Industrial High Voltage Motor Market Research, 2032

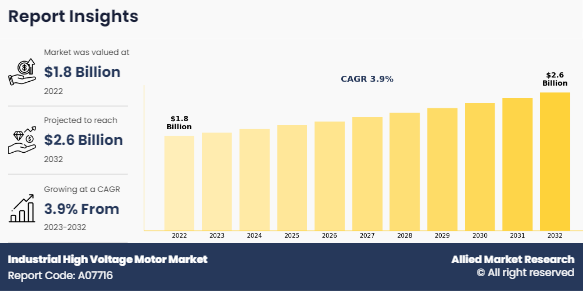

The global industrial high voltage motor market size was valued at $1.8 billion in 2022, and is projected to reach $2.6 billion by 2032, growing at a CAGR of 3.9% from 2023 to 2032. Industrial high voltage motors are electric motors designed to operate at high voltage levels with typical voltage greater than 600 volts. The voltage level of an industrial high voltage motor can vary from hundreds to thousands of volts based on the application and power requirements.

The industrial high voltage motors are majorly used in power generation facilities which includes conventional power plants as well as renewable energy sources such as wind and hydropower. Industrial high voltage motors are used to drive generators, pumps, compressors, and other equipment that are used in oil & gas, metal production, manufacturing, and other applications. The industries operating in rolling mills and heavy machinery also use industrial high voltage motors.

The growing applications of industrial high voltage motors in mining, metals, manufacturing, and water & wastewater treatment are estimated to drive the industrial high voltage motor market growth in the upcoming years. For instance, in mining operations, the industrial high voltage motors are used to power large machineries involved in mining such as conveyor systems, crushers, and others. Industrial high voltage motors have robust design that can withstand harsh conditions involved in mining operations. Similarly, the municipalities and industrial sectors use high voltage motors to power the blowers, pumps, and other equipment involved in water and wastewater treatment plants. In addition, these motors find range of applications across marine sector in which these motors are used in propulsion systems in ships and other offshore platforms. Furthermore, in marine operations, these motors are used in deck machinery on ships which includes cranes, winches, and other anchor handling systems as industrial high voltage motors offer necessary torque and power required for handling heavy loads on the deck. Also, the offshore vessels involved in activities such as construction or drilling use dynamic positioning systems. These systems involve the use of high voltage motors that is necessary for controlling the thrusters and maintaining the vessels positions for precise & sable operations.

Safety concerns, maintenance requirements, integration challenges, and voltage compatibility are some of the factors estimated to hamper the industrial high voltage motors market in the upcoming years. For instance, industrial high voltage motors are designed to operate in demanding conditions owing to which their maintenance is challenging. These motors also require regular inspection & maintenance for optimal performance and to avoid machine failures. Also, the downtime for maintenance of these motors can be a hurdle for smooth operations. In addition, as these motors are designed for high power applications, their size is large and bulky. Hence, the installation of these motors can be challenging especially where space is a constraint such as in marine or aerospace applications.

An increase in demand for energy-efficient motors as well as technological advancements are anticipated to generate excellent opportunities in the industrial high voltage motor industry. Increasing demand for energy efficiency is anticipated to create excellent growth opportunities for the manufacturers of industrial high voltage motors in the upcoming years. Industrial high voltage motors offer excellent energy efficiency that can reduce the energy consumption and overall operating cost of businesses. In addition, the integration of Industry 4.0 principles and the Internet of Things (IoT) into industrial processes are anticipated to generate excellent opportunities in the industry. For instance, industrial high voltage motors are equipped with IoT capabilities that offer remote diagnostics, predictive analytics, and real-time monitoring that offers reliable operations. In addition, electrification in the transportation sector which includes the use of electric ships and hybrid electric vehicles use industrial high voltage motors. Manufacturers in the automotive and marine industries use high-voltage motors for the development of suitable electric propulsion systems.

