Kitchen Lighting Market Research, 2031

The global kitchen lighting market size was valued at $12.6 billion in 2021, and is projected to reach $25.7 billion by 2031, growing at a CAGR of 7.7% from 2022 to 2031.

A light fixture is an electric device containing an electric lamp that provides illumination which is known as kitchen lighting. Several types of kitchen lighting include pendant lighting, under-cabinet lighting, island lighting and track lighting.

Currently, traditional lighting fixtures are being replaced with smart lighting fixtures owing to the integration of Internet of Things. Kitchen lighting fixtures are illumination solutions that are created to provide customized lighting. Based on consumer requirements, some of the kitchen lighting fixtures available in the market are architectural, recessed, tracks, under cabinets, pendants, chandeliers, ceilings, wall sconces, desks, floors, and table lamps. Considering these factors, the kitchen lighting market is expected to experience gradual growth in future.

The surge in demand for under cabinet lighting fixtures in the kitchen segment and the adoption of energy-efficient kitchen ceiling lights products such as LEDs & OLEDs are some of the major factors that are expected to drive the kitchen lighting industry during the forecast period. Increasing penetration of hanging lights for kitchen and smart lighting fixtures is also expected to fuel the residential lighting fixture kitchen lighting market forecast. COVID-19 pandemic has adversely impacted the kitchen lighting market as a huge workforce of enterprises across the globe is working from home. This has led to a decline in advertising expenditure, which, in turn, reduced the demand for kitchen lighting products.

Top Impacting Factors

Significant factors impacting the growth of the kitchen lighting market include a rise in demand for technological advancements and innovation in kitchen lighting and increasing consumer preference towards decorative lighting. However, safety and security concerns for IoT controlled lights may hamper market growth. Furthermore, higher adoption rate of energy-efficient lights to save cost and power provides lucrative kitchen lighting market opportunity.

Segment Overview

The kitchen lighting market analysis is segmented into product type, channel and region.

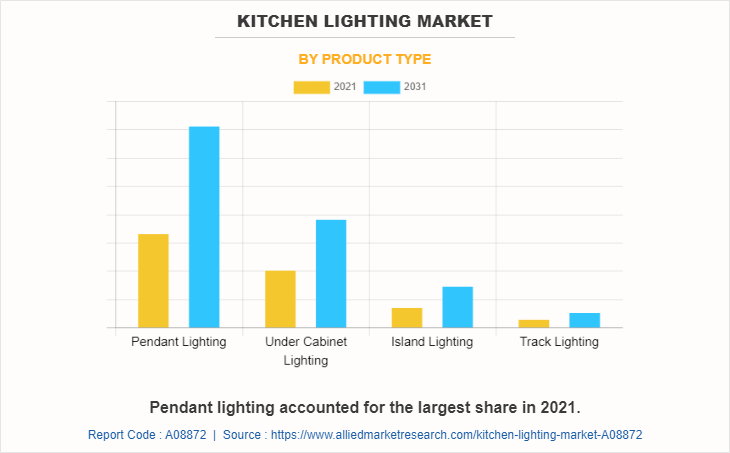

By product type, the market is classified into pendant lighting, under cabinet lighting, island lighting and track lighting. The pendant lighting segment dominated the digital holography industry, in terms of revenue in 2021, and is expected to follow the same trend during the forecast period.

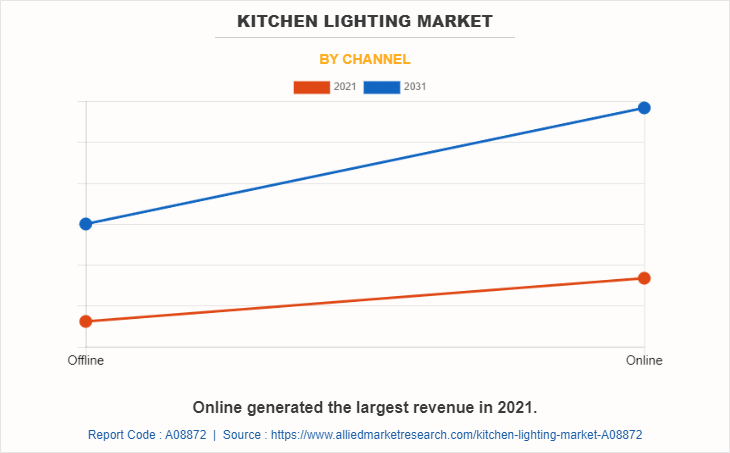

By channel, it is divided into online and offline. The online channel dominated the kitchen lighting industry, in terms of revenue in 2021, and is expected to follow the same trend during the forecast period. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA along with their prominent countries. Asia-Pacific was the highest revenue contributor to the market.

Competitive Analysis

Competitive analysis and profiles of the key kitchen lighting market outlook market leaders include General Electric, Hubbell.Inc, Acuity Brands, Inc., Lutron Electronics Co., Inc, Osram lighting private limited, Signify Holding, Kichler lighting, Koninklijke Philips N.V., Panasonic Corporation, and Havells India Ltd. These key players adopt several strategies such as new product launch and development, acquisition, partnership and collaboration and business expansion to increase the kitchen lighting market share during the forecast period.

