Intellectual Property Software Market Insight, 2032

The global intellectual property software market size was valued at $7.5 billion in 2022, and is projected to reach $31.3 billion by 2032, growing at a CAGR of 15.6% from 2023 to 2032.

Intellectual property (IP) software is a computer code protected from copying and theft. IP software is either created by companies or they are purchased by companies. Unauthorized use of software is consider illegal. Intangible property produced by the mind includes innovations, literary and artistic creations, designs, names, and pictures. Software is included in this group as well. There are 4 types of intellectual property such as patents, copyright, trade secrets, and trademarks.

The key factors such as rapid modernization and increasing number of disputes are significant factors driving the growth of this market. In addition, the rising costs associated with protection and enforcement is hampering market growth. Furthermore, growing surge in digitalization is providing an opportunity for market growth.

The report focuses on growth factors, restraints, and trends of the intellectual property software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the market.

Top Impacting Factors

Rapid Modernization

Different companies are currently going through heavy digitalization. Most of the companies are digitalizing their operations and therefore intellectual property (IP), patents, trademarks, and copyrights are increasing. IP software helps in streamlining and centralizing solution managing, protecting, and exploiting these assets. Furthermore, companies are expanding their operations across borders. This expansion involves dealing with complex IP laws and regulations in different jurisdictions. IP software is helping businesses by navigate these complexities through providing tools for managing and protecting intellectual property on a global scale.

Moreover, the most spectacular feature of the intellectual software is that it helps in the management of intellectual property portfolios, thus eliminating infringement risk and potential litigation for various companies. Therefore, all these factors are expected to drive the growth of the market during the forecast period.

Increasing Number of Disputes

The management of intellectual properties such as patents, trademarks and copyrights is becoming increasingly challenging due to the growing number of IP filings. The large of volume of filings are demanding efficient intellectual property tools. Furthermore, technological advancements and globalization is creating interconnection between different worlds to operate across borders, thus pushing the market growth.

Moreover, due to the complexities associated with intellectual property laws, the demand for IP software is growing increasingly to track changing laws, regulations, rules and legal disputes. Hence, IP software is becoming an important requirement. Therefore, all these factors are expected to escalate and enhance the growth of the intellectual property software market during the forecast period.

Rising Costs Associated with Protection and Enforcement

Businesses are facing budget restraints due to the expensive costs associated with legal services, litigation and intellectual property protection efforts. Furthermore, legal disputes associated with intellectual property problems are difficult to deal as due to the high legal costs businesses do not consider it viable to invest in intellectual software solutions.

Moreover, due to high cost associated with intellectual property protection and security, businesses are not able to decide whether to invest in this part or other business aspects such manpower, machinery and others. Therefore, all these factors are expected to hamper the intellectual property software market growth during the forecast period.

Growing Emphasis on Digitalization

Due to increasing innovations and digitalization, there is a sudden rise in IP filings. Furthermore, business are increasingly focusing on protecting their digital assets and opting for intellectual property software due to global digitalization and internet access, as intellectual property software offers solutions for managing and safeguarding digital intellectual property, including copyrights for digital content, software patent, and online brand protection.

Moreover, intellectual property software is facilitating collaboration for providing centralized platforms for real time collaboration, portfolio management and communication between stakeholders irrespective of their location. Therefore, all these factors are expected to deliver an opportunity for the market growth during the forecast period.

