BPO represents an efficient and strategic option for insurance companies that are trying to flourish in these tumultuous times. If implemented properly, it helps them in reducing costs, survive any economic uncertainty and most importantly set a concrete stage for future expansion and growth. Insurance companies frequently use outsourcing for different aspects of their operations ranging from business processes which include claims handling and underwriting to various other systems that reinforce those functions. Policy servicing is another area where immediate business benefits can be achieved.

Advantages of a robust BPO model include rationalized delivery model, standardized business processes and a commercialized approach to customer retention and operations. In the past decade or so, enterprises engaged in the insurance sector have been appreciating the importance of flexible and agile outsourcing models. By leveraging the potential of business process outsourcing (BPO), insurance companies have drastically minimized operating expenditures along with streamlining back-office operations.

One significant growing trend and opportunity for the insurance BPO market in Japan is insurers are increasingly recognizing the importance of focusing on core competencies such as underwriting, risk assessment, and product development. By outsourcing non-core processes like policy administration, claims handling, and customer support to BPO providers, insurers can concentrate on strategic initiatives and improve their competitiveness in the market. This trend opens up opportunities for cost reduction, improved customer experience, and enhanced operational efficiency.

The insurance industry experiences fluctuations in demand due to various factors such as seasonality, market conditions, and regulatory changes. BPO services offer scalability and flexibility to handle such fluctuations efficiently. Insurers can scale up or down their operations as per business needs, without the need for significant investments in infrastructure or human resources.

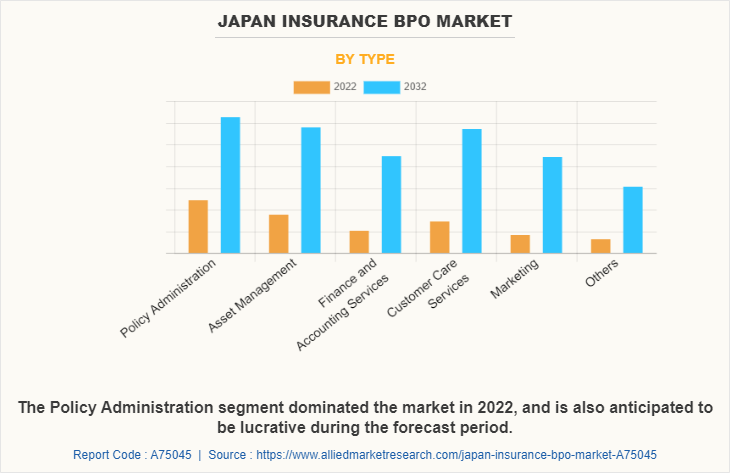

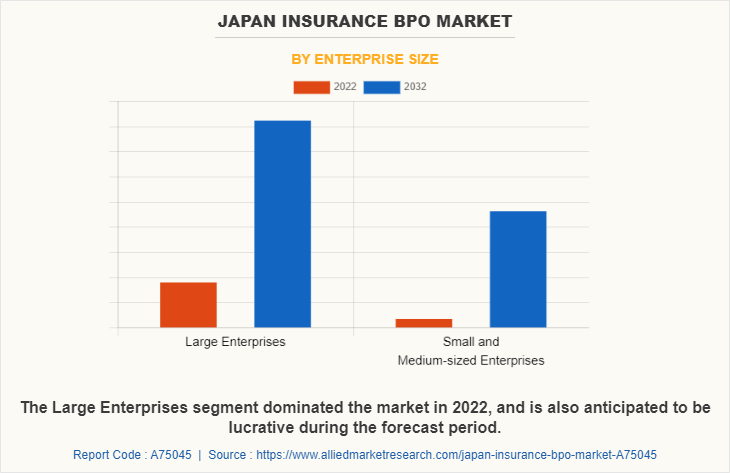

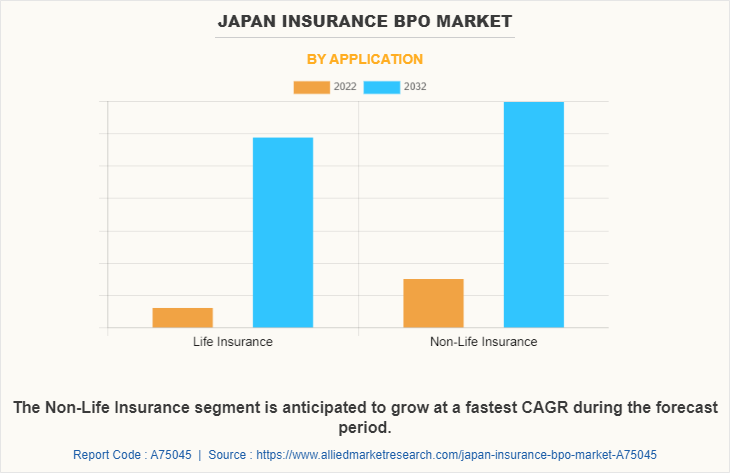

The insurance BPO market is segmented based on type, enterprise size and application. By type segment is classified into asset management, policy administration, finance and accounting services, customer care services, market and others. By enterprise size the market is bifurcated into large enterprise and small and medium-sized enterprises. On the basis of application, the insurance BPO market is categorized into non-life insurance and life insurance market. And key players covered in this research study are Cognizant, Infosys, Accenture, Xerox, Wipro, Genpact, CGI Group, HCL Technologies, Capgemini, and DXC Technology.

In Japan insurance business process outsourcing market is expanding due to favorable government regulations as labor regulations play an essential role in the BPO industry, as they govern employment practices and workers' rights. In Japan, BPO companies must comply with labor laws, which include regulations related to wages, working hours, vacation entitlements, social security contributions, and employee protections. Compliance with these regulations ensures fair and ethical employment practices within the insurance BPO sector.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Japan Insurance BPO Market analysis from 2022 to 2032 to identify the prevailing Japan Insurance BPO industry opportunities.

- The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

- In-depth analysis of the Japan Insurance BPO Market growth assists to determine the prevailing market opportunities.

- The report includes an analysis of the regional as well as Japan Insurance BPO Market share, key players, market segments, application areas, and market growth strategies.

- Major countries are mapped according to their revenue contribution to the Japan Insurance BPO Market size.

- Identify key players and their strategic moves in the Japan Insurance BPO Market forecast.

- Assess and rank the top factors that are expected to affect the growth of the Japan Insurance BPO Market outlook.

Japan Insurance BPO Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 82 |

| By Type |

|

| By Enterprise Size |

|

| By Application |

|

| Key Market Players | Fujitsu Ltd., NTT Data Corporation, Accenture Japan Ltd., Hitachi Solutions Ltd., HCL Technologies Ltd., Infosys Ltd., CGI Japan Corporation, Concentrix Japan Corporation, Wipro Ltd., Capgemini Japan Ltd. |

The Japan Insurance BPO Market is estimated to reach $1.5 billion by 2032

NTT Data Corporation, Fujitsu Ltd., Accenture Japan Ltd., Hitachi Solutions Ltd., Concentrix Japan Corporation, Capgemini Japan Ltd., Wipro Ltd., CGI Japan Corporation, HCL Technologies Ltd., Infosys Ltd. are the leading players in Japan Insurance BPO Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in japan insurance bpo market.

3. Assess and rank the top factors that are expected to affect the growth of japan insurance bpo market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the japan insurance bpo market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Japan Insurance BPO Market is classified as by type, by enterprise size, by application

Loading Table Of Content...

Loading Research Methodology...