Intermodal Freight Transportation Market Research, 2032

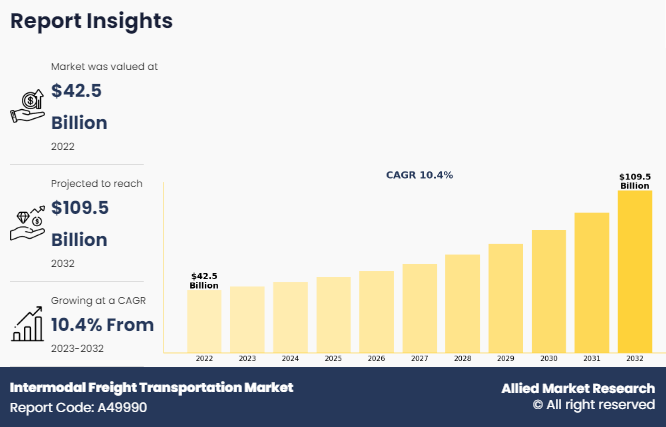

The global Intermodal Freight Transportation Market Size was valued at $42.5 billion in 2022, and is projected to reach $109.5 billion by 2032, growing at a CAGR of 10.4% from 2023 to 2032.

Intermodal transportation is the movement of products via two or more modes of transportation, such as trucks, trains, and cargo ships, without the commodities being handled directly during transit. The items are loaded into a container, which is then moved from one method of transportation to another, such as ships, trucks, trains, or planes, without the contents being removed and placed in another unit.

Intermodal transportation is a useful choice for shippers looking to cut transportation expenses. For example, a shipper loads products into a container on a truck chassis, transfers it to an intermodal ramp, and then sends the container by train. Intermodal transportation helps to reduce traffic congestion on highways by transferring a major amount of goods transportation to rail or water.

Key Market Developments

In February 2024 - Logistics companies Danser Group, Swissterminal, and DP World joined forces for freight transport on the Rhine. In their cooperation, they collectively aim to establish a sustainable, reliable, and flexible inland shipping service from the border triangle (Switzerland, France, Germany) to the West Sea ports.

In January 2024 - Bison Transport announced a partnership with Canadian Pacific Kansas City (CPKC) focusing on intermodal transportation services along the north-south corridor connecting Canada, the U.S., and Mexico.

In November 2023 - Lowell-based carrier J.B. Hunt Transport Services Inc., Fort Worth, Texas-based BNSF Railway and Mexico carrier Grupo Mexico Transports collaborated on a new intermodal service between Central Mexico and the U.S. border in Texas.

Market Dynamics

Technology and Efficiency in Logistics

Intermodal transportation is undergoing a transformation driven by technological advancements such as the Internet of Things (IoT), Artificial Intelligence (AI), and blockchain. These improvements are altering the logistics landscape by bringing features such as real-time tracking, intelligent route planning, and increased transparency throughout the supply chain. Companies use IoT sensors implanted in shipments to monitor cargo status in real time, allowing for proactive decision-making and minimizing disruptions. AI algorithms optimize route planning by analyzing large datasets, considering aspects such as weather, traffic patterns, and delivery deadlines, resulting in more efficient and cost-effective transportation. Furthermore, blockchain technology assures data integrity and security by providing an immutable transaction record, hence increasing stakeholder confidence and transparency. Automation is critical in optimizing intermodal operations, decreasing manual errors, and speeding processes, resulting in improved overall reliability and customer satisfaction. Furthermore, data analytics takes advantage of the quantity of information generated by interconnected systems, allowing businesses to obtain important insights into performance indicators and find areas for improvement. As multimodal transportation evolves, technological developments will play a significant role in driving operational efficiency, cost-effectiveness, and sustainability in the business.

Intermodal transport has undergone significant advancements driven by technology integration, resulting in enhanced efficiency and effectiveness in logistics operations. Key developments include real-time tracking facilitated by IoT sensors in containers and vehicles, utilized by companies like Maersk Line and CMA CGM to monitor cargo location and conditions. Route optimization powered by AI algorithms, employed by UPS and FedEx, minimizes fuel consumption, and reduces transit times. Blockchain ensures transparency and security in data sharing among supply chain stakeholders, as demonstrated by IBM and Walmart. In addition, automation in warehousing, exemplified by Amazon Robotics and KUKA AG, streamlines order fulfillment processes through robotic inventory management and packing systems. These advancements underscore how technology drives efficiency and transparency in intermodal transport, with industry leaders like Maersk Line, UPS, IBM, and Amazon at the forefront of innovation.

