Infant Nutrition Market Research, 2032

The global infant nutrition market was valued at $45.5 billion in 2022, and is projected to reach $95.5 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

One of the most important factors that affects a child's development is nutrition. A wide variety of newborn formulae and baby food products are included in the market for infant nutrition. Infant nutrition is manufactured from powdered or liquid baby food and is produced for feeding babies & infants, who are typically under the age of one year. Infant nutrition enhances cognitive function & development of babies, shields them from allergies, and boosts immune & digestive health.

Moreover, the only other time of baby’s high development after pregnancy is during infancy. To achieve proper growth and organ development, the diet must be optimized. Maintaining optimum nutrition is one of the crucial aspects of infancy, with a great focus being placed on the developmental foundations of health and disease, a theory that was pioneered by the Barker hypothesis. Intrauterine growth restriction (IUGR), which is accompanied by poor organogenesis and lower birth weight, can result from undernutrition during the fetal stage brought on by placental, maternal, or fetal circumstances. While postnatal growth limitation in the neonatal and post-neonatal period is mostly an acquired condition due to poor food intake, fetal nutrition is typically not impaired until an excessive degree of maternal malnutrition occurs.

Furthermore, the demand for dried baby food has considerably increased over the years due to rise in awareness about the benefit of balanced nutrition for baby. Longer shelf life of dried baby food products fosters the market to some extent. Change in socio-economic factors and improvement in living standard due to considerable increase in disposable income have led to the growth of infant nutrition market. Increase in population of women professionals, short maternity leave period, and time-constraints for home food preparation have further increased the adoption of baby food products, which has helped increase the infant nutrition market size.

Dietary practices regarding baby food have evolved over the years. In addition, there is increase in awareness among consumers about the importance of adequate nutrition for healthy growth of infants. Owing to this, numerous brands have upgraded the nutritional components in their baby food products by adding functional & organic ingredients, which further fuels the infant nutrition market growth.

Over time, dietary guidelines for feeding infants have changed. Moreover, customers are becoming more aware of the significance of proper nutrition for an infant's healthy development. As a result, many companies have improved the nutritional value of their infant food products by incorporating organic and useful ingredients. In addition, the government launched programmes to raise awareness about baby care. Moreover, a rise in internet advertising for baby food-related products contributes to the market's expansion.

Over the past few years, the global per capita income has grown rapidly, especially in emerging economies. In many developing and developed markets, increase in urbanization, rising middle class consumption, and rise in rates of female labor force participation promoted the adoption of convenience-oriented lifestyles, increase in consumer demand for infant nutrition products such as baby formula and prepared baby food. Moreover, per capita income in emerging countries will rise significantly during the next ten years, as a result of which, the market will likely rise in the forecast year.

Up until the age of six months, mother's milk is the finest source of nutrients for newborns. Women make up 39% of the global labor force, according to figures from the International Labour Organisation (ILO). In addition, many working women begin their careers soon after giving birth. As a result, prepared baby foods and formulas present an alluring alternative for working mothers, satisfying their demand for wholesome food for their newborns and supporting the market for infant nutrition.

Major market companies are able to survive in the customer-focused market owing to consistent innovation in product functionality and performance as well as coherent tactics such customized packaging that reflect the nutritious elements of the infant food items. Moreover, appealing and practical packaging is a top priority for top manufacturers. Infant food items should be packaged in tamper-proof containers to ensure the highest level of food safety. In addition, social and environmental issues are now expected on a global scale; as a result, businesses must embrace green standards for product design, packaging, and other value chain components, which can help increase the infant nutrition market share of such companies.

However, for the first six months after birth, breastfeeding is a requirement for babies as it provides virtually all of the nutrients needed for their overall growth. The collective efforts of various organizations, including the WHO, the Canadian Public Health Agency, and the UNICEF have raised women's awareness of breastfeeding and its advantages. These non-profit organizations’ initiatives, thereby promoting breastfeeding among lactating women, may restrain the infant nutrition market demand.

