Infectious Disease Diagnostic Market Research, 2030

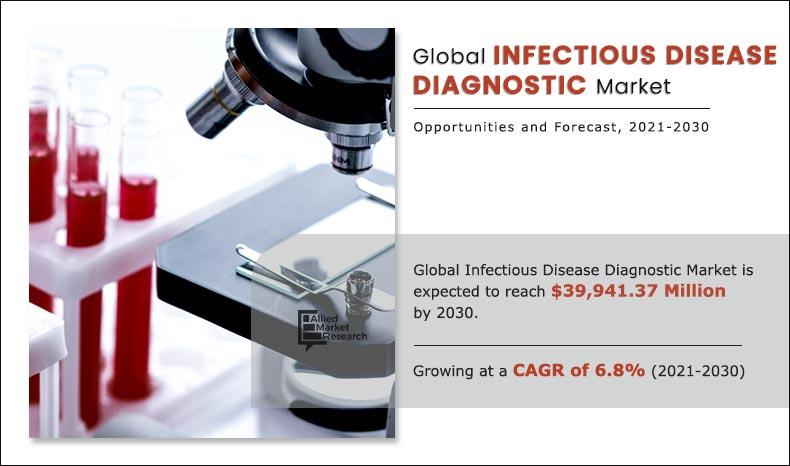

The global infectious disease diagnostic market was valued at $23,321.99 million in 2020, and is estimated to reach $39,941.37 million by 2030, growing at a CAGR of 6.8% from 2021 to 2030. Infectious disease diagnosis is defined as a laboratory test, which is executed with the help of skilled technicians and physicians to diagnose infectious diseases. It is a diagnostic procedure in which the causative organism of an infectious disease is characterized and identified. The sample of urine, blood, mucus, or other body fluids are analyzed to provide information about the causative organism by the use of various diagnosis procedure and instruments.

Growth of the global infectious disease diagnostic market is majorly driven by increase in prevalence of infectious disease such as hepatitis, influenza, COVID-19, & human immuno deficiency virus (HIV); rise in demand for point-of-care diagnostic test; increase in funding from private & government organizations for diagnostic service centers; and advancements in technologies in the field of infectious disease diagnostics. According to the Centers for Disease Control and Prevention (CDC), in 2018, it was reported that approximately 1.7 million infections and 99,000 associated deaths occur every year in American hospitals. Furthermore, surge in demand for point-of-care testing is anticipated to fuel the growth of the infection disease diagnostic market.

For instance, in March 2020, Abbott, a global healthcare company, announced the launch of Abbott ID NOW COVID-19 test, which is a molecular point-of-care test used to detect COVID-19 in as little as 5 minutes. In addition, rise in geriatric population fuels the market growth, owing to the fact that aged individuals are more susceptible to infectious diseases. According to the U.S. Food and Drug Administration (FDA), in 2020, it was reported that around 300,000 individuals aged 50 and above are diagnosed with pneumococcal pneumonia, every year. In May 2021, Neuberg Diagnostic, a leading company that offers best-in-class laboratories, launched the clinical laboratory's operation in the U.S. to offer genomic and molecular testing on new generation sequencing technology.

In addition, increase in number of medical laboratories, for infectious disease diagnostic testing, anticipate the growth of the market. The Government of India, in 2020, announced the launch of three state-of-the-art high throughput Indian Council of Medical Research labs in Kolkata, Mumbai, and Noida, in order to increase the number of COVID-19 testing capacity. Apart from COVID-19 tests, these labs are also used for other diagnosis test for infectious diseases such as HIV, hepatitis, tuberculosis and dengue. Furthermore, rise in awareness among individuals for early diagnosis and management of infectious disease, increase in number of information technology system to develop advanced diagnostic devices is expected to provide remunerative opportunities for the expansion of the global infectious disease diagnostic market during the forecast period.

Thus, technological advancements in diagnostic instrument and rise in awareness regarding early diagnosis propel the growth of the market. However, high cost associated with diagnostic instruments and lack of skilled technicians is expected to restrict the market growth during the forecast period.

Infectious Disease Diagnostic Market Segmentation

The global infectious disease diagnostic market is segmented into product, disease type, technology, and region. By product, the market is categorized into assays & reagents, instruments, and software. On the basis of disease type, it is divided into hepatitis, human immunodeficiency virus, influenza, and others. Depending on technology, it is categorized into immunodiagnostics, clinical microbiology, polymerase chain reaction, and next-generation sequencing, and others. Region-wise, the infectious disease diagnostic market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product

Depending on product, the assays & reagents segment dominated the market in 2020, and this trend is expected to continue during the forecast period, owing to increase in R&D activities in the pharmaceutical & biotechnology industry, rise in demand for reagents, and surge in adoption of point-of-care testing. However, the instruments segment is expected to witness considerable growth during the forecast period, owing to surge in number of research laboratories and increase in funds by government & private organizations for development of diagnostic instruments in the pharmaceutical & biotechnology industry.

By Product

Assays and Reagents segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By Disease Type

By disease type, the others segment was the major contributor in 2020, and is expected to maintain its lead during the forecast period, owing to increase in prevalence of healthcare associated infection, rise in the number of surgical procedures and increasing demand for early diagnostic. However, the hepatitis segment is expected to witness considerable growth during the forecast period, due to increase in prevalence of hepatitis, rise in demand for early diagnosis, and development of advanced diagnostic laboratory in the hospital and clinics.

