Industrial Dust Collector Market Overview

The Global Industrial Dust Collector Market Size was valued at $7.9 billion in 2021, and is projected to reach $12.2 billion by 2031, growing at a CAGR of 4.4% from 2022 to 2031. The market is driven by stringent environmental regulations, increasing awareness of workplace safety, and rising industrialization across sectors like manufacturing, pharmaceuticals, and mining. Growing demand for efficient air pollution control systems and advancements in filtration technologies also contribute to the market's expansion, ensuring cleaner and safer work environments.

Market Dynamics & Insights

- The industrial dust collector industry in North America held a significant share of over 40.2% in 2021.

- The industrial dust collector industry in France is expected to grow significantly at a CAGR of 4.9% from 2022 to 2031

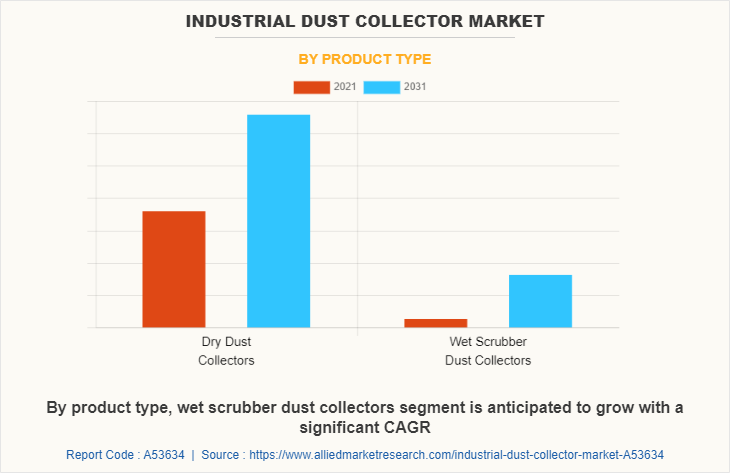

- By product type, dry dust collectors segment is one of the dominating segments in the market and accounted for the revenue share of over 71.1% in 2021.

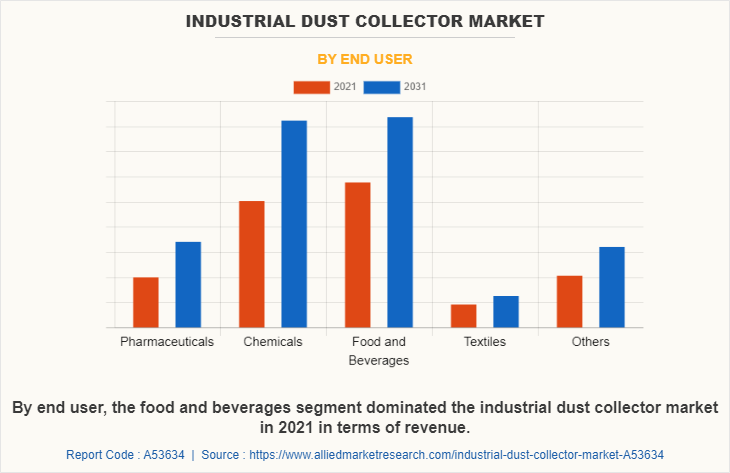

- By end-user, the pharmaceuticals segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2021 Market Size: $7.9 Billion

- 2031 Projected Market Size: $12.2 Billion

- CAGR (2022-2031): 4.4%

- North America: Largest market in 2021

- Asia-Pacific: Fastest growing market

What is Meant by Industrial Dust Collector

The industrial dust collector is a type of equipment used to control and remove particulate matter or dust from industrial exhaust streams. Industrial processes that generate dust or other airborne particles can present health hazards to workers, damage equipment, and negatively impact the environment. This is especially important in industries that generate large amounts of dust or other airborne particles, such as metalworking, mining, and chemical processing.

Market Dynamics

The market for industrial dust collectors has expanded because of increasing rates of industrialization and urbanization around the world. Furthermore, in November 2022, according to the World Bank, India will need to invest around $840 billion in urban infrastructure over the next 15 years in order to adequately meet the needs of its rapidly growing urban population, which is expected to reach $600 million by 2036, or 40% of the country's population. In addition, according to this World Bank projection, 40% of India's population, or 600 million people, would live in urban areas by 2036. As a result, the government will have to make significant expenditures on building the different amenities required to support urban inhabitants’ livelihoods.

