Industry 5.0 Market Research, 2032

The Global Industry 5.0 Market was valued at $129.1 billion in 2022, and is projected to reach $637.4 billion by 2032, growing at a CAGR of 17.3% from 2023 to 2032.

The continuous advancements in technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), robotics, and advanced analytics contribute to the enhancement of industrial processes, productivity, and efficiency. In addition, Industry 5.0 emphasizes the collaboration between humans and machines, leveraging the strengths of both to achieve optimal results. This approach leads to improved decision-making, flexibility, and adaptability in industrial operations.

Industry 5.0, the most recent stage in the progression of industry, signifies a fundamental shift by placing significant importance on integrating human intelligence with advanced technologies. It builds upon the foundations laid by Industry 4.0 but goes a step further by cultivating a harmonious collaboration between humans and machines, thereby enhancing the overall efficiency and adaptability of industrial processes.

At its essence, Industry 5.0 aims to optimize the synergy between human workers and intelligent machines, acknowledging the distinct strengths each contributes to the manufacturing ecosystem. In contrast to its predecessors, which concentrated on automation and connectivity, Industry 5.0 gives precedence to establishing a balanced and cooperative environment where humans and machines collaborate to leverage their respective capabilities.

An illustration of Industry 5.0 in practice is the deployment of collaborative robots, or cobots, in manufacturing settings. These robots are specifically designed to operate alongside human workers, taking on repetitive or physically demanding tasks while humans concentrate on more intricate and strategic aspects of production. For example, in an automobile manufacturing plant, cobots can assist with tasks such as lifting heavy components or accurately placing intricate parts, allowing human workers to oversee quality control or engage in creative problem-solving.

The end-use sectors reaping the benefits of Industry 5.0 encompass a broad spectrum, underscoring the versatility and transformative influence of this approach. Particularly in manufacturing, industries such as aerospace and automotive witness the introduction of a more flexible and responsive production environment. Human-robot collaboration facilitates swift adjustments in manufacturing processes, accommodating variations in product specifications, and responding promptly to market demands.

Key Takeaways of Industry 5.0 Market Report

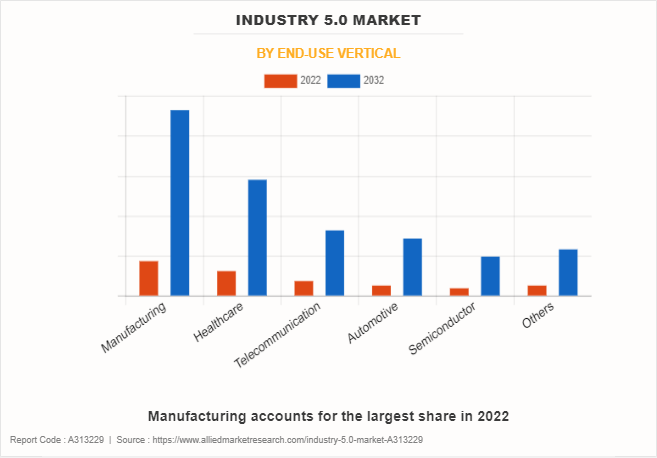

- On the basis of end use vertical, the manufacturing segment dominated the industry 5.0 market size in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

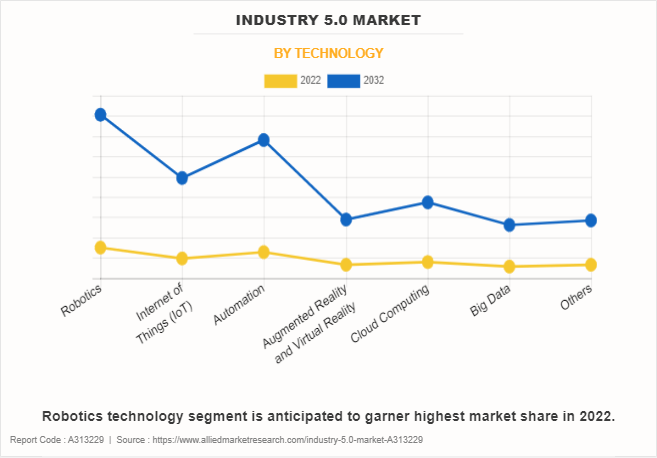

- On the basis of technology, the robotics segment dominated the industry 5.0 market share in terms of revenue in 2022 owing to its pivotal role in enhancing automation, precision, and efficiency in industrial processes.

