IoT Market Overview

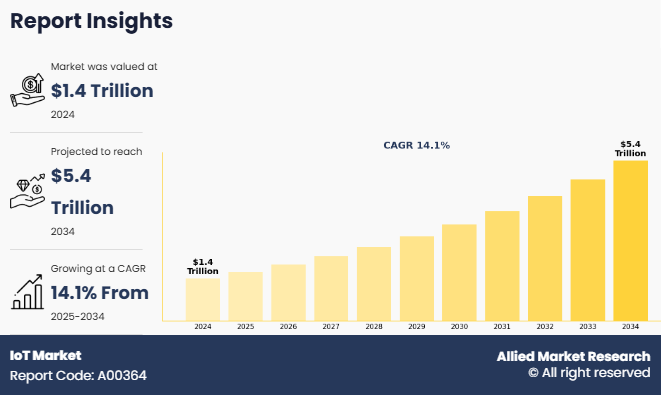

The global IoT market was valued at USD 1,425.58 billion in 2024, and is projected to reach USD 5,372.46 billion by 2034, growing at a CAGR of 14.1% from 2025 to 2034. The growth of the Internet of Things (IoT) market is majorly driven by the development of wireless networking technologies, increase in cloud platform adoption, and advent of advanced data analytics & data processing drives. However, data security & privacy concerns and high implementation & maintenance cost of IoT devices restrain the growth of the market globally. On the contrary, reduction in cost of connected devices and IoT traction among SMEs is expected to create lucrative opportunities for the expansion of the global IoT market.

Key Market Insights

- By Component, the solution segment held the largest share in the IoT market for 2024.

- By Application, the industrial segment held the largest share in the IoT market for 2024.

- By Deployment, the cloud segment held the largest share in the IoT market for 2024.

- Region-wise, North America held the largest market share in 2024. However, LAMEA is expected to witness the highest CAGR during the forecast period.

Market Size & Forecast

- 2034 Projected Market Size: USD 5,372.46 Billion

- 2024 Market Size: USD 1,425.58 Billion

- Compound Annual Growth Rate (CAGR) (2025-2034): 14.1%

What is the Internet of Things (IoT)

Internet of Things (IoT) in IoT industry describes the network of physical objects that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet. These devices range from ordinary household objects to sophisticated industrial tools. Over the past few years, IoT has become one of the most important technologies of the globe. IoT devices share data that is collected by IoT sensors or other edge devices where data is sent to the cloud server to be analyzed. These devices further communicate with other related devices and act on the information they receive from one another. The devices do most of the work without human intervention, although people can interact with the devices.

IoT Market Segment Review:

The Internet of Things (IoT) market is segmented into component, deployment, application, and region. By component, the market is divided into solution and service. Depending on deployment, it is segregated in to on-premise and cloud. On the basis of application, it is bifurcated into commercial and industrial. The industrial segment is further divided into retail & ecommerce, energy & utilities, healthcare, transportation & logistics, manufacturing and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the solution segment attained the highest market share in 2024 in the IoT market, as solutions include essential hardware and software products like sensors, devices, and platforms that are needed to build and run IoT systems. These solutions are the core components that enable connectivity, data collection, and real-time decision-making, making them crucial for industries such as manufacturing, healthcare, and smart cities. Meanwhile, the services segment is projected to be the fastest-growing segment during the forecast period, owing to rise in demand for managing, maintaining, and upgrading their IoT systems. As IoT networks become more complex, the demand for consulting, support, cloud integration, and cybersecurity services continues to rise.

Region-wise, North America attained the highest IoT market share in 2024 and emerged as the leading region in the IoT market due to North America's strong technology infrastructure, high internet penetration, and leading tech companies that are early adopters of IoT solutions. The region also benefits from high investments in smart homes, industrial automation, and connected healthcare, which further accelerates the market growth. On the other hand, LAMEA is projected to be the fastest-growing region during the IoT market forecast period owing to increasing digital transformation initiatives, expanding internet connectivity, and rising adoption of smart technologies across various industries. Countries like Brazil, South Africa, and the United Arab Emirates are heavily investing in IoT technologies, which is driving strong market growth in the region.