As a result, demand for industrial dust collectors increases as more commercial and residential construction increases. For instance, Vietnam is constructing approximately 400 industrial parks around the country. The demand for dust collectors in these facilities is anticipated to rise significantly because these parks will service a variety of businesses, from the production of building materials to the processing of food. Moreover, the need for industrial dust collectors has grown as a result of strict environmental and governmental requirements. For instance, in June 2022, according to the United States Environmental Protection Agency (EPA), under the Clean Air Act (CAA), the EPA sets restrictions on specific air contaminants, including the maximum amounts that can be present in the air at any place in the U.S.

The Clean Air Act also gives the EPA the power to control air pollution emissions from several sectors of the U.S. economy, including steel mills, utilities, and chemical plants. Owners of manufacturing facilities must adhere to rules because of these kinds of international government prohibitions. As a result, they set up commercial dust collectors at their factories and other construction sites. However, high capital and operational costs of industrial dust collectors are anticipated to restrain the industrial dust collector market growth.

Moreover, constant innovations in dust collector products from different key players is an industrial dust collector market opportunity for the growth of the key players. For instance, in June 2021, Atlas Copco AB, a leading manufacturer of industrial tools and equipment launched a new product called the DCP 30 pneumatic dust collector, which is the first pneumatic dust control system available on the market that can be used to collect dust at the source while drilling with three handheld rock drills simultaneously and reducing the exposure to respirable crystalline silica dust, improving the operators' health and assuring a safe working environment.

The demand for the industrial dust collector market decreased in 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic had shut down production of various products for the industrial dust collector end user, owing to prolonged lockdowns in major global countries. This substantially slowed the market for industrial dust collectors during the pandemic. The market for industrial dust collectors was previously witnessing strong demand from large manufacturing nations such as the U.S., Germany, Italy, the UK, and China.

However, this demand was halted by the spread of the coronavirus. However, after the introduction of vaccines of COVID-19, the number of infections has decreased. Now, at the beginning of 2023, the market has gained traction, and demand for industrial dust collectors has increased. Contrarily, the number of COVID-19 cases in China, have increased spontaneously, which is negatively affecting the market. Manufacturers of industrial dust collectors are thus, required to safeguard their personnel, operations, and supply chains to respond to urgent emergencies and devise new operational strategies once the number of COVID-19 infection cases starts to decline.

Industrial Dust Collector Market Segmental Overview

The industrial dust collector is segmented on the basis of product type, media type, end user and region. By product type, it is divided into dry dust collectors and wet scrubber dust collectors. By media type, it is categorized into woven and non-woven. By end user, it is divided into pharmaceutical, chemical industry, food & beverage, textile and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type:

The industrial dust collector market is divided into dry dust collectors and wet scrubber dust collectors. In 2021, the dry dust collectors dominated a larger industrial dust collector market share, in terms of revenue. However, the wet scrubber dust collectors segment is anticipated to grow at a significant CAGR. The most common form of equipment for removing dust from industrial environments is dry dust collectors. The implementation of new industrial rules to improve working conditions in mines and other industrial sites is driving the installation of dry type dust collectors.

Also, a large number of top producers of industrial dust collectors are adding cutting-edge technologies to the market for the advantage of employees. The wet scrubber dust collector system collects the dust particles using water droplets. The wet scrubber dust collectors are simple to use, have a low initial investment requirement, are highly effective at purifying the air, and can remove harmful particles in addition to dust while also bringing the temperature of the gas down. It can also withstand high temperatures, high relative humidity, and flammable and explosive dust gas.

Therefore, there are many applications for these systems in many industries, dry dust collectors and wet scrubber dust collectors are increasingly being used as they are exceptionally effective at removing highly combustible dusts, which in turn is driving the market's growth.

By Media Type:

