The industrial food cutting machines market was valued at $2.4 billion in 2023, and is projected to reach $3.9 billion by 2032, growing at a CAGR of 5.5% from 2024 to 2032.

Market Introduction and Definition

Industrial food cutting machines are designed to automate the process of slicing, dicing, chopping, and otherwise reducing food items into smaller, uniform pieces. These machines are integral to food processing industries, enhancing efficiency, consistency, and safety in food preparation. They are used to process a wide variety of foods, including fruits, vegetables, meats, cheese, and baked goods.

Industrial food cutters can produce specific shapes and sizes to meet the requirements of various food products and recipes. The machines vary in complexity, from simple mechanical slicers to advanced models with computerized controls that allow for precise adjustments and multifunctionality. Safety features are paramount in these machines, preventing accidents and ensuring hygienic processing environments.

Key Takeaways

The industrial food cutting machines market growth study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major industrial food cutting machines industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The industrial food cutting machines market is experiencing growth due to the rise in demand for processed and convenience food, technological advancements in food processing, and the need for high efficiency and precision in food production. Increased consumer health awareness is also driving the demand for fresh-cut produce, supporting market growth.

However, the growth is hindered by high initial investment costs and the complexity of incorporating advanced machinery into existing production lines. In addition, small and medium-sized enterprises (SMEs) often face financial limitations, restricting their ability to adopt these technologies. Market challenges include maintaining strict hygiene standards, ensuring consistent product quality, and managing operational efficiency. The need for regular maintenance and skilled operators for sophisticated machines further complicates market dynamics.

The development for affordable and user-friendly machines, integrating smart technologies like IoT and AI to enhance automation and monitoring, and expanding into developing regions where urbanization and rising disposable incomes present significant industrial food cutting machines market opportunity.

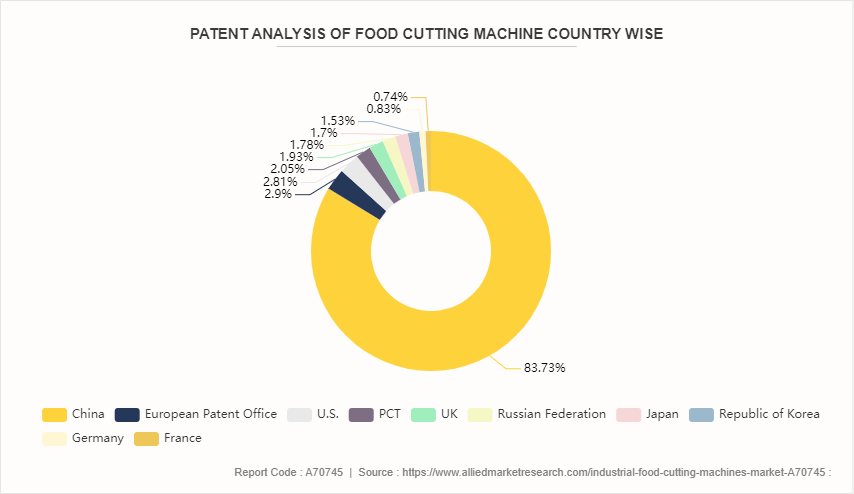

Patent Analysis of Global Industrial Food Cutting Machines Market Country Wise

The industrial food cutting machines market analysis is segmented according to the patents filed by China, European Patent Office, U.S., PCT, United Kingdom, Russian Federation, Japan, Republic of Korea, Germany, France has the largest number of patent filings, owing to suitable research infrastructure. Approvals from these countries are followed by high adoption of industrial food cutting machine and initiatives associated with enhancing food quality and standard at regional and global level. Therefore, these countries have the maximum number of patent filings.

Market Segmentation

The industrial food cutting machines market is segmented into product type, technology, application, and region. On the basis of product type, the market is divided into food slicers, food dicers, food shredders, and others. On the basis of technology, the market is segregated into automatic, semi-automatic and manual. On the basis of application, the market is segmented into cheese, meat, fruits and vegetables and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East & Africa.

Market Segment Outlook

Based on product type, the food slicers segment held the highest market share in 2023, accounting for nearly half of industrial food cutting machines market size. Food slicers are widely used across various food products, including meats, cheeses, fruits, vegetables, and baked goods. Their ability to handle a broad range of slicing tasks makes them more versatile.

Based on technology, the automatic segment held the highest market share in 2023, accounting for nearly three-fifths of the industrial food cutting machines market share. It ensures uniformity and precision in cutting, which is important for maintaining product quality and meeting industry standards.

