Inkjet Coder Market Research, 2032

The global inkjet coder market was valued at $2 billion in 2022, and is projected to reach $3.3 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032. Inkjet coders are devices used to apply various types of codes, marks, or information on products or packaging. These codes can include dates, batch numbers, barcodes, logos, graphics, or other variable data. Inkjet coders utilize inkjet printing technology, which involves the ejection of tiny droplets of ink onto a substrate to create the desired code or marking. There are different types of inkjet coding technologies, such as Continuous Inkjet (CIJ), Thermal Inkjet (TIJ), and Drop-on-Demand (DOD), each with its own unique characteristics and applications.

The food sector is expanding due to the growing population, especially in developing nations. Governments and regulatory bodies across various industries have imposed strict regulations regarding product labeling, traceability, and coding. This includes requirements for printing batch numbers, expiration dates, barcodes, and other variable data on products and packaging. Inkjet coders offer a versatile and efficient solution to comply with these regulations, driving their demand. Consumer awareness and demand for product safety and traceability have been on the rise. Inkjet coders help ensure accurate and visible coding, providing consumers with important information about the products they purchase, such as the origin, manufacturing date, and ingredients. This demand for transparency and traceability contributes to the growth of the inkjet coder industry.

Inkjet coders may face challenges with adhesion on certain substrates, particularly those with low surface energy or uneven surfaces. This can lead to issues such as smudging, fading, or incomplete codes. Additional surface preparation or specialized inks may be required to improve adhesion, which can add complexity and cost to the coding process. Product coder typically require specific inks formulated for their technology. This limits the compatibility of inks that can be used with a particular inkjet coding system. Switching between different ink types or colors may require purging and cleaning the printhead, resulting in downtime and additional maintenance.

With the rising trend of industrial automation, companies are adopting advanced coding and marking solutions to streamline their production processes. Inkjet Printer coders integrate well with automated production lines, offering high-speed printing and real-time coding capabilities. They help reduce manual errors, improve productivity, and enhance overall operational efficiency. Inkjet coders find applications across a wide range of industries, including food & beverage, pharmaceuticals, cosmetics, automotive, electronics, and others. The versatility of inkjet coders to print on various substrates, such as paper, plastic, metal, glass, and flexible packaging, makes them suitable for different product types and packaging materials. This broad application scope is projected to boost the demand for inkjet coder market opportunity in the upcoming years.

The inkjet coder market forecast players profiled in this report include ANSER CODING INC, Hitachi Industrial Equipment Systems Co., Ltd, Markem-Imaje S.A, Videojet Technologies Inc, Domino Printing Sciences Plc, Control Print Limited, Shanghai Rottweil Handyware Printing Technology Co., Ltd, Xaar Plc, MapleJet, and Linx Printing Technologies. Investment and agreement are common strategies followed by major market players. For instance, in July 2022, Control Print Limited, India's foremost integrated coding & marking solutions provider announced the acquisition of Markprint BV, a global supplier of high-speed printing and coding solutions. Control Print has bought 75% of Markprint B.V. for USD 1.64 million through its Dutch holding company ControlPrint B.V. as part of the transaction. Control Print has made a strategic acquisition in order to expand its technical skills and gain a foothold in the European market.

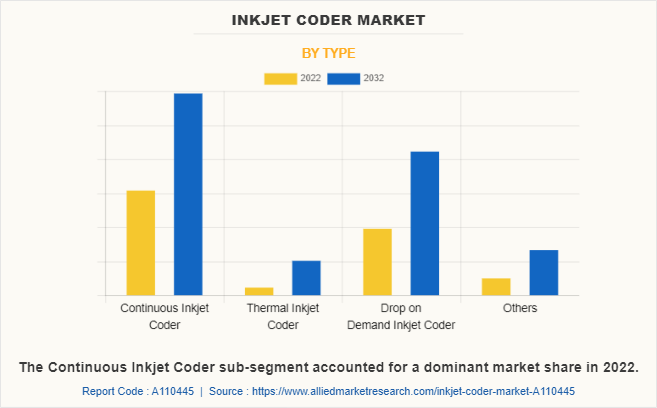

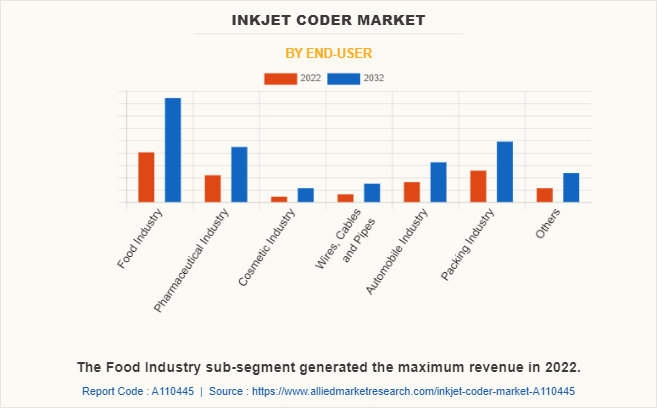

The inkjet coder market outlook is segmented on the basis of type, end user, and region. By type, the market is divided into continuous inkjet coder, drop on demand inkjet coder, thermal inkjet coder, and others. By end user, the market is classified into food industry, pharmaceutical industry, cosmetic industry, wires, cables, and pipes, automobile industry, packing industry, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The inkjet coder market is segmented into Type and End-user.