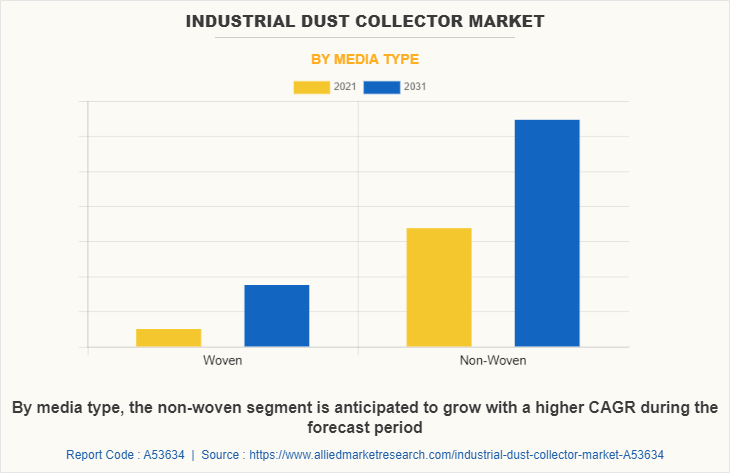

The industrial dust collector market is classified into woven and non-woven. The non-woven segment generated the highest revenue in 2021, and is also expected to grow at the highest CAGR during the forecast period. To make cartridges that fit inside the dust collector, woven media is frequently employed. These cartridges can be pleated to increase the filtration surface area and are usually cylindrical in shape. Furthermore, filter sleeves that are positioned around a dust collector tube sheet can be made from woven media.

The purpose of these sleeves is to collect tiny particles that could otherwise pass through the dust collector. In baghouse filters, the filtering medium is non-woven media. Baghouse filters are cylinder-shaped or rectangular non-woven fabric bags used to remove dust and other airborne contaminants. Since non-woven media is sturdy, resilient, and able to bear the strains of continuous usage, it is preferred for baghouse filters. Manufacturers from a variety of industries have been urged to use woven and non-woven media types for industrial dust collectors, which in turn boosts market growth in the future.

By User Industry:

The industrial dust collector market is categorized into pharmaceuticals, chemical industry, food & beverage, textile, and others. Dust collectors are crucial for maintaining a clean and sterile environment in pharmaceutical manufacturing plants, where even small concentrations of airborne dust and particles could potentially contaminate products and undermine their safety and efficacy. As different chemicals and powders are blended and mixed, dust and fumes are created. They are collected using industrial dust collectors.

These microscopic dust particles, which can be harmful to workers' health are collected and removed using dust collectors. The other segment includes the usage of industrial dust collector in power and construction industry. Dust collectors have a direct impact on the safety and security of people on and around a construction site, thereby adopting industrial dust collectors in various industries boosting the growth of the market.

By Region:

The industrial dust collector market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is expected to dominate the market throughout the forecast period. Asia-Pacific is projected to experience high growth during the forecast period owing to expansion of the construction industry in the region. There are several industrial dust collector manufacturers in North America, from major multinational corporations to small, specialized firms.

These companies provide a wide range of product offerings of industrial dust collectors including baghouse dust collectors, cartridge dust collectors, cyclone dust collectors, and wet scrubbers. For instance, in February 2020, Parker-Hannifin Corporation,. which is a leading worldwide diversified manufacturer of motion & control technologies and systems launched ProTura SB Nano Pleated Filters, a dust collection filter that would be utilized in several demanding applications. Using cutting-edge nanofiber filtration technology, ProTura SB Nano Pleated Filters are available. ProTura SB is a 100% synthetic base medium that is prepared to handle even the most demanding applications due to the application of a special nanofiber layer to the collecting surface.

Industrial dust collectors are used in a wide variety of industries in Asia-Pacific. For instance, in November 2021, Indian Oil Corporation (IOCL) announced plans to invest $495.22 million to set up India’s first mega-scale maleic anhydride unit for manufacturing high-value specialty chemicals at its Refinery in Haryana, India. The LAMEA region uses industrial dust collectors for various industries, such as mining, cement production, metalworking, and woodworking. For instance, in July 2021, Bridgestone Corp., which is a leading designer, producer, and seller of automobile tyers has announced a new investment of $139 million in its tires manufacturing plant in the city of Camacari, in the state of Bahia, Brazil. Thus, all such factors are expected to boost the industrial dust collector market during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the industrial dust collector market, such as Atlas Copco AB, Babcock & Wilcox Enterprises, Inc., CECO Environmental Corp., Daikin Industries Ltd. (American Air Filter Company, Inc.), Donaldson Company, Inc., FLSmidth & Co. A/S, Parker-Hannifin Corporation, Span Filtration Systems Pvt. Ltd., Sumitomo Heavy Industries, Ltd. and Thermax Limited are provided in this report.