Based on application, the fruits and vegetables segment held the highest market share in 2023, accounting for two-fifths of the industrial food cutting machines market revenue. The fruit and vegetables category includes a vast array of products, leading to a higher overall volume of processed items compared to other segments.

Regional/Country Market Outlook

The North America industrial food cutting machines market is driven by factors such as advanced food processing industry, high demand for processed food, and technological innovations. For instance, companies like Urschel Laboratories, Inc., based in Indiana, USA, have been expanding their product portfolios to cater to evolving consumer demands and enhance operational efficiency. Recent developments include the integration of advanced automation technologies and the introduction of precision cutting solutions.

Another example is JBT Corporation, headquartered in Chicago, Illinois, which has been focusing on developing cutting-edge food processing solutions tailored to the North American market. These developments reflect the ongoing efforts within the region to improve food safety, optimize production processes, and meet the increasing demand for high-quality processed foods.

In June 2023, the biggest food industry companies in France pledged to cut prices on hundreds of products from next month, as announced by Finance Minister Bruno Le Maire. This move is aimed at reflecting a fall in raw material costs.

China is experiencing a tech revolution with intense uptake of digitalization and robotics in the food and Agtech sectors. This includes the use of drones for monitoring and conducting plant operations, such as spraying fertilizers and pesticides.

Competitive Landscape

The major players operating in the industrial food cutting machines market include GEA Group AG, JBT Corporation, FAM N.V., Marel, Urschel Laboratories, Inc., TREIF Maschinenbau GmbH, Holac Maschinenbau GmbH, Bühler AG, Grote Company and Weber Maschinenbau GmbH.

Other players in the industrial food cutting machines market include Illinois Tool Works Inc. (Hobart) , Hallde (AB Hallde Maskiner) , Nemco Food Equipment, Ltd., Brunner-Anliker AG, Cheersonic Ultrasonics Equipment Co., Ltd. and others.

Recent Key Strategies and Developments

In June 2022, JBT introduced the SuperCRss Retort System, a state-of-the-art take on saturated steam sterilization technology, combined with robust and labor-saving automation options. This system is designed to process a variety of products and includes JBT’s processing management system LOG-TEC™, which ensures uniformity of product quality.

In November 2023, JBT developed DSI water-jet portioners which are being used globally in the poultry, meat, seafood, and pet food industries. These machines are capable of producing a wide variety of products, including poultry parts, fillets, steaks, medallions, strips, nuggets, and even complicated shapes.

Industry Trends:

In July 2023, the food industry in Germany is being disrupted by foodtech startups. These startups are innovating in various sectors, including food cutting, and are transforming how food is produced, distributed, and consumed. Among these, startups focusing on sustainable protein sources and bioreactor technology are gaining attention.

In March 2024, France is home to 71 deeptech startups in the foodtech and agritech sectors, which cover the entire food chain from agricultural production to the end consumer. The French government backed these startups with $2.67 billion in funding up to 2030.

In Australia, The Queensland state budget for 2024-25 included a $1.5 billion allocation to support skills, training, employment, and small businesses, which could create opportunities for the food and beverage sector.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the industrial food cutting machines Market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the industrial food cutting machines market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global industrial food cutting machines market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global industrial food cutting machines market trends, key players, market segments, application areas, and market growth strategies.

Industrial Food Cutting Machines Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.9 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Product Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Marel, Holac Maschinenbau GmbH, Treif Maschinenbau GmbH, Urschel Laboratories, Grote Company, FAM N.V., JBT Corporation, GEA Group AG, Bühler AG, WEBER Maschinenbau GmbH |

increasing trend towards automation in food processing, rising consumer awareness and stringent regulations regarding food safety and growing demand for customized food products are the upcoming trends of Industrial Food Cutting Machines Market in the globe

Fruits and Vegetables segment has the leading application of Industrial Food Cutting Machines Market.

North America is the largest regional market for Industrial Food Cutting Machines

The industrial food cutting machines market was valued at $2.4 billion in 2023.

GEA Group AG, JBT Corporation, FAM N.V., Marel, Urschel Laboratories, Inc., TREIF Maschinenbau GmbH, Holac Maschinenbau GmbH, Bühler AG, Grote Company and Weber Maschinenbau GmbH are the top companies to hold the market share in Industrial Food Cutting Machines.

Loading Table Of Content...