environments, enhancing durability, and providing aesthetic appeal. As construction activities increase, particularly in large-scale infrastructure projects such as bridges, roads, and commercial buildings drive the demand for protective coatings.

Introduction

Industrial coating refers to a specialized type of protective layer applied to various surfaces and substrates in industrial settings to enhance their durability, performance, and lifespan. These coatings are designed to withstand harsh operating conditions such as exposure to chemicals, abrasion, corrosion, and extreme temperatures, thereby providing protection and improve the appearance of industrial equipment, machinery, infrastructure, and surfaces.

Key Takeaways

- The global industrial coatings market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of type, solvent type, additives type, end-use, 5 major regions, and more than 15 countries.

- The global industrial coatings market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the industrial coatings market are Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, Beckers Group, Hempel A/S, Jamestown Coating Technologies, Jotun, Kansai Helios, Nippon Paint Holdings Co. Ltd, PPG Industries Inc., RPM International Inc., Teknos Group, The Chemours Company, and The Sherwin-Williams Company.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global industrial coatings market.

Market Dynamics

The global demand for industrial coating is propelled by the expansion of construction and infrastructure projects globally. For instance, the Minister of Tourism and Associate Minister of Finance of Canada announced more than $5 million in new funding to help the Fort McMurray International Airport recover from the effects of the COVID-19 pandemic and to support continued air services and important transportation infrastructure projects at the airport. As economies grow and urbanization accelerates, there is a heightened need for robust protective solutions to safeguard the longevity and structural integrity of various surfaces and components in industrial settings. In addition, the increase in focus on environmental sustainability and regulatory compliance is driving innovation in the field of industrial coatings. All these factors are expected to drive the demand for the global industrial coatings market during the forecast period.

However, raw material availability and price volatility pose significant challenges to the growth of the industrial coatings sector. These coatings are essential for protecting various surfaces in industrial settings such as steel structures and automotive components. However, the industry's reliance on specific raw materials, such as resins, pigments, solvents, and additives, makes it susceptible to supply chain disruptions and price fluctuations. Industrial floor coatings require specialized chemicals and compounds that have limited sources of production. Disruption in the supply chain due to geopolitical tensions, or regulatory issues lead to shortages and production delays. All these factors hamper the global industrial coatings market growth.

The surge in demand for eco-friendly waterborne coatings represents a significant opportunity for the industrial coatings sector. As environmental awareness grows and regulatory pressures increase, industries are increasingly seeking alternatives to traditional solvent-based coatings that pose environmental and health risks. Regulations such as the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) and the European Green Deal mandate the use of safer, more sustainable materials in industrial processes, including coatings. Waterborne coatings offer a sustainable solution by significantly reducing volatile organic compound (VOC) emissions and hazardous air pollutants. All these factors are anticipated to offer new growth opportunities in the global industrial coatings market forecast.

Segments Overview

The industrial coatings market is segmented into type, end use, solvent type, additive type, and region. On the basis of type, the market is classified as polyurethane, epoxy, acrylic, polyester, alkyd, fluoropolymer, thermoset, thermoplastic, and others. On the basis of end use, the market is categorized into containers coatings, ACE (agricultural, construction, earthmoving) equipment, transportation, industrial wood, structural steel, coil, automotive, and others. By solvent type the market is segmented into water-based coating, solvent based coating, and powder. On the basis of additive type, the market is categorized into wetting agent, dispersing agent, defoamer, stabilizers, rheology, emulsifiers, flash rust inhibitors, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East, and Africa, and LATAM.