By Disease Type

Others segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By Technology

On the basis of technology, the others segment dominated the market in 2020, and this trend is expected to continue during the forecast period, owing to large number key players offering advanced diagnostic medical devices, increase in demand for DNA analysis, development of novel & innovative PCR tools, and advancement in R&D activities for infectious disease diagnosis. However, the immunodiagnostic segment is expected to witness considerable growth during the forecast period, owing to increase in number of genomic projects, surge in awareness about DNA sequencing, and advancements in R&D for DNA analysis activities.

By Technology

Others segment is projected as one of the most lucrative segment.

By Region

North America garnered the major share in the infectious disease diagnostic market in 2020, and is expected to continue to dominate during the forecast period, owing to rise in prevalence of infectious disease, presence of key players, development of the healthcare sector, presence of national clinical laboratories, and advancement in technology for diagnostic instruments in the region. However, Asia-Pacific is expected to register the highest CAGR of 8.5% from 2021 to 2030, owing to increase in prevalence of infectious diseases, rise in demand for early diagnosis, development of healthcare infrastructure, and technological advancement in diagnostic testing.

Competition Analysis

The key players operating in the global infectious disease diagnostic market include Abbott Laboratories, Becton Dickinson and Company, BioMerieus SA, Bio-Rad Laboratories, Danaher Corporation, F Hoffman-La Roche, Hologic Inc., Luminex Corporation, Qiagen Inc., and Thermo Fisher Scientific Inc.

By Region

North America was holding a dominant position in 2020 and would continue to maintain the lead over the analysis period.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the infectious disease diagnostic market, and the current trends & future estimations to elucidate imminent investment pockets.

- It presents a quantitative analysis of the infectious disease diagnostic market from 2021 to 2030 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the infectious disease diagnostic market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the infectious disease diagnostic market.

Key Market Segments

By Product

- Assays & Reagents

- Hepatitis

- Human Immunodeficiency Virus

- Influenza

- Others

- Instruments

- Hepatitis

- Human Immunodeficiency Virus

- Influenza

- Others

- Software

- Hepatitis

- Human Immunodeficiency Virus

- Influenza

- Others

By Disease Type

- Hepatitis

- Human Immunodeficiency Virus

- Influenza

- Others

By Technology

- Immunodiagnostics

- Clinical Microbiology

- Polymerase Chain Reaction

- Next Generation Sequencing

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Key Market Players

- Abbott Laboratories

- Becton Dickinson and Company

- bioMerieus SA

- Bio-Rad Laboratories

- Danaher Corporation

- F Hoffman-La Roche

- Hologic Inc.

- Luminex Corporation

- Qiagen Inc.

- Thermo Fisher Scientific Inc.

Infectious Disease Diagnostic Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By DISEASE TYPE |

|

| By TECHNOLOGY |

|

| By Region |

|

| Key Market Players | Bio-Rad Laboratories, Qiagen Inc., Biomerieux SA, Becton Dickinson and Company, Abbott Laboratories, F Hoffmon La-Roche, Hologic Inc., .Luminex Corporation, ThermoFisher Scientific, Danaher Corporation |

Analyst Review

Growth of the infectious disease diagnostic market is attributed to factors such as technological advancements in the healthcare sector; rise in prevalence of infectious diseases such as hepatitis, pneumonia, influenza, HIV, & COVID-19; increase in funds from private and government organizations for development of various diagnostic service centers; and rise in awareness about early diagnosis. The infectious disease diagnostic market gains interest of pharmaceutical and biotechnology companies, owing to surge in demand for point-of-care diagnostic testing. This leads to increase in adoption of diagnostic testing for detection of infectious diseases. Moreover, infectious disease diagnostics technology, such as immunodiagnostic testing, polymerase chain reaction, DNA microarray, and DNA sequencing, have gained high traction in the market in recent years, as infectious disease diagnostic tools are used in diagnosis of infectious diseases.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in prevalence of infectious diseases, increase in number of diagnostic tests, and technological advancement of diagnostic instruments in the region.

Asia-Pacific was the second largest contributor to the market in 2020, and is expected to register the fastest CAGR during the forecast period, owing to increase in prevalence of infectious diseases, rise in government initiative for development of advanced diagnostic service, surge in demand for RT-PCR test, and increase in awareness among people for early diagnostic testing.

However, lack of skilled laboratory technicians and high cost associated with diagnostic testing are anticipated to restrain the market growth during the forecast period.

The total market value of infectious disease diagnostic market is $23,321.99 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of infectious disease diagnostic Market in 2021 was $22,181.54 million

The base year for the report is 2020.

Yes, infectious disease diagnostic companies are profiled in the report

The top companies that hold the market share in infectious disease diagnostic are Abbott Laboratories, Becton Dickinson and Company, BioMerieus SA, Bio-Rad Laboratories, Danaher Corporation, F Hoffman-La Roche, Hologic Inc., Luminex Corporation, Qiagen Inc. and Thermo Fisher Scientific Inc

No, there is no value chain analysis provided in the infectious disease diagnostic Market report

The key trends in the infectious disease diagnostic market are growth in increase in prevalence of infectious disease such as hepatitis, influenza, COVID-19, and HIV; rise in demand for point-of-care diagnostic test; increase in funding from private & government organizations for the diagnostic service center; and advancement in technology for infectious disease diagnostic.

Loading Table Of Content...