The key players profiled in this report include ABB, WEG, General Electric Company, Teco Australia, Siemens AG, Toshiba Mitsubishi-Electric Industrial Systems Corporation, OME, HYOSUNG HEAVY INDUSTRIES, Shanghai Electric Machinery Co., Ltd., and Regal Beloit Corporation. Business expansion, partnership, and investment are common strategies followed by major market players. In November 2022, WEG, the Brazilian manufacturer of industrial high voltage motor, inaugurated its WEG motors production plant in Algeria. Based on the same, the production capacity of WEG Algeria Motors Spa will be over one million motors per year.

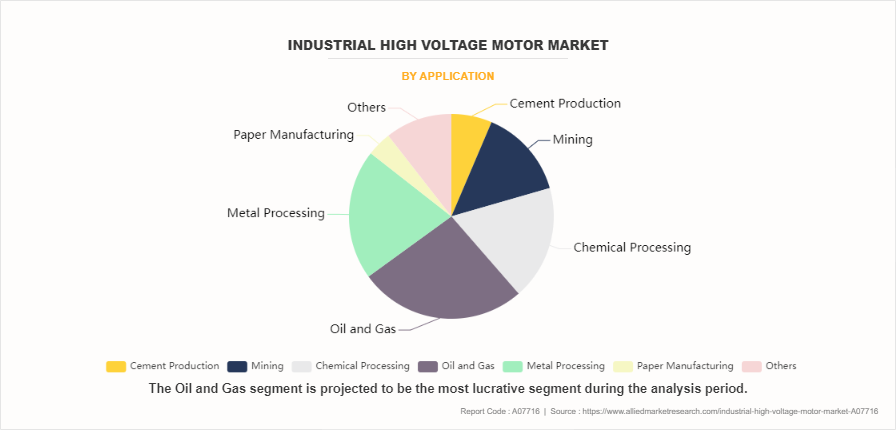

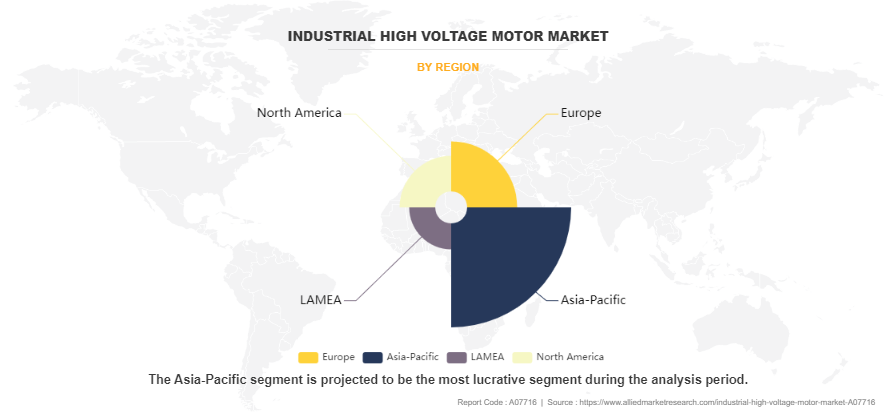

The industrial high voltage motor market is segmented on the basis of type, product, application, and region. By type, the market is divided into squirrel cage motor and slip ring motors. By product, the market is classified into synchronous high voltage motor and asynchronous high voltage motor. By application, the market is classified into cement production, mining, chemical processing, oil & gas, metal processing, paper manufacturing, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The industrial high voltage motor market is segmented into Type, Product and Application.

