Knee Replacement Devices Market Research, 2031

The global knee replacement devices market size was valued at $8.8 billion in 2021, and is projected to reach $12.3 billion by 2031, growing at a CAGR of 3.4% from 2022 to 2031. Knee replacement also referred as knee arthroplasty is a type of joint replacement surgery which removes the damaged tissues from the knee and replaces with an artificial joint or implant. This type of surgery is used in the treatment of patients suffering from post-traumatic arthritis, osteoarthritis or rheumatoid arthritis. The implant used during surgical procedures is made up of materials such as metal alloys, ceramic material or plastic. The primary goal of knee replacement is to resurface the parts of the knee joint that are damaged and to relieve chronic knee pain among patients.

The growth of the knee replacement devices industry is majorly driven by rise in the prevalence of osteoarthritis and other joint diseases such as psoriatic arthritis and rheumatoid arthritis across the globe. For instance, according to a data published by the Arthritis Foundation, in 2020, it was estimated that around 14 million people in the U.S. have symptomatic knee osteoarthritis. In addition, according to European Journal of Rheumatology, it was estimated that there were 200 million people suffering from osteoporosis disorder out of which 30% were women in the U.S. and Europe in 2020. Thus, rise in number of patients with osteoporosis disorders has led to rise in demand for knee replacement surgery which significantly drives the market growth.

In addition, in May 2021, Conformis Inc., received the U.S. FDA approval for its Identity Imprint knee replacement system. This system is available in both cruciate retaining and posterior stabilized versions, which expands the range of options open for orthopedic surgeons as well as patients. Identity Imprint designed to fit the unique size, shape, and curvature of each patient’s anatomy. Thus, emphasis of market players to launch innovate implants is expected to boost the market growth.

In addition, rise in incidence of post-traumatic arthritis and increase in demand for minimally invasive surgical procedures are expected to propel the knee replacement devices market growth during the forecast period. For instance, according to the estimations of the Agency for Healthcare Research and Quality (AHRQ), more than 600,000 knee replacement surgeries are performed in the U.S every year. Furthermore, in August 2021, Zimmer Biomet, a global medical technology leader and Canary Medical, a medical data company received an FDA authorization for Persona IQ, the world’s first and smart knee replacement device for the treatment of total knee replacement surgery. This patient centric development approach by key players views toward the unmet needs for an effective treatment of severe knee osteoarthritis which drives the market growth.

The knee replacement devices market size has witnessed significant growth due to the advancements in surgical techniques such as robotics and navigation support system over the years. Moreover, increase in demand for cost-effective and customized knee implants encourages major manufactures to invest in R&D, thus creating future growth opportunities. In addition, rise in awareness regarding treatment of orthopedic disorders boosts the growth of the global knee replacement devices Market.

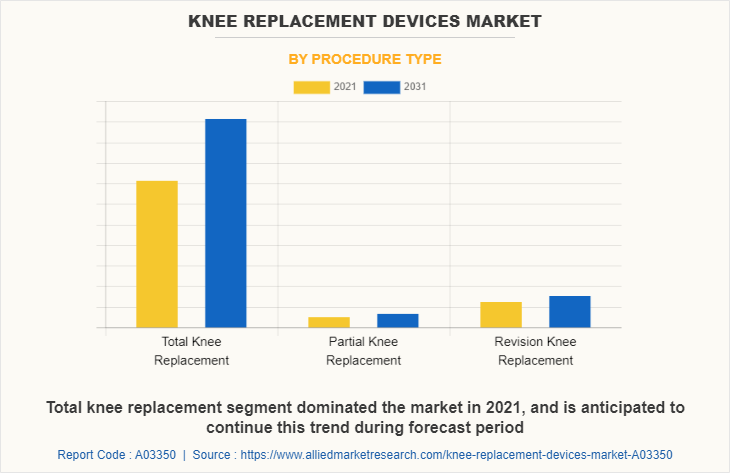

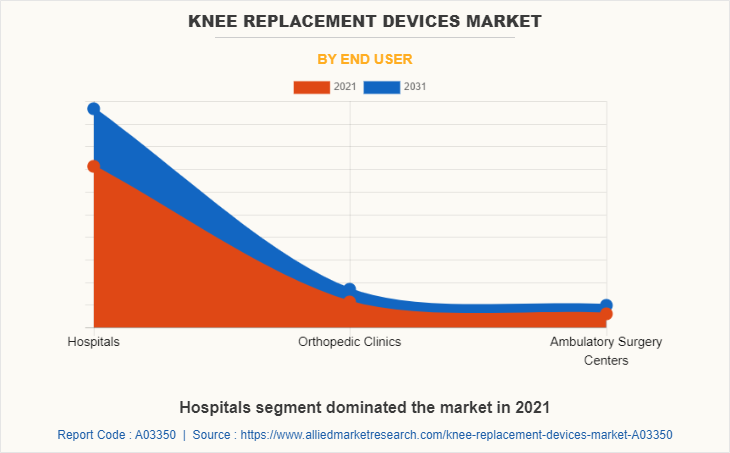

The knee replacement devices market is segmented into Procedure Type, Implant Type and End User. On the basis of procedure type, it is categorized into total knee replacement, partial knee replacement and revision knee replacement. The total knee replacement segment is further bifurcated into cemented and cementless. On the basis of implant type, the market is divided into fixed bearing, mobile bearing and others. On the basis of end user, it is divided into hospitals, orthopedic clinics and ambulatory surgery centers.