As part of their ongoing endeavor to quantify the nutritional and functional qualities of human milk in newborn products, players in infant formula have evaluated a variety of substances. As a result, there has been a gradual increase in the number of infant formulae that are supplemented with prebiotics and probiotics. Commercial infant formulae are now supplemented with prebiotics and probiotics that have been designated as GRAS (generally recognized as safe) by the FDA. Manufacturers may see this as a chance to increase sales of their goods.

Organic products have been gaining steady share in the retail market. Moreover, organic infant nutrition is one of the fastest growing segments in the food industry. Change in purchasing behavior pattern among the consumers creates huge opportunities for the organic baby food sector. In addition, the preference for organic and clean-labelled products increased significantly, due to increase in health consciousness among consumers. However, stringent quality checks and strict mandates by the government and food departments have posed major restraints for the infant nutrition market.

Segmental Overview

The Infant nutrition market is segmented on the basis of product type, form, distribution channel, and region. Depending on product type, it is categorized into follow-on milk, specialty baby milk, infant milk, prepared baby food, and dried baby food. According to form, it is bifurcated into solid baby food and liquid baby food. As per distribution channel, it is divided into e-commerce and offline channels. Moreover, the market is further classified into third-level segmentation through the distribution channel. Depending on offline channel, it is fragmented into hypermarkets/supermarkets, convenience stores, pharmacy, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Switzerland, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, UAE, and rest of LAMEA).

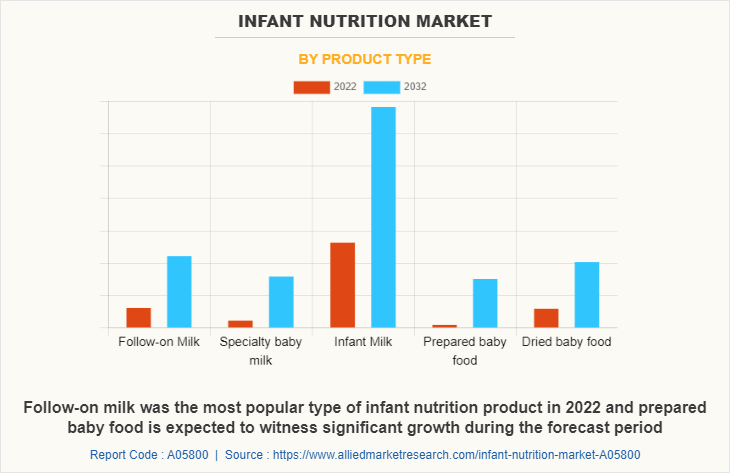

By Product Type

Depending on product type, the infant milk segment dominated the market in 2022, garnering around two-fifths of the market share; moreover, the prepared baby food segment is expected to grow at the highest CAGR of 8.6% from 2023 to 2032. In addition, newborn milk segment is introduced in gas-tight composites, which keeps the product fresh and extends its shelf life, contributing to the expansion of the newborn feeding business. In addition, as infant milk is intended to replace human breast milk (HBM), extra consideration is paid to the fat analogues in infant milk to imitate HMF analogues. The current trend in the newborn nutrition market is to create fat analogues by integrating palmitic acid in fatty acids through a lipase-catalyzed reaction to increase infant milk digestion and fat and mineral absorption, which can bring positive growth opportunities for the infant nutrition market forecast.

