Industrial Valves Market Research: 2031

The Global Industrial Valves Market Size was $65 billion in 2021 and is projected to reach $110.5 billion by 2031, registering a CAGR of 5.3% from 2022 to 2031. Industrial valves are used in process industries for the direction, regulation, and control of gases, slurries, liquids, vapors, and others. Industrial valves are mainly manufactured using carbon steel, cast iron, stainless steel, and other high-functioning metal alloys to obtain efficient flow control in industries such as water & wastewater, oil & power, food & beverages, chemicals, and others.

Market Dynamics

A valve is a device or natural object that regulates, directs or controls the flow of a fluid (gases, liquids, fluidized solids, or slurries) by opening, closing, or partially obstructing various passageways. Valves are technically fittings, but are usually discussed as a separate category. In an open valve, fluid flows in a direction from higher pressure to lower pressure. The word is derived from the Latin valva, the moving part of a door, in turn from volvere, to turn, roll which is an important factor for industrial valves market.

Moreover, a valve mainly consists of the main body, a stem, and a seat that are generally manufactured using different materials including polymers, rubber, metals, and others to avoid wastage of liquid flowing through the valve. Valves are mainly differentiated by their operating mechanisms. The most widely used valves in industrial valves market are globe valves, butterfly valves, ball valves, gate valves plug valves, pinch valves, diaphragm valves, and check valves.

Industrial valves are electro-mechanical or mechanical devices used for control of gases, liquid, slurries, and others through pipes and tubes in industries. Different kinds of industrial valves perform various functions such as shut on/off, pressure control, and other regulation purposes. There are various kinds of industrial valves, including ball valves, butterfly valves, check valves, gate valves, globe valves, pinch valves, and others, which are designed for regulation, control, and on & off purposes.

Moreover, industrial valves are manufactured using carbon steel, cast iron, stainless steel, and various other metal alloys for attaining high efficiency. Furthermore, the high automation and control in industrial valves improve their functioning in hazardous applications such as oil & gas, chemical processing, nuclear power generation plants, and others. In addition, the implementation of automation technologies has assisted in reducing the wastage of liquids passing through the pipes and valves, which result in reduction of costs. Various industries adopt automation and control technologies by upgrading their pre-installed industrial valves, which in turn drives the industrial valves market growth.

Furthermore, the focus on increasing the production of oil & gas in North America has created a high demand for industrial valves in the region. The investments for extraction of oil & gas have propelled substantially, which has led to infrastructural development. This is expected to create massive demand for industrial valves, which in turn will boost the growth of the market. The COVID-19 pandemic has negatively affected the market that affected the market mainly due to the halt in international trade, prolonged lockdowns, and ceased manufacturing processes. In addition, the major end-user manufacturing companies located in countries such as the U.S., Germany, the UK, and others are also facing financial impacts due to halted production, which had hinder the growth of the market during 2020.

Moreover, a valve mainly consists of the main body, a stem, and a seat that are generally manufactured using different materials including polymers, rubber, metals, and others to avoid wastage of liquid flowing through the valve. Valves are mainly differentiated by their operating mechanisms. The most widely used valves in industries are globe valves, butterfly valves, ball valves, gate valves plug valves, pinch valves, diaphragm valves, and check valves. Thus, various companies manufacturing industries valves are launching new valves in order to set new industrial valves market trends.

As per the industrial valves market analysis, the oil & gas industry is the largest consumer of industrial valves and includes the use of industrial valves in downstream, midstream, and upstream process applications. Rise in demand for industrial valves in North America boosts the need for importing industrial valves from other countries: thereby, driving the growth of the market. Moreover, the food & beverages processing industry is largely saturated in developed countries, including the European Union countries, the U.S, and China.

Rise in demand for food from developing nations such as Brazil, India, and others boosts the agriculture industry, which in turn fuels the growth of the food & beverage processing industry. This is further expected to drive the demand for industrial valves; thereby, fostering the growth and providing industrial valves market opportunity.