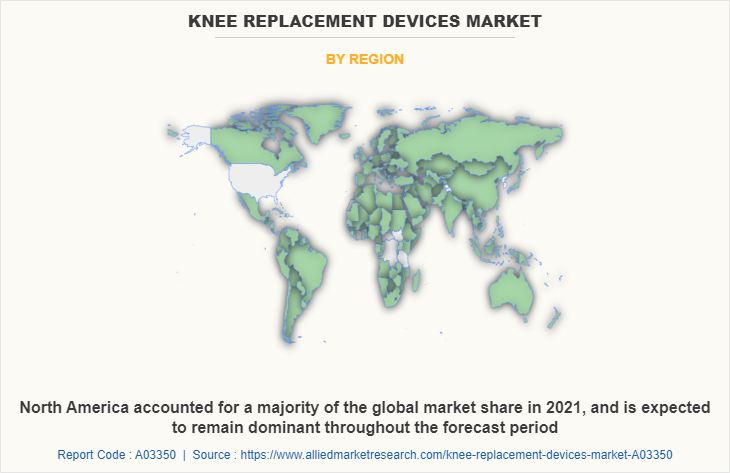

On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

Segment Review

On the basis of procedure type, the total knee replacement segment dominated the knee replacement devices market share in 2021, owing to rise in geriatric population and comparatively higher successful rate of total knee replacement procedures. However, the revision knee replacement segment is expected to witness considerable growth during the forecast period, owing to rise in demand for revision knee replacement and technological advancements in knee implants.

On the basis of implant type, the fixed bearing segment dominated the market in 2021 owing to its distinct clinical properties and comparatively lower cost. However, the mobile bearing segment is expected to register higher CAGR during the forecast period due to the superior range of motion provided by this type of implant which is suitable for young patients.

By Implant Type

Fixed bearing segment was the highest contributor to the market in 2021

On the basis of end user, the hospitals segment dominated the market in 2021 owing to presence of well trained professionals in hospitals, and increase in number of hospital admission. However, the ambulatory surgery centers segment is expected to project higher CAGR during the forecast period owing to increase in number of joint replacement surgeries performed in such facilities.

On the basis of region, North America contributed for the major Knee replacement devices market share in 2021, and is expected to continue to dominate during the forecast period owing to increase in number of product approvals by the U.S FDA. Moreover, growth in number of research activities to develop cost-effective and novel implants in developed countries of North America positively impacted the market growth. However, Asia-Pacific is expected to register the highest CAGR during knee replacement devices market forecast, owing to rise in number of patients suffering from severe arthritis and growing awareness regarding minimally invasive surgical procedures.

The key players that operate in the knee replacement devices industry include Aesculap Inc (B Braun Company), Zimmer Biomet, MicroPort Scientific, DePuy Synthes, Medacta, Stryker, Smith & Nephew, CONMED, Exactech, and ConforMis

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the knee replacement devices market analysis from 2021 to 2031 to identify the prevailing knee replacement devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the knee replacement devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global knee replacement devices market trends, key players, market segments, application areas, and market growth strategies.

Knee Replacement Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.3 billion |

| Growth Rate | CAGR of 3.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 337 |

| By Procedure Type |

|

| By Implant Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Exactech, Stryker, ConforMis, Aesculap Inc (B Braun Company), Zimmer Biomet, Medacta International, Smith and Nephew, CONMED, MicroPort Scientific, DePuy Synthes (J&J) |

Analyst Review

According to the CXOs, knee replacements is a surgical procedure involving the reconstruction or replacement of a knee joint.

The knee replacement procedure type includes, total knee replacement, partial knee replacement, and revision knee replacement. The knee replacement prosthetics are mainly made up from combination of metal, ceramic, and polyethylene.

Factors such as increase in prevalence of orthopedic diseases, advancements in knee replacement tools, and increase in adoption of navigated & robotics in knee replacement procedures drive the growth of the knee replacement devices market. In addition, increase in geriatric population and rise in healthcare expenditures of patients are expected to contribute the growth of the knee replacement devices market.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in the incidences of road accidents, strong presence of key players for manufacturing & developing of advanced knee implants, and well-established healthcare infrastructure in the region. However, the high cost of knee replacement and product recall can hamper market growth.

Rise in the prevalence of osteoarthritis and other joint diseases, increase in the incidence of road accidents and increase in number of new product launches are some major driving factors of the market

Among procedure types, total knee replacement is the leading segment in 2021.

North America is the largest regional market for Knee Replacement Devices

The estimated industry size of Knee Replacement Devices was $8,813.1 million in 2021

Stryker, Zinmer Biomet and DePuy Synthes are some of the major players in Knee replacement devices market

Loading Table Of Content...