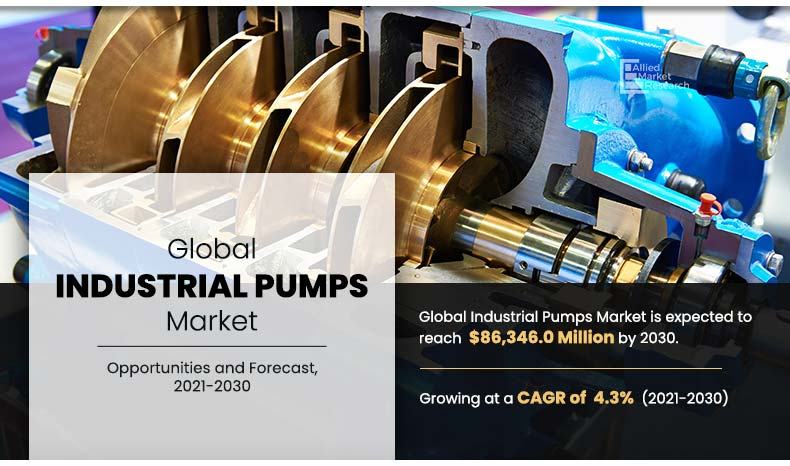

The Global Industrial Pumps Market Size is expected to reach $86,346.0 million in 2030, from $55,830.1 million in 2020, growing at a CAGR of 4.3% from 2021 to 2030.

Industrial pumps are used in process industries for regulation, control, and direction of gases, liquids, vapors, slurries, and others. They are mainly manufactured using cast iron, stainless steel, carbon steel, and other high functioning metal alloys to obtain efficient flow control in industries such as water & waste water, oil & power, food & beverages, chemicals, and others.

Moreover, an industrial pump mainly consists of a main body, a stem, and a seat that are generally manufactured using different materials, including polymers, rubber, metals, and others to avoid wastage of liquid flowing through the pump. Pumps are mainly differentiated by their operating mechanisms.

Rise in adoption of industrial pumps in petrochemicals, chemicals, medical, and pharmaceutical industry fuels the growth of the global industrial pumps market.

Furthermore, the oil & gas industry is the largest consumer of industrial pumps globally, and includes the use of industrial valves in downstream, midstream, and upstream process applications. Rise in demand for industrial pumps in North America boosts the need for importing industrial pumps from other countries, thereby driving the industrial pumps market growth. Moreover, the food & beverages processing industry is largely saturated in the developed countries, including the European Union countries, the U.S., and China.

However, rise in demand for food from developing nations, such as Brazil, India, and others, boosts the agriculture industry, which, in turn, fuels the growth of the food & beverages processing industry. This is further expected to drive the demand for industrial pumps, thereby fostering the growth of the industrial pumps industry.

However, the U.S. administration increased the tariffs on derivative aluminum and steel imports, effective from February 8, 2020. This hike includes 25% surge on steel and 10% surge on aluminum imports, which negatively affected the U.S. manufacturing sector. Although the tariff is aimed at gaining more revenues from imports, the global trade for industrial pumps has been affected negatively. Industrial pumps manufacturing utilizes steel on a large scale, and the tariff on steel is anticipated to hinder the growth of the global industrial pumps market.

In addition, the COVID-19 pandemic has shut down the production and sales of various products in the industrial pumps industry, mainly owing to the prolonged lockdown in major global countries, including the U.S., Italy, the UK, and others. This hampered the growth of the industrial pumps market significantly in 2020.

Furthermore, fluctuation in raw material prices is anticipated to restraint the growth of the global industrial pumps market. Contrarily, technological innovation in industrial pumps is anticipated to provide lucrative opportunities for the growth of the global industrial pumps market.

By Type

Centrifugal segment holds dominant position in 2019

The global industrial pumps market is segmented into type, position, driving force, end user, and region. By type, the market is categorized into centrifugal, reciprocating, rotary, and others. Centrifugal segment generated the highest revenue in 2020. By position, the market is categorized into submersible, and non-submersible. Non-submersible segment generated the highest revenue in 2020. Depending on driving force, it is segregated into engine-driven and electrical-driven. Electrical driven segment generated the highest revenue in 2020. On the basis of end-user, it is differentiated into oil & gas, chemicals, power generation, water & wastewater, and general industry. General industry segment generated the highest revenue in 2020.