Segment Review

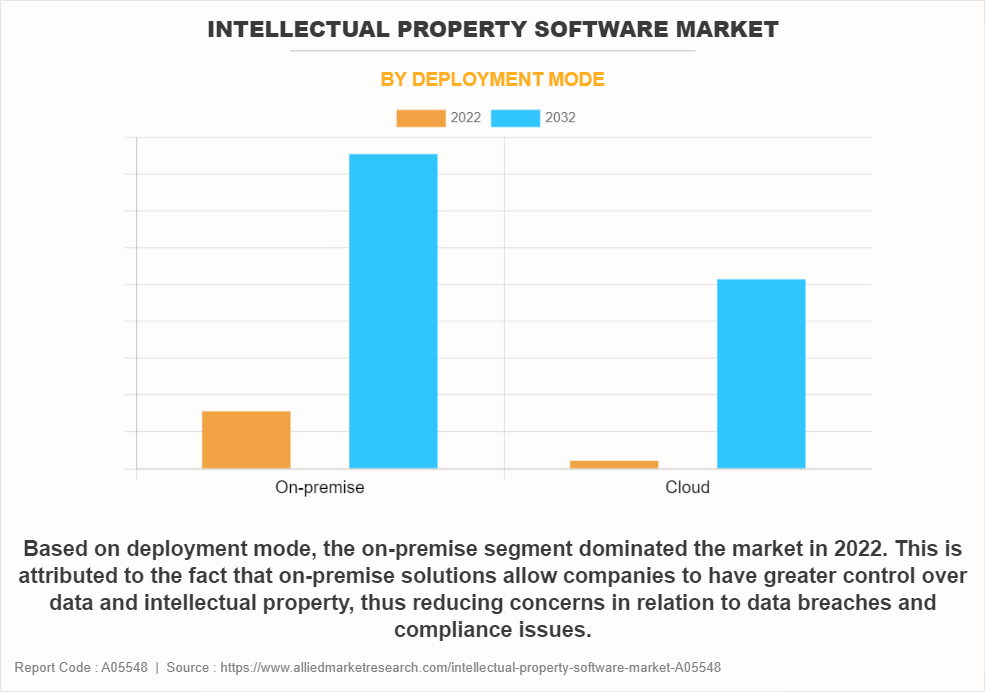

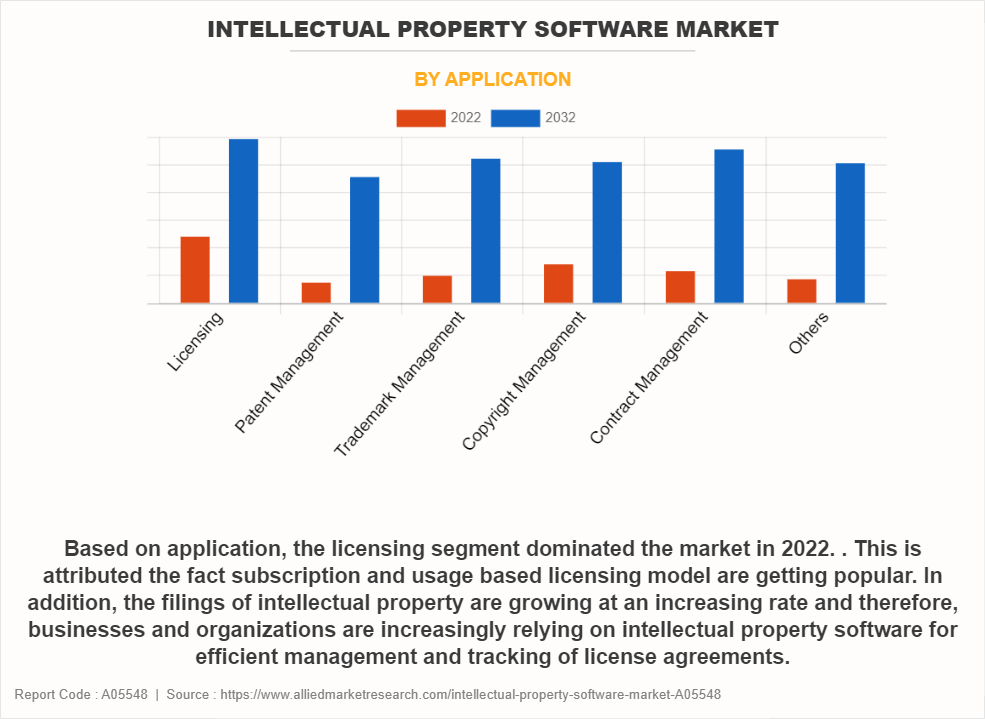

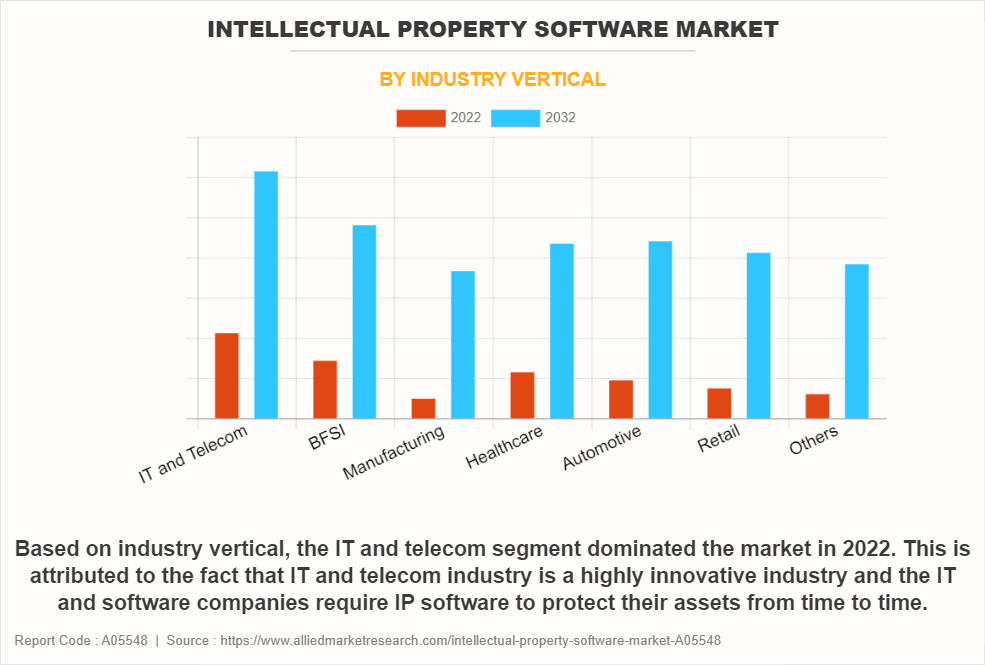

The intellectual property software market is segmented into deployment mode, application, industry vertical and region. By deployment mode, the market is bifurcated into on-premise and cloud. By application, the market is divided into licensing, patent management, trademark management, copyright management, contract management and others. Depending on industry vertical, the market is classified into IT & Telecom, BFSI, manufacturing, healthcare, automotive, retail and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific and LAMEA.

Based on deployment mode, the on-premise segment dominated the market in 2022. This is attributed to the fact that on-premise solutions allow companies to have greater control over data and intellectual property, thus reducing concerns in relation to data breaches and compliance issues. Therefore the demand and use of in-premise solutions is more as compared to cloud solutions.

Based on application, licensing segment dominated the market in 2022. This is because subscription and usage based licensing model are getting popular. In addition, the filings of intellectual property are growing at an increasing rate and therefore, businesses and organizations are increasingly relying on intellectual property software for efficient management and tracking of license agreements.

Based on industry vertical, IT & telecom segment dominated the market in 2022. This is attributed to the fact that IT & telecom industry is a highly innovative industry and the IT and software companies require IP software to protect their assets from time to time.

Based on the region, North America dominated the market in 2022. This can be attributed to concentration of high-tech industries, that highly demand intellectual property software solutions in the region.

The report analyzes the profiles of key players operating in the market such as Clarivate Plc, Patsnap, Anaqua Inc., LexisNexis (RELX), Alt Legal Inc., Patseer Technologies Limited, Questel, Patrix AB, Flextrac and Innovation Asset Group, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the market.

Market Landscape and Trends

