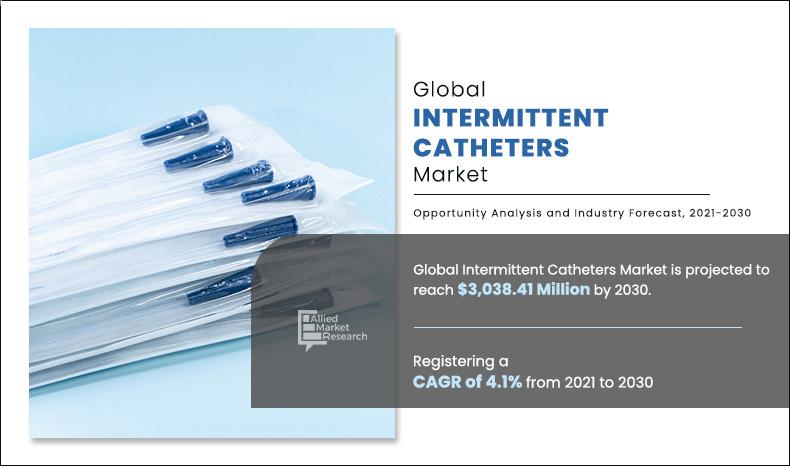

The global Intermittent Catheters market was valued at $2,031.87 million in 2020, and is projected to reach $3,038.41 million by 2030, registering a CAGR of 4.1% from 2021 to 2030.

Intermittent catheter is a type of urological catheter, which is utilized to drain urine from the urinary bladder when individuals are not able to urinate naturally. Intermittent catheterization is widely advocated as an effective bladder management strategy for patients with incomplete bladder emptying due to idiopathic or neurogenic detrusor (bladder) dysfunction (NDO). These catheters are made from polyvinyl chloride ( PVC) or vinyl, latex rubber, and silicone materials, and are intended for one-time use. The major users of intermittent catheters are individuals with spinal cord injury or people suffering from urinary incontinence. The global Intermittent Catheters market was valued at $2,031.87 million in 2020, and is projected to reach $3,038.41 million by 2030, registering a CAGR of 4.1% from 2021 to 2030.

The key factors driving the growth of intermittent catheter market are rise in urinary incontinence cases and increase in geriatric population globally. However, price competition at the domestic level and lack of awareness about the benefits of intermittent catheters hinder the market growth. On the contrary, launch of novel catheters such as the hydrophilic antimicrobial intermittent catheters is anticipated to provide lucrative opportunities for the market expansion.

Furthermore, the intermittent catheters market is segmented on the basis of product, indication, category, end user, and region. On the basis of product, the market is bifurcated into uncoated intermittent catheter and coated intermittent catheter. The coated intermittent catheters segment is further classified into antimicrobial, hydrophilic, and others. By indication, the market is categorized into urinary incontinence, spinal cord injuries, general surgery, and others. According to category, it is fragmented into female length catheter, male length catheter, and kid length catheter. Depending on end user, it is classified into hospitals, ambulatory surgical centers, and medical research centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

COVID-19 Impact

Coronavirus (COVID-19) was discovered in December 2019 in Hubei province of Wuhan city in China. The disease is caused by a virus called as severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted among humans.

Following its discovery in Wuhan, the disease rapidly spread to other parts of the globe. Moreover, this virus causes various symptoms in patients ranging from common to serious symptoms. For instance, common symptoms include fever, dry cough, and fatigue. However, serious symptoms include difficulty in breathing or shortness of breath, chest pain or pressure, and loss of speech or movement. Furthermore, the virus had significant fatality potential in geriatric population. On March 11, 2020, the World Health Organization declared it as pandemic. In addition, only a few vaccines have received emergency approvals for COVID-19 prevention. Thus, social distancing was observed as the most important measure to limit the spread of this disease. Furthermore, to maintain social distancing, various countries across the globe adopted nationwide lockdowns.

By Category

Female Length Catheters segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

The overall impact of COVID-19 remains negative on the global intermittent catheters market. As intermittent catheters are used for surgical applications, they are expected to be impacted to some extent due to the temporary postponement of various elective surgeries, as governments and authorities seek to ensure the availability of resources for COVID-19 patients. In an effort to reduce the strain on the healthcare system, limit disease transmission, and conserve personal protective equipment (PPE), various governments have provided guidelines on elective surgeries. As of March 18, 2020, the U.S. Centers for Medicare & Medicaid (CMS) announced that all elective surgeries as well as nonessential medical, surgical, and dental procedures would be delayed, which led to decline in demand for intermittent catheters products in the market.