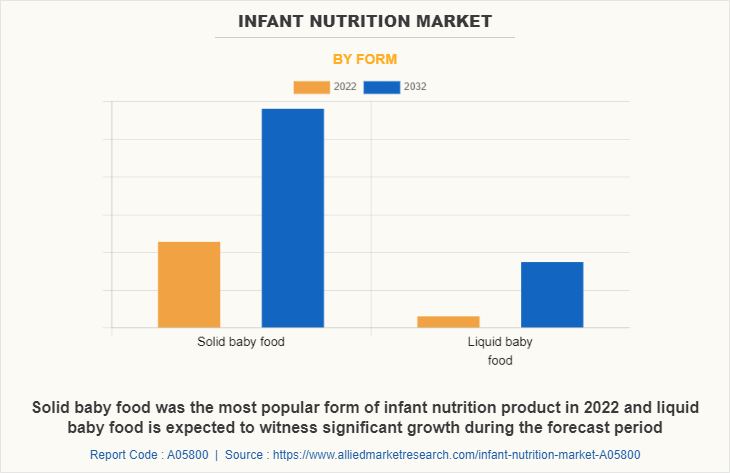

By Form

By form, the solid baby food segment dominated the market in 2022, garnering around three-fourth of the market share. Moreover, the liquid baby food segment is expected to grow at the highest CAGR of 8.0% from 2023 to 2032. In addition, major market players are able to survive in the consumer-centric market, which is the current trend in solid baby food, owing to continuous innovation in product functionality and performance along with coherent strategies such as tailored packaging that reflect the healthy ingredients of the products. Due to the fact that many working women begin their careers soon after giving birth, solid baby food is an appealing alternative for working mothers, satisfying their need for wholesome, nutritional meals for their babies, and contributing to the expansion of the infant nutrition market.

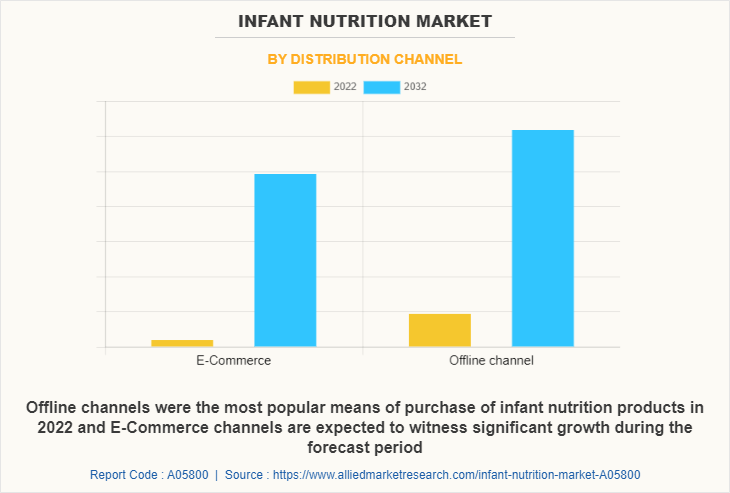

By Distribution Channel

According to distribution channel, the offline channel segment dominated the market in 2022, garnering majority of the market share. Moreover, the e-commerce segment is expected to grow at the highest CAGR of 7.9% from 2023 to 2032. In addition, the offline channel provides a vast collection of product portfolios from many domains in the market; thus, making it simply accessible for the clients. It is an organized store having both domestic as well as global presence that has a vast selection of infant nutrition. These kinds of stores provide customers with access to niche products that are available on the market. As a result, the development of offline channels in numerous locations opens up lucrative prospects for the expansion of the Infant nutrition market. Through these channels, manufacturers provide special discounts and encourage hypermarket & supermarket chains to sell their own goods, which significantly increases the sale of infant nutrition products.

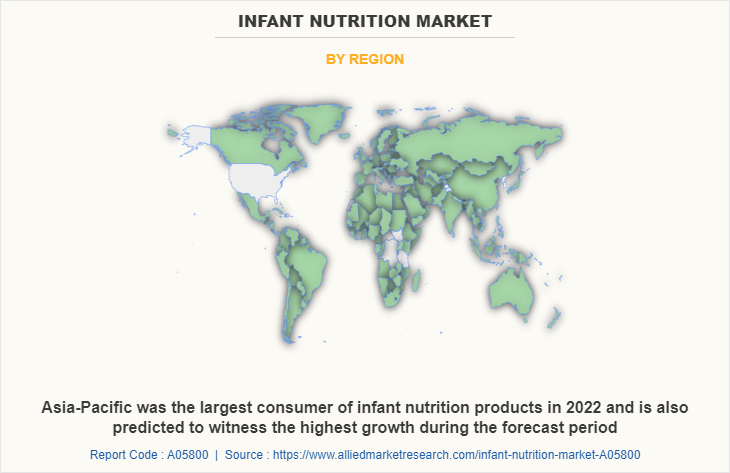

By Region

Region wise, Asia-Pacific dominated the market in 2022, garnering a market share of 44.1%. The demand for infant nourishment products in Asia-Pacific has been greatly boosted by rise in purchasing power of the region's people. Moreover, the government has launched programs to raise awareness about baby care. In addition, the expansion of the infant nutrition industry would be further aided by increase in internet advertising for health & nutritional newborn food. Further, companies established in this region are concentrating on launching cutting-edge items depending on local demand.