Different companies such as Anaqua Inc., Clarivate plc, Questel, and others are offering different suite of tools for intellectual property portfolio management, docketing, analytics and collaboration. Furthermore, significance of cyber security is growing inside intellectual property software market. This includes securing sensitive intellectual property data and preventing unauthorized access to intellectual property information. Moreover, due to global expansion of businesses intellectual property software is offering different solutions to manage the challenges of intellectual property rights across different jurisdictions such as compliance with international patent laws, trademark regulations, and other intellectual property related considerations.

Regional Insights

The Intellectual Property (IP) Software market is expanding globally, driven by increasing awareness of IP protection, rising patent filings, and the need for streamlined management of intellectual property portfolios.

North America holds the largest share of the IP software market, primarily driven by the U.S., where innovation and patent filings are at their peak. The region's strong technological infrastructure and presence of numerous tech and pharmaceutical companies contribute to high demand for IP management solutions. Additionally, stringent IP laws and the growing need for patent protection in industries like IT, healthcare, and entertainment are boosting the adoption of IP software. The region is also witnessing increased integration of AI and automation into IP software platforms, making the IP management process more efficient.

Europe is another key player in the IP software market, with countries like the U.K., Germany, and France leading in patent filings and trademark registrations. The region’s strong industrial base, particularly in automotive, manufacturing, and life sciences, is driving demand for robust IP management solutions. European companies are increasingly adopting IP software to protect their innovations and comply with complex IP laws, especially with the introduction of the Unified Patent Court (UPC) and the European Patent System. Additionally, the region is focusing on digital transformation, further fueling the demand for cloud-based IP management solutions.

Asia-Pacific is the fastest-growing region in the intellectual property software market. Countries like China, India, Japan, and South Korea are witnessing a surge in patent filings, driven by growing innovation in technology, electronics, and pharmaceuticals. China, in particular, is rapidly becoming a leader in global patent applications, prompting the need for advanced IP management tools. The region’s expanding tech sector, coupled with increasing awareness of IP protection and government initiatives to strengthen IP laws, is boosting the adoption of IP software. India and Japan are also investing in IP management solutions as part of their broader efforts to enhance innovation and protect local industries.

