Integrated Security Services Market Statistics, 2031

The global integrated security services market was valued at $15.8 billion in 2021, and is projected to reach $55.5 billion by 2031, growing at a CAGR of 13.7% from 2022 to 2031

Factors such as rising awareness regarding the benefits of integrated security services and the cost efficiency of integrated security solutions are major growth factors for the market. In addition, the growing demand for integration platforms as a service (iPaaS) and solutions is the major growth factor for the integrated security services market. However, the need for the implementation of supporting technology while deploying integrated security services is the major factor hampering the growth of the market. On the contrary, an increase in service innovations embedded with emerging technologies will provide lucrative opportunities for the growth of the market in the upcoming years. For instance, in March 2021, IBM Security announced new and enhanced services designed to help organizations manage their cloud security strategy, policies, and controls across hybrid cloud environments. The services bring together cloud-native, IBM, and third-party technologies along with IBM expertise to help organizations create a unified security approach across their cloud ecosystems.

Integrated security services is a security platform that offers multilayered security features at the field device, control system levels, and network. The offering includes the integration process of systems in the organization to minimize the threat risk of these systems. In addition, the integration of security systems is offered by integrating multi-layered security systems into one single solution. Owing to the cost-efficiency, an increasing number of companies are adopting integrated security solutions. The demand for integrated security services is also increasing for compliance management in order to ensure the set of rules is being followed.

For instance, in February 2020, the networking giant Cisco unveiled the Cisco SecureX platform, which aims to connect integrated Cisco security products along with customers' infrastructure for a unified experience. The network-centric security framework was designed to integrate Cisco products to streamline policy enforcement and provide enterprises with contextual awareness regarding devices, users, and potential threats. Furthermore, the Cisco SecureX platform builds on that strategy by giving enterprises a crucial point that connects to the vendor's integrated security portfolio and the customers' environments. The integrated security services market is segmented into Deployment Mode, Enterprise Size, Industry Vertical and Type.

Segment Review

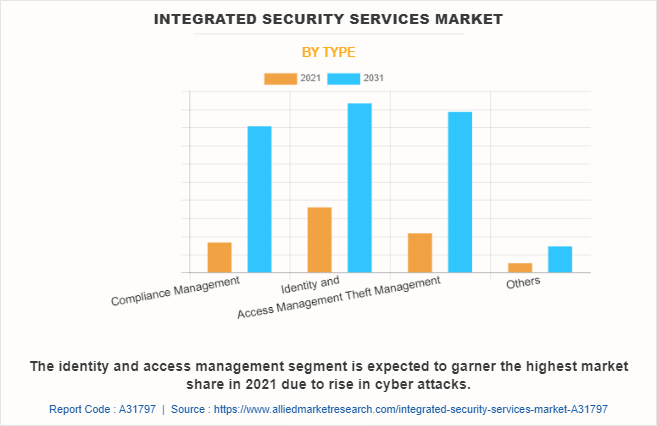

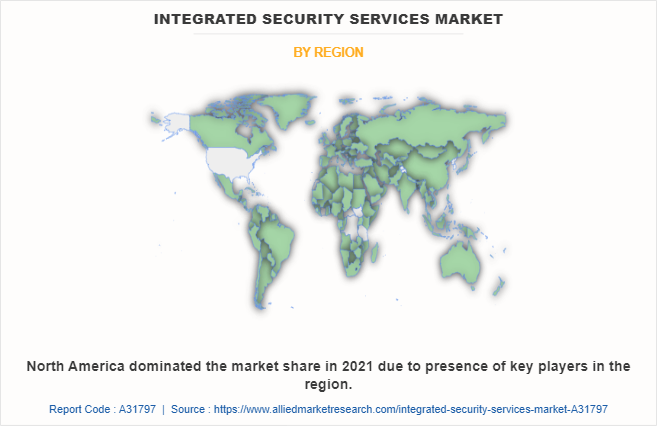

The integrated security services market is segmented on the basis of type, deployment mode, enterprise size, industry vertical, and region. By type, it is segmented into compliance management, identity & access management, theft management, and others. On the basis of deployment mode, it is divided into on-premises and cloud. Based on enterprise size, it is segregated into large enterprise and small & medium enterprise. By industry vertical, the market is divided into BFSI, healthcare, IT & telecom, retail, energy & utilities, manufacturing, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the identity and access management segment acquired the largest market share of integrated security services market size in 2021 as these services help organizations secure their critical data and prevent unauthorized access. However, compliance management is expected to garner highest growth rate during the forecast period due to rapid adoption of regulatory guidelines in security services.

Region-wise, North America dominated the integrated security services market forecast in 2021. This is attributed to increase in incidents of thefts, and cyber-attacks in the region. However, Asia-Pacific is expected to garner highest growth rate during the forecast period due to rapid digitalization and adoption of security systems in developing countries such as China and India.

Top Impacting Factors

Rising awareness regarding the benefits of integrated security services

Integration security services offer integrated security solutions that can easily adapt to the changing environment along with a prominent level of intelligence, speed, and sophistication. Companies are also providing security solutions that integrate video management solutions and access control to provide multi-tiered protection. Furthermore, its features such as proactive threat management, threat monitoring, and customization of security services as per the requirement are some of the major factors contributing to the growth of integrated security services. Moreover, it provides real-time monitoring, enabling the staff to automate tasks and quickly check on various aspects of the organization. Therefore, these benefits of integrated security services propel the growth of the integrated security services industry.

