Insurance Third Party Administrator Market Research, 2032

The global insurance third party administrator market size was valued at $324.9 billion in 2022, and is projected to reach $795.1 billion by 2032, growing at a CAGR of 9.6% from 2023 to 2032.

A third-party administrator (TPA) is a licensed third-party entity, which provides administrative solutions to health insurance companies, employment firms, and other entities. It acts as an intermediary between the insurance company and the policyholder to ensure cashless claims and reimbursement claims are settled effectively.

Furthermore, the increase in health insurance customers has accelerated the quantity of work and led to a decrease in the quality of services. Therefore, TPAs are established to assist insurers in arranging for cashless treatments for customers demanding seamless claim settlements. In addition, TPAs also scrutinize hospital bills and documents for their accuracy and help in the processing of the claim.

The rise in the adoption of third-party administrators in the health insurance industry and the rise in the need for operational efficiency & transparency in the insurance business are driving the growth of insurance third party administrator market. However, security issues and privacy concerns, along with limited understanding or awareness of insurance third-party administrator services limit the growth of insurance third party administrator market. Conversely, technological advancements in third-party administrator services are anticipated to provide numerous opportunities for the expansion of the insurance third party administrator market during the forecast period.

The report focuses on growth prospects, restraints, and analysis of the global insurance third-party administrator market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global insurance third party administrator market share.

Segment Review

The insurance third party administrator market is segmented into Service Type, End User, and Enterprise Size.

The insurance third-party administrator market is segmented on the basis of service type, end user, enterprise size, and region. By service type, it is segmented into claims management, policy management, commission management, and others. By end user, it is bifurcated into life & health insurance and property & casualty (P&C) insurance. The life & health insurance type segment is further bifurcated into life insurance and health insurance. Health insurance is divided into disease insurance and medical insurance. Further, disease insurance is segmented into senior citizens, adults, and minors. By enterprise size, the market is divided into large enterprises and small & medium-sized enterprises. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

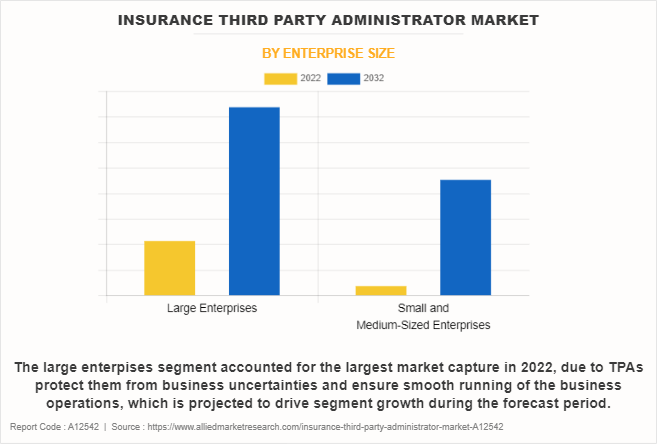

Depending on enterprise size, the large enterprises segment dominated the market in 2022 and is expected to continue this trend during the forecast period, as large enterprises deal with a high volume of insurance policies, claims, and policyholders, which further drive the market demand in these enterprises. However, the small and medium-sized enterprises segment is expected to witness considerable growth in the upcoming years, as it provides significant benefits in lower costs and greater claim efficiency to these enterprises, which boosts the adoption of the insurance third party administrator industry among SMEs.

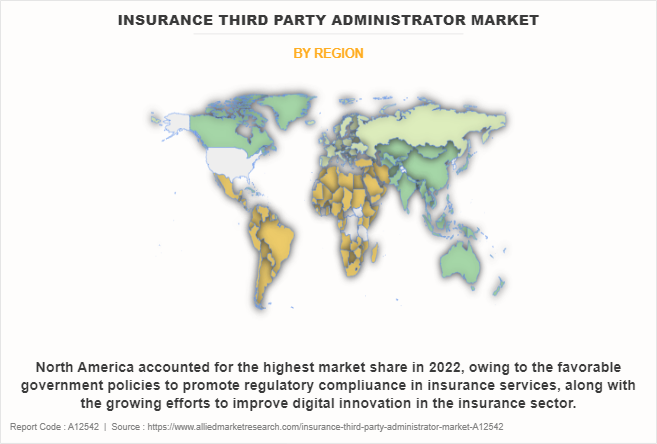

Region-wise, the insurance third-party administrator market was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the growing demand for efficient healthcare claims processing and administration in the North America insurance third party administrator market. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to fast growth in the economy in the region and a growing middle-class population, thus resulting in increased demand for insurance goods and services. Thus, these factors are expected to drive the growth of the global insurance third party administrator market during the forecast period.

