Insurance Rating Software Market Research, 2032

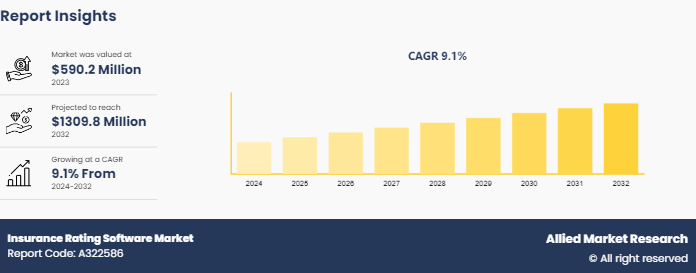

The global insurance rating software market was valued at $590.2 million in 2023, and is projected to reach $1309.8 million by 2032, growing at a CAGR of 9.1% from 2024 to 2032. Rising need for accurate pricing and risk evaluation is a major factor driving market revenue growth. In order to handle the policy, claim, invoicing, and insurance processes and produce quotes for customers, agencies and brokerages can benefit from insurance rating software.

Market Introduction and Definition

Insurance rating software is a specialized tool used by insurance companies to calculate premiums for various insurance policies. It leverages advanced algorithms, data analytics, and often artificial intelligence (AI) and machine learning (ML) technologies to assess risk factors associated with policyholders. By analyzing a wide range of data, such as historical claims, demographic information, and external factors, the software provides accurate and customized pricing models. This not only enhances the precision of premium calculations but also streamlines the underwriting process, improving efficiency and compliance with regulatory standards. In additionIn addition, insurance rating software can adapt to market trends and customer demands, enabling insurers to offer tailored, usage-based products. It plays a crucial role in modernizing the insurance industry, facilitating better risk management, and delivering superior customer experiences through quicker and more accurate policy pricing.

Key Takeaways

The insurance rating software market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major Insurance rating software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends

In May 2023, Sapiens International Corporation, a global provider of software solutions for the insurance industry, launched its new Parameter Management (PaM) solution. Sapiens aims to empower the financial sector, with a focus on insurance, to transform and become digital, innovative and agile. The company provides an insurance platform with pre-integrated, low-code solutions and a cloud-first approach. In addition, PaM extends decision automation further into the enterprise by enabling business users outside of the IT department to make changes in data-related business logic, avoiding a time-consuming software development lifecycle (SDLC) to put changes into production.

In May 2024, insurance software provider Agiliux announced that it will be launching in the UK market. The insurtech’s software offers end to end digitalization of brokers’ internal processes.

Key market dynamics

The global insurance rating software market is expanding due to several key factors, such as the increasing demand for efficient policy rating management, advancements in cloud computing, and stringent regulatory requirements in the insurance industry. However, high initial implementation costs and concerns regarding data privacy pose challenges to market growth. Nevertheless, the proliferation of digital insurance platforms and the development of AI-driven solutions will provide significant opportunities for market expansion during the forecast period. One key driver of the insurance rating software market is rise in demand for efficient and accurate rating processes in the insurance industry. Insurance companies are constantly seeking ways to streamline their operations and enhance customer experiences. Rating software offers a solution by automating the complex process of calculating insurance premiums based on various risk factors. This automation not only reduces the time and resources required for manual rating but also minimizes errors, ensuring more precise pricing. In addition, as insurance products become more diverse and tailored to specific customer needs, the flexibility of rating software to accommodate different product configurations and pricing models becomes increasingly valuable. Overall, the adoption of insurance rating software is driven by the industry's need for faster, more accurate, and adaptable rating solutions to stay competitive in the market.

Technological Innovations: Global Insurance Rating Software Market

Technological innovations are propelling the global insurance rating software market, driving significant advancements and efficiency improvements. The integration of artificial intelligence (AI) and machine learning (ML) has revolutionized customer service and risk assessment, enabling more precise and personalized insurance offerings. Cloud computing solutions have enhanced data accessibility and scalability, allowing insurance agencies to manage operations seamlessly and cost-effectively. In addition, blockchain technology is being increasingly adopted to ensure data security and transparency in transactions. The use of advanced analytics and big data tools is facilitating more accurate underwriting and premium calculations, while robotic process automation (RPA) is streamlining repetitive tasks, reducing operational costs, and minimizing human errors. These technological innovations not only improve operational efficiency but also enhance customer experiences, providing a competitive edge to insurance agencies in a rapidly evolving digital landscape.

