Interventional Cardiology And Peripheral Vascular Devices Market Research, 2030

The global interventional cardiology and peripheral vascular devices market size was valued at $17,960.8 million in 2020, and is projected to reach $41,900.3 million by 2030, growing at a CAGR of 8.5% from 2021 to 2030. Interventional cardiology deals with the catheter-based approach for the treatment of structural heart diseases. If a catheter-based approach is used in the region of arms or legs, then it is included under peripheral vascular devices.

The demand for healthcare services has significantly increased in the past few years owing to rise in global population. Furthermore, the number of patients suffering from cardiological and vascular diseases has consistently increased owing to surge in geriatric population. This has fueled the demand for devices used in treatment of cardiological and vascular diseases. Furthermore, interventional cardiology and peripheral vascular devices can be used for treatment of various heart and artery ailments. Also, advancements in technology have positively influenced the interventional cardiology and peripheral vascular devices market share. In addition, the rapid growth of healthcare industry in developing countries, positively influence the interventional cardiology and peripheral vascular devices market growth.

According to U.S. Department of Health & Human Services, heart diseases are a leading cause of death in U.S., as 1 in every 4 deaths is associated with heart diseases. Furthermore, Coronary heart disease is the most common type of heart disease in U.S. that killed 360,900 people in 2019.Furthermore, according to Centers for Disease Control and Prevention, an entity of U.S. Department of Health & Human Services, as of 2021, 6 in every 10 U.S. adults have a chronic disease and 4 in every 10 U.S. adults have two or more chronic diseases. This significantly increases the use of interventional cardiology and peripheral vascular devices for treatment of cardiovascular diseases. Furthermore, the healthcare infrastructure in developing countries has expanded rapidly. For instance, according to India Brand Equity Foundation, by 2022, the Indian healthcare infrastructure is expected to reach a value of US$ 349.1 billion and by 2025.

The novel coronavirus has rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic has increased the highlighted the importance of government healthcare facilities, thereby increasing healthcare spendings across the globe. Furthermore, the number of COVID-19 cases is expected to reduce in the near future as the vaccine for COVID-19 is introduced in the market. This has led to the reopening of interventional cardiology and peripheral vascular devices manufacturing facilities at their full-scale capacities. This is expected to help the interventional cardiology market to recover by the start of 2022. After COVID-19 infection cases begin to decline, companies involved in manufacturing of interventional cardiology and peripheral vascular devices must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Furthermore, the capabilities of interventional cardiology and peripheral vascular devices to effectively treat cardiovascular ailments propel the growth of the interventional cardiology market. Also, increasing awareness among masses regarding various medical treatments positively influences the market. In addition, the advancements in healthcare facilities of developing countries is one of the major interventional cardiology and peripheral vascular devices market opportunities.

