Infertility Treatment Market Research, 2033

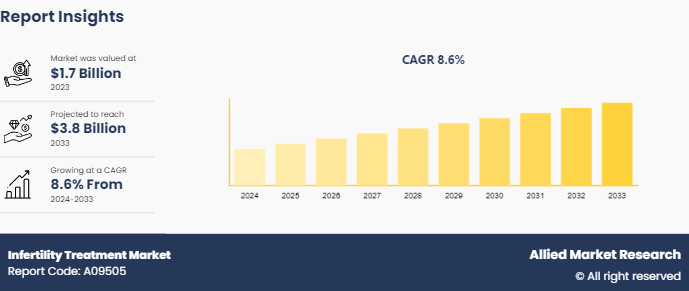

The global infertility treatment market size was valued at $1.7 billion in 2023 and is projected to reach $3.8 billion by 2033, growing at a CAGR of 8.6% from 2024 to 2033. Changing demographics, including delayed childbearing driven by increased access to education and career opportunities for women, contribute to age-related fertility decline and infertility prevalence.

Market Introduction and Overview

Infertility treatment industry encompasses a spectrum of interventions aimed at addressing the underlying causes of infertility and assisting couples in achieving conception. Defined as the inability to conceive after a year of regular, unprotected intercourse, infertility can be attributed to various factors, including ovulation disorders, tubal issues, endometriosis, and male factor infertility. The treatment approach depends on the specific cause identified through diagnostic tests and the available options within the local integrated care board (ICB) . Generally, infertility treatments fall into three main categories namely medicinal therapies, surgical procedures, and assisted conception techniques. Medicinal interventions involve the use of fertility drugs to regulate or stimulate ovulation, such as clomifene, gonadotrophins, metformin, and letrozole. Surgical procedures may be employed to address structural abnormalities, such as repairing fallopian tubes or treating conditions like endometriosis. Assisted conception techniques, including intrauterine insemination (IUI) and in vitro fertilization (IVF) , offer advanced methods to facilitate conception when natural methods are unsuccessful. The choice of treatment modality is tailored to individual needs, considering factors like age, duration of infertility, and personal preferences. Treatment decisions entail significant physical, emotional, and financial considerations, highlighting the multifaceted nature of addressing infertility.

Key Takeaways

- The infertility treatment market size covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major infertility treatment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The infertility treatment market share, particularly in vitro fertilization (IVF) , is on the rise due to several societal and demographic factors. Policies aimed at reversing declining fertility rates, such as insurance coverage for fertility treatments and subsidies for child-rearing, are gaining traction, which is driving the infertility treatment demand. However, ethical considerations and the need for rigorous evaluation of emerging technologies are paramount to ensure safety, efficacy, and public trust in reproductive medicine. In addition, disparities in access to reproductive healthcare services can prevent individuals from seeking timely diagnosis and treatment. Moreover, the acceptance of non-traditional families and advancements in third-party IVF are anticipated to generate excellent opportunities in the market. As IVF becomes more affordable and accessible, driven by technological innovations like automation and microfluidics in the IVF laboratory, demand is expected to continue to increase.

Analysis of the Infertility Treatment Market Opportunity

Infertility, affecting millions globally, poses profound challenges to individuals, families, and communities. Rooted in male and female reproductive system dysfunctions, it is often attributed to tubal, uterine, ovarian, and endocrine disorders. Despite its prevalence, fertility care remains inadequately addressed, especially in low and middle-income countries. Fertility World, a fertility clinic, offers a comprehensive approach to in-vitro fertilization (IVF) , prioritizing patient-centric care and transparency in success rates. With a focus on legal compliance and ethical standards, Fertility World boasts an array of certified assisted reproduction technologies, ensuring a conducive environment for hopeful parents. For those seeking IVF with high success rates in Canada, Fertility World offers a reliable platform for navigating the complexities of fertility treatment with confidence and assurance. These factors are anticipated to drive the infertility treatment market share in the coming years.

Fertility World General IVF Success Rates Table 2021:

IVF Success Rate | Percentage |

IVF With Donor Eggs | 80 to 99%% |

IVF With Self Eggs | 70% |

IVF With Donor Sperms | 70% |

IVF With Self Sperms | 75% |

IVF With ICSI | 85% |

IVF With FET | 60% |

IVF with PESA | 55% |

IVF with PGD | 43% |

Market Segmentation

The infertility treatment market is segmented into procedure, patient type, end user, and region. On the basis of procedure, the market is divided into assisted reproductive technology, artificial insemination, fertility surgeries, and other procedures. On the basis of patient type, the market is classified into female infertility treatment and male infertility treatment. On the basis of end user, the market is divided into fertility centers, hospitals & surgical clinics, cryobanks, and research institutes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

In the U.S., infertility remains a prevalent issue, with approximately 19% of heterosexual women aged 15 to 49 who have never given birth experiencing infertility, according to the Centers for Disease Control and Prevention (CDC) as of 2021.