However, the U.S, administration increased the tariff on derivative aluminum and steel imports, effective from February 8, 2020, this hike includes 25% surge in steel and 10% surge in aluminum imports, which has negatively affected the U.S, manufacturing sector. The global trade for industrial valves has been affected negatively, though the tariff aimed at gaining more revenues from imports, Industrial valves manufacturing utilizes steel on a large scale and the tariff on steel is anticipated to hinder the growth of the industrial valves market.

In addition, the COVID-19 pandemic has shut-down the production and sales of various products in the industrial valves industry and affected industrial valves market share, mainly owing to the prolonged lockdown in major countries including the U.S., Italy, the UK, and others. Th This has affected the growth of the market since 2019 till 2020 Conversely, industries are gradually resuming their regular manufacturing processes, which fueled the recovery of market in the second half 2022.

On the contrary, the integration of artificial intelligence and Internet of things (loT) in manufacturing processes under the “Industry 4.0" upgradation has pushed the manufacturing industry more towards the automation which further helps in improving the quality of the work and process. Thereby, providing lucrative opportunities for the growth of the industrial valves market.

The global industrial valves market is segmented on the basis of material type, valve type, application, and region.

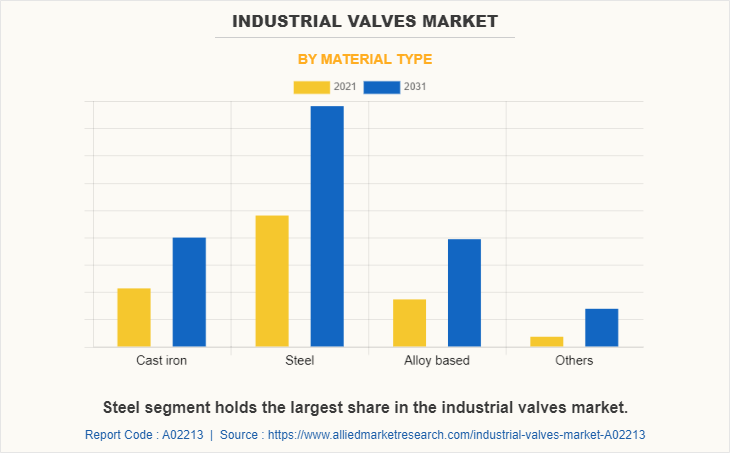

On The Basis of Material Type,

The market is categorized into cast iron, steel, alloy-based, and others.

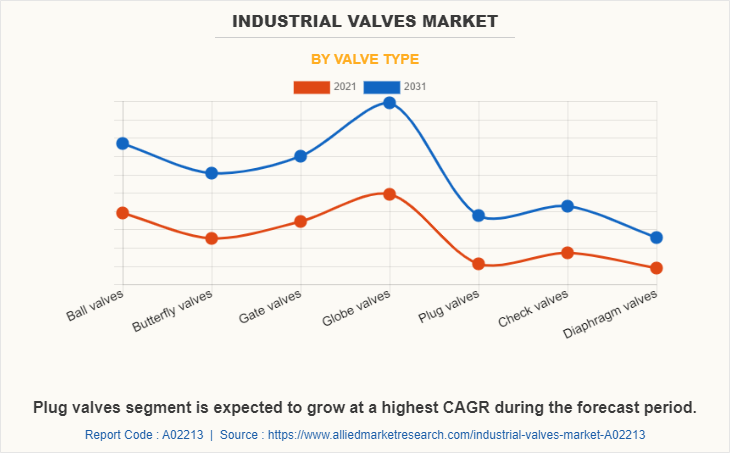

On The Basis of Valve Type,

It is segregated into ball valves, butterfly valves, gate valves, globe valves, plug valves, check valves, and diaphragm valves.

