Label Printing Software Market Research, 2031

The global label printing software market was valued at $565.2 million in 2021, and is projected to reach $936.2 million by 2031, growing at a CAGR of 5.2% from 2022 to 2031.

Factors that enhance label printing software market share include increase in adoption of big data platform, measures to minimize office paper use, lower operating costs, greater productivity, and flexibility to meet specific customer needs, and increase in information security. However, the market growth is significantly hampered by new and strategic collaborations and agreements as well as recurring costs. In addition, rise in cloud printing service usage and increased print security spending is anticipated to drive the growth of the managed print services market.

Label printing software optimizes and manages overall printing processes and devices in a cost-effective and efficient manner. Label printing software enables users to safeguard and share digital data across numerous mobile platforms from any location. It is frequently used to improve processes and regulate costs, mobility, security, and authentication. Systems for managing prints can be used by businesses to coordinate their printing resources. It lets businesses to manage, repair, and keep an eye on a variety of printing equipment like copiers, desktop printers, scanners, and more using a single application.

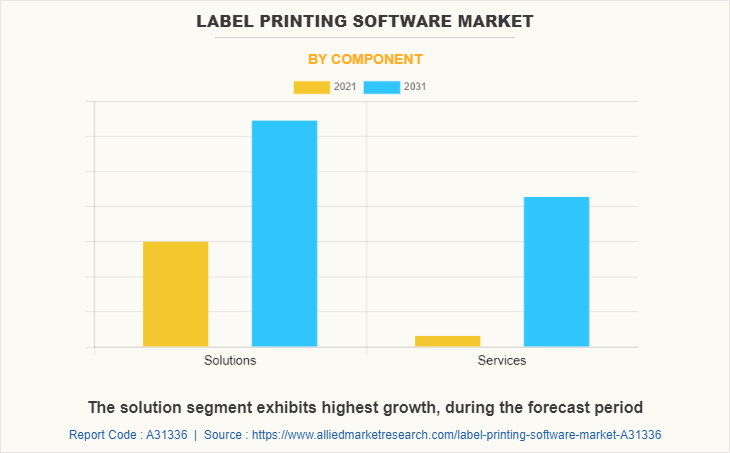

The application supports offset printing, quick printing, mailing, and distribution. Label printing software showcases wide usage owing to enhanced control of networked devices such as printers. Hence, to enhance user experience, service providers are offering a variety of value-added services, such as network security, information governance, and regulatory compliances, user authentication, data security, and document security. The label printing software industry is segmented into Component, Deployment Model, Organization Size and End Use Vertical.

Print management services enable efficient management and optimization of printing equipment and associated procedures. It is also helpful in managing the quantity and type of print materials. In addition, it controls print queues and offers secure printing choices, along with options for user authentication for access to printers and other document print services.

Print service helps to find out true cost per-page, discover actual cost of ownership for each printer, error, and history reports deliver valuable information to improve fleet management, optimize fleet for improved workflows, easy-to-use web interfaces provide visibility to help staff members and its teams do their jobs more efficiently and free up IT staff to focus on core business objectives and training. For instance, Equitrac is a print tracking and cost recovery software solution that can be integrated with multifunctional printers such as HP, Sharp, Canon, and Konica Minolta. It helps organizations reduce waste, recover costs, increase security, and simplify IT support once implemented.

