Kitchen Sinks Market Research, 2034

Market Introduction and Definition

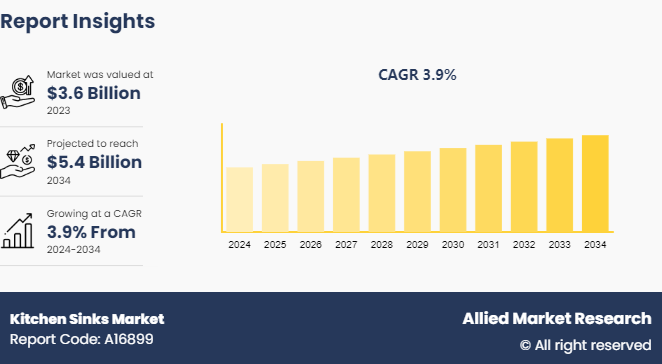

The global kitchen sinks market size was valued at $3.6 billion in 2023, and is projected to reach $5.4 billion by 2034, growing at a CAGR of 3.9% from 2024 to 2034. Kitchen sinks are essential fixtures installed in kitchen countertops, designed for washing dishes, food preparation, and cleaning tasks. They typically consist of a basin or multiple basins with a drain and are made from various materials, including stainless steel, ceramic, and composite. Kitchen sinks often feature a built-in faucet for running water and may include additional components like cutting boards or drying racks. They come in various sizes and configurations, such as single-basin, double-basin, or farmhouse styles, to suit different kitchen layouts and user needs. Kitchen sinks are crucial for maintaining hygiene and efficiency in the kitchen, facilitating everyday tasks from meal preparation to cleanup.

Key Takeaways

The kitchen sinks market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major kitchen sinks market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in demand for premium kitchen fixtures, rise in adoption of modular kitchens, and increase in consumer expenditure on home improvement and home décor products are expected to drive the kitchen sinks market growth during the forecast period. The rise in consumer income, surge in penetration of restaurants and other food service units and increase in the number of real estate projects across the globe are anticipated to propel the growth in the kitchen sinks market demand in the forthcoming years.

There is a rise in the number of hotels, restaurants, and cafes (HoReCa) as the industry is recovering rapidly after the pandemic. According to the report of the U.S. Department of Agriculture, full-service and fast-food restaurants are the two largest segments of the commercial foodservice market that accounted for about 69.3% of all food-away-from-home sales in 2022. In 2021, the food service and food retailing industries supplied about $2.39 trillion worth of food in the U.S. In 2022, the share of food-at-home expenditures was 43.8%, and food away from home was 56.2% going back to pre-pandemic levels after accounting for 51.1% in 2020. As a result, the recovery of food service industries in 2022 boosted demand for kitchen sinks, supporting market growth. A cloud kitchen uses a commercial kitchen for preparing food for delivery or takeout only, with no dine-in customers. Due to limited availability of space and the rising number of food delivery channels such as Swiggy and Zomato the cloud kitchen is rising and is expected to grow. All these factors are expected to help the market to grow.

Increasing urbanization is expected to result in the expansion of the building industry as major builders and constructors are developing new residential development projects to meet the need for housing from migrants. According to the United Nations Conference on Trade and Development in 2010, 51.6% lived in urban areas. By 2022, the share of the urban population increased to 56.9%. It is generally higher in the developed (79.7% in 2022) than in the developing world (52.3%) . Along with this, with the rise in urbanization, the number of people who are making their homes appealing and comfortable is expected to increase. Thus, owing to all these factors, the rise in urbanization will lead to the growth of the kitchen sinks market share.

However, the fluctuating prices of raw materials may hamper the growth of the kitchen sinks industry. Stainless steel is the major raw material for the manufacturing of kitchen sinks due to its durability, resistance, and reliability. The price of stainless steel has risen by around 130% in the previous six years. The rise in stainless steel prices will likely increase the cost of kitchen sinks, which could hinder market growth. Stainless steel is the primary material for manufacturing kitchen sinks, and the high prices may deter consumers from making purchases, leading to a slowdown in kitchen sinks market expansion.

Various steps are being taken by the players in the kitchen sink market. For instance, the Kohler smart kitchen sink offers voice control, while Xiaomi’s Mensarjor kitchen sink offers smart dishwasher integration with high-frequency vibrations for cleaning vegetables and fruits. Internet of Things is a growing network of everyday objects that connects industrial machines to consumer home appliances which will help in sharing information and completing tasks while doing other chores. Along with this, the introduction of a portable sink by GoSun is also a great initiative that uses solar energy to pump water at 15 PSI, and can function as a portable handwashing station, and a source of clean drinking water. Such technological advancements by players will create an opportunity for the market growth.