Infrastructural Development

Intermodal transportation offers numerous benefits, including increased efficiency and reduced environmental impact. However, it also encounters significant challenges. Substantial infrastructural investments are required to support seamless connectivity between different transport modes, ensuring smooth cargo transfer. In addition, effective coordination among various modes of transportation is essential to optimize the intermodal network and minimize transit times. Moreover, regulatory discrepancies across regions pose hurdles that impede the seamless flow of goods. Furthermore, while technology integration holds promise for enhancing intermodal transport efficiency, there is a need for further development in tracking and optimizing systems to fully realize its potential. Overcoming these challenges requires collaborative efforts from stakeholders across the transportation sector to foster innovation and implement comprehensive solutions.

Collaboration Across Borders

In recent months, the intermodal freight transportation market has witnessed several strategic partnerships and collaborations, signaling significant opportunities for growth and expansion. Bison Transport's partnership with Canadian Pacific Kansas City (CPKC) in January 2024 emphasizes the importance of intermodal services along the north-south corridor, connecting Canada, the U.S., and Mexico. This initiative highlights the potential for seamless cross-border transportation solutions, catering to the increasing demand for efficient logistics across North America. Similarly, the collaboration between J.B. Hunt Transport Services Inc., BNSF Railway, and Grupo Mexico Transports in November 2023 aims to establish a new intermodal service linking Central Mexico to the U.S. border in Texas, tapping into emerging trade routes and enhancing connectivity in the region. Furthermore, the alliance formed by Danser Group, Swiss terminal, and DP World in February 2024 for freight transport on the Rhine underscores the importance of inland shipping as a sustainable and flexible mode of transportation. This collective effort aims to strengthen connectivity from the border triangle of Switzerland, France, and Germany to West Sea ports, providing efficient logistics solutions and fostering economic growth in the region. Overall, these collaborations present promising opportunities for the intermodal freight transportation market to meet evolving customer needs, expand its geographical reach, and drive innovation in the global supply chain landscape.