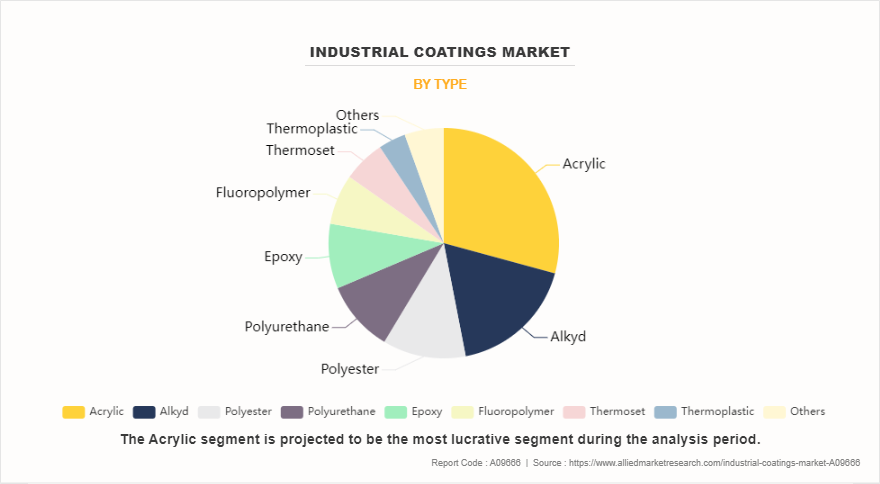

On the basis of type, the market is classified as polyurethane, epoxy, acrylic, polyester, alkyd, fluoropolymer, thermoset, thermoplastic, and others. The acrylic segment accounted for less than one-third of the global industrial coatings market share in 2023 and is expected to maintain its dominance during the forecast period. Acrylic coatings offer excellent resistance to UV radiation, moisture, and chemical exposure, which is crucial for protecting infrastructure and machinery in outdoor and industrial settings. This durability ensures a longer lifespan for coated surfaces, reducing maintenance costs and downtime for repairs. In addition, the ease of application and fast drying times of acrylic coatings provide practical benefits for manufacturers and contractors.

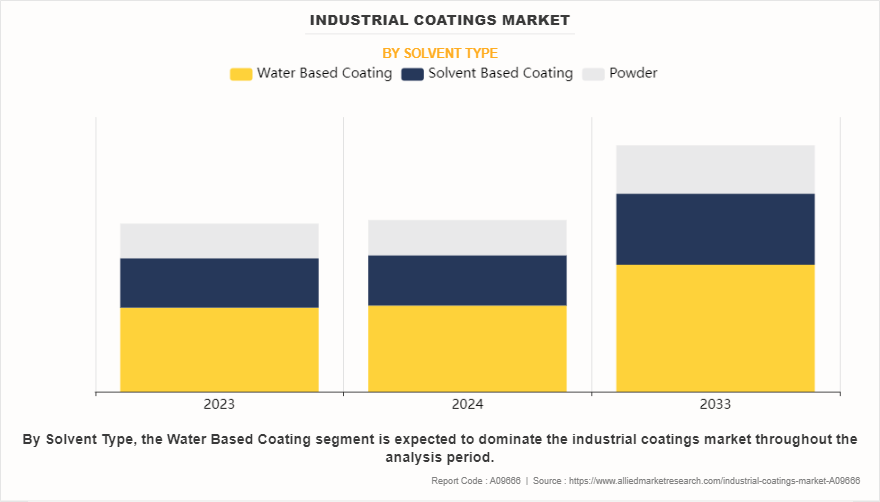

By solvent type, the market is segmented into water-based coating, solvent based coating, and powder. The water-based coating segment accounted for half of the global industrial coatings market share in 2023 and is expected to maintain its dominance during the forecast period. Stringent environmental regulations of coating drive the demand for water-based coatings. Governments and regulatory bodies are imposing strict limits on VOC emissions to curb air pollution and protect public health. Compliance with these regulations necessitates the use of low-VOC or VOC-free coatings. Water-based coatings, which meet these stringent requirements, enable manufacturers and construction companies to adhere to legal standards without compromising on performance or quality.

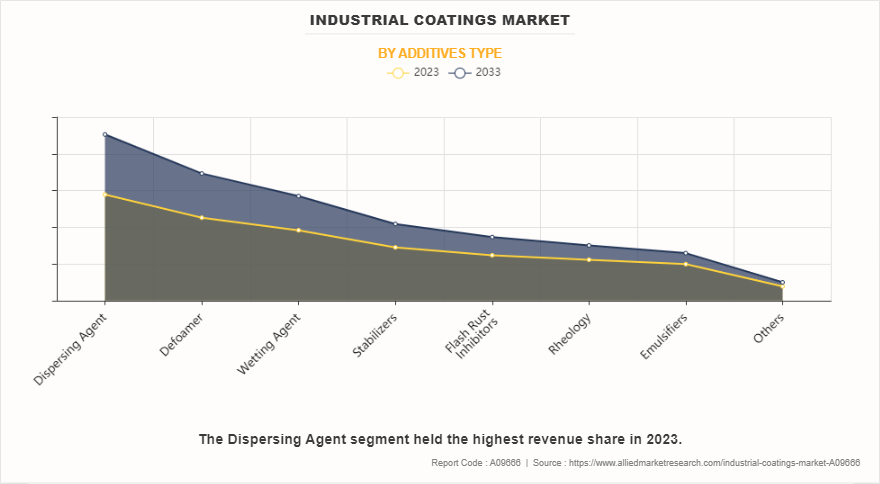

On the basis of additives type, the market is categorized into wetting agent, dispersing agent, defoamer, stabilizers, rheology, emulsifiers, flash rust inhibitors, and others. The dispersing agent segment accounted for less than one-fourth of the global industrial coatings market share in 2023 and is expected to maintain its dominance during the forecast period. Dispersing agents help in achieving a homogeneous distribution of pigments and fillers within the coating formulation. This uniform dispersion is vital for maintaining consistent color, gloss, and overall appearance of the coated surface. In industrial applications where aesthetic and functional properties are critical, such as automotive, aerospace, and consumer goods, the use of effective dispersing agents ensures that the final product meets high-quality standards.

