Industrial Packaging Market Research, 2033

Industrial Packaging Market Report Key Highlighters

• The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

• The Industrial packaging market share is marginally fragmented, with players such as Grief, Inc., Mondi PLC., Amcor Limited, Westrock Company, International Paper Company, Bemis Company, Inc., Orora Limited, Mauser Group, Sigma Plastics Group, and Wuxi Sifang Drums Limited Company. Major strategies such as product Launch, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Industrial Packaging Market dynamics

Rapid growth of imports and exports between various countries, which requires superior packaging standards for the international market, is expected to positively affect the Industrial Packaging Market Overview during the forecast period. Wood boxes offer excellent product protection and are often used as export and import packaging. Also, corrugated packaging is gaining popularity as export and import packaging material owing to its lightweight and ease of customization.

However, fluctuating prices of raw mterial negatively effect the profitability of the manufacturers. Thus, this fluctuation of raw materials is expected to restrain the industrial packaging market growth. For instance, the price of metal reduced by $79.8/metric tonne or about 14.51% in China in the start of 2024. Similarly, in April 2024, the futures of metal fell to about $466.2/metric tonne in March 2020. In addition, aluminum prices surged to $2,450 per tonne in April 2024, the highest in 14 months. This was due to a rally for other base metals, pressure on the dollar, supply concerns, and some traction in demand from China.

Moreover, growing demand for sustainable development is driving the demand for various types of eco-friendly packaging materials which includes paper & board, metal, glass and similar types of packaging. This creates a opportunity for growth for the key players in the Industrial packaging market.

The industrial packaging market has witnessed various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced construction and industrial activities, eventually leading to reduced demand for industrial packaging from the construction and industrial sectors. However, COVID-19 has subsided, and the major manufacturers in 2023 have been performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for construction which is a major end-user sector of industrial packaging. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, a peace agreement between Ukraine and Russia can be devised, with the continued talks between different countries, which is expected to end the war between them and reduce global inflation.

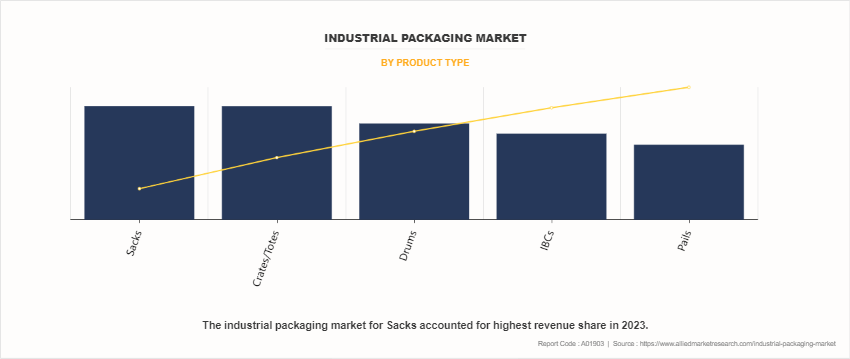

Segmental Overview

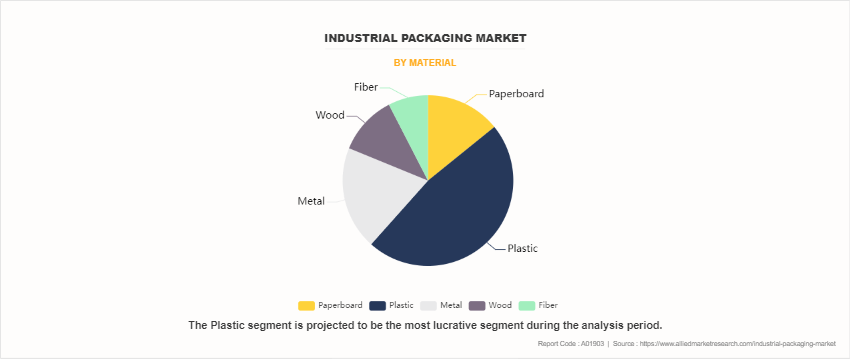

By material, the Industrial packaging market is categorized into paperboard, plastic, metal, wood, and fiber. In 2023, plastic segment held the largest market share in terms of revenue. Paperboard packaging, known for its versatility and sustainability, is commonly used for corrugated boxes, cartons, and tubes, providing protection and containment for a variety of goods during transportation and storage. Plastic packaging offers lightweight, durable, and flexible solutions for a range of industries, including food and beverage, healthcare, and consumer goods, with options such as bags, films, bottles, and containers. Metal packaging, including steel and aluminum, provides robust and tamper-resistant solutions for storing and transporting liquids, chemicals, and industrial products, often in the form of drums, cans, and pails. Wood packaging, such as pallets, crates, and skids, offers strength and stability for heavy or irregularly shaped items, commonly used in logistics and shipping applications. Fiber packaging, made from materials like corrugated cardboard and molded pulp, provides cushioning and protection for fragile or sensitive products, offering eco-friendly and recyclable alternatives for packaging needs.

By application, the Industrial packaging market is categorized chemical and pharmaceuticals, building and construction, oil and lubricant, agriculture and horticulture, and others. In 2023, chemical and pharmaceuticals segment held the largest market share in terms of revenue. On the other hand, food and beverages segment is anticipated to grow with a higher CAGR during the forecast period. In chemical and pharmaceutical sectors, packaging ensures safe transportation of hazardous materials. Building and construction industries rely on durable packaging for heavy construction materials. Oil and lubricant sectors use leak-proof containers for petroleum-based products. Agriculture and horticulture utilize packaging for fertilizers, pesticides, and produce. Additionally, industrial packaging supports various other industries, including automotive, electronics, manufacturing, and logistics, providing tailored solutions for efficient handling and transportation needs.