E-commerce has boomed as a sales channel. ITU estimates that approximately 5.4 billion people or 67% of the world’s population were using the Internet in 2023. This represents an increase of 45% since 2018, with 1.7 billion people estimated to have come online during that period. The rising penetration of smartphone and internet users is expected to drive significant growth in e-commerce as a sales channel in the kitchen sinks market. Along with this, there is a rise in the number of online sales channels such as Amazon, Flipkart, and others. Such a rise in the e-commerce channel is expected to increase the sales of kitchen sinks during the forecast period since the rise in the number of internet users will result in rising awareness of the product to consumers.

Value Chain of Global Kitchen sinks Market

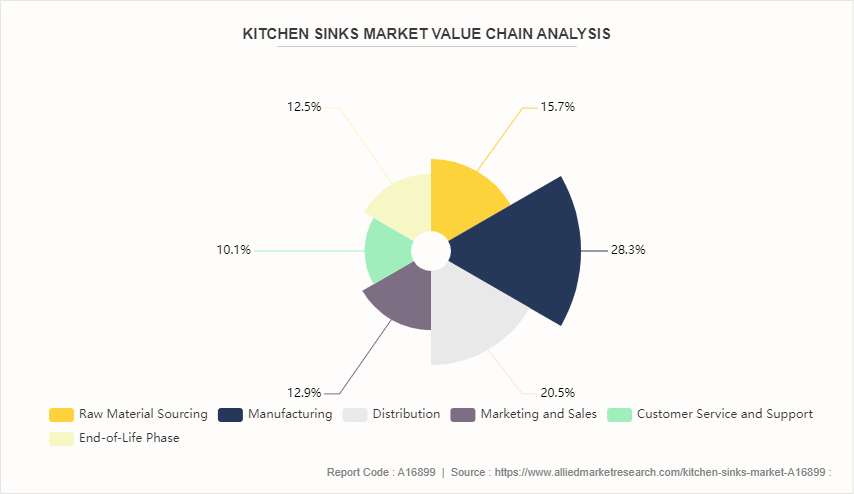

The value chain analysis of the kitchen sinks market consists of several stages, from raw material sourcing to consumer purchase. The process begins with the procurement of materials such as stainless steel, ceramic, or composite materials, which are then used in manufacturing. Manufacturing involves designing and producing sinks with features such as various basin configurations and integrated accessories. The sinks are then distributed through multiple channels, including wholesalers, retailers, and e-commerce platforms. Marketing and sales strategies play a crucial role in reaching potential buyers, highlighting features and benefits to drive demand. After the sale, customer service and support ensure consumer satisfaction and address any issues. The value chain concludes with the product’s end-of-life phase, which may involve recycling or disposal considerations. Each stage contributes to the overall value and competitiveness of kitchen sinks in the market.

Market Segmentation

According to the kitchen sinks market analysis, the market is categorized on the basis of material, installation, bowl, end user, and region. Depending on the material, it is segmented into metal and non-metal. The metal segment is further divided into stainless steel, copper, and others. The non-metal segment is further categorized into granite, fireclay, quartz, and others. By installation, the market is classified into drop-in/top mount, undermount, farmhouse/apron-front, and others. By bowl, the market is segmented into single, double, and multiple. Depending on the end user, the market is categorized into residential and commercial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In North America, major growth potentials driving the demand for kitchen sinks include the increase in trend of kitchen remodels and home renovations, which boost the need for modern and high-quality kitchen sink fixtures. The rise in popularity of custom and high-end kitchen designs in the U.S. and Canada has significantly contributed to market growth. Moreover, advancements in sink technology, such as integrated smart features and eco-friendly materials, are appealing to environmentally conscious consumers. In addition, the expansion of real estate development and new residential construction projects further supports the demand for innovative kitchen sinks across the region.

The rapid expansion of the kitchen sink market in the Asia-Pacific region is driven by several key factors. Urbanization and increase in residential construction in countries such as China and India have boosted demand for modern kitchen fixtures including kitchen sinks. In emerging economies such as Vietnam and Indonesia, there is a rise in preference for high-quality, stylish sinks, which has helped drive demand for kitchen sinks products. In addition, South Korea and Japan have seen increased focus on home renovations, driving the demand for contemporary designs in the kitchen sinks segment. Moreover, government initiatives promoting infrastructure development in the Philippines and Thailand have contributed to kitchen sinks market growth. Furthermore, the growing middle class in Malaysia and Singapore is also seeking upgraded kitchen amenities, further fueling the expansion of the kitchen sink market in the region.