The global insurance third-party administrator market is dominated by key players such as Charles Taylor, CorVel, Crawford & Company, ESIS, ExlService Holdings, Inc., Gallagher Bassett Services, Inc., Helmsman Management Services LLC, Meritain Health, Sedgwick, and United HealthCare Services, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the insurance third party administrator market.

Digital Capabilities

Insurance Third-Party Administrators (TPAs) have increasingly adopted digital capabilities to streamline their operations, enhance customer service, improve data management, and stay competitive in the evolving insurance industry. Some common digital potentials in the insurance third party administrator market are online portals, integration of mobile apps, electronic claims submission, automated claims processing, implementation of customer chatbots, and data analytics, among others. Hence, the surge in technological advancements in insurance third party administrator services is expected to create numerous opportunities for global insurance third party administrator market growth.

In addition, the rise in demand for automation in claim processing and policy administration, and other technologies such as artificial intelligence (AI) and machine learning (ML) contribute to the growth of insurance third party administrator market. Hence, numeors vendors in the insurance third party administrator market are introducing new products and services, with the aim to expand the market size in the global market. For instance, in June 2023, Simplifai unveiled the world-first generative AI tool for insurance that helps in improved decision-making for automated claims management, while maintaining privacy and data security. Such strategic developments in the field of autonomous claims management are anticipated to pave the growth outlook of the insurance third party administrator market.

Moreover, traditional third-party administrator services have been deployed for several decades; however, the increase in adoption of advanced technologies, such as the Internet of Things (IoT) and robotics process automation, has led to the growth of the insurance third party administrator market. Technological innovations in North America countries, such as the U.S., are expected to create several opportunities for the third party administrator market. According to CompTIA, Inc., in February 2023, there are more than 585,000 tech companies in the U.S. and nearly 60% of entrepreneurs believe that AI is currently the most promising technology from an innovation standpoint. These digital capabilities enhance the overall customer experience and enable TPA service providers to remain relevant in a digital landscape, which in turn reinforces the insurance third party administrator market growth over the forecast period.

End-User Adoption

The growing adoption of insurance services by third party administrators is accelerating end-user adoption. The end users in the insurance TPA market may vary based on the specific services provided by the TPA and the insurance type it manages. However, a few common end-users for insurance third-party administrators are policyholders, beneficiaries, healthcare providers, employers, employees, claimants, and more. Further, the insurance third party administrator services find a wider application in the life & health insurance market, as it manages administrative tasks related to life insurance and health insurance policies. In addition, it helps in end-to-end claim processing by verifying policyholder information, assessing the validity of claims, and facilitating the settlement process. Hence, such remarkable benefits of TPA service in the life & health insurance segment are expected to contribute to its high demand, and eventually result in numerous opportunities for insurance third party administrator market growth.

In addition, vendors are focused on partnerships and acquisitions with other vendors or solution providers to enhance their product and service offerings. For instance, in March 2023, Medi Assist acquired a nearly 100% stake in Raksha Insurance. Through this acquisition, Medi Assist TPA intends to grow its retail segment by nearly 30%, to expand the company’s presence in North and West India. Furthermore, third-party claims administrators are largely used by companies providing health insurance, which involve outsourcing of many administrative functions. Such advancements and the expansion of insurance TPA services are expected to drive the growth of the insurance third party administrator industry.

Top impacting factors

Surge in Adoption of Third-party Administrators in the Health Insurance Industry

Third-party administrator plays a vital role in the health insurance industry and helps health insurance companies increase their efficiency by processing claims and settling payments. In addition, third-party administrators provide several features to the end user, which include 24/7 support responding to customer queries over multiple channels such as social media, chat, and email, and capitalizing on sales opportunities beyond geographic locations. These aforementioned factors are likely to boost the insurance third party administrator market.

However, after the COVID-19 situation, there was an increase in health insurance customers, which led to a surge in the burden of work and a decrease in the quality of claim processing & settlement services, thereby driving the growth of the market. Consequently, third-party administrators are increasingly adopted by health insurance companies, as they offer various value-added services along with processing the claim and scrutinizing the hospital bills such as ambulance, helpline facilities for knowledge sharing, and providing a long list of network hospitals. This subsequently fuels the growth of the insurance third-party administrator industry.

