Inland Water Freight Transport Market Research, 2033

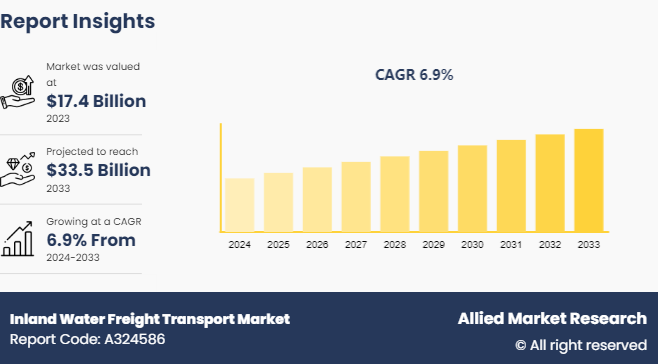

The global inland water freight transport market was valued at $17.4 billion in 2023, and is projected to reach $33.5 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Market Introduction and Definition

Inland water freight transport refers to the motion of products and cargo through rivers, canals, and other navigable inland waterways. This medium of transport is important due to its cost-efficacy, energy planning, and magnitude to control a high quantity of merchandise, thus making it an imperishable replacement for road and rail transport. Inland waterways lowers congestion on land-based transport networks, decrease greenhouse gas emissions, and are specifically acceptable for bulk products such as coal, minerals, and agricultural commodities.

The strategic development and integration of inland water transport systems can intensify regional congruence, improve economic growth, and reinforce environmental sustainability goals. The key components of inland water freight transport include waterways, ports, terminals, vessels, navigation aids, logistics, warehousing, regulatory framework, maintenance and infrastructure management, intermodal connections, environment and safety measures, technology, and innovation.

Key Takeaways

The inland water freight transport market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major inland water freight transport industry participants along with authentic industry journals, trade associations and releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

In June 2024, Nippon Express launched a new inland water freight transport solution that focuses on increasing its sustainability efforts. In addition, to address climate change, Nippon Express instituted a carbon offset transport service for all ocean freight less-than-container-load (LCL) shipments. This service counterbalances greenhouse gas emissions initiated by LCL transport by obtaining carbon credits from certified projects that not only alleviate global warming but also contribute to local community benefits. This initiative covers all LCL shipments globally and is designed to help customers reduce their carbon footprint without additional costs. This strategic move will enhance the growth of inland water freight transport market size.

In April 2024, Fox Brasil launched a new inland water freight transport solution, expanding its comprehensive logistics services to include enhanced inland waterway capabilities. This new service aims to provide efficient and cost-effective transportation solutions by leveraging Brazil's extensive river network. The inland water freight transport solution includes specialized services such as break bulk, roll-on/roll-off (RoRo) , over-dimensional cargo handling, and sensitive cargoes. Fox Brasil offers a complete range of logistics support, including load-out operations, barge services, route surveys, structural and geometric studies, and end-to-end delivery and discharge at job sites. This strategic move will drive the growth of inland water freight transport market size.

In October 2023, Ingram Barge Company expanded its inland water freight transport capabilities by acquiring Inland River Transport Holdings LLC (SCF) from Seacor Holdings. This acquisition includes more than 1, 000 dry cargo hopper barges, eight high-power towboats, and a comprehensive terminal and fleeting infrastructure along the Mississippi River. The deal importantly reinforced Ingram's logistics network, permitting it to transport crucial agricultural and industrial commodities more effectively across over 4, 500 miles (about 7242.05 km) of the U.S. inland waterways.

In October 2023, SCF Marine was involved in a significant transaction where SEACOR Holdings sold its U.S. Inland River Transport Holdings LLC, including SCF Marine to Ingram Barge Company. This sale is expected to enhance SCF's service capabilities and allow for further development of innovative and sustainable transport solutions.

In January 2023, Maxitrans launched the latest inland water freight transport service. The goal of the solution is to make canal logistics more sustainable and productive. The policy aims to provide affordable and environmentally sustainable alternatives for product delivery via rivers and canals, therefore decreasing the dependence on road transportation and, in turn, lowering emissions and traffic congestion.