Growing demand for integration platform as a service (iPaaS) and solutions

The increasing adoption of iPaaS platforms among small and medium-level enterprises for integration propels the growth of the integrated security services market. The iPaaS solutions help in reducing the cost of ownership which enables enterprises to adopt these solutions easily. Moreover, these platforms enable IT worker or consultants to write custom connectors and operate packaged solutions available with the platform or in their various marketplaces to utilize off-the-shelf integration with popular services such as Salesforce, Oracle, Akamai, and others.

Furthermore, iPaaS is a purpose to help companies to manage the integration requirements of the business environment, future-proof their integration solutions and increase the value of their investments. Moreover, to meet the growing demand for secure and reliable cloud integration solutions, many vendors have begun offering Integration Platform-as-a-Service which increased the demand for integrated security solutions market.

Cost efficiency of integrated security solutions

The integrated security solutions come with high operational efficiency, reliability, and high performance. The market experienced a continuous expansion due to its cost-efficiency, hence, an increasing number of companies are adopting integrated security solutions. The objectives of integrated security solutions are to identify unauthorized activities and thefts with more reliability and delay them until an effective response/engagement can be accomplished.

Furthermore, it offers multi-layered security systems and integrates them into one solution. Moreover, integrated security services play a key role in the business environment empowering companies to accomplish their growth initiatives and set targeted benchmarks. Therefore, the cost efficiency of integrated security solutions drives the global integrated security services industry growth during the forecast period.

Market Landscape & Trends

Integrated security is the concept of using a singular unified solution to protect every service that a company runs through a set of common policies and configuration settings. Since companies are facing pressure to protect systems and security and prevent breaches that can expose sensitive data. Hence, the rising awareness regarding benefits of integrated security services including efficiency, centralization, theft prevention propelling the growth of the integrated security services market.

In addition, the trend of customized integrated security solutions is also gaining traction that drives the growth of the market. The use of advanced technologies to provide an integrated solution that is more secure and robust integrated security services (ISS) provides a more secure and robust solution for customers despite the reduction in manpower. It utilizes smart devices such as intelligent cameras with video analytic capability and multiple wireless communication technologies using TV White Space (TVWS) as the core technology. The video analytics allow the officers to respond to alerts instead of constantly looking out for abnormal activities from the multiple monitors installed in the ISS. Therefore, these are the trends attributed to the increase in the growth of the integrated security services market.

For instance, in July 2021, DynTek Services, Inc., a leading provider of professional technology solutions, announced that it has joined the Microsoft Intelligent Security Association, an ecosystem of independent software vendors and managed security service providers that have integrated their solutions with Microsoft to increase visibility and better protect against threats.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the integrated security services market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities of integrated security services market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the integrated security services market segmentation assists in determining the prevailing integrated security services market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as integrated security services market trends, key players, market segments, application areas, and market growth strategies.

Integrated Security Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 55.5 billion |

| Growth Rate | CAGR of 13.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 292 |

| By Type |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Broadcom, Cisco Systems, Inc., Sophos Ltd., DynTek, Inc., IBM Corporation, Optiv Security Inc., CGI Inc., Honeywell International Inc., Trend Micro Incorporated, Microsoft |

Analyst Review

Due to the increasing criticality of the services and solutions offered by the organizations need for integrated security solutions is on high demand. Ensuring the reliability and performance of back-office systems and enhancing technology infrastructure for front-line security solutions, need for integrated security solutions arises to help organization operate at peak levels. Currently, security integrated solutions is playing a key role in enabling enterprise organizations to achieve targeted benchmarks and growth initiatives. For instance, in February 2021, Honeywell, a global leader in connected buildings, and IDEMIA, the global leader in Augmented Identity, announced a strategic alliance to create and cultivate an intelligent building ecosystem that provides a more seamless and enhanced experience for operators and occupants alike. The alliance integrates Honeywell’s security and building management systems with IDEMIA’s biometric-based access control systems to create frictionless, safer, and more efficient buildings.

For instance, in October 2022, Sophos Ltd. launched a new third-party security technology compatibilities with Sophos Managed Detection and Response (MDR), its industry-leading service that currently secures more than 12,000 customers worldwide. By integrating data and telemetry from third-party endpoint, cloud, identity, email, firewall, and other security technologies as part of the Sophos Adaptive Cybersecurity Ecosystem, Sophos MDR can better detect and remediate attacks with speed and precision across diverse customer and operating environments.

The global integrated security services market was valued at $15,805.62 million in 2021, and is projected to reach $55,448.43 million by 2031, registering a CAGR of 13.7% from 2022 to 2031.

Rise in awareness regarding the benefits of integrated security services and cost efficiency of integrated security solutions are major growth factors for the market.

North America is the largest regional market for integrated security services market.

Broadcom, CGI Inc., Cisco Systems, Inc., DynTek, Inc., Honeywell International Inc., IBM Corporation, Microsoft, Optiv Security Inc., Sophos Ltd., and Trend Micro Incorporated.

The key growth strategies include product portfolio expansion, acquisition, partnership, merger, and collaboration.

Loading Table Of Content...

Loading Research Methodology...