Latin America and the Middle East & Africa are emerging markets for IP software. In Latin America, countries like Brazil and Mexico are seeing rising demand for IP management solutions due to growing innovation and increased IP filings. In the Middle East and Africa, countries like the UAE and South Africa are focusing on enhancing IP infrastructure, driving the adoption of IP software to support economic diversification and innovation.

Key Industry Developments

Recent Product Launch in market

In September 2023, Clarivate Inc., launched IPfolio software for corporate teams to manage their patents, trademarks, and designs. IPfoilio software helsp customers to manage intellectual property operations from centralized hub and collaborate across different divisions.

Recent acquisition in market

In December 2022, Questel acquired Equinox Inc., a UK based intellectual property management system company. The aim behind this acquisition was to use Equinox technology to help solve law firm client’s problems through effective solution.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, future estimations, and dynamics of the intellectual property software market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities for market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intellectual property software market segmentation assists in determining the prevailing intellectual property software market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional and global intellectual property software market trends, key players, market segments, application areas, and market growth strategies.

Intellectual Property Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.3 billion |

| Growth Rate | CAGR of 15.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Deployment Mode |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | patrix ab, Alt Legal Inc., LexisNexis (REALX), Anaqua Inc., Flextrac, Questel, Patsnap, Innovation Asset Group, Inc., Patseer Technologies Limited, Clarivate plc |

Analyst Review

As per the insights of the top level CXOs, software pertaining to intellectual property (IP) is a tool used to administer, safeguard, and enforce IP rights. Intellectual property includes components like names, symbols, designs, inventions, and mental works. Trade secrets, copyrights, patents, and trademarks are the primary categories of intellectual property. IP software is useful for handling renewals, compliance requirements, trademarks, copyrights, and patent status tracking. IP software facilitates the management of patent filing, prosecution, and maintenance processes for businesses. Furthermore, intellectual property software facilitates licensing, ensures copyright compliance, and monitors the use of protected content. Moreover, IP software aids in the safe preservation of private commercial data. Furthermore, IP analytics facilitates the analysis of patent landscapes, competitive landscape assessments, and data-driven strategic decisions.

The CXOs further added that market players are adopting strategies like product launch and acquisition for enhancing their services in the market and improving customer satisfaction. For instance, in January 2023, Anaqua Inc. launched AQX Pharma. This software provides tools to improve product decision making, IP lifecycles and improve profitability. In addition, in April 2021, Anaqua Inc. launched a business innovation suite to support inventors and empower organizations to enhance and accelerate their innovation capabilities and processes. The business innovation suite facilitates cross-functional innovation in line with the business plan of the firm, which benefits all departments within it, particularly product management, intellectual property, and research & development. Furthermore, in August 2023, Alt legal Inc. acquired TM Cloud, a visionary trademark and IP docketing and record keeping software for corporate IP departments and law firms. Customers of TM Cloud will make the switch to Alt Legal's reliable and dependable docketing software, which handles millions of files and deadlines for more than 1,000 businesses. Customers of TM Cloud will be able to take advantage of other improvements, such as Alt Legal's integrated trademark monitoring and market-leading United States patent and trademark office (USPTO) and global docketing automation. In addition, in December 2022, Questel acquired a majority stake in Equinox, a UK-based technology company renowned for its powerful IP management system (IPMS). The Equinox IPMS solution will bolster Questel’s already well-established position in the IPMS market by adding a dedicated solution for law firm clients. Therefore, such strategies are expected to boost the growth of the intellectual property software market in the upcoming years.

The report analyzes the profiles of key players operating in the intellectual property software market such as Clarivate Plc, Patsnap, Anaqua Inc., LexisNexis (RELX), Alt Legal Inc., Patseer Technologies Limited, Questel, Patrix AB, Flextrac and Innovation Asset Group, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the intellectual property software market.

Increasing focus on cyber security and global expansion of businesses are the upcoming trends of Intellectual Property Software Market in the world.

Licensing is the leading application of Intellectual Property Software Market.

North America is the largest regional market for Intellectual Property Software.

$7478.2 million is the estimated industry size of Intellectual Property Software.

Clarivate Plc, Patsnap, Anaqua Inc., LexisNexis (RELX), Alt Legal Inc., Patseer Technologies Limited, Questel, Patrix AB, Flextrac and Innovation Asset Group, Inc. are the top companies to hold the market share in Intellectual Property Software.

Loading Table Of Content...

Loading Research Methodology...