Keratin Products Market Research, 2035

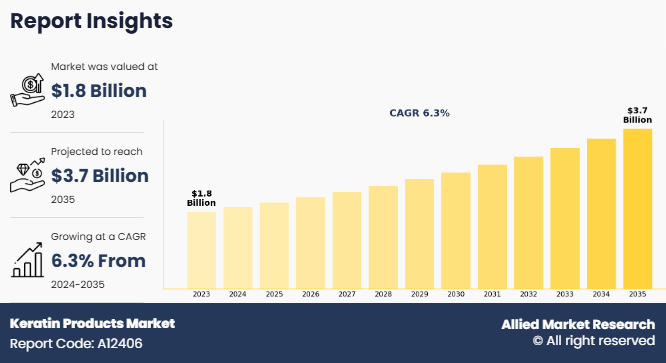

The global keratin products market size was valued at $1.8 billion in 2023, and is projected to reach $3.7 billion by 2035, growing at a CAGR of 6.3% from 2024 to 2035. Keratin is a fibrous protein. It is naturally found in hair, nails, and the outer layer of the skin. It is derived from various natural sources such as animal sources and human hair. In the beauty and personal care industry, keratin is widely used in cosmetics and hair care products. Moreover, various products are formulated with keratin to leverage its strengthening and smoothing properties for hair care. These products include shampoos, conditioners, masks, serums, and treatments designed to enhance the health, appearance, and manageability of hair.

MARKET DYNAMICS

Rise in usage of natural & organic products, product innovation & diversification, and increase in awareness of sustainability & ethical consideration are some of the major factors drive the keratin products market expansion. Moreover, the integration of technology in product formulation along with availability of personalized & customized keratin products are expected to boost market growth.

The need for keratin products has expanded globally. The continuous change in the lifestyle of people has made them more conscious about their skin and hair care. Moreover, males have started using keratin products more in their daily lives, which drives the expansion of the global market for keratin products.

The market for keratin products has expanded globally owing to this shift in lifestyle. Furthermore, there is rise in demand for products that provide nourishing, healing, and rejuvenating hairs as consumers have become more aware of the effects of aging, lifestyle choices, and environmental factors on their skin & hair.

Moreover, professional salon services that use keratin, such as straightening and smoothing, greatly boost the growth of the keratin product market. Consumers seek keratin-based treatments as they want manageable, frizz-free hair, and salon-quality results. Furthermore, consumers who seek practical and efficient solutions have been drawn to the continuous advancements in product formulas, which include the creation of sophisticated keratin-based products. Moreover, ongoing R&D initiatives to enhance the efficacy, applicability, and adaptability of keratin products boost the keratin products market growth.

However, the market for keratin products has observed notable limitations as a result of formulation issues and complicated constituent sources. It is challenging to formulate products owing to the complex structure of keratin and its compatibility with other substances. It takes significant approaches to achieve stability and efficacy in different formulations such as shampoos and conditioners. Furthermore, maintaining a consistent and aesthetically pleasant texture in line with customer tastes adds a layer of difficulty. The procurement of keratin from various sources, such as plant-based or animal byproducts, has issues with sustainability and quality. In addition, product legality and consumer trust depend on maintaining the quality and purity of keratin sources and addressing sustainability issues.

The safety problems and regulatory compliance restrain the market for keratin products. Certain chemicals are used in the chemical composition and processing of keratin, raising concerns about product safety and regulatory compliance. Moreover, regulatory agencies have placed restrictions on the amount of formaldehyde that is found in various keratin-based treatments due to health concerns. Safety problems are further compounded by allergic reactions to proteins or other components in keratin products. In addition, complying with international standards and regulations on animal testing has further complicated global market access. Furthermore, the market has been threatened by concerns about precise labeling, open communication, and navigating the ambiguity of international legislation.

The innovation in keratin product compositions is possible due to ongoing research and development in beauty science. Businesses are engaged in seeking novel methods of keratin extraction and processing to increase its usefulness in a range of applications in various industrial products. Furthermore, the market for keratin products has additional growth potential owing to its product variety. Moreover, leaving aside the typical hair care treatment, companies have expanded their product line to include keratin-infused shampoos, conditioners, styling products, and even skincare goods. Through this growth, businesses have been able to reach a wider audience and satisfy the various demands of customers looking for all-inclusive beauty and personal care products.