Key Market Dynamics

Efficiency in costs and growing environmental awareness are the two critical factors driving the growth of the inland water freight transport market share. Furthermore, the adoption of automated vessels, real-time tracking systems and advanced logistics management systems, and integration with different transport modes are the two primary factors expected to provide inland water freight transport market opportunity during the inland water freight transport market forecast. Moreover, the lack of developed infrastructure and variations in season are two significant factors acting as restraints for inland water freight transport market growth.

Inland water freight transport is increasingly economical in comparison to road and rail transport, specifically in the case of substantial and mass commodities. Furthermore, the combination of inland water freight transport with other modes of transport such as road, rail, and air will enhance the comprehensive effectiveness of logistics and will provide consistent transport solutions.

Market Segmentation

The inland water freight transport market is segmented into type, fuel type, vessel type, and region. By type, the market is bifurcated into liquid bulk transportation and dry bulk transportation. By fuel type, the market is divided into heavy fuel oil, diesel, biofuel, and other fuels. By vessel type, the market is categorized into cargo ships, container ships, tankers, and other vessel types. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

According to data released by Waterways Journal on July 14, 2023, the U.S. inland water freight transport market saw a variety of possibilities and difficulties in 2023. On the plus side, the market benefited from higher agricultural and industrial production, which made inland waterways' effective and bulk transport options necessary. Chemicals, coal, and grain were a small part of the goods transported through the Mississippi River and other large rivers.

According to the data released by CH Robinson, technical changes are improving the operational effectiveness and safety of inland water transportation through enhanced navigation systems and vessel designs. Moreover, industry is suffering from environmental challenges, such as changes in water levels due to climate change, which is impacting dependability and navigability. The goal of the continuing infrastructure upgrade, which includes modernizing locks and dams, is to lower the problems and increase the river network's resilience.

According to data released by Maersk on June 22, 2023, environmental concerns and climate changes influenced the dynamics of the sector. Furthermore, increasing emphasis is being placed on sustainable practices, as businesses adopt eco-friendly technology and streamline their processes to reduce its carbon impact. For instance, Maersk launched electric vehicle (EV) trucks for drayage operations, which demonstrates a trend in Canada towards greener logistics solutions.

Competitive Analysis

The major players operating in the inland water freight transport market include Ingram American Commercial Barge Line (U.S.) , Ingram Barge Company (U.S.) , Maxitrans (Australia) , SCF Marine, Inc. (U.S.) , Fox Brasil (Brazil) , McKeil Marine Limited (Canada) , Maersk (Denmark) , Rhenus Group (Germany) , Imperial Logistics International (South Africa) , Seacor Holdings Inc. (U.S.) , Nippon Yusen (Japan) , Deutsche Post AG (Germany) , Jeffboat (U.S.) , Svitzer (Denmark) , Genesee & Wyoming Inc. (U.S.) , COSCO Shipping Co., Ltd. (China) , Hapag-Lloyd (Germany) , Yang Ming Marine Transport Corporation (Taiwan) , Evergreen Marine Corp. (Taiwan) .

The other player in the market includes Grimaldi Group (Italy) , Stolt-Nielsen Limited (UK) , Clipper Group (Denmark) , Mediterranean Shipping Company S.A. (Switzerland) , Wilhelmsen Ship Management (Norway) , China Navigation Company (Hong Kong) , Keppel Offshore & Marine (Singapore) , Eagle Bulk Shipping Inc. (U.S.) , Genco Shipping & Trading Limited (U.S.) , Dry Ships Inc. (Greece) and Nippon Express (Japan) .

The players adopted product launches, acquisitions, service expansion, and other strategies to increase their market share in the global inland water freight transport industry.

Industry Trends

As per the information published by WTA Group on 05/28/2024, the inland water freight transport sector is witnessing several significant developments and trends in 2024. One notable trend is the increasing freight rates, particularly on the Asia-Europe trade lanes, driven by operational challenges and higher-than-expected demand. Factors contributing to this surge include vessel shortages, operational blank sailings, and congestion at key ports like Algeciras and Barcelona. These conditions have led carriers to implement general rate increases, further exacerbating the capacity crunch expected to persist into June.

As per the information published by CH Robinson, in U.S., the inland water transport system is becoming increasingly vital amid discussions of reshoring manufacturing and reducing reliance on long global supply chains. This shift underscores the importance of maintaining a robust and reliable inland waterway network to support domestic logistics and trade.