Key Developments/ Strategies

- In October 2022, Havells India Limited, launched elegant range of lighting products called 'Glamtubes'. The new range of LED battens comes in six different shapes inspired by six cosmic and heavenly elements and offers a mix of cutting-edge technology and creativity that offers an expression of elegance and sophistication.

- In November -2021, Panasonic Corporation launched a new addition to its smart home ecosystem. The company has unveiled a new Smart Wi-Fi LED Bulb. According to the company, the core benefit of the 9 watt Smart Wi-Fi LED Bulb is its multi-colour lighting option and automated scheduling functions.

Country Analysis

Country-wise, the China acquired a prime share in the kitchen lighting market in the Asia Pacific region and is expected to grow at a significant CAGR during the forecast period of 2019-2031.China holds major market share in terms of revenue generation from the sale of pendant lighting because of the higher presence of presence of the kitchen lighting manufacturers.

In Europe, the UK, dominated the kitchen lighting market growth, in terms of revenue, in 2021 and is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's kitchen lighting with a notable CAGR, advancement of technology across industry verticals is a crucial factor that contributes to the growth of the kitchen lighting and thus creates lucrative growth opportunities for the kitchen lighting market in Germany.

In North America, U.S. is expected to emerge as a significant market for the kitchen lighting industry, The U.S. market had the largest share in 2020 and is anticipated to hold onto that position during the projected period. Widespread product adoption has been facilitated by the presence of renowned industry leaders like GE Lighting, Acuity Brands, and Cree, Inc. The development of the building sector affects the lighting industry significantly. The installation of cost-effective lighting systems is a result of the increase in new construction projects.

By LAMEA region, the Latin America country garner significant market share in 2021 In Latin America, the rise in demand for enhanced technologies in countries, such as Dubai, Abu Dhabi, Oman, Saudi Arabia, and others, these factors are expected to reshape the growth of kitchen lighting market in the Middle East.

Key Benefits for Stakeholder

- This study comprises an analytical depiction of the market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global kitchen lighting market forecast is quantitatively analyzed from 2021 to 2031 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the kitchen lighting market.

- The report includes the market share of key vendors and global kitchen lighting market trends.

Kitchen Lighting Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 25.7 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 297 |

| By Product Type |

|

| By Channel |

|

| By Region |

|

| Key Market Players | Hubbell.Inc, Lutron Electronics Co., Inc, Panasonic Corporation, OSRAM LIGHTING PRIVATE LIMITED, kichler lighting, Acuity Brands, Inc., Signify Holding, General Electric, Koninklijke Philips N.V., Havells India Ltd |

Analyst Review

The kitchen lighting market is expected to leverage high potential for the pendant lighting and under-cabinet lighting during the forecast period. The current business scenario is witnessing an increase in demand for kitchen lighting, particularly in developing regions such as China, India, and UK, owing to increase in advancements in kitchen lighting products. Companies in this industry are adopting various innovative techniques such as mergers and acquisition activities to strengthen their business position in the competitive matrix.

The major factor that drives the growth of the kitchen lighting market across Asia-Pacific is the immense digital needs of emerging economies with high populations in countries such as such as China, India, and Indonesia. In addition, Market players are looking to launch new products to strengthen their market position. For instance, in October 2021, Cree Lighting introduced the CPY500TM Series which is a completely new canopy lighting solution. This has constituted to benefit business canopies from its inventive and sleek design, which delivers visual comfort and energy efficiency. This lighting solution provides a sparkle for attracting the eye of consumers and creates a new form of comfort visual light. This is a key development for market growth.

Kitchen lighting products such as are gaining positive attention as growing use of LED lights instead of the traditional halogen bulbs is creating numerous market opportunities. Beneficial characteristics of LED lights such as low heat radiation, long life, and energy efficiency are fueling global LED lighting acceptance. Furthermore, the growth of end-user industries is also escalating significant demand for kitchen lighting. Key kitchen lighting market leaders profiled in the report include General Electric, Hubbell.Inc, Acuity Brands, Inc., Lutron Electronics Co., Inc, Osram lighting private limited, Signify Holding, Kichler lighting, Koninklijke Philips N.V., Panasonic Corporation, and Havells India Ltd.

The pendant lighting is the leading product type of kitchen lighting market.

The key trends of kitchen lighting include a rise in demand for technological advancements and innovation in kitchen lighting and increasing consumer preference towards decorative lighting.

Asia-Pacific is the largest regional market for kitchen lighting.

The global kitchen lighting market was valued at $12,557.0 million in 2021.

Osram lighting private limited, Havells India Ltd. and Koninklijke Philips N.V. are the top companies to hold the market share in Kitchen Lighting.

Loading Table Of Content...

Loading Research Methodology...