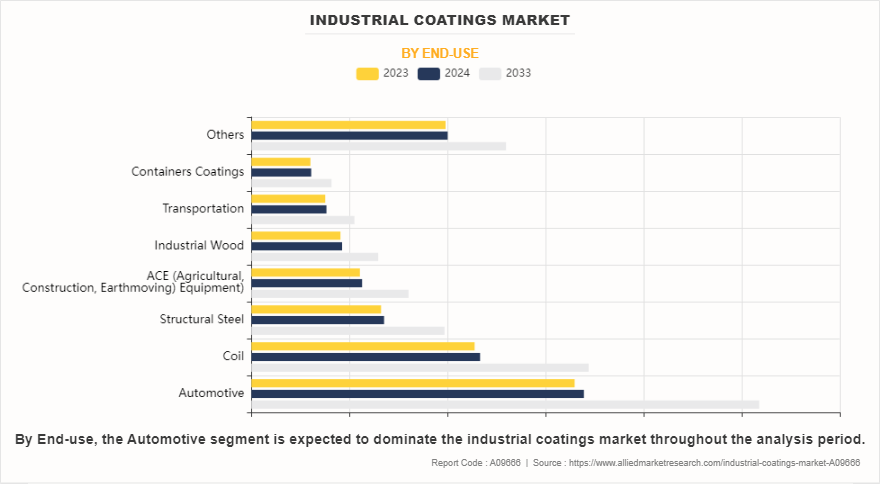

On the basis of end use, the market is categorized into containers coatings, ACE (agricultural, construction, earthmoving) equipment, transportation, industrial wood, structural steel, coil, automotive, and others. The automotive segment accounted for more than one-fourth of the global industrial coatings market share in 2023 and is expected to maintain its dominance during the forecast period. The automotive industry's push towards sustainability and environmental responsibility is influencing the demand for more eco-friendly coating solutions. As automakers strive to reduce their environmental footprint, there is a growing preference for coatings that are low in volatile organic compounds (VOCs) and free from hazardous substances. This trend is driving innovation in waterborne and high-solid coatings, which offer similar performance benefits to traditional solvent-based coatings but with reduced environmental impact.

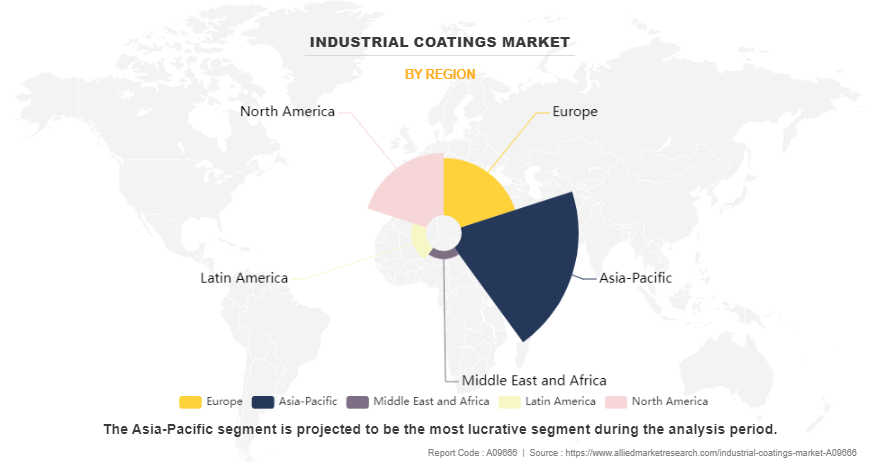

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East, and Africa, and LATAM. The Asia-Pacific segment accounted for less than half of the global industrial coatings market share in 2023 and is expected to maintain its dominance during the forecast period. Rapid industrialization and urbanization occurring in countries such as China, India, and Southeast Asian nations drive the demand for the industrial coatings. As these countries continue to develop their manufacturing and infrastructure sectors, the demand for industrial coatings, which are essential for protecting machinery, buildings, and other structures from corrosion and wear, has significantly increased. According to the India Brand Equity Foundation, India enhances its infrastructure to reach its 2025 economic growth target of $5 trillion. All these factors are anticipated to offer new growth opportunities for industrial coatings market in Asia-Pacific.

