Information Technology (IT) Security as a Service Market Insights, 2032

The global information technology (IT) security as a service market was valued at $15.3 billion in 2022, and is projected to reach $49.7 billion by 2032, growing at a CAGR of 12.8% from 2023 to 2032.

The IT security as a service market is expected to witness notable growth owing to growing incidence of data breaches, high costs associated with on-premise solutions, and increased adoption from SME's. Moreover, growing trend of BYOD in enterprises is expected to provide lucrative opportunity for the growth of the market during the forecast period. On the contrary, vulnerability of cloud-based applications to cybercrimes limits the growth of the IT security as a service market.

Information technology (IT) is the use of any computers, storage, networking, and other physical devices, infrastructure, and processes to create, process, store, secure and exchange all forms of electronic data. Typically, IT is used in the context of business operations, as opposed to technology used for personal or entertainment purposes. The commercial use of IT encompasses both computer technology and telecommunications. Information Security is not only about securing information from unauthorized access.

Information Security is the practice of preventing unauthorized access, use, disclosure, disruption, modification, inspection, recording or destruction of information. Information can be a physical or electronic one. Information can be anything such as Your details or we can say your profile on social media, your data on mobile phone, your biometrics etc. Thus, Information Security spans so many research areas such as such as cryptography, mobile computing, cyber forensics, and online social media.

Key Findings

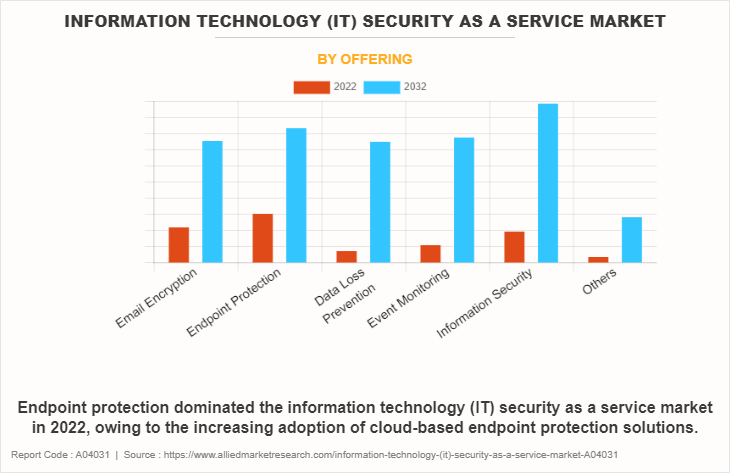

- By offering, the endpoint protection segment held the largest share in the information technology (IT) security as a service market in 2022.

- By end user, the energy and utilities segment is expected to show the fastest market growth during the information technology (IT) security as a service market forecast period.

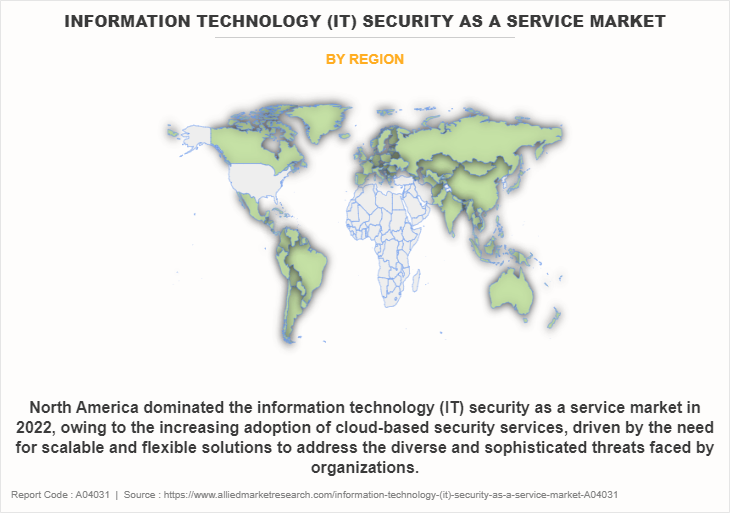

- Region-wise, North America held the largest market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Top Impacting Factors

Growing incidence of data breaches

The escalating frequency and severity of data breaches have catalyzed a transformative shift in how organizations approach their cybersecurity strategies, particularly fueling the surge in demand for IT security as a service. The traditional reactive measures are proving inadequate in the face of increasingly sophisticated cyber threats that exploit vulnerabilities in both technology and human factors. High-profile incidents of data breaches have not only led to financial losses but have also eroded the trust of consumers and partners. As a response, businesses are recognizing the limitations of in-house security solutions and are turning to security-as-a-service models that offer continuous monitoring, threat intelligence, and adaptive defenses.