Competitive Analysis

The key players operating in the infant nutrition industry include Abbott, Arla Foods Amba, Campbell Soups, Dana Dairy Group Ltd., Danone, Nestle S.A., Reckitt Benckise (Mead Johnson & Company LLC), Perrigo Company Plc, Heinz Baby, and Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF).

Some Examples of Product Launch in the Global Infant Nutrition Market

In July 2022, Danone S.A., launched the new dairy & plants blend baby formula to meet the consumers demands for feeding options that are suitable for vegetarian, flexitarian and plant-based diets, and furthers meet their baby’s specific nutritional requirements.

In November 2021, Abbott Laboratories launched the Similac 360 Total Care, which is infant formula with a blend of five different human milk oligosaccharides. This new formula provides nutrition to support the whole baby’s health and development, including the developing immune system, digestive system and brain.

In November 2020, Abbott Laboratories launched the Similac Pro-Advance with 2'-Fucosyllactose Oligosaccharide, which is its first infant formula in Canada.

Some Instances of Expansion in the Global Infant Nutrition Market

In February 2022, Arla Foods amba announced to introduce its milk fractionation technology namely, ORIGIN for infant formula manufacturers.

In August 2022, Abbott Laboratories announced to restart its Similac infant formula production at its Sturgis manufacturing plant in Michigan in order to overcome the nationwide infant formula shortage.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the infant nutrition market analysis from 2022 to 2032 to identify the prevailing infant nutrition market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the infant nutrition market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global infant nutrition market trends, key players, market segments, application areas, and market growth strategies.

Infant Nutrition Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 95.5 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 262 |

| By Distribution Channel |

|

| By Product Type |

|

| By Form |

|

| By Region |

|

| Key Market Players | Reckitt Benckiser Group PLC, The Kraft Heinz Company, Perrigo Company plc, DANA DAIRY GROUP LTD., Gujarat Cooperative Milk Marketing Federation Ltd., Nestle S.A., Arla Foods amba, Abbott Laboratories, Sun-Maid Growers of California, Inc., Danone S.A. |

Analyst Review

Numerous companies under different brands in the market offer infant foods. R&D activities and innovations for improving the flavors & ingredients of infant nutrition food has helped these companies to increase their overall sale of infant food products in the market. Busy lifestyle of individuals influenced them to use prepared baby food and infant formula. People in the rural and semi-urban areas have steadily started using packaged infant foods, owing to increase visibility due to the proliferation of media & other communication channels. Evolution of online sale of infant food products further increased the overall revenue for the industry.

The growth of infant food is highly dependent on the awareness among the consumers to provide complete nutrition to their child. Demand for infant foods is higher in the emerging countries, as they are equally growing in terms of disposable income and population. Acquisition and product launch is the key to sustain in the ever-growing infant nutrition market.

One of the primary drivers for the increase in demand for infant nutrition is rise in demand for nutritional food across the globe. Many new players are expected to enter the market during the forecast period, attracted by profitable growth and high-profit margins. Consequently, the demand for infant nutrition has seen a multifold increase in the past four years, especially in the developed countries of North America and Europe such as the U.S., Canada, the UK, and Germany.

The global infant nutrition market was valued at $45.5 billion in 2022, and is projected to reach $95.5 billion by 2032

The global Infant Nutrition market is projected to grow at a compound annual growth rate of 7.7% from 2023 to 2032 $95.5 billion by 2032

The key players operating in the infant nutrition industry include Abbott, Arla Foods Amba, Campbell Soups, Dana Dairy Group Ltd., Danone, Nestle S.A., Reckitt Benckise (Mead Johnson & Company LLC), Perrigo Company Plc, Heinz Baby, and Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF).

Region wise, Asia-Pacific dominated the market in 2022

Loading Table Of Content...

Loading Research Methodology...