Moreover, when examining infertility statistics by sex, it is evident that both men and women are affected nearly equally. About 10% of women aged 15 to 44 in the U.S. struggle with infertility, with approximately one-third of cases attributed to male factors, one-third to female factors, and one-third to a combination of both partners' issues. African American women aged 33 to 44 were reported to be twice as likely to face infertility as Caucasian women in the U.S.

In 2021, approximately 86, 146 infants were born using ART, representing 2.3% of all infants born in the U.S. IVF, which accounts for over 99% of assisted reproductive technology (ART) procedures performed, enables individuals to create embryos from combined eggs and sperm, with subsequent embryo transfer into the uterus or freezing for future use. The increasing reliance on ART reflects its effectiveness in addressing infertility challenges. These factors are anticipated to have positive impact on infertility treatment market forecast.

Competitive Landscape

The major players driving the infertility treatment market growth include Thermo Fisher Scientific, Baker Company INC., Vitrolife, Cook Group, Genea Biomedx Ltd., Esco Micro Pte Ltd., Hamilton Thorne Ltd., FUJIFILM Irvine Scientific, IVFtech APS, and others.

Recent Key Strategies and Developments

- In May 2024, a potential male birth control injection, targeting the STK33 protein to render sperm immobile, has shown promise in mice. Injected twice daily for 21 days, male mice were temporarily infertile, with only one out of 13 mice impregnating a female after treatment. Infertility reversed three weeks after cessation of treatment, with no recorded side effects. Researchers aim to test an oral version in primates. While effective, experts suggest other approaches, like the NES/T gel containing synthetic hormones, may offer faster results in humans.

- On May 17, 2024, a recent study conducted by Rutgers Health experts revealed that infertility treatment patients face an increased risk of post-delivery hospitalization for heart disease compared to spontaneously conceived patients. Analyzing over 31 million hospital records, researchers found that infertility patients were twice as likely to be hospitalized for heart disease and hypertension in the year following delivery. The study emphasizes the importance of early postpartum checkups, particularly for patients who undergo infertility treatment to conceive.

- On February 16, 2024, Lupin Limited launched Ganirelix Acetate Injection, 250 mcg/0.5 mL, single-dose prefilled syringe in the U.S. Approved by the FDA, it is a generic equivalent to Organon USA LLC's Ganirelix Acetate Injection. The treatment aims to inhibit premature LH surges in women undergoing controlled ovarian hyperstimulation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the infertility treatment market analysis from 2023 to 2033 to identify the prevailing infertility treatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the infertility treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart form the above mentioned points, the report includes the analysis of the regional as well as global infertility treatment market trends, key players, market segments, application areas, and market growth strategies.

Industry Trends

- On May 27, 2024, CHA Medical Group inaugurated the Korea’s premier global infertility training center, aiming to enhance skills of infertility researchers and improve success rates in treatments. The state-of-the-art facility at CHA Bio Complex, Pangyo, offers theoretical and practical sessions, including cutting-edge techniques like intracytoplasmic sperm injection and embryo biopsy. Led by experienced PhD-level researchers, the program targets both domestic and international professionals.

- On May 21, 2024, a groundbreaking study published in Nature by researchers at Kyoto University's Institute for the Advanced Study of Human Biology unveils significant progress in human in vitro gametogenesis (IVG) . Led by Dr. Mitinori Saitou, the study identifies key culture conditions necessary for epigenetic reprogramming and differentiation of human primordial germ cells into precursors of mature gametes. This advancement holds promise for treating all forms of infertility, transcending existing limitations in assisted reproductive technologies.

- On May 16, 2024, a study conducted by Rutgers health experts in New Jersey revealed a concerning trend in patients undergoing infertility treatment face double the risk of hospitalization due to heart disease after delivery compared to those who conceive naturally. Analyzing over 31 million hospital records, the study highlights the importance of postpartum checkups, particularly for older patients and those who experience severe high blood pressure.

Key Sources Referred

- Integra LifeSciences

- World Health Organization (WHO)

- National Institutes of Health (NIH)

- Cleveland Clinic

- WebMD LLC.

- U.S. Department of Health & Human Services

- Society of Reproductive Surgeons (SRS)

Infertility Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.8 Billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Patient Type |

|

| By End User |

|

| By Region |

|

| By Procedure |

|

| Key Market Players | IVFtech ApS, vitrolife, Esco Micro Pte Ltd., FUJIFILM Irvine Scientific, Genea Biomedx Ltd., Cook Group, Hamilton Thorne Ltd., Baker Company INC, Thermo Fisher Scientific Inc. |

Analyst Review

The emerging trends in infertility treatment market include genetic screening of embryos, non-invasive fertility diagnostics, and personalized medicine approaches.

North America is the largest regional market for infertility treatment.

The global infertility treatment market is estimated to reach $3.8 billion by 2033.

The top companies to hold the market share in infertility treatment are Thermo Fisher Scientific, Baker Company INC., Vitrolife, Cook Group, Genea Biomedx Ltd., Esco Micro Pte Ltd., Hamilton Thorne Ltd., FUJIFILM Irvine Scientific, and IVFtech APS.

Loading Table Of Content...