Cloud-based security services, characterized by their scalability and accessibility, have gained prominence as they provide a dynamic defense against evolving threats. These services leverage advanced technologies such as machine learning and artificial intelligence to detect anomalies, recognize patterns indicative of potential breaches, and respond in real-time. This proactive approach is crucial in an environment where the attack surface is expanding due to the proliferation of remote work, mobile devices, and interconnected systems.

Moreover, the regulatory landscape surrounding data protection and privacy is becoming more stringent globally. Instances such as the implementation of GDPR in Europe have inspired similar legislative efforts elsewhere, emphasizing the need for organizations to comply with comprehensive data protection standards. This regulatory environment further amplifies the imperative for robust IT security measures, encouraging the adoption of security-as-a-service solutions that inherently address compliance requirements.

High costs associated with on- premise solutions

The rising costs associated with on-premise security solutions are compelling organizations to reconsider their cybersecurity strategies and opt for more cost-effective IT security as a service. On-premise solutions traditionally require substantial investments in hardware, software licenses, and skilled personnel for deployment and ongoing maintenance. As cybersecurity threats become more sophisticated and dynamic, the need for regular updates and enhancements to on-premise systems put a continuous financial strain on organizations.

The flexibility and scalability inherent in security-as-a-service models provide a viable solution to these challenges. Cloud-based security services eliminate the need for significant upfront capital investments, offering a subscription-based pricing structure that aligns more closely with operational expenses. This pay-as-you-go model allows organizations to scale their security infrastructure according to their needs, avoiding the financial burden of overprovisioning for potential future threats.

In addition, the outsourcing of security functions to specialized service providers in the cloud allows organizations to leverage the provider's expertise and infrastructure, reducing the need for in-house security personnel and further streamlining costs. The pursuit of cost-effectiveness is driving a strategic shift toward IT security as a service, enabling organizations to enhance their security posture while maintaining financial prudence in an increasingly challenging cybersecurity landscape.

Segment Overview

The information technology (IT) security as a service market is segmented on the basis of type, end user, and region. On the basis of type, the market is categorized into email encryption, endpoint protection, data loss prevention, event monitoring, information security, and others. On the basis of end user, the market is segregated into BFSI, healthcare, telecom, media and entertainment, education, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

The report focuses on growth prospects, restraints, and analysis of the global information technology security as a service market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global IT security as a service market analysis.

On the basis of offering, the endpoint protection segment dominated the information technology security as a service market size in 2022, owing to the increasing adoption of cloud-based endpoint protection solutions. Organizations are leveraging the scalability, flexibility, and ease of management offered by cloud services to enhance their security postures. This shift allows for real-time updates, threat intelligence sharing, and improved response times.

However, the data loss prevention segment is expected to witness the fastest growth, owing to the convergence of DLP with other security components, creating integrated solutions that provide comprehensive protection against a spectrum of cyber threats. As privacy regulations and compliance standards become more stringent, DLP solutions are evolving to offer robust compliance management features, assisting organizations in meeting regulatory requirements, and avoiding potential legal repercussions.

Region-wise North America dominated the information technology security as a service market share in 2022, owing to the increasing adoption of cloud-based security services, driven by the need for scalable and flexible solutions to address the diverse and sophisticated threats faced by organizations. The move toward Zero Trust Architecture, emphasizing continuous verification and strict access controls, is gaining traction as a proactive approach to enhance data protection.

However, Asia-Pacific is expected to witness the fastest growth in the upcoming year, owing to the heightened adoption of cloud-based security services, driven by the region's robust digital transformation initiatives and the need for scalable, cost-effective solutions. As organizations embrace remote work and mobile technologies, there is a growing emphasis on securing endpoints and ensuring robust identity and access management.