By End User

Power Generation segment is expected to grow at a significant CAGR of 4.9%.

The global industrial pumps market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Russia, and the rest of Europe), Asia-Pacific (China, India, Japan, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is expected to hold the largest market share throughout the study period, and is expected to grow at the fastest rate.

By Region

Asia- Pacific region registered highest revenue in 2020.

Competition Analysis

The key market players profiled in the report include Flowserve Corporation, The Weir Group plc, Grundfos, KSB, ITT Inc, Sulzer, EBARA Corporation, Xylem, SPX Flow Corporation, and Baker Hughes.

Many competitors in the industrial valves market adopted acquisition as their key developmental strategy to expand their geographical foothold and upgrade their product technologies. For instance, in June 2019, Crane Co. acquired Circor International Corporation, which is a U.S.-based manufacturer of flow and motion control products. It provides products, such as pumps, valves, actuators, and others for industrial applications, and the acquisition aided Crane Co. to improve its foothold in the U.S. Similarly, in August 2019, IMI plc acquired PBM Inc., which is a specialty valve manufacturer and offers a wide portfolio of industrial valves and other flow control products.

Key Benefits For Stakeholders

- The report provides an extensive industrial valves market analysis of the current and emerging global industrial pumps market trends and dynamics.

- In-depth analysis of the market is conducted by constructing market estimations for the key market segments between 2020 and 2030.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive industrial pumps market opportunity analysis of all the countries is also provided in the report.

- The global industrial pumps market forecast analysis from 2021 to 2030 is included in the report.

- The key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industry.

Industrial Pumps Market Report Highlights

| Aspects | Details |

| By Type |

|

| By POSITION |

|

| By DRIVING FORCE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | THE GORMAN-RUPP COMPANY, ITT INC., EBARA CORPORATION, GRUNDFOS HOLDING A/S, KSB SE & CO. KGAA, ATLAS COPCO AB, THE WEIR GROUP PLC, FLOWSERVE CORPORATION, XYLEM INC., SULZER LTD. |

Analyst Review

The global industrial pumps market possesses organic growth potential during the forecast period. The demand for pumps is witnessed from oil & power industries, mainly owing to high infrastructural upgrades under the “Industry 4.0” development. With the development in automated regulation and control of industrial pumps, the market is expected to garner high revenues globally.

Moreover, increased investment in oil & gas extraction infrastructure in North American countries, including the U.S. and Canada, surges the demand for industrial pumps, which, in turn, boosts the growth of the industrial pumps market. Furthermore, high demand from North America is satisfied by major manufacturers of industrial valves located in China, Germany, India, and others, which resulted in significant growth of the global industrial pumps market. In addition, the food & beverage processing industries have garnered high growth from the developing countries, including Brazil, India, and others, which boosts the demand for industrial pumps. This further drives the global industrial valves market growth significantly during the forecast period.

The industrial pumps industry is highly fragmented in nature; however, various valve manufacturers are adopting product launch as a strategy to enhance the market share. For instance, in September 2019, Little Giant launched technically advanced HVAC condensate pump, VCMA-20 ULS. This advanced HVAC condensate pump has a safety switch included in it to ensure the safety of the pump in case of any failure. VCMA-20 ULS is capable of collecting the condensate, detecting, and automatic removal of condensate from air conditioning device. It can be used to eliminate the condensate from the condensing boilers and de-humidifiers.

However, fluctuation in raw material prices is anticipated to be a restraint for the growth of the industrial pumps market. Contrarily, technological innovation in industrial pumps is anticipated to provide lucrative opportunity for the growth of the industrial pumps market.

The global industrial pumps market size was $55,803.1 million in 2020 and is projected to reach $86,346.0 million in 2030, growing at a CAGR of 4.3% from 2021 to 2030.

The forecast period considered for the global industrial pumps market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

The base year considered in the global industrial pumps market is 2020.

No, the report does not provide Value Chain Analysis for the global industrial pumsp market.

On the basis of type, the centrifugal segment is expected to be the most influencing segment growing in the global industrial pumps market report.

Based on the end-user industry, in 2020, the general segment generated the highest revenue, accounting for 35.5% of the market and is projected to grow at a CAGR of 4.5% from 2020 to 2030

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically covers company overview, geographical presence, and market dominance (in terms of revenue and volume sales).

The market value of global industrial pumps market is $58,956.6 million in 2021.

Loading Table Of Content...