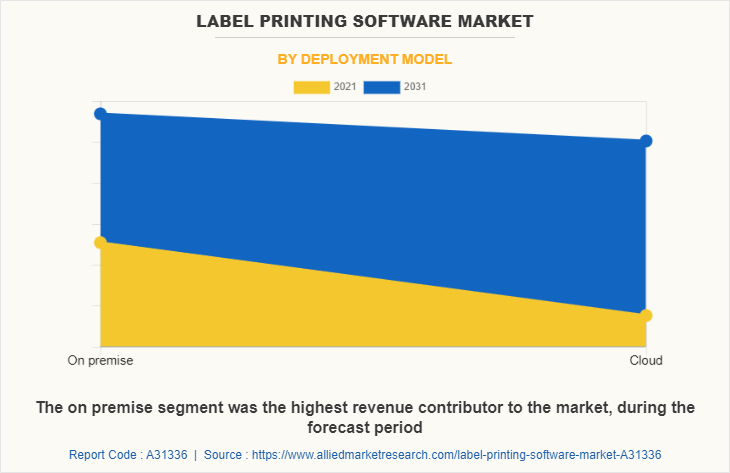

Adoption of on-premise-based managed print services is sparked by the fact that the on-premise segment gives users more control over how security is established, monitored, and contained. In addition, on-premise solutions are frequently simpler for novice users of print managed services to comprehend; nevertheless, cloud solutions give a certain level of customizability that can make the system more understandable to its user.

Cloud-based print services can dramatically lower the IT workload and costs related to print server management while achieving further cost and productivity benefits. Although there are on-premise solutions that enable print server consolidation, moving this activity to the cloud is probably the best course of action for firms that really want to take advantage of print software advantages. Hence, many businesses are converting to cloud-centric printing software, which propels the market growth.

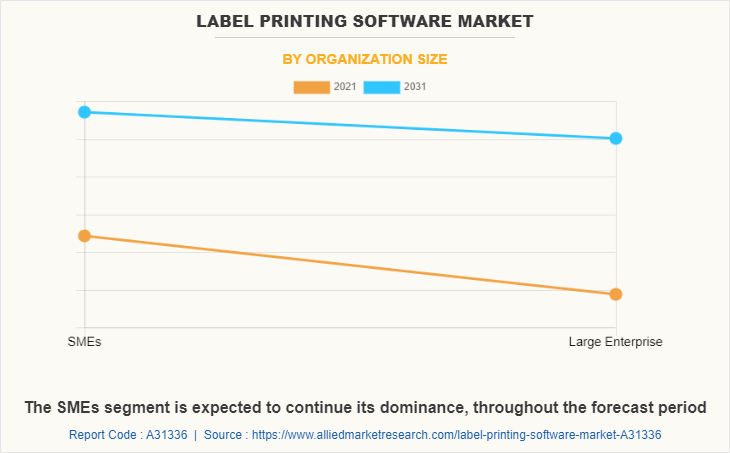

SMEs businesses in emerging nations such as India are becoming more receptive to creative cost-cutting initiatives and are now seen as a viable market for print software. For instance, India has the lowest print software penetration in the Asia-Pacific, at about 10–15% in 2017.

An increased number of printer manufacturers are entering this market to support businesses in achieving their goals and include business process automation, document workflow, and information management, which is anticipated to fuel the market growth. Large enterprises are focusing on adoption of document workflow automation to reduce costs.

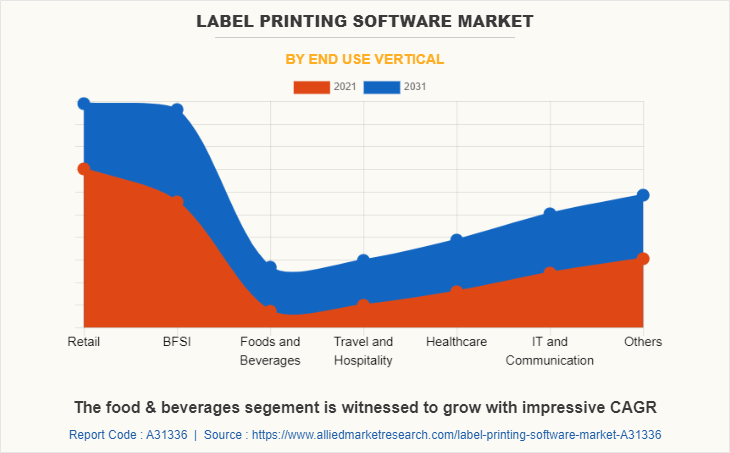

In retail printers, electronic devices are designed specifically for printing of labels and receipts and are used within the retail space. A retail printer uses ribbons and labels working in tandem to get an image printed. The consumables used with retail printers are labels, ribbons, and paper. These consumables are readily available in the market, which propels the market growth.