Moreover, the rise in demand for health insurance expertise and the necessary infrastructure to handle claims and policy enrollment drives the global insurance third party administrator market growth in this sector. These factors encouraged several private and public companies to adopt various strategies such as product launches, partnerships, and others to expand their product portfolio. For instance, in March 2022, Charles Taylor launched InHub, to deliver a unique connected experience for the insurance market and its customers. It further helps insurance companies to reduce the cost of the IT landscape by evolving rather than replacing legacy systems alongside integrating technology and launching new products. Therefore, such developmental strategies contribute to driving the insurance third party administrator market forecast.

Security Issues and Privacy Concerns

Security and privacy maintenance of data have become complex with the increase in the number of claims in the insurance industry. In addition, concerns regarding the security of personal and financial information of policyholders are on the rise due to the rise in volume of data generation by insurance companies. These threats cause insurance operations to be restricted in an unplanned manner, which negatively impacts the punctuality and growth of the global insurance third party administrator market.

Moreover, security is one of the most significant concerns associated with third-party service implementation. Lack of awareness among insurance companies regarding sharing account information and confidential data online hampers the market growth. In addition, the possibility of unauthorized access to accounts of users via hacked log-in credentials creates huge security & privacy concerns among insurance companies. Furthermore, the sharing of sensitive customer data by insurance companies to third-party administrator service providers results in the disclosure of personal information and exposes businesses to security risks. These factors, as a result, are predicted to hamper growth of insurance third party administrator market outlook.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance third party administrator market analysis from 2022 to 2032 to identify the prevailing insurance third party administrator market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the insurance third party administrator market growth assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report on insurance third party administrator market trends includes an analysis of the regional as well as global insurance third party administrator market share, key players, market segments, application areas, and market growth strategies.

Insurance Third Party Administrator Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 795.1 billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 460 |

| By Service Type |

|

| By End User |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | United Healthcare Services, Inc., Meritain Health, Inc., Charles Taylor, Helmsman Management Services, LLC, Crawford & Company, ExlService Holdings, Inc., ESIS, Gallagher Bassett Services LLC, CorVel, Sedgwick |

Analyst Review

In accordance with several interviews that were conducted with top-level CXOs, there is a rapid rise in demand for insurance third-party administrators (TPA) for handling the claims of worker’s compensation offered by employment firms under employee benefits. In addition, TPA is used to manage a company’s benefits, particularly health, workers' compensation, and dental claims that are typically self-funded.

Furthermore, health insurance companies often find the application of TPAs with the aim to handle claims of the policyholders and provide value-added services, including the hospitalization of patients, and medical facilities, such as the arrangement of wheelchairs, beds, medicines, and others. Key providers in the insurance third-party administrator market are ExlService Holdings, Inc., Crawford & Company, and CorVel. With the rise in demand for TPA services, various companies have established partnerships to increase their solutions offerings in insurance services. For instance, in July 2022, ExlService Holdings, Inc. collaborated with Xceedance, to deliver property and casualty claims, along with digital TPA services to insurers, including an enhanced, modern claims servicing experience. Such collaborative strategies are further expected to drive the insurance third party administrator market demand.

In addition, with the surge in demand for TPA services, various companies have expanded their current product portfolio to stay competitive in the global market. For instance, in December 2021, CorVel Corp. launched CogencyIQ, an artificial intelligence and predictive analytics tool, designed to address complex claims. It provides customized loss-run analysis, advanced analytics, and comparative analysis to businesses. Similarly, in April 2023, Gallagher Bassett New Zealand Ltd. acquired Symetri Ltd., with an aim to strengthen GB’s offering to the New Zealand general insurance market by combining Symetri’s systems and capability. This strategic acquisition is expected to drive the insurance third party administrator market growth during the forecast period.

Rise in the adoption of third-party administrators in the health insurance industry and the rise in the need for operational efficiency & transparency in the insurance business are driving the growth of the market. Conversely, technological advancements in third-party administrator services are anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

Based on service type, the cable television segment held the highest market share in 2022, accounting for around three-fifths of the global insurance third party administrator market revenue, owing to the rise in penetration of data analytics in claim management to process and analyze large volumes of claims data.

North America held the highest market share in terms of revenue in 2022, accounting for nearly half of the global insurance third party administrator market revenue.

The global Insurance Third Party Administrator Market generated $324.90 billion in 2022, and is anticipated to generate $795.05 billion by 2032, witnessing a CAGR of 9.6% from 2023 to 2032.

The global insurance third-party administrator market is dominated by key players such as Charles Taylor, CorVel, Crawford & Company, ESIS, ExlService Holdings, Inc., Gallagher Bassett Services, Inc., Helmsman Management Services LLC, Meritain Health, Sedgwick, and United HealthCare Services, Inc.

Loading Table Of Content...

Loading Research Methodology...