- Further, among technology, the automation segment is anticipated to grow at the fastest CAGR during the forecast period owing to owing to an increase in demand for streamlined and efficient industrial processes.

- Region wise, North America region dominated the industry 5.0 market in terms of revenue in 2022. Specially US dominate the industry 5.0 market size by country in North America region. While, the market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Segment Overview

The industry 5.0 market is segmented into end-use vertical, technology and region.

On the basis of end-use vertical, the industry 5.0 industry is divided into manufacturing, healthcare, telecommunication, automotive, semiconductor, and others. In 2022, manufacturing dominate the market in terms of revenue. Moreover, the manufacturing segment is projected to manifest highest CAGR during the forecast period owing increase in focus on smart manufacturing practices. Embracing Industry 5.0 technologies, such as advanced robotics, Internet of Things (IoT), and artificial intelligence, enables manufacturers to optimize production processes, enhance operational efficiency, and adapt to dynamic market demands. The integration of these technologies in manufacturing fosters increased productivity, improved quality control, and streamlined supply chain management, positioning the manufacturing sector at the forefront of Industry 5.0 growth.

On the basis of technology, the industry 5.0 market is classified into Robotics, Internet of Things (IoT), Automation, Augmented Reality and Virtual Reality, Cloud Computing, Big Data, and Others. In 2022, the robotics segment dominated the market in terms of revenue and automation is expected to grow at highest CAGR during the forecast period owing increased demand for efficiency, cost savings, and streamlined industrial processes in diverse sectors.

On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), and Middle East and Africa (Saudi Arabia, Africa, and Rest of Middle East and Africa). Asia-Pacific, specifically China, remains a significant participant in the industry 5.0 market with a CAGR of 18.50% due to robust technological adoption, manufacturing prowess, and government initiatives promoting advanced industrial practices, which is driving the growth of the industry 5.0 industry in Asia-Pacific region.

Competitive Analysis

Competitive analysis and profiles of the major global Industry 5.0 market share by company that have been provided in the report include ABB, Kuka AG., Universal Robots A/S, Nexus Integra, Siemens A.G., Rockwell Automation, Inc., Schneider Electric, Cisco Systems, Inc., FANUC CORPORATION, and Yaskawa Electric Corp. The key strategies adopted by the major players of the Industry 5.0 market are product launch, and product development. For instance, in August 2022, ABB (Switzerland) launched its new smart factory in India which follows Industry 5.0 standards that includes human and cobots collaboration. The launch of new smart factory will enhance the productivity by 40%, and expected to have a test automation ration of around 50%.

Market Dynamics

Increase in use of collaborative robots

The Industry 5.0 market has witnessed a substantial boost due to the increased adoption of collaborative robots, often referred to as cobots. These robots play a central role in shaping Manufacturing 5.0, an integral component of the broader 5.0 Industrial Revolution. The advent of Industrialization 5.0 signifies a paradigm shift where human-robot collaboration takes precedence, fostering a more harmonious and efficient working environment.

Collaborative robots are designed to work alongside human workers, facilitating seamless cooperation and enhancing overall productivity. Unlike traditional industrial robots that operate in isolation, cobots are equipped with advanced sensors and safety features, ensuring a safer and more interactive workspace. This increased focus on human-robot collaboration addresses challenges posed by complex and dynamic manufacturing processes.