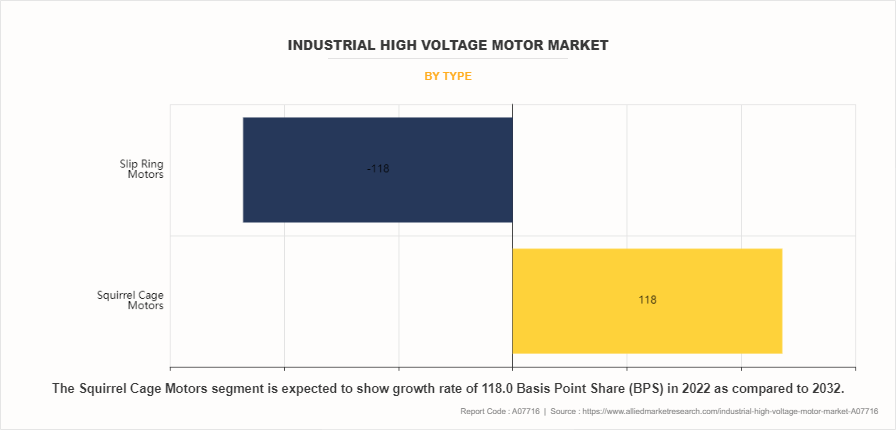

By type, the squirrel cage motors sub-segment dominated the market in 2022. Squirrel cage motors have high efficiency as they typically operate at an efficiency level that ranges from 80% to 95%. Therefore, the squirrel cage motors are highly efficient, and they are suitable for various industrial applications such as manufacturing, metals, mining, and others. In addition, squirrel cage motors are available in a wide range of sizes, ranging from small fractional horsepower motors to large motors. This versatility makes these motors suitable for its use across various industrial applications. In addition, the rotor inertia of squirrel cage motors is relatively low. The squirrel cage motors can respond to variable load conditions owing to the low rotor inertia. Hence, squirrel cage motors are used in several applications where rapid acceleration or deceleration is required. These factors are anticipated to boost the squirrel cage motors demand in the upcoming years.

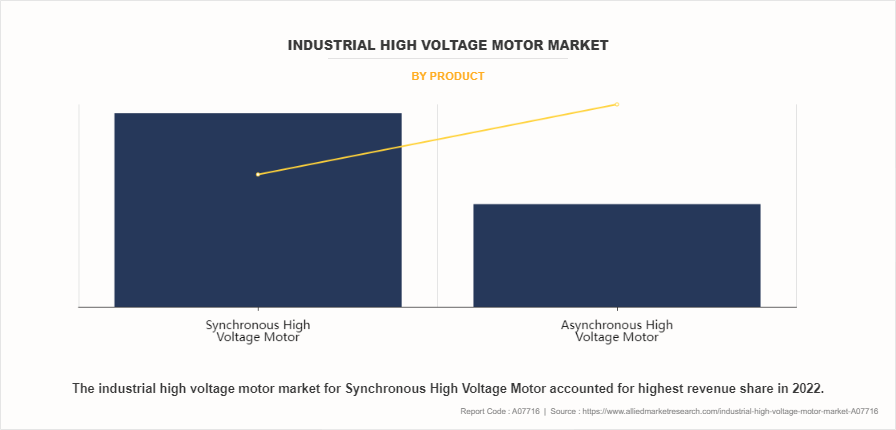

By product, the synchronous high voltage motor sub-segment dominated the global industrial high voltage motor market share in 2022. Synchronous high voltage motors are being widely used owing to their high efficiency, precise control, and reliability aross various industrial applications. These motors operate at a constant speed that is synchronized with the frequency of the applied voltage. This makes them ideal for tasks requiring consistent performance, such as in pumps, compressors, and generators. These motors ensure optimal performance by adjusting parameters such as voltage and frequency according to the motor's load requirements. Moreover, they often feature protective measures like overcurrent and overvoltage detection to safeguard the motor and associated equipment from damage.

By application, the oil and gas sub-segment dominated the global market in 2022. In the oil and gas sector, industrial high voltage motors are used in drilling operations, powering pumps & compressors, crude oil and gas processing as well as in offshore platforms. Industrial high voltage motors are used in the oil and gas sector in drilling operations for driving various equipment such as drill bit and mud pumps owing to their high torque and power. Also, these motors are compatible with Variable Frequency Drives (VFDs) used in the oil and gas industry. This compatibility is crucial for offering precise control over the motor speed & torque that enhances the efficiency and flexibility of different industrial operations.