Market Segmentation

The Insurance rating software market is segmented into deployment mode, enterprise size, application, and region. On the basis of deployment mode, the market is divided into cloud-based, on-premises. On the basis of enterprise size, the market is divided into large enterprises and SMEs. As per the application, the market is bifurcated into claims management, commission management, contract management, document management, insurance rating, quote management, and policy management. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America Insurance Rating Software Market is poised for substantial growth, driven by several key factors. The region's robust insurance industry, characterized by a high penetration of both life and non-life insurance products, provides fertile ground for the adoption of advanced software solutions. Regulatory compliance remains a significant driver, with stringent requirements pushing insurance agencies to adopt sophisticated software to ensure adherence to laws and standards. In addition, the growing demand for digital transformation and customer-centric approaches has led to increased investments in AI and machine learning technologies, which enhance customer service and operational efficiency. The adoption of cloud-based solutions is particularly strong in North America, offering scalability, flexibility, and cost-efficiency to insurance agencies. Furthermore, the region's advanced IT infrastructure and the presence of major market players such as Vertafore and Applied Systems contribute to a competitive and innovation-driven market environment. Despite challenges such as high implementation costs and data privacy concerns, the outlook for the North America Insurance Rating Software Market remains positive, with significant opportunities for growth and technological advancements in the coming years. The sheer size and diversity of the market creates opportunities for insurance providers to offer specialized solutions tailored to different segments and niches. For instance, in June 2023, Simplifai, an AI automation solutions provider, launched Simplifai InsuranceGPT a world-first custom-built GPT tool, fueled by the company’s revolutionary no-code AI-powered platform. With InsuranceGPT, Simplifai has strengthened its end-to-end business process automation capabilities, providing enriched communication between insurers and their customers through the power of generative AI – delivering fast, concise, and accurate responses in a secure way.

Competitive Landscape

The major players operating in the insurance rating software market include Applied Systems Inc., Vertafore, Inc., EZLynx, HawkSoft, Sapiens International Corporation, LLC, Buckhill Ltd., and XDimensional Technologies, Inc. Other players in the Insurance rating software market include QQ Solutions, Inc., Jenesis Software, RatingBloc, and so on.

Recent Key Strategies and Developments

In June 2023, Insurance Software Automation released a new version of its flagship product, Best Plan Pro. Version 2.0 couples Best Plan Pro's world-class tech with an upgraded interface and data entry system to provide agents with a superior user experience, faster processing, and more accurate product recommendations. Now agents can automatically pre-qualify a client for final expense, term life, and/or Medicare supplement products in seconds.

In October 2023, Appian announced the availability of the Connected Underwriting Life Workbench to help insurers unify workflows and data in an automated, end-to-end process. The solution makes underwriters' lives easier by giving them a single interface to evaluate and classify risk, handle exceptions, and make case decisions.

In November 2023, The Delhi-based insurance broker company, RiskBirbal, announced the launch of its new insurance and risk management products aimed at mitigating financial risks for small and medium businesses. The company will offer online quotes for all the policies along with financial solutions.

Key Sources Referred

National Association of Professional Insurance Agents (PIA)

Independent Insurance Agents & Brokers of America (IIABA)

The Council of Insurance Agents & Brokers (CIAB)

InsurTech Community

Applied Technology Council (ATC)

The Chartered Insurance Institute (CII)

International Association of Insurance Supervisors (IAIS)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the insurance rating software market segments, current trends, estimations, and dynamics of the Insurance rating software market analysis from 2023 to 2032 to identify the prevailing Insurance rating software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Insurance rating software market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global Insurance rating software market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global Insurance rating software market trends, key players, market segments, application areas, and market growth strategies.

Insurance Rating Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1309.8 Million |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | HawkSoft, Sapiens International, ACS, EZLynx, Agency Matrix, Buckhill, Vertafore, Applied Systems, InsuredHQ, ITC |

The Insurance rating software Market is estimated to grow at a CAGR of 9.1% from 2024 to 2032.

The Insurance rating software Market is projected to reach $1.3 billion by 2032.

The Insurance rating software Market is expected to witness notable growth due to increasing demand for efficient policy rating management, advancements in cloud computing, and stringent regulatory requirements in the insurance industry.

The key players profiled in the report include Applied Systems Inc., Vertafore, Inc., EZLynx, HawkSoft, Sapiens International Corporation, LLC, Buckhill Ltd., and XDimensional Technologies, Inc. Other players in the Insurance rating software market include QQ Solutions, Inc., Jenesis Software, RatingBloc, and so on.

The key growth strategies of Insurance rating software Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...