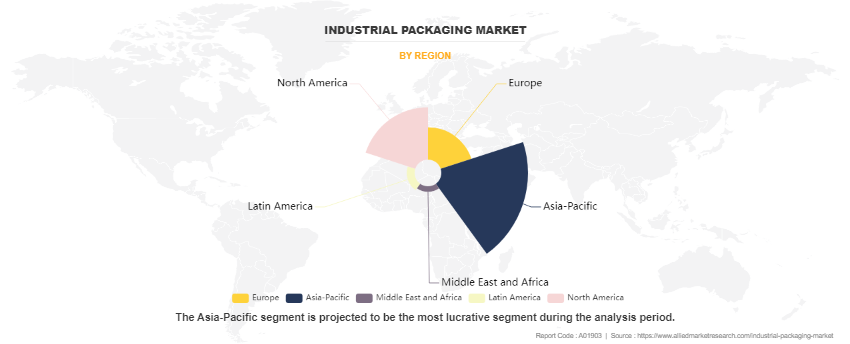

By region, the Industrial packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2023, Asia-Pacific had the highest market share and is anticipated to secure the leading position during the forecast period. The Asia-Pacific region presents many growth opportunities to the major players in the Industrial packaging market, owing to rapid industrialization in the countries such as India, and China.

Competition Analysis

Recent Development in the Industrial packaging Market

- In August 2022, BASF and Nippon Paint China, a prominent coatings manufacturer, have collaboratively introduced an environmentally friendly industrial packaging solution, which has been integrated into Nippon Paint's dry-mixed mortar series products. Utilizing BASF's water-based acrylic dispersion Joncryl® High-Performance Barrier (HPB) as the primary barrier material, this innovative packaging material is specifically tailored for Nippon Paint's construction dry mortar products. Notably, this marks the inaugural application of BASF's water-based barrier coatings in industrial packaging within China.

- In July 2023, Conner Industries, Inc., a top-tier supplier of lumber, industrial wood crates & pallets, and comprehensive packaging solutions, declared on Tuesday the inauguration of a new manufacturing plant situated in Guthrie, Kentucky. This recent venture into the manufacturing sector in southern Kentucky strengthens Conner's presence in the integrated packaging division, facilitating expansion of its operational footprint.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging Industrial packaging market trends and dynamics.

- In-depth Industrial packaging market analysis is conducted by constructing market estimations for the key market segments between 2023 and 2033.

- Extensive analysis of the Industrial packaging market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The Industrial packaging market forecast analysis from 2024 to 2033 is included in the report.

- The key market players within Industrial packaging market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the Industrial packaging industry.

Industrial Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 99.6 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 245 |

| By Product Type |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sigma Plastics Group, International Paper Company, Bemis Company, Inc., Wuxi Sifang Drums Limited Company, Amcor Limited., Orora Limited, WestRock Company, Mondi Plc., Grief, Inc., Mauser Group GmbH & Co. KG |

Analyst Review

The industrial packaging market is experiencing growth driven by increasing global trade and industrialization worldwide. Emerging economies like India, China, and Vietnam are implementing policies to support domestic industries, while international trade has rebounded since the pandemic-induced downturn. However, fluctuating raw material prices, particularly in metals like aluminum, pose challenges to market profitability. On the upside, there's a growing demand for eco-friendly packaging materials, presenting opportunities for market growth. Despite COVID-19 disruptions and ongoing inflation concerns, major manufacturers are performing well, although inflation remains a key obstacle due to geopolitical tensions. A potential peace agreement between Ukraine and Russia could mitigate inflationary pressures in the future.

A significant rise in global trade, and rising industrialization in many developing countries drive the growth of the global industrial packaging market.

The latest version of the Industrial packaging market report can be obtained on demand from the website.

The Industrial packaging market size was valued at $65.9 billion in 2023.

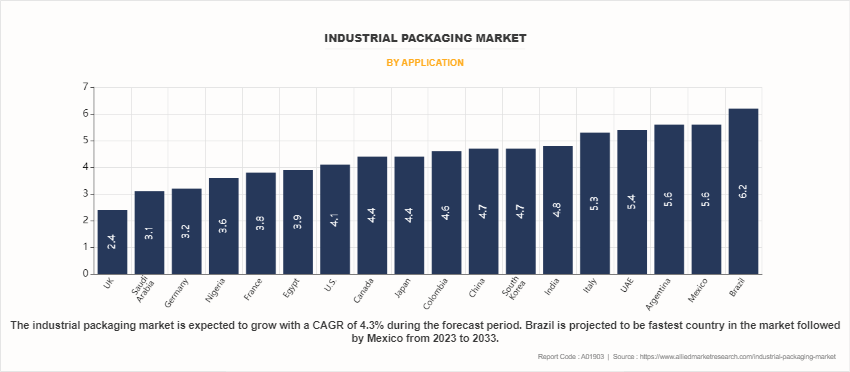

The Industrial packaging market size is estimated to reach $99.6 billion by 2032, exhibiting a CAGR of 4.3% from 2023 to 2032.

The forecast period considered for the industrial packaging market is 2024 to 2033, wherein, 2023 is the base year, 2024 is the estimated year, and 2033 is the forecast year.

Chemical and Pharmaceuticals segment is the largest market for Industrial packaging market.

Key companies profiled in the Industrial packaging market report include Grief, Inc., Mondi PLC., Amcor Limited, Westrock Company, International Paper Company, Bemis Company Inc., Orora Limited, Mauser Group, Sigma Plastics Group, and Wuxi Sifang Drums Limited Company.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...