Competition Analysis

Competitive analysis and profiles of the major players in the information technology security as a service industry include Check Point Software Technologies Ltd., Cisco Systems, Inc., Barracuda Networks, Inc., Broadcom, Radware, Trend Micro Incorporated, Cloudflare, Inc., Fortinet, Inc., Quick Heal Technologies Ltd, and Hewlett Packard Enterprise Development LP. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the IT security as a service industry.

Recent Partnership in the Information Technology (IT) Security as a Service Market

In June 2023, Check Point® Software Technologies Ltd., a leading provider of cybersecurity solutions globally, has partnered with communications technology company, TELUS, to launch the TELUS Cloud Security Posture Management (CSPM) service in Canada. Backed by Check Point’s AI-powered threat prevention and high-fidelity posture management technology, TELUS CSPM provides a comprehensive managed solution for Canadian organizations to monitor cloud security posture in real-time and detect, remediate, and report on vulnerabilities.

Recent Acquisition in the Information Technology (IT) Security as a Service Market

In September 2023, Check Point Software Technologies Ltd., a global leader in cybersecurity solutions, acquired Atmosec, an innovative Software as a Service (SaaS) security vendor. This acquisition underscores Check Point’s commitment to bolster its SaaS security offerings and address the growing cybersecurity challenges faced by organizations in an increasingly SaaS-driven world.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IT security as a service market size from 2022 to 2032 to identify the prevailing IT security as a service market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the IT security as a service industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global information technology (it) security as a service market trends, key players, market segments, application areas, and market growth strategies.

Information Technology (IT) Security as a Service Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 324 |

| By Offering |

|

| By End User |

|

| By Region |

|

| Key Market Players | Cloudflare, Inc., Hewlett Packard Enterprise Development LP, Broadcom, Check Point Software Technologies Ltd., Quick Heal Technologies Ltd, Fortinet, Inc., Cisco Systems, Inc., Trend Micro Incorporated, Barracuda Networks, Inc., Radware |

Analyst Review

Information Technology (IT) security as a service has a critical role in today's dynamic cybersecurity landscape. Analysts often highlight the shift toward a more proactive and adaptive security posture, emphasizing that traditional, reactive approaches are no longer sufficient in the face of sophisticated cyber threats. Cloud-based security solutions receive praise for their ability to provide scalable and on-demand services, allowing organizations to match their security needs with the evolving nature of cyber risks.

Managed security services are frequently lauded for their outsourced expertise, enabling organizations to access specialized skills and technologies without the need for in-house maintenance. This is particularly beneficial for smaller businesses or those facing resource constraints. Analysts recognize that AI and machine learning technologies contribute significantly to the efficiency of IT security services by automating threat detection, response, and mitigation. This enhances the speed of identifying potential threats and reduces the workload on security teams.

Furthermore, analyst reviews often stress the importance of a holistic IT security strategy, encompassing various layers such as network security, endpoint protection, identity management, and data encryption. The emphasis is on adopting a multi-layered approach that integrates different security technologies to create a robust defense against diverse cyber threats. As cyber threats continue to evolve in complexity, analysts consistently underscore the need for organizations to view IT security as an ongoing, strategic investment rather than a one-time initiative. Continuous monitoring, regular updates, and staying abreast of emerging technologies are highlighted as key components of an effective IT security strategy. In summary, analyst reviews serve as valuable guides for businesses seeking to navigate the complex landscape of IT security, offering insights into emerging trends, best practices, and the efficacy of various security services.

The global information technology (IT) security as a service market generated $15,271.43 million in 2022, and is estimated to reach $49,730.42 million by 2032, witnessing a CAGR of 12.8% from 2023 to 2032.

The global information technology (IT) security as a service market is dominated by key players such as Check Point Software Technologies Ltd., Cisco Systems, Inc., Barracuda Networks, Inc., Broadcom, Radware, Trend Micro Incorporated, Cloudflare, Inc., Fortinet, Inc., Quick Heal Technologies Ltd, and Hewlett Packard Enterprise Development LP.

North America is the largest regional market for Information Technology (IT) Security as a Service

Growing trend of BYOD in enterprises is the leading application of Information Technology (IT) Security as a Service Market

Growing incidence of data breaches and high costs associated with on-premise solutions are the upcoming trends of Information Technology (IT) Security as a Service Market in the world

Loading Table Of Content...

Loading Research Methodology...