Rise in consumer demand for retail banking services such as speed, civility, and correctness is anticipated to boost the market expansion. Other significant aspects that contribute toward the market expansion in the BFSI sector include expanding need for tools necessary to meet these demands and desire to forge closer bonds with consumers.

Region wise, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

Adoption of third platform technologies, notably those related to cloud, Big Data, and mobility, which support the market expansion drives a significant change in Asia-Pacific imaging and printing environment. From the desktop level to the industrial level, end users continue to assess and implement new technologies to improve their work environments.

Top Impacting Factors

Significant factors that impact global label printing software market growth include rapid adoption of big data platform, rise in measures to minimize office paper use, lowered operational cost along with greater productivity, and flexibility to meet specific customer needs, and increase in information security. However, new and strategic collaborations and agreements as well as recurring costs, hampers the growth of this market. On the contrary, surge in cloud printing service usage and increased print security spending is expected to provide lucrative market opportunity during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major global label printing software industry players, such as Canon, Inc., Epaper Ltd., Hewlett-Packard Inc., HID Global, Honeywell International Inc., Lenovo Group Ltd., Nuance Communications, Ringdale UK Ltd., Seiko Epson Corporation and Xerox Corporation are provided in this report.

Key Benefits for Stakeholders

- This study comprises analytical depiction of the global label printing software market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global label printing software market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global label printing software market forecast is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the smart display.

- The report includes the market share of key vendors and global label printing software market trends.

Label Printing Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Model |

|

| By Organization Size |

|

| By End Use Vertical |

|

| By Region |

|

| Key Market Players | XEROX CORPORATION, L.P PRINT, HONEYWELL INTERNATIONAL INC., HID GLOBAL, SEIKO EPSON CORPORATION, Printix.net, LENOVO GROUP LTD., TE CONNECTIVITY, NUANCE COMMUNICATIONS, MAPRINTER LTD, HEWLETT-PACKARD ENTERPRISE, PAPERCUT SOFTWARE INTERNATIONAL, CANON INC., PCOUNTER, RINGDALE UK LTD., EPAPER LTD, PRINT MANAGER |

Analyst Review

Demand for label printing software for simulation purposes is driven by rapid rise in digitization and increase in use of cutting-edge technologies such as Industry 4.0, smart factories, robotics, machine learning, and others. These innovations raise likelihood that this technology will be adopted and used more widely throughout industries, including aerospace, automotive, and healthcare.

In the digital era where artificial intelligence and internet of things have taken over the world, there seems to be a comparatively less growth rate of the printing software market than digital marketing. Through various studies it has been observed that many countries across the globe are experiencing massive digital disruptions in advanced manufacturing technologies. U.S. is a potential user of label printing technology. In 2018, the U.S. Department of Defense included this technology as an important capability in their budget.

Even tech software giants such as Autodesk, Microsoft, and HP have launched products aimed at additive and printing manufacturing. For instance, the automotive industry is expected to show a huge adoption of this technology. Rapid tooling incorporated with additive manufacturing has become the priority of many automotive manufacturers. Customization of automotive interiors is another major application of this technology in the automotive industry.

In addition, with the robust expansion of the label printing software market, demand for advanced methods is expected to pile up. As per the analysis, there would be some major technologies and trends that can revolutionize the label printing market. There has been a significant rise in demand for reducing weight of product packaging, which is expected to benefit the market.

The upcoming trends of label printing software market include increase in adoption of big data platform and increase in information security.

Asia-Pacific is the the largest regional market for label printing software market.

the leading application of label printing software market are in retail, BFSI, IT sector, foods & beverages, travel & hospitality and others.

The leading market players such as Canon, Inc., Lenovo Group Ltd., Hewlett-Packard Inc., and Xerox Corporation hold majority of the market share.

Loading Table Of Content...