Segmental Overview

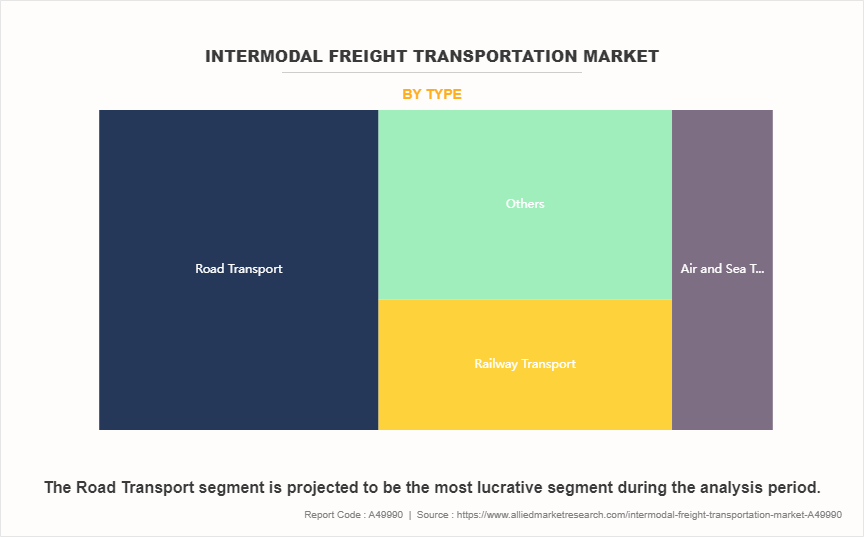

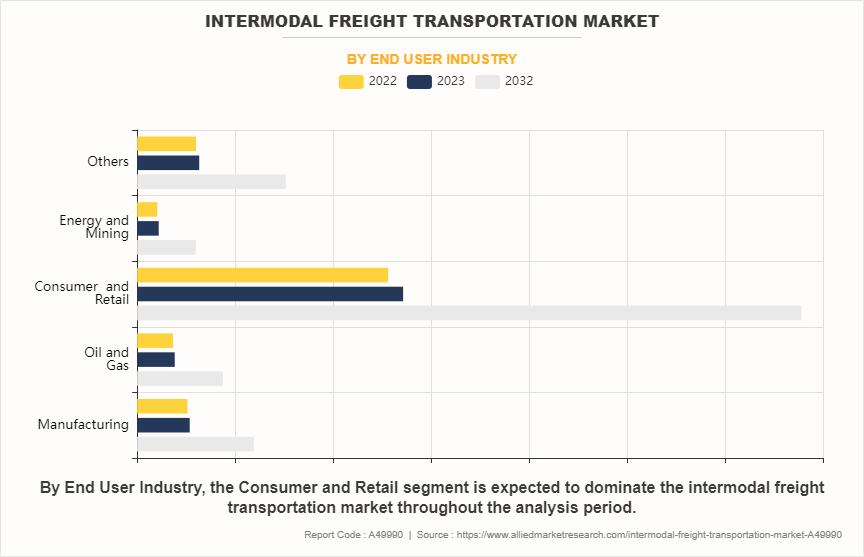

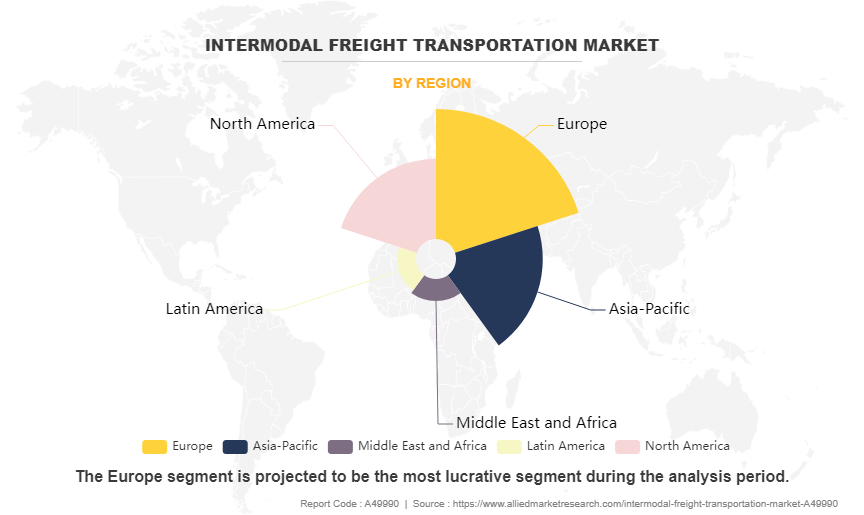

The intermodal freight transportation market is segmented on the basis of type, end user industry, and region. On the basis of type, the market is classified into railway transport, road transport, inland, waterway transport, pipeline transport, maritime transport, air transport, and others. On the basis of end user industry, the market is divided into manufacturing, oil & gas, consumer & retail, aerospace & defense, energy & mining, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Type

Based on type, the road transportation segment had the dominating Intermodal Freight Transportation Market Share in the year 2022 and is likely to remain dominant during the forecast period. Its dominance is projected to persist through the Intermodal Freight Transportation Market Forecast period. This segment's prevalence stems from its adaptability, extensive network, and efficiency in connecting various modes of transportation. Road transport offers flexibility in reaching remote locations and urban centers alike, catering to diverse logistical needs. Moreover, advancements in technology and infrastructure further enhance its competitive edge. As economies continue to grow and trade volumes increase, the demand for intermodal freight transportation via road is expected to escalate. Thus, the road transportation sector is poised to maintain its stronghold in the intermodal freight market, driving significant developments and shaping future logistics landscapes.

By End User Industry

Based on end user industry, the Consumer & Retail segment dominated the global Intermodal Freight Transportation Market Sizein the year 2022 and is likely to remain dominant during the forecast period. This sector's ascendancy signifies the substantial reliance on intermodal transportation for the movement of consumer goods and retail merchandise across various regions. Factors such as the growing demand for efficient supply chain solutions, expanding e-commerce activities, and increasing consumer preferences for diverse products have propelled the Consumer & Retail segment to the forefront. Additionally, advancements in technology and infrastructure improvements have further facilitated the seamless integration of intermodal transportation within the consumer and retail landscape, reinforcing its position as the primary driver of Intermodal Freight Transportation Market Growth. As such, stakeholders anticipate sustained momentum in this segment, underpinned by evolving Intermodal Freight Transportation Industry dynamics and the pursuit of enhanced operational efficiencies.