Which are the Top IoT companies

The following are the leading companies in the IoT market. These players have adopted various strategies to increase their market penetration and strengthen their position in the IoT industry.

- Amazon Web Services, Inc.

- Robert Bosch GmbH

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Siemens AG

- Telefonaktiebolaget LM Ericsson

- ABB Ltd.

- Qualcomm Technologies, Inc.

- Zebra Technologies Corp

- Thales

- Advantech Co., Ltd.

- Hitachi, Ltd.

- Samsung SDS Co Ltd

- Huawei Cloud Computing Technologies Co., Ltd.

- Alphabet (Google Inc.)

- Armis Inc.

What are the Recent Developments in the IoT Market

In April 2025, Toshiba launched its first overseas business for the ifLink open IoT platform in Thailand, marking a significant step in its global IoT expansion. The platform allows users to easily connect IoT devices and web services using simple "if-then" logic, making it accessible even to those with limited technical knowledge. In partnership with Toshiba Asia Pacific (Thailand), the initiative aims to support local manufacturing through cost-effective IoT solutions and hands-on training, helping drive digital transformation in the region.

In March 2025, Verizon expanded its Global IoT Orchestration platform by partnering with Singtel and Skylo, enhancing its global IoT connectivity capabilities. Singtel joins as a Mobile Network Operator (MNO) partner, enabling Verizon customers to activate IoT devices across the Asia-Pacific region. Meanwhile, Skylo brings satellite IoT connectivity, extending Verizon’s reach to remote areas where terrestrial networks are limited. These services are integrated into Verizon’s ThingSpace IoT management platform, allowing centralized control of IoT deployments in up to 200 global territories.

In February 2025, Globalstar launched a two-way satellite IoT solution using its LEO (Low Earth Orbit) satellite constellation, marking a major advancement from its previous one-way tracking systems. The new solution, powered by the RM200M module, supports low-power, low-latency, and globally available communication for applications like fleet tracking, asset monitoring, pipeline telemetry, and precision agriculture. It integrates GNSS, Bluetooth, an accelerometer, and an application processor, enabling edge computing and future cellular support. This innovation positions Globalstar to compete aggressively in the expanding satellite IoT industry.

What are the Top Impacting Factors

Key Market Driver

Developments of wireless networking technologies

Interconnected devices, which are commonly known as edge computing devices or IoT, are gaining high traction in the global market. IoT market growth is being driven by the increasing use of IoT devices produced by a wide range of vendors, which in turn is expanding the IoT market size across various industries. IoT primarily exploits standard protocols and networking technologies. However, the major enabling technologies and protocols of IoT are radiofrequency identification (RFID), near-field communication (NFC), low-energy Bluetooth, low-energy wireless, low-energy radio protocols, LTE-A, and Wi[1]Fi-direct, which is expected to provide numerous IoT market opportunity for the market growth. These technologies support the specific networking functionality required in an IoT system in contrast to a standard uniform network of common systems. Moreover, the emergence of 5G technology is boosting the implementation of IoT, further accelerating Internet of Things market size.

The commercial success of any IoT is ultimately tied to its performance, which is dependent on how quickly it can communicate with other IoT devices, smartphones, and tablets. With 5G, data transfer speed will increase significantly, as 5G will be 10 times faster than current LTE networks. This increase in speed will allow IoT devices to communicate and share data significantly faster, contributing to IoT market demand. Furthermore, top companies are investing in wireless networking technologies by partnering and product launching. For instance, in March 2021, Nokia partnered with Microsoft Corporation to develop 4G and 5G private wireless networks, which are designed for enterprises. The collaboration will combine Nokia’s Cloud RAN (vRAN) technologies with Microsoft Azure cloud-based services to drive end-user digital environment such as artificial intelligence and IoT, creating additional IoT market insights.