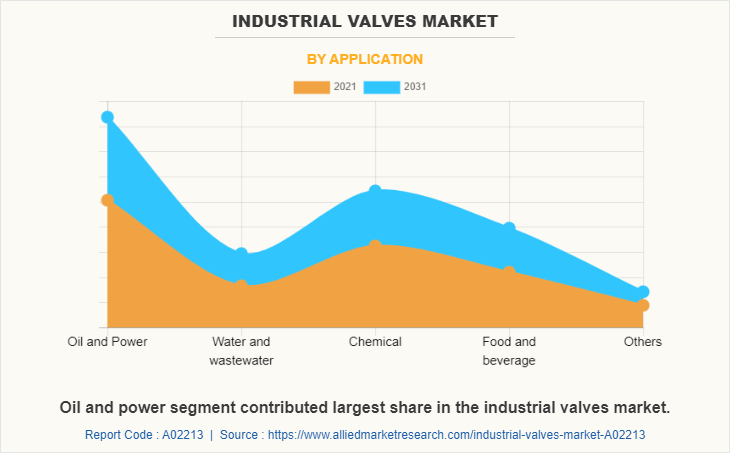

On The Basis of Application,

It is differentiated into oil & power, water & wastewater, chemical, food & beverage, and others.

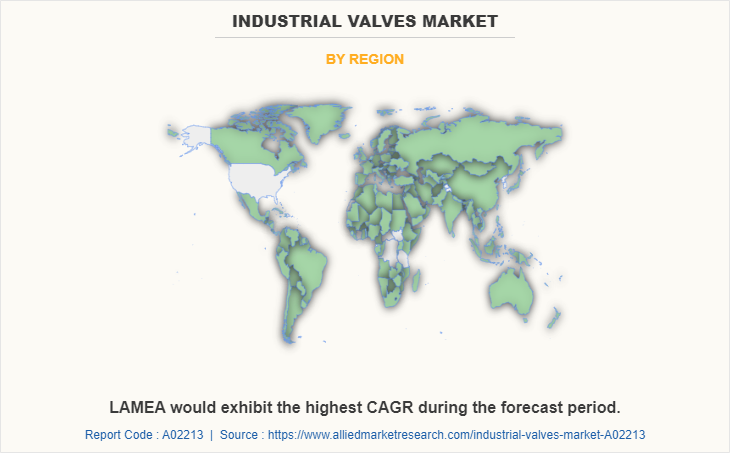

On The Basis of Region,

The market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Asia-Pacific is the largest contributor in the industrial valves industry with the highest share during 2020. The industrial valves market has lucrative growth opportunities in China and India, which are likely to exhibit significant growth during the forecast period. This is due to the low material costs and extensive growth in industrial infrastructure during the past years.

On the basis of material type, in 2021 the steel segment dominated the industrial valves market, in terms of revenue, and the alloy-based segment is expected to witness growth at the highest CAGR during the forecast period. On the basis of per valve type, in 2021, the globe valve segment led the market, and the butterfly valve segment is expected to exhibit highest CAGR during the forecast period. On the basis of application, the oil & power segment led the market in 2021, in terms of revenue, and the food & beverage segment is anticipated to register the highest CAGR during the forecast period. On the basis of region, Asia-Pacific garnered the highest revenue in 2021; and it is anticipated to register the highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the industrial valves market report include AVK Holding, Avcon Controls Pvt. Ltd., Schlumberger Limited, Crane, Emerson Electric Co., Flowserve Corp., Forbes Marshall, IMI Plc, Metso Corporation, The Weir Group Plc, EG Valves Manufacturing Co., Ltd., Sirca International S.p.A., KLINGER Holding, Böhmer GmbH, Fluidline Valves Co. Pvt Ltd., Anything Flows LLC, Davis Valve, Powell Valves, Tianjin City Binhaihuayi Valve Co., Ltd., Virgo Engineers Inc, Jag Valves, Walworth, Sap Industries Ltd, Microfinish Valves And Pumps, Newmans Valve LLC, Fluidchem Valves (India) Pvt. Ltd, Goodwin International, Global Valve & Controls, Gemini Valve and Flow Control Technology Valve.