The surge in the use of collaborative robots can be attributed to their versatility and adaptability across various tasks, from repetitive assembly line operations to intricate, precision-driven activities. Their ability to assist human workers rather than replace them aligns with the core principles of Industry 5.0, emphasizing the integration of human skills with advanced technologies.

This collaborative approach not only enhances operational efficiency but also contributes to a more agile and responsive manufacturing ecosystem. As industries embrace the potential of collaborative robots, the Industry 5.0 market is propelled forward, ushering in a new era of industrialization characterized by intelligent, collaborative, and human-centric production processes.

Surge in demand for manufacturing industry

The surge in demand for the Industry 5.0 market is significantly propelled by the robust growth in the manufacturing industry. Manufacturing 5.0, characterized by the integration of advanced technologies like robotics, artificial intelligence, and the Internet of Things (IoT), is fostering a paradigm shift in industrial processes. The adoption of Manufacturing 5.0 principles results in increase in efficiency, improved collaboration between humans and machines, and streamlined production workflows. This transformation addresses the evolving needs of the manufacturing sector by offering solutions that enhance productivity, reduce operational costs, and ensure product quality. As industries increasingly recognize the potential benefits of Manufacturing 5.0 in optimizing processes, mitigating challenges, and staying competitive in the global market, the demand for Industry 5.0 solutions continues to surge, driving the industry 5.0 market growth during the forecast period.

High installation cost

High installation costs pose a significant constraint for small and medium-sized enterprises (SMEs) entering the Industry 5.0 landscape. While Industry 5.0 promises transformative advancements in industrial processes, the initial investment required for implementing cutting-edge technologies can be prohibitive for smaller businesses. The Industry 5.0 Growth Projections underscore the vast potential for enhanced collaboration between humans and technology, offering improved efficiency and productivity. However, the Industry 5.0 Market Overview indicates that the cost-intensive nature of adopting robotics, automation, and other Industry 5.0 technologies poses a barrier for SMEs. Overcoming this challenge may involve tailored financial models, government incentives, or collaborative initiatives to make these innovative solutions more accessible for smaller enterprises, fostering broader industry-wide adoption and ensuring that the benefits of Industry 5.0 are not limited to larger corporations.

The growing availability of cost and energy-efficient robots

The Industry 5.0 market is experiencing significant growth driven by the increasing availability of cost and energy-efficient robots. Industry 5.0, representing the convergence of human capabilities with advanced technologies, relies heavily on robotics to optimize industrial processes. Companies operating within the Industry 5.0 landscape are increasingly adopting robotics solutions to enhance automation, precision, and overall operational efficiency.

The affordability and energy efficiency of robots play a pivotal role in this trend. As technology advances, the cost of acquiring and implementing robotic systems has decreased, making them more accessible to a broader range of industries. This affordability has prompted companies to invest in robotic solutions, driving the adoption of Industry 5.0 practices. Moreover, energy-efficient robotic systems align with the global push for sustainable and environmentally conscious practices within industries.

Industry 5.0 companies recognize the transformative potential of cost-effective and energy-efficient robotics in streamlining production, reducing downtime, and improving overall productivity. Growth projections for the Industry 5.0 market highlight the increasing importance of robotics, with companies strategically integrating these technologies to stay competitive and meet the evolving demands of modern industrial processes. As the Industry 5.0 landscape continues to evolve, the role of cost and energy-efficient robots is anticipated to be a key driver of sustained market expansion.

Recent Developments in Industry 5.0 Industry

- In August 2021, Unify Twin, Inc. (US) announced the launch of new Industry 5.0 solution which focuses on unifying human and machine intelligence to eliminate the digital blind spots to achieve smart manufacturing operations.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industry 5.0 market analysis from 2022 to 2032 to identify the prevailing industry 5.0 market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industry 5.0 market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industry 5.0 market trends, key players, market segments, application areas, and market growth strategies.