By Product Segment Review

By product type, the intermittent catheter market is divided into coated intermittent catheter and non-coated intermittent catheter. Coated intermittent catheter dominated the market segments, owing to the introduction of antimicrobial intermittent catheter. These catheters aid in minimizing infections caused during the catheterization process. For instance, the Magic 3 intermittent antibacterial catheter by C.R. Bard is coated with nitrofurazone, which is an antibacterial agent that is applied on the outer surface of the catheter, and has been proven to be effective against a variety of pathogens

By Product

Uncoated Intermittent Catheters segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Indication Segment Review

On the basis of indication, intermittent catheter market is segmented into urinary incontinence, spinal injuries, surgery, and others. The urinary incontinence accounted the largest market share in 2020, due to rise in urinary infections & diseases and rise in geriatric population across the globe in 2020.

By Indication

Urine Incontinenece segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

End User Segment Review

Depending on end user, intermittent catheter market is divided into hospitals, clinics, ambulatory care centers, and others. The hospital segment was the highest contributor to the market in 2020, and this trend is expected to continue during the forecast period. Increase in the number of patients suffering from urinary tract infections, urethral obstructions, renal diseases, rise in cases of tumors in the urinary system or reproductive organs, and the fast-growing elderly population drive the growth of the segment.

By End User

Hospital holds a dominant position in 2020 and continue to maintain lead in the forecast year

Region Segment Review

Region wise, it is classified into North America, Europe, Asia-Pacific, LAMEA. North America dominated the market in 2020, accounting for a major share and is expected to witness substantial growth in the future attributing to the increase in awareness about urine infections, presence of well-established healthcare facilities, and availability of highly skilled doctors in the region. Asia-Pacific is expected to register the fastest CAGR from 2021 to 2030. The product demand in the region is driven owing to the prevalence of BPH, spinal cord injury, and urinary tract infection (UTI) . UTI is one of the most prevalent infectious diseases in this region. It is associated with significant morbidity and mortality rates, particularly in hospitals, and puts a substantial financial burden on the community.

By Region

North America holds a dominant position in 2020 and continue to maintain lead in the forecast year

The key players operating in the global intermittent catheter market includes Adapta Medica, B. Braun Melsunge, Becton, Dickinson and Company, Coloplast, Convatec, Cure Medical, Hollister, Hunter Urology, Pennine Healthcare, and Teleflex.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the intermittent catheter market, and the current trends &future estimations to elucidate imminent investment pockets.

- It presents a quantitative analysis of the market from 2021 to 2030 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the market.

Intermittent Catheter Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Indication |

|

| By Category |

|

| By End Users |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

According to CXO, intermittent catheter market is projected to witness significant rise in the future, owing to increase in incidences of urinary continence and the introduction of hydrophilic intermittent catheters. This market is largely segregated, and several manufacturers focus on offering advanced products that provide enhanced flexibility and durability. Technological innovation is adopted as a principal strategy to increase the bargaining power of buyers.

Intermittent catheters have emerged as promising medical devices, which curb disabilities associated with urinary incontinence. Rise in adoption of hydrophilic and antimicrobial intermittent catheters has supplemented the market growth. Such increase in adoption has been witnessed over the years to control the injuries and infections caused by uncoated intermittent catheters to the urethra. Moreover, the introduction of many reimbursement schemes in countries such as Australia, Japan, and South Korea has fueled the adoption and sales of intermittent catheters. However, peer pricing among the competitors and availability of alternatives to intermittent catheters restrain the growth of the market.

The total market value of Intermittent Catheters Market is $3,319.32Million in 2030

The forecast period in the report is from 2021 to 2030

The market value of Intermittent Catheters in 2020 was 2,031.87 million in 2020

The base year for the report is 2020

Yes, Intermittent Catheters Market companies are profiled in the report

The top companies that hold the market share in Intermittent Catheters Market are Adapta Medica, B. Braun Melsunge, Becton, Dickinson and Company, Coloplast, Convatec

No, there is no value chain analysis provided in the Intermittent Catheters Market report

The key trends in the Intermittent Catheters Market arerise in urinary incontinence cases and increase in geriatric population globally. Increase in the number of patients suffering from urinary tract infections, urethral obstructions, renal diseases, rise in cases of tumors in the urinary system or reproductive organs, and the fast-growing elderly population drive the growth

Loading Table Of Content...