Furthermore, the availability of specialized formulations to address various hair kinds and conditions has made it possible to take a more customized approach. In addition, forging ahead with men's grooming items has allowed them to take advantage of the expanding market for male personal care. Thus, owing to this product diversification, a wide range of consumers have access to comprehensive and creative solutions that are in line with their changing preferences.

SEGMENTAL REVIEW

The keratin products market is segmented on the basis of product type, application, form, and region. On the basis of product type, it is categorized into hydrolyzed keratin, oxidized keratin, keratins (IFP: Intermediate Filament Proteins), and wool keratin. On the basis of application, it is divided into hair beauty salon, skin cream, nutraceutical, pet care & supplement, medical, active pharmaceutical ingredient, and others. On the basis of form, it is classified into powder, liquid, and tablet. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

BY PRODUCT TYPE

As per product type, the hydrolyzed keratin segment dominated the keratin products market in 2023 and is anticipated to maintain its dominance throughout the forecast period. Products such as shampoos, conditioners, masks, and treatments contain hydrolyzed keratin as a component. Hydrolyzed keratin contains hydrating and skin conditioning qualities that are utilized in skin care products. Moreover, certain amino acids are sourced from hydrolyzed keratin for some nutraceutical compositions. In addition, rise in disposable income and the globalization of beauty standards have resulted in the growth of highend, luxurious hair care products to reduce frizz and improve hair texture. The demand for hydrolyzed keratin that is obtained from natural sources such as wool and feathers has increased. Along with that, the number of people seeking natural and organic ingredients in personal care products has also witnessed a rise. Furthermore, the need for keratin products with hydrolyzed keratin formulation to improve hair health and appearance has been fueled by rise in awareness of the significance of hair health and the desire for strong, lustrous, and manageable hair.

BY APPLICATION

As per application, the hair beauty salon segment dominated the keratin products market in 2023 and is anticipated to maintain its dominance throughout the forecast period. A variety of services for hair styling, haircuts, coloring, and other beauty treatments are provided by the hair salon facilities. It also provides chemical operations such as relaxers or perms, the installation of hair extensions, treatments to improve the health of the hair, and styling for special events. The number of hair and beauty shops has grown significantly in the last few years. Salons that offer a variety of hair treatments have become popular. This is characterized by the rise in trend of accepting a variety of beauty standards, which has pushed hairdressers to offer a large selection of hair textures, kinds, and styles. In addition, keratin treatments have become more popular in hair salons as clients seek them out for hair that is frizz-free and smoother, which has raised demand for keratin-infused products. Furthermore, hair and beauty clinics capitalize on the surge in demand for keratin treatments by selling products laced with keratin.

BY FORM

As per form, the powder segment dominated the keratin products market in 2023 and is anticipated to maintain its dominance throughout the forecast period. Powdered keratin is available and is used in dietary supplements, hair care products, and the cosmetic & personal care industries. It is widely utilized in formulations for cosmetics, such as hair care and skincare items. In recent years, keratin powder has been used more often in formulations for skincare, makeup, and dietary supplements. This is attributed to the rise in hair care and beauty trends that highlight shiny, healthy hair and glowing skin, which raises consumer demand for keratin powder-containing products. Furthermore, the growing demand for keratin powder that are sourced from natural sources, such as wool, feathers, or plants, satisfies consumer preferences for pure and eco-friendly products.

BY REGION

As per region, Asia-Pacific dominated the keratin products market in 2023 and is anticipated to maintain its dominance throughout the forecast period. Asia-Pacific is analyzed across South Korea, Japan, China, India, and the rest of the region. Growth in the female workforce, middle-class consumer development, and urbanization have all fostered the adoption of convenience-oriented lifestyles, which has increased demand for keratin products in both developing and developed economies. To grow their consumer base and broaden their geographic reach, numerous businesses are investing in the Asia-Pacific keratin products market. The Asia-Pacific region has witnessed an increase in demand for keratin products due to rise in awareness of natural and organic ingredients. Surge in use of keratin products in nations such as China and India drives the growth of the keratin products market in Asia-Pacific.

COMPETITION LANDSCAPE

The major players in the keratin products industry include UMP Keraglow, Sigma Aldrich, Tri K Industries, Sia Fluffy Unlimited, Keraplast Technologies, Inc., Croda International Plc, Greentech Biochemicals Co., Limited, BASF SE, Active Concepts, LLC, and BioOrganic Concepts.