Industry 5.0 Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 637.4 billion |

| Growth Rate | CAGR of 17.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By End-Use Vertical |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Nexus Integra, ABB, Schneider Electric, Yaskawa Electric Corp., Cisco Systems, Inc., Rockwell Automation, Inc., Universal Robots A/S, Siemens A.G., Kuka AG., FANUC CORPORATION |

Analyst Review

In the relentless pursuit of innovation, Industry 5.0 has emerged as a transformative force, reshaping the industrial landscape with a human-centric approach. This paradigm shift goes beyond the smart factories of Industry 4.0, emphasizing collaboration between humans and machines. This analyst review explores the dynamic market of Industry 5.0, delving into its key components, implications, and notable examples.

Key Components of Industry 5.0:

Human-Machine Collaboration:

Industry 5.0 places a strong emphasis on fostering collaboration between humans and machines, augmenting each other's strengths. This collaboration aims to create a symbiotic relationship where humans contribute creativity, problem-solving abilities, and emotional intelligence, while machines handle repetitive tasks and provide data-driven insights.

Advanced Robotics and Automation:

The integration of advanced robotics and automation technologies is a hallmark of Industry 5.0. This includes the use of collaborative robots (cobots) that work alongside humans, enhancing efficiency and safety. For example, companies like BMW have implemented cobots in their assembly lines, leading to a more flexible and adaptive production process.

Digital Twins and Virtual Reality (VR):

Industry 5.0 leverages digital twins and VR technologies to create virtual replicas of physical systems. This enables real-time monitoring, predictive maintenance, and immersive training simulations. An exemplary case is Siemens' use of digital twins in the energy sector, optimizing the performance of power plants and minimizing downtime.

Implications for Industries:

Increased Productivity:

The collaborative nature of Industry 5.0 fosters increased productivity by leveraging the unique strengths of both humans and machines. This synergy leads to more efficient workflows, reduced errors, and enhanced overall operational performance.

Enhanced Flexibility and Adaptability:

Industry 5.0 enables industries to respond swiftly to changing market demands. With human workers and machines working together seamlessly, companies can easily adapt their production processes, accommodating diverse product lines and customization requirements. Adidas' Speedfactory, for instance, exemplifies how Industry 5.0 principles can be applied for agile and on-demand manufacturing.

Improved Quality and Innovation:

The integration of human insights with machine precision results in improved product quality and innovation. This is evident in the aerospace industry, where Industry 5.0 principles are applied to design and manufacture complex components, ensuring both safety compliance and cutting-edge advancements.

Challenges and Opportunities:

Workforce Reskilling:

The transition to Industry 5.0 necessitates a focus on workforce reskilling. Companies must invest in training programs to equip employees with the skills required to collaborate effectively with advanced technologies. Governments and educational institutions play a crucial role in facilitating this transition.

Data Security and Privacy Concerns:

The increased reliance on interconnected systems raises concerns about data security and privacy. Industry stakeholders must implement robust cybersecurity measures to safeguard sensitive information and maintain the trust of consumers and partners.

Industry 5.0 represents a groundbreaking evolution in the industrial landscape, emphasizing the harmonious collaboration between humans and machines. As industries navigate this transformative journey, there is a need for strategic investments in technology, workforce development, and cybersecurity. The market's potential is vast, and the organizations that successfully embrace Industry 5.0 principles are poised to lead the way in innovation, productivity, and sustainability

Upcoming trends in the Industry 5.0 market include increased adoption of advanced robotics, expanded use of edge computing, integration of AI and machine learning, and the growing prominence of digital twins for enhanced industrial processes.

Robotics is the leading application of Industry 5.0 Market.

North America is the largest regional market for Industry 5.0.

The global industry 5.0 market was valued at $129.1 billion in 2022.

ABB, Kuka AG., Universal Robots A/S, Nexus Integra, Siemens A.G., Rockwell Automation, Inc., Schneider Electric, Cisco Systems, Inc., FANUC CORPORATION, and Yaskawa Electric Corp.

Loading Table Of Content...

Loading Research Methodology...