Key Sources Referred

Waterways Journal

CH Robinson

Maersk

Nippon Express

Fox brasil

WTA Group

Seacor Holdings Press Release

UNECE

Inland Marine Expo

Marine Log

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the inland water freight transport market analysis from 2024 to 2033 to identify the prevailing inland water freight transport market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the inland water freight transport market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global inland water freight transport market trends, key players, market segments, application areas, and market growth strategies.

Inland Water Freight Transport Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 33.5 Billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Fuel Type |

|

| By Vessel Type |

|

| By Region |

|

| Key Market Players | Stolt-Nielsen Limited (UK), Svitzer (Denmark), Genesee & Wyoming Inc. (U.S.), Maersk (Denmark), COSCO Shipping Co., Ltd. (China), Eagle Bulk Shipping Inc. (U.S.), Nippon Yusen (Japan), Keppel Offshore & Marine (Singapore), Seacor Holdings Inc. (U.S.), Evergreen Marine Corp. (Taiwan), McKeil Marine Limited (Canada), Imperial Logistics International (South Africa), Hapag-Lloyd (Germany), Fox Brasil (Brazil), Nippon Express (Japan), Clipper Group (Denmark), Jeffboat (U.S.), Wilhelmsen Ship Management (Norway), Maxitrans (Australia), Ingram American Commercial Barge Line (U.S.), Dry Ships Inc. (Greece), Rhenus Group (Germany), Mediterranean Shipping Company S.A. (Switzerland), SCF Marine, Inc. (U.S.), Ingram Barge Company (U.S.), China Navigation Company (Hong Kong), Grimaldi Group (Italy), Deutsche Post AG (Germany), Yang Ming Marine Transport Corporation (Taiwan), Genco Shipping & Trading Limited (U.S.) |

Increasing freight rates, particularly on the Asia-Europe trade lanes, driven by operational challenges and higher-than-expected demand.

Dry bulk transportation is the leading application of the inland water freight transport market. This is due to the high demand for the movement of commodities such as coal, grains, minerals, and aggregates.

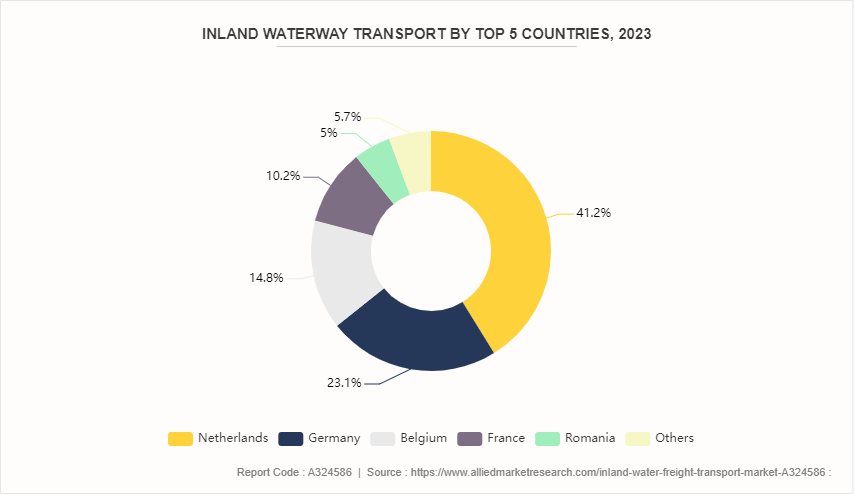

Europe is the largest regional market for inland water freight transport. This is due to the well-established and extensive inland waterway networks such as the Rhine, Danube, and others in the European region.

$33.5 billion is the estimated industry size of inland water freight transport.

Ingram American Commercial Barge Line (U.S.), Ingram Barge Company (U.S.), Maxitrans (Australia), SCF Marine, Inc. (U.S.), Fox Brasil (Brazil), McKeil Marine Limited (Canada), Maersk (Denmark), Rhenus Group (Germany), Imperial Logistics International (South Africa), Seacor Holdings Inc. (U.S.), Nippon Yusen (Japan), Deutsche Post AG (Germany), Jeffboat (U.S.), Svitzer (Denmark), Genesee & Wyoming Inc. (U.S.), COSCO Shipping Co., Ltd. (China), Hapag-Lloyd (Germany), Yang Ming Marine Transport Cor

Loading Table Of Content...