By region, Asia-Pacific dominated the global market in 2022. Rapid industrialization, expansion of manufacturing industry, rapid urbanization, and growth in the construction industry are the major factors driving the Asia-Pacific industrial high voltage motor market. Asia-Pacific has been undergoing rapid industrialization and infrastructure development which leads to an increase in the use of high voltage motors for various industrial processes and applications. The Southeast Asian countries namely Singapore, Indonesia, and Malaysia have been investing in the oil & gas sector where these motors are used in exploration, extraction, and processing. In addition, companies leading in the manufacturing sector namely in India, China, and others have seen high demand for high voltage industrial motors that are used in large machineries. Also, in heating, ventilation, and air conditioning (HVAC) systems, elevators, and other applications industrial high voltage motors are used. The adoption of advanced technologies and automation in industries across Asia-Pacific is driving the adoption of industrial high voltage motors. The region is a global manufacturing hub, and it accounts for nearly 48.5% of the global manufacturing output.

Impact of COVID-19 on the Global Industrial Voltage Motor Industry

- The industrial high voltage market was negatively impacted by the pandemic owing to supply chain disruptions that affected the production and delivery of high voltage motors. The high voltage motor manufacturers faced disruptions in sourcing of materials & components which resulted in production delays.

- The social distancing norms and disruptions in the availability of workforce impacted different industrial activities in countries namely China, India, South Korea, and European countries. This is because the majority of the construction projects were temporarily halted, which affected the industrial high voltage market expansion.

- The investments in R&D and the purchase of new industrial equipment were delayed owing to the increased focus of companies on cost-cutting measures. Thus, reduced industrial activities affected the demand for high voltage motors.

Key Benefits For Stakeholders

- The report provides exclusive and comprehensive analysis of the global industrial high voltage motor market trends along with the industrial high voltage motor market forecast.

- The report elucidates the industrial high voltage motor market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the industrial high voltage motor market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the industrial high voltage motor market demand.

Industrial High Voltage Motor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.6 billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Type |

|

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | teco australia, General Electric Company, Toshiba Mitsubishi-Electric Industrial Systems Corporation., WEG, ABB Ltd., HYOSUNG HEAVY INDUSTRIES, Regal Beloit Corporation, Siemens AG, Shanghai Electric Machinery Co., Ltd., OME |

The rising applications of industrial high voltage motors in the mining, oil & gas, power generation sectors owing to the energy efficiency offered by these motors is the major factor driving the market growth. In addition, the technological advancements in the industrial high voltage motors with the integration of industrial automation and Industry 4.0 is anticipated to generate excellent opportunities in the market.

The major growth strategies adopted by the industrial high voltage motor market players are partnership, business expansion, and investment.

Asia-Pacific is projected to provide more business opportunities for the global industrial high voltage motor market in the future.

ABB, WEG, General Electric Company, Teco Australia, Siemens AG, Toshiba Mitsubishi-Electric Industrial Systems Corporation, OME, HYOSUNG HEAVY INDUSTRIES, Shanghai Electric Machinery Co., Ltd., and Regal Beloit Corporation are the major players in the industrial high voltage motor market.

The synchronous high voltage motor sub-segment of the product acquired the maximum share of the global industrial high voltage motor market in 2022.

The potential customers of the industrial high voltage motor industry are the power utilities sector, chemicals industry, steel processing sector, automotive sector, and others.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global industrial high voltage motor market from 2022 to 2032 to determine the prevailing opportunities.

The use of industrial high voltage motors in pulp & paper, chemical & petrochemical, and metals & manufacturing sectors is anticipated to drive the adoption of industrial high voltage motors.

The current trends such as electrification in the transportation sector, rise in the adoption of renewable energy, growing focus on predictive maintenance, and others are anticipated to drive the demand for industrial high voltage motors in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...