Restraints

High cost associated with the implementation and maintenance of IoT platform

Efficient use of IoT solutions requires high investments by end users. In addition, initial investments for IoT are high for small- to medium-sized organizations in industry verticals such as healthcare and retail. However, the manufacturing sector finds it difficult to afford such systems, as they have limited budgets and cannot justify long payback periods. In addition, implementation and installation efforts and time of these software can take as long as several months, which is a major concern as some organizations cannot operate for such long periods.

In addition, support, maintenance, and further customization in platform and hardware costs are high, which restrains the IoT market growth. Moreover, the costs of these services can be more than the price of the platform. Additionally, lack of internal IT expertise and skillful worker for operating these IoT platforms is further acting as the key deterrent factor of the global IoT market.

Opportunity

Increase in use of IoT among SMEs

The necessity for digital transformation, better connectivity, and declining device costs have all contributed to a notable increase in IoT adoption among SMEs in recent years. IoT is being used more and more by SMEs to improve operations, cut expenses, and obtain real-time information, contributing to the IoT market size. One prominent example is PrecisionPro, a tiny Iowan agricultural company that optimized irrigation in 2022 by deploying Internet of Things-based soil sensors and weather monitoring devices. Within a year, this resulted in a 30% decrease in water consumption. Similar to this, in 2023, UK-based logistics SME SmartFleet Solutions implemented GPS-enabled IoT trackers and fuel monitoring devices, which improved delivery times and cut gasoline costs by 18%. Similarly, in 2023, UK-based logistics SME SmartFleet Solutions implemented GPS-enabled IoT trackers and fuel monitoring devices, which improved delivery times and cut gasoline costs by 18%. By integrating IoT into their machinery in late 2021, FlexiMek, an Indian SME, was able to reduce downtime by 25% in just six months and enable predictive maintenance in the manufacturing sector.

Moreover, the adoption is expected to increase further as governments and tech companies offer reasonably priced IoT solutions and support, such as Cisco's IoT Control Center for SMBs, which was introduced in 2023. IoT is increasingly essential for SMEs hoping to prosper in the digital age; it is no longer a luxury for big businesses.

What are the Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the iot market analysis from 2024 to 2034 to identify the prevailing iot market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the IoT market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global iot market trends, key players, market segments, application areas, and market growth strategies.

IoT Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 5.4 trillion |

| Growth Rate | CAGR of 14.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 256 |

| By Application |

|

| By Deployment |

|

| By Component |

|

| By Region |

|

| Key Market Players | Hewlett Packard Enterprise Development LP, Amazon Web Services, Inc., Intel Corporation, Qualcomm Technologies, Inc., Siemens AG, Zebra Technologies Corp, Armis Inc., Hitachi, Ltd., Robert Bosch GmbH, Oracle Corporation, Samsung SDS Co., Ltd., ABB Ltd., Advantech Co., Ltd., Alphabet (Google Inc.), SAP SE, IBM Corporation, Telefonaktiebolaget LM Ericsson, Huawei Cloud Computing Technologies Co., Ltd., Thales, Microsoft Corporation |

The IoT market is expected to witness notable growth due to developments of wireless networking technologies and increase in cloud platform adoption for deployment of IoT.

The IoT market is projected to reach $5,372.46 billion by 2034.

The IoT market is estimated to grow at a CAGR of 14.1% from 2025 to 2034.

The key players profiled in the report include Amazon Web Services, Inc., Robert Bosch GmbH, Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Siemens AG, Telefonaktiebolaget LM Ericsson, ABB Ltd., Qualcomm Technologies, Inc., Zebra Technologies Corp, Thales, Advantech Co., Ltd., Hitachi, Ltd., Samsung SDS Co Ltd, Huawei Cloud Computing Technologies Co., Ltd., Alphabet (Google Inc.), and Armis Inc.

The key growth strategies of IoT market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...