Some examples of product launches in the market

In June 2021, Atlas Copco AB, which is a leading manufacturer of industrial tools and equipment launched a latest product named DCP 30 pneumatic dust collector which is the first pneumatic dust control system on the market that can be utilized to collect dust at the source while drilling with three handheld rock drills simultaneously and reducing the exposure to respirable crystalline silica dust, thereby improving the operators' health and ensuring a safe working environment. Moreover, in October 2020, Donaldson Company, Inc., a leading worldwide manufacturer of innovative filtration systems and parts, launched Donaldson Torit Rugged Pleat (RP) baghouse industrial dust collector. The collector is designed to collect the heavy, abrasive dust that is produced by the grain processing, mining, and woodworking sectors, among many others. Donaldson's SuperSepTM inlet pre-separates up to 97% of the dust before it reaches the filters in the new RP baghouse collector, and the PerfectPulseTM cleaning technology concentrates cleaning energy directly over the filters to support long life.

Acquisitions in the market

In June 2022, CECO Environmental Corp. acquired Western Air Ducts Ltd. which is a leading manufacturer and seller of dust & fume extraction system. This acquisition will increase it’s the production capacity of CECO Environmental Corp.

Geographical Expansion in the market

In June 2022, Donaldson India Filtration Systems Pvt. Ltd., a wholly-owned subsidiary of Donaldson Company, Inc., which is a leading manufacturer of filtration system and replacement parts, opened its new industrial facility in Pune, India. The new manufacturing facility is 50,000 square feet and this plant is used for producing industrial dust, fume and mist collector systems for the South Asian market.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging global industrial dust collector market trends and dynamics.

- In-depth market global industrial dust collector analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

- Extensive industrial dust collector market analysis is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- Industrial dust collector market forecast analysis from 2022 to 2031 is included in the report.

- The key players within industrial dust collector market are profiled in this report and their strategies are analysed thoroughly, which help understand the competitive outlook of industrial dust collector industry.

Industrial Dust Collector Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.2 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 348 |

| By End User |

|

| By Product Type |

|

| By Media Type |

|

| By Region |

|

| Key Market Players | Span Filtration Systems Pvt. Ltd., Sumitomo Heavy Industries, Ltd., Atlas Copco AB, CECO Environmental Corp., Parker-Hannifin Corporation, Thermax Limited, Daikin Industries Ltd. (American Air Filter Company, Inc.), Babcock & Wilcox Enterprises, Inc., FLSmidth & Co. A/S, Donaldson Company, Inc. |

Analyst Review

The industrial dust collector market has witnessed a significant growth in the past few years, owing to rise in awareness regarding the effect of air pollution by industries on human health. Rapid industrialization and urbanization in developing countries such as India, China, and Brazil have resulted into increase in industrial and construction activities, which has resulted into rise in air pollution level. This is expected to propel the growth of the industrial dust collector market during the forecast period.

The growth in industrialization has led to an increase in demand for industrial dust collector, which has resulted in the growth of the industrial dust collector market. As industrialization has increased around the world, more industries are generating dust and other airborne particles, which can be harmful to human health and the environment. To mitigate the negative impacts of airborne particles, industries are increasingly using industrial dust collectors to control dust and other pollutants. Dust collectors are essential for ensuring worker safety, maintaining air quality standards, and complying with environmental regulations. As a result, the demand for dust collectors has increased significantly in recent years.

This is expected to accelerate the growth of the industrial dust collector market during the forecast period. Furthermore, players in the industrial dust collector market are working to develop cost effective and efficient industrial dust collectors to capture the market, which is expected to boost growth of industrial dust collector market during the forecast period. Players operating in the market have adopted acquisition, geographical expansion, and product launch as their key growth strategies to gain a stronger foothold which is expected to offer lucrative opportunities for the growth of the market.

Growth in industrialization and construction industry, stringent environmental and government regulations and increasing health & safety concerns are a few of the trends that are driving market growth.

Industrial Dust Collector is used for collecting dust and other airborne particles produced during manufacturing and construction activities.

North America is the largest regional market for Industrial Dust Collector.

The global industrial dust collector market was valued at $7,871.2 million in 2021.

Companies such as such as Atlas Copco AB, Babcock & Wilcox Enterprises, Inc., CECO Environmental Corp., Daikin Industries Ltd. (American Air Filter Company, Inc.), Donaldson Company, Inc., FLSmidth & Co. A/S, Parker-Hannifin Corporation, Span Filtration Systems Pvt. Ltd., Sumitomo Heavy Industries, Ltd. and Thermax Limited are provided in this report.

The global industrial dust collector market is projected to reach $12,223.2 million by 2031, registering a CAGR of 4.4% from 2022 to 2031.

By product type, in 2021, the dry dust collectors dominated the industrial dust collector market, in terms of revenue.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...