Manufacturers in the keratin products market are always creating new products and formulae to meet the change in requirements of their customers. They make R&D investments to create novel combinations of ingredients with enhanced functionality, stability, selectivity and create new applications for keratin products.

Manufacturers of keratin products are frequently working with innovative manufacturers in the beauty industry and regulatory organizations to develop new products. Manufacturers are expected to increase their capacities, pool their knowledge, and create novel solutions through these collaborations.

Manufacturers have improved their production capacity and cost cutting, which are expected to involve both investment in new production facilities and renovating current ones to keep up with the rise in keratin products market demand. Furthermore, manufacturers of keratin products are anticipated to merge with or buy other businesses to broaden their product lines, get access to new markets or technologies, or do both at the same time. Manufacturers are expected to benefit from merging and acquiring businesses by expanding their product lines, gaining a larger keratin products market share, and enhancing their economies of scale.

SOME KEY DEVELOPMENTS IN THE MARKET

- In October 2023, Croda International Plc announced to open a greenfield site in GuangZhou, China, that will become its new multi-purpose production facility for fragrances and beauty active ingredients in China.

- In January 2025, TRI-K Industries opened a state-of-the-art proteins production plant in Derry, NH, expanding its capacity for proteins, peptides, and specialty actives. This facility enhances the company’s R&D capabilities, ensuring sustainable and innovative beauty solutions. By maintaining US-based manufacturing, TRI-K strengthens supply chain reliability while offering high-priority ingredients like natural peptides and modern preservatives.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the keratin products market analysis from 2023 to 2035 to identify the prevailing keratin products market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the keratin products market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global keratin products market trends, key players, market segments, application areas, and market growth strategies.

Keratin Products Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 3.7 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2035 |

| Report Pages | 250 |

| By Product Type |

|

| By Application |

|

| By Form |

|

| By Region |

|

| Key Market Players | Croda International Plc, Sigma Aldrich, Sia Fluffy Unlimited, UMP Keraglow, Greentech Biochemicals Co., Limited, Tri K Industries, Keraplast Technologies, LLC, Active Concepts, LLC, BioOrganic Concepts, BASF SE |

Analyst Review

According to the perspective of top-level CXOs, innovation is the key to growth of the keratin products market, in terms of value sales. Rise in demand for various keratin products among customers makes way for manufacturers to produce herbal or organic skin care products along with affordable prices and eco-friendly packaging. CXOs further added that the rise in consciousness regarding physical appearance among individuals as well as working-class professionals propels the growth of the keratin products market.

Use of natural ingredients such as keratin in hair care and skin care products to reduce the harmful effects of products drives the growth of the keratin products market globally. The industry has recently observed an emerging trend of men using keratin products in their daily lives. The use of keratin products by men is expected to eventually increase and in turn, supplement the growth of the global keratin products market.

Moreover, keratin products have witnessed prominent adoption in developing countries, such as India, owing to swift changes in consumer lifestyle, increase in disposable income, and surge in need for keratin products derived from ethical sourcing. Furthermore, increase in penetration of various online portals globally and rise in the number of offers or discounts attract a large consumer base to purchase skin care keratin products through online channels. Moreover, online sales channels have increased consumer reach, making them a key source of revenue for many companies.

The global keratin products market was valued at $1,776.2 million in 2023, and is projected to reach $3,679.2 million by 2035, registering a CAGR of 6.3% from 2024 to 2035.

The forecast period in the Keratin products market report is 2024 to 2035.

The base year calculated in the Keratin products market report is 2023.

The top companies analyzed for the Keratin products market report are UMP Keraglow, Sigma Aldrich, Tri K Industries, Sia Fluffy Unlimited, Wellnature Biotech, Croda International Plc, Greentech Biochemicals Co., Limited, BASF SE, Active Concepts, LLC, and BioOrganic Concepts.

The hydrolyzed keratin segment is the most influential segment in the Keratin products market report.

Asia-Pacific holds the maximum market share of the Keratin products market.

The company profile has been selected on the basis of key developments such as partnership, product launch, merger and acquisition.

The market value of the Keratin products market in 2023 was $1,776.2 million.

Loading Table Of Content...

Loading Research Methodology...