Major companies in the market have adopted product launch, partnership, business expansion, and acquisition as their key developmental strategies to offer better products and services to customers in the industrial valves market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the industrial valves market forecast, market segments, current trends, estimations, and dynamics of the market from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and industrial valve market opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial valves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global key players, market segments, application areas, and market growth strategies.

Industrial Valves Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 110.5 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 219 |

| By Material type |

|

| By Valve type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Fluidline Valves Co. Pvt. Ltd., EG Valves Manufacturing Co., Ltd., Emerson Electric Co., Tianjin City Binhai Huayi Valve Co., Ltd., Gemini Valve, Flow Control Technology Valve, Jagflo Components, Fluidchem Valves (India) Pvt. Ltd., Bohmer GmbH, IMI plc, Microfinish Valves Pvt. Ltd., Walworth, Sap Industries Ltd., Avcon Controls Pvt. Ltd., Crane Co., Newmans Valves LLC, Sirca International S.p.A., KLINGER Holding, Goodwin International Ltd., Global Valve & Controls, Davis Valve, The Weir Group PLC, Powell Valves, Anything Flows LLC, Metso Outotec Corporation, Forbes Marshall, Virgo Engineers Inc., AVK Holdings A/S, Schlumberger Limited, Flowserve Corp. |

Analyst Review

The global industrial valve market is expected to have an organic growth potential during the forecast period. The demand for valves is witnessed from the oil & power industries, mainly owing to high infrastructural upgradations under the ”Industry 4.0” development. The market is anticipated to garner high revenues globally, with the development of automated regulation and control of industrial valves.

Moreover, the increased investments in oil & gas extraction infrastructure in North American countries including the U.S. and Canada drive the demand for industrial valves, which in turn boosts the growth of the market. The high demand from North America is satisfied by major manufacturers of industrial valves located in China, Germany, India, and others, which has resulted in significant growth of the market globally. In addition, the food & beverage processing industries have garnered high growth from developing countries including Brazil, India, and others which has surged the demand for industrial valves. This has boosted the global industrial valve market growth significantly in 2021.

Many competitors in the industrial valve market adopted acquisition as their key developmental strategy to expand their geographical foothold and upgrade their product technologies. For instance, in 2020, Crane Co. acquired Circor International Corporation, which is a U.S.-based manufacturer of flow and motion control products. It provides products such as pumps, valves, actuators, and others for industrial applications, and the acquisition has aided Crane Co. to improve its foothold in the U.S. Similarly, in August 2019, IMI plc acquired PBM Inc., which is a specialty valve manufacturer and offers a wide portfolio of industrial valves and other flow control products.

The Industrial Valves Market valued for $64,994.9 million in 2021 and is estimated to reach $110,472.2 million by 2031, exhibiting a CAGR of 5.3% from 2022 to 2031.

The forecast period considered for the global industrial valves market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global industrial valves market report can be obtained on demand from the website.

The base year considered in the global industrial valves market report is 2021.

The top companies holding the market share in the global industrial valves market report AVK Holding, Avcon Controls Pvt. Ltd., Schlumberger Limited, Crane, Emerson Electric Co., Flowserve Corp., Forbes Marshall, IMI Plc, Metso Corporation, The Weir Group Plc, EG Valves Manufacturing Co., Ltd., Sirca International S.p.A., KLINGER Holding, Böhmer GmbH, Fluidline Valves Co. Pvt Ltd., Anything Flows LLC, Davis Valve, Powell Valves, Tianjin City Binhaihuayi Valve Co., Ltd., Virgo Engineers Inc, Jag Valves, Walworth, Sap Industries Ltd, Microfinish Valves And Pumps, Newmans Valve LLC, Fluidchem Valves (India) Pvt. Ltd, Goodwin International, Global Valve & Controls, Gemini Valve and Flow Control Technology Valve.

The top thirty market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By material type, the steel segment is the highest share holder of industrial valves market.

Loading Table Of Content...