By type, the continuous inkjet coder sub-segment dominated the market in 2022. Continuous Inkjet (CIJ) technology has been in use for several decades and has a large market presence. Many sectors and manufacturers have well-established CIJ coding systems and operations. The familiarity and dependability of CIJ coders contribute to their continuous growth, as organizations frequently prefer to continue with tried-and-true technology. CIJ coders have evolved over the years with technological advancements. Manufacturers continuously invest in R&D to improve printing quality, reliability, ease of use, and maintenance of CIJ coding systems. Innovations such as advanced printhead designs, improved ink formulations, and enhanced software interfaces have further boosted the performance and capabilities of CIJ coders. These are predicted to be the major factors affecting the inkjet coder market size during the forecast period.

By end user, the food industry sub-segment dominated the global inkjet coder market share in 2022. The food business needs to examine numerous rules, norms, and regulations. Food manufacturers and co-packers are frequently required to comply with several labelling requirements, ranging from state-level meat and dairy coding regulations to federal labelling standards such as the Fair Packaging and Labelling Act (FPLA), to avoid costly fines and product recalls. . To address public health concerns and food safety issues, state and local governments around the world have adopted new traceability legislation on a regular basis. Food safety and quality are becoming increasingly important as consumer awareness and regulatory requirements develop. Strict rules exist to ensure that food products fulfill particular standards and are safe to consume. Customized and personalized products are becoming more popular in the food business. With the help of inkjet coders, it is possible to print variable data on food packaging, such as production and expiry date, customized messages, marketing offers, or information relevant to a certain region. Food brands may interact with consumers, develop a distinctive brand experience, and increase customer loyalty with the help of this personalization facility.

By region, Europe dominated the global market in 2022. T The region is a major hub for pharmaceutical manufacturing, with countries like the UK, Germany, and Belgium being key players in the industry. The pharmaceutical sector requires precise and accurate coding solutions for product identification, serialization, and track-and-trace purposes. Inkjet coders that meet the stringent requirements of the pharmaceutical industry, including compliance with regulations and high-quality printing on different packaging materials, have significant growth potential in this region. Europe is at the forefront of adopting Industry 4.0 principles and automation in manufacturing. Inkjet coders are integrated into smart factories, connected production lines, and centralized control systems. This integration enables real-time data exchange, remote monitoring, and predictive maintenance, enhancing production efficiency and driving the regional inkjet coder market growth. The inkjet coding industry in Europe has witnessed market consolidation through acquisitions and partnerships among key players. This consolidation has led to the sharing of resources, expertise, and market reach, resulting in increased market penetration and growth.

Impact of COVID-19 on the Global Inkjet Coder Industry

- Automation and digitalization of manufacturing processes have been adopted more quickly because of the need to reduce human interaction and maintain social distance during the pandemic. Systems for inkjet coding that were easily integrated with automated production lines became more popular. Manufacturers looked for solutions that would increase operational effectiveness while reducing their dependency on physical labor.

- Companies faced challenges in conducting trials, prototyping, and introducing new inkjet coding technologies or product advancements. This delayed innovation and slowed down the introduction of new features or solutions in the market.

- The pandemic has led to an increase in demand for proper packaging of products that were previously sold as basic items. As a result of the rapid growth of packaging sectors in the post-pandemic period, there is a greater demand in world for coding and marking systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the inkjet coder market analysis from 2022 to 2032 to identify the prevailing inkjet coder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the inkjet coder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global inkjet coder market trends, key players, market segments, application areas, and market growth strategies.

Inkjet Coder Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.3 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Type |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Control Print Ltd, Shanghai Rottweil Handyware Printing Technology Co., Ltd, Domino Printing Sciences plc, Videojet Technologies Inc., MapleJet, Linx Printing Technologies Limited, ANSER CODING INC., Xaar plc, Hitachi Industrial Equipment Systems Co.,Ltd., Markem-Imaje S.A |

Inkjet coders offer advantages such as high-speed printing, non-contact printing capabilities, flexibility in printing on different substrates, and the ability to print variable data. These features make them suitable for a wide range of applications and contribute to their popularity in the market.

The major growth strategies adopted by inkjet coder market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global inkjet coder market in the future.

Markem-Imaje S.A and Videojet Technologies Inc are the major players in the inkjet coder market.

The food industry sub-segment of end-user acquired the maximum share of the global inkjet coder market in 2022.

The food and pharmaceutical industries are the major customers in the global inkjet coder market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global inkjet coder market from 2022 to 2032 to determine the prevailing opportunities.

Inkjet coders have the potential to expand their capabilities beyond traditional coding and marking. For example, advancements in ink formulations and print head technologies can enable the printing of complex barcodes, high-resolution graphics, and even functional coatings on products. Exploring and developing new applications and features can differentiate inkjet coder and open up new market opportunities.

The rising importance of product safety, credibility, and traceability will boost inkjet coder application across various industries. Demand for advanced inkjet coding systems will be driven by laws & regulations and consumer expectations for accurate and visible coding on items, such as expiry dates, batch numbers, and barcodes.

Loading Table Of Content...

Loading Research Methodology...