Industry Trends:

Innovative materials have reshaped the kitchen sink market by enhancing durability, functionality, and aesthetics. Manufacturers are incorporating materials such as quartz composites, which offer superior resistance to scratches and stains, and stainless steel with advanced finishes for improved longevity and ease of maintenance. The introduction of fireclay and ceramic materials has also added a touch of elegance while providing robustness. In addition, new materials such as nano-ceramic coatings have made sinks more resistant to corrosion and discoloration. These advancements have not only extended the lifespan of kitchen sinks but also allowed for a wider range of design options, setting a new trend toward combining style with practicality.

Integration of smart technology has significantly influenced trends in the global kitchen sink market. Modern sinks feature touchless faucets with sensors for water flow control, enhancing convenience and hygiene. Smart sinks incorporate built-in LED lighting, automatic water temperature adjustments, and integrated filtration systems for improved functionality. Some models offer voice-activated controls and connectivity with home automation systems, which allows users to manage sink operations remotely. These innovations have streamlined kitchen tasks and promoted water conservation and energy efficiency. The rise of smart technology in kitchen sinks has driven consumer demand for high-tech, multifunctional home appliances, setting a new standard for convenience and efficiency in kitchen design.

Competitive Landscape

The major players operating in the kitchen sinks market include Delta Faucet Company, Huida Sanitary Ware Co., Ltd, JULIEN INC, Duravit AG, Elkay Manufacturing Company, Roca Sanitario, S.A, ACRYSIL Ltd, House of Rohl, Kohler Co., and Franke Management AG.

Other players in the kitchen sinks market include BLANCO America, Inc., Oliveri Solutions, Ruvati, Crown Products Limited, Teka Group, Moen Incorporated, Kraus USA, Hansgrohe SE, Astracast, ALVEUS, Schock GmbH, JOMOO Kitchen & Bath Co., Ltd., Leicht Kuchen AG, VIGO Industries, and so on.

Recent Key Strategies and Developments

In February 2024, Roca introduced its latest collection of sleek and minimalist sink designs, focusing on space-saving solutions for urban living environments?.

In September 2023, Franke announced a collaboration with top designers to develop customizable kitchen sink solutions, allowing customers to tailor sinks to their specific design preferences?.

In May 2023, Kohler unveiled its eco-friendly line of kitchen sinks, incorporating recycled materials and water-saving technologies, catering to environmentally conscious consumers?.

In August 2022, Elkay expanded its product line with stainless steel sinks to emphasize durability and modern aesthetics. The new range was introduced in response to growing demand from both residential and commercial sectors?.

In March 2022, Moen launched new sink designs with integrated smart features such as touchless faucets and water filtration systems, targeting tech-savvy consumers seeking convenience and efficiency in their kitchen.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the kitchen sinks market analysis from 2024 to 2034 to identify the prevailing kitchen sinks market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the kitchen sinks market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global kitchen sinks market trends, key players, market segments, application areas, and market growth strategies.

Kitchen Sinks Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 5.4 Billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 290 |

| By Material |

|

| By Installation |

|

| By Bowl |

|

| By End User |

|

| By Region |

|

| Key Market Players | JULIEN INC., Elkay Manufacturing Company, ROCA SANITARIO, S.A., Huida Sanitary Ware Co., Ltd, S.A, ACRYSIL Ltd, House of Rohl, LLC, Franke Management AG., Duravit AG, Kohler Co., Delta Faucet Company |

Upcoming trends in the global kitchen sinks market include sustainable materials, smart sink technology, multifunctional designs, and customized options.

The leading application of the kitchen sinks market is residential use, driven by home renovations and new construction projects.

By region, Asia-Pacific held the highest market share in terms of revenue in 2023.

The kitchen sinks market size was valued at $3.6 billion in 2023.

The major players operating in the kitchen sinks market include Delta Faucet Company, Huida Sanitary Ware Co., Ltd, JULIEN INC, Duravit AG, Elkay Manufacturing Company, Roca Sanitario, S.A, ACRYSIL Ltd, House of Rohl, Kohler Co., and Franke Management AG.

Loading Table Of Content...

Loading Research Methodology...