Competitive Analysis

Key players in the global industrial coatings industry include Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, Beckers Group, Hempel A/S, Jamestown Coating Technologies, Jotun, Kansai Helios, Nippon Paint Holdings Co. Ltd, PPG Industries Inc., RPM International Inc., Teknos Group, The Chemours Company, and The Sherwin-Williams Company.

In the global industrial coatings industry, companies have adopted partnership and acquisition strategies to expand the market or develop new products. For instance, in May 2024, Axalta Coating Systems, a leading global coatings company, announced that it has entered into a definitive agreement to acquire The CoverFlexx Group from Transtar Holding Company. The CoverFlexx Group manufactures and sells coatings for automotive refinish and aftermarket applications, focused on economy customers in North America. This acquisition will increase the demand for the industrial coatings market. Moreover, in February 2023, The Sherwin-Williams Company, the leading paint and coatings manufacturer, and the Mercedes-AMG PETRONAS Formula One Team have announced a new partnership. Sherwin-Williams became the approved supplier of automotive paint and coatings to the Mercedes-AMG PETRONAS Formula One team's F1 cars.

Upcoming Trends in Industry

Advanced formulations for environmental sustainability:

- Low VOC formulations: Volatile Organic Compounds (VOCs) contribute to air pollution and have adverse health effects. Thus, there is a shift towards low or zero VOC formulations in industrial coatings. Water-based coatings, UV-curable coatings, and powder coatings are gaining popularity due to their reduced environmental impact.

- Bio-based Coatings: They are derived from renewable resources such as plant oils, soybean, and corn. Bio-based coatings offer an eco-friendly alternative to petroleum-based counterparts. These coatings are biodegradable, reducing dependence on fossil fuels and lowering carbon footprints.

Nanotechnology for enhanced properties:

- Nanocoating: Nanotechnology enables the development of coatings with exceptional properties such as high hardness, scratch resistance, and UV stability. Nanostructured coatings offer precise control over surface characteristics at the nanoscale, resulting in improved performance and functionality.

- Nano-enabled additives: Nano-sized additives such as nanoparticles, nano clays, and nanotubes are incorporated into coatings to enhance mechanical strength, barrier properties, and chemical resistance. These additives improve coating performance without significantly increasing thickness or weight.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial coatings market analysis from 2023 to 2033 to identify the prevailing industrial coatings market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial coatings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial coatings market trends, key players, market segments, application areas, and market growth strategies.

Industrial Coatings Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 89.8 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 536 |

| By Type |

|

| By Solvent Type |

|

| By Additives Type |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Nippon Paint Holdings Co. Ltd, Hempel A/S, Axalta Coating Systems, LLC, Jotun, Jamestown Coating Technologies, Teknos Group, Beckers Group, RPM International Inc., The Sherwin-Williams Company, Akzo Nobel N.V., BASF SE, The Chemours Company., Kansai Helios, PPG Industries Inc. |

Analyst Review

According to the opinions of various CXOs of leading companies, the global industrial coatings market is expected to witness an increase in demand during the forecast period. A surge in construction and infrastructure projects, and cost and application efficiency increased the demand for the global industrial coatings market during the forecast period. As construction activities escalate to meet the growing urbanization and infrastructure needs, the need for protective coatings becomes increasingly crucial to ensure the longevity and durability of structures, equipment, and surfaces.

Cost efficiency is an important concern for stakeholders in construction and infrastructure projects. Industrial coatings offer a cost-effective solution by providing durable protection against corrosion, weathering, and chemical damage. By applying coatings to structural steel, concrete surfaces, bridges, pipelines, and other infrastructure components, developers significantly extend their lifespan and reduce long-term maintenance and repair costs. Moreover, the application efficiency of industrial coatings plays a critical role in meeting the stringent timelines and efficiency targets common in construction and infrastructure projects.

The global industrial coatings market was valued at $61.2 billion in 2023, and is projected to reach $89.8 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033.

Asia-Pacific is the fastest growing region for the Industrial Coatings Market

Rise in demand for eco-friendly waterborne coatings is the upcoming trends of Industrial Coatings Market in the world

Automotive is the leading application of Industrial Coatings Market

Expansion of construction and infrastructure projects, and cost and application efficiency are the leading drivers for the Industrial Coatings Market

Asia-Pacific is the largest regional market for Industrial Coatings

Key players in the global industrial coatings market include Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, Beckers Group, Hempel A/S, Jamestown Coating Technologies, Jotun, Kansai Helios, Nippon Paint Holdings Co. Ltd, PPG Industries Inc., RPM International Inc., Teknos Group, The Chemours Company, and The Sherwin-Williams Company.

Loading Table Of Content...

Loading Research Methodology...