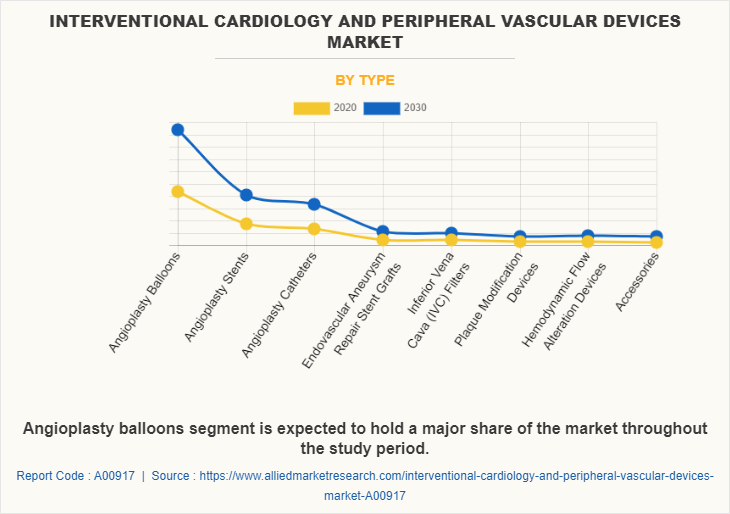

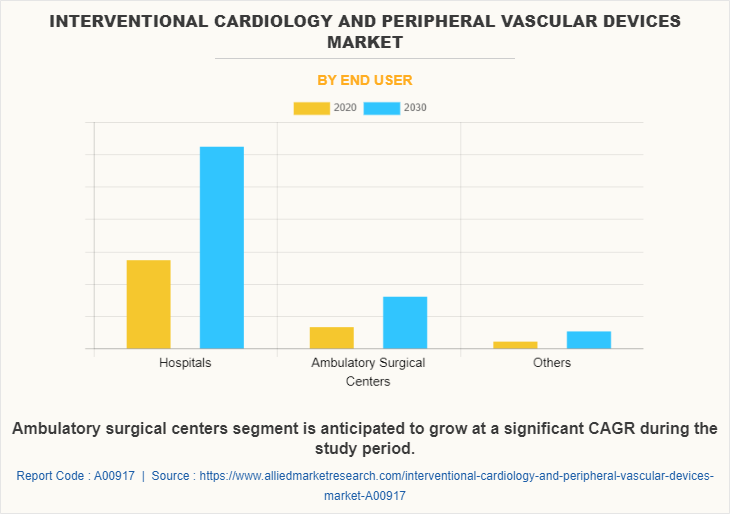

The interventional cardiology and peripheral vascular devices market is segmented on the basis of product, end user, and region. By product, the market is categorized into angioplasty balloons, angioplasty stents, angioplasty catheters, endovascular aneurysm repair stent grafts, inferior vena cava (IVC) filters, plaque modification devices, hemodynamic flow alteration devices, and accessories. By end user, it is segmented into hospitals, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to increase in population and rise in spending of healthcare facilities.

Competition Analysis

Key companies profiled in the interventional cardiology and peripheral vascular devices market report include Abbott Laboratories, B. Braun Melsungen AG, Becton, Dickinson and Company, Biotronik SE & Co. KG, Boston Scientific Corp., Cardinal Health Inc., Cook Medical, Koninklijke Philips N.V., Medtronic plc., and Terumo Corporation.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging interventional cardiology and peripheral vascular devices market trends and dynamics.

- In-depth interventional cardiology and peripheral vascular devices market size analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the interventional cardiology and peripheral vascular devices market size is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive interventional cardiology and peripheral vascular devices market analysis of all the regions is provided to determine the prevailing opportunities.

- The global interventional cardiology and peripheral vascular devices market forecast analysis from 2021 to 2030 is included in the report.

- The key players within interventional cardiology and peripheral vascular devices industry are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the interventional cardiology and peripheral vascular devices industry.

Interventional Cardiology and Peripheral Vascular Devices Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | B. Braun Melsungen AG, Biotronik SE & Co. KG, Cook Group, Abbott Laboratories, Boston Scientific Corporation, Cardinal Health Inc., Koninklijke Philips N.V., Medtronic plc, Becton, Dickinson and Company., Terumo Group |

Analyst Review

The interventional cardiology and peripheral vascular devices market has witnessed significant growth in past few years owing to rapid growth of healthcare infrastructure across the globe and increased spending on healthcare facilities in developing countries.

The rise in global population has created a demand for healthcare facilities across the globe. Surge in number of patients suffering from various cardiovascular diseases has fueled the use of interventional cardiology and peripheral vascular devices. Furthermore, technological advancements have significantly enhanced the effectiveness of interventional cardiology and peripheral vascular devices in treatment of a wide range of heart and artery disorders. Moreover, increased awareness among masses has resulted in regular health checkups and has positively influenced the industry.

Moreover, supportive government initiatives and rapid growth of healthcare infrastructure in emerging countries provide lucrative growth opportunities for the interventional cardiology and peripheral vascular devices market.

Abbott Laboratories, Biotronik SE & Co. KG and Koninklijke Philips N.V. are some of the top companies to hold the market share in interventional cardiology and peripheral vascular devices.

In 2020, $17,960.8 million is the estimated industry size of interventional cardiology and peripheral vascular devices.

North America is the largest regional market for interventional cardiology and peripheral vascular devices.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Product launch is key growth strategy of interventional cardiology and peripheral vascular devices industry players.

Loading Table Of Content...