By Region

Based on region, the European region dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. This dominance is attributed to Europe's extensive transportation infrastructure, efficient logistics networks, and strategic geographical location, facilitating seamless intermodal transportation across various modes such as road, rail, and sea. Additionally, favorable government policies promoting intermodal connectivity and sustainability initiatives further bolster Europe's position in the Intermodal Freight Transportation Industry. As a result, key players in the intermodal freight transportation sector continue to invest in the region to capitalize on its lucrative opportunities and meet the growing demand for efficient and sustainable freight movement. This trend underscores Europe's significance as a pivotal hub for intermodal transportation on the global stage.

Competition Analysis

The report focuses on the growth prospects, restraints, and opportunities of the global market. The study provides Porter’s five forces analysis to understand the impact of several factors such as competitive intensity of competitors, bargaining power of suppliers, threat of substitutes, threat of new entrants, and bargaining power of buyers of the market. The intermodal freight transportation market analysis for key players includes Air Ground Xpress, FedEx, CMA CGM Group, Hub Group, Inc., Berkman Forwarding, J.B. Hunt Transport, Inc., STG USA., CLX Logistics, LLC., LOGISTEED, Ltd., and Kuehne+Nagel.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the intermodal freight transportation market analysis from 2022 to 2032 to identify the prevailing intermodal freight transportation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intermodal freight transportation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global intermodal freight transportation market trends, key players, market segments, application areas, and market growth strategies.

Intermodal Freight Transportation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 109.5 billion |

| Growth Rate | CAGR of 10.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By End User Industry |

|

| By Type |

|

| By Region |

|

| Key Market Players | Air Ground Xpress, LOGISTEED, Ltd., Kuehne+Nagel Inc., Hub Group, Inc., j.b. hunt transport, inc., FedEx, berkman forwarding, CMA CGM Group, CLX Logistics, LLC., STG USA. |

Analyst Review

Strategic alliances and technology advancements are reshaping the intermodal freight transportation market, presenting stakeholders with both problems and opportunity. The collaboration between Maersk and IBM, which is expected to result in the release of TradeLens in 2021, demonstrates the industry's commitment to embracing blockchain technology to improve supply chain visibility and efficiency. This collaboration emphasizes the rise in need of safe and transparent documentation throughout global supply chains, laying the groundwork for future digitization projects.

Meanwhile, innovations such as Amazon Air's development plans from 2021 to 2024 show a determined attempt to strengthen multimodal logistics networks. Amazon plans to improve package delivery operations by investing in new cargo planes, regional air hubs and expanding its Prime Air fleet, bolstering its position as a prominent participant in the intermodal freight transportation sector. However, the growth of autonomous technologies, as demonstrated by Tesla's debut of the Semi Truck in 2022 and TuSimple's driverless trucks in 2023, presents both opportunities and difficulties to traditional freight carriers. While these advances promise to transform efficiency and safety, they also need massive infrastructure and regulatory changes.

Furthermore, strategic partnerships like the collaboration between Union Pacific and JB Hunt in 2022, and FedEx's partnership with Nuro in 2024, underscore the industry's focus on seamless intermodal solutions. By combining rail and trucking capabilities or leveraging robotics for last-mile logistics, these partnerships aim to address the evolving demands of modern supply chains, emphasizing efficiency, reliability, and sustainability. However, challenges such as regulatory hurdles, cybersecurity concerns, and the need for substantial infrastructure investments impede the full realization of the potential benefits associated with these partnerships and innovations, requiring proactive industry collaboration and government support to navigate effectively.

The global intermodal freight transportation market was valued at $42,451.8 million in 2022, and is projected to reach $109,542.7 million by 2032, registering a CAGR of 10.4% from 2023 to 2032.

From 2023-2032 would be forecast period in the market report.

$42,451.8 million is the market value of intermodal freight transportation market in 2022.

2022 is base year calculated in the intermodal freight transportation market report.

Air Ground Xpress, FedEx, CMA CGM Group, Hub Group, Inc., Berkman Forwarding, J.B. Hunt Transport, Inc., STG USA., CLX Logistics, LLC., LOGISTEED, Ltd., and Kuehne+Nagel are the top companies hold the market share in intermodal freight transportation market.

Loading Table Of Content...

Loading Research Methodology...