Laboratory Informatics Market Research, 2032

The global laboratory informatics market size was valued at $3.5 billion in 2022, and is projected to reach $8.5 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032. Laboratory informatics is defined as a variety of technological tools for data collection and analysis in a laboratory setting. It refers to the application of information technology, software, and data management techniques in laboratory settings to enhance overall work efficiency and productivity. Various types of laboratory informatics products such as laboratory information management system (LIMS), electronic lab notebook (ELN), laboratory execution system (LES), and scientific data management system (SDMS) are used in laboratory for increased efficiency and accuracy of results.

Market Dynamics

Growth of laboratory informatics market share is driven by rise in R&D activities, increase in number of research laboratories in developing countries, and rise in technological advancement in laboratory informatics software. For instance, in June 2023, Revvity, Inc. (PerkinElmer Informatics), announced the launch of its Signals Research Suite, a unified, cloud-native SaaS platform that drives scientific collaboration across R&D disciplines from drug discovery to specialty chemicals material development. It integrates the Revvity Signals Notebook, VitroVivo and Inventa applications into a single, robust solution that supports the entire drug development process, from early research and in vitro testing & safety to early development.

Compliance to government regulations is another major factor that drives the growth of the laboratory informatics market share. The healthcare sector needs to comply with various government regulations, such as Good Laboratory Practices (GLP), Good Manufacturing Practices (GMP), and the International Organization for Standardization (ISO) 9000 standards, which has increased the demand for laboratory informatics solutions.

In addition, laboratory informatics software helps in capturing, storing, and organizing data of various diseases (particularly cancer), such as patient information, genomic data, experimental results, and clinical data. It enables secure & centralized storage, allowing researchers & clinicians to access & retrieve data easily when needed. Thus, rise in prevalence of cancer boosts the demand for laboratory informatics software, thus fueling the laboratory informatics market growth. For instance, according to the American Cancer Society, new cancer cases of female breast (281,550), uterine cervix (14,480), colon & rectum (149,500), uterine corpus (66,570), lung & bronchus (235,760), melanoma of the skin (106,110), non-Hodgkin lymphoma (81,560), prostate (248,530), and urinary bladder (83,730) were diagnosed in 2021 in the U.S.

Furthermore, rise in adoption of different strategies by key players such as acquisition, collaboration, expansion, partnership, and product launch to stay competitive drive the growth of the laboratory informatics market during the forecast period.

What is the Impact of 2023 Recession on Laboratory Informatics Market?

According to a comprehensive study by the World Bank published in September 2022, central banks around the globe have raised interest rates on loans in 2022 with a degree of synchronicity not seen over the past five decades— a trend that is likely to continue well into next year. Higher interest rates can discourage investors & venture capitalists from allocating funds to R&D labs in which laboratory informatics software is used.

Laboratories may prioritize cost-cutting measures and delay or scale back their adoption of new technologies. They may postpone planned upgrades or implementations of laboratory informatics solutions during a recession. Uncertainty and financial strain may prompt organizations to hold off on investing in new software or hardware until the economic conditions improve. Recession can deter new market entrants due to financial uncertainties and decrease investor confidence. Startups and smaller vendors may face challenges in securing funding and gaining market traction. This can result in slower introduction of new laboratory informatics solutions or consolidation of existing market players. Therefore, recession is negatively impacting the growth of laboratory informatics market.

Furthermore, the impact of recession on laboratory informatics market is temporary. On the other hand, high growth potential in developing countries, rise in adoption of key strategies, and growth in use of laboratory informatics software to comply with stringent government regulations are expected to drive the growth of laboratory informatics market during the forecast period.

Segmental Overview

The global laboratory informatics market is segmented on the basis of type, component, delivery mode, and region to provide a detailed assessment of the market. Depending on type, the market is classified into laboratory information management system (LIMS), electronic lab notebook (ELN), laboratory execution system (LES), scientific data management system (SDMS), and others [electronic data capture (EDC) software, chromatography data system (CDS) software]. By component, it is classified into software and services. As per delivery mode, it is divided into on-premises and web-hosted & cloud-based. On the basis of end user, the market is classified into life science industries, chemical industries, food & beverages and agriculture industries, and others (environmental testing laboratories, metal & mining industries, petrochemical refineries, and oil & gas industries).

The life science industries segment is further bifurcated into pharmaceutical & biotechnology companies, contract service organization, academic & research institute, and others (biobank & biorepositories and molecular diagnostics & clinical research laboratories). Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

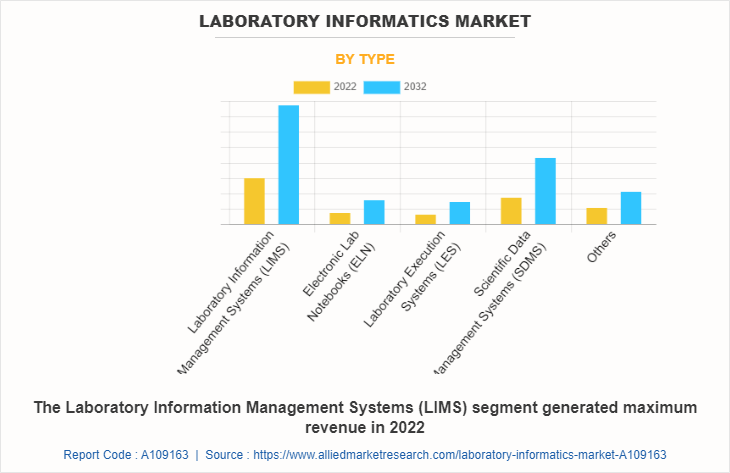

By Product Type

The laboratory information management system (LIMS) segment generated maximum revenue in 2022, owing to a higher number of people using LIMS and its wider availability. The same segment is expected to witness the highest CAGR during the forecast period, owing to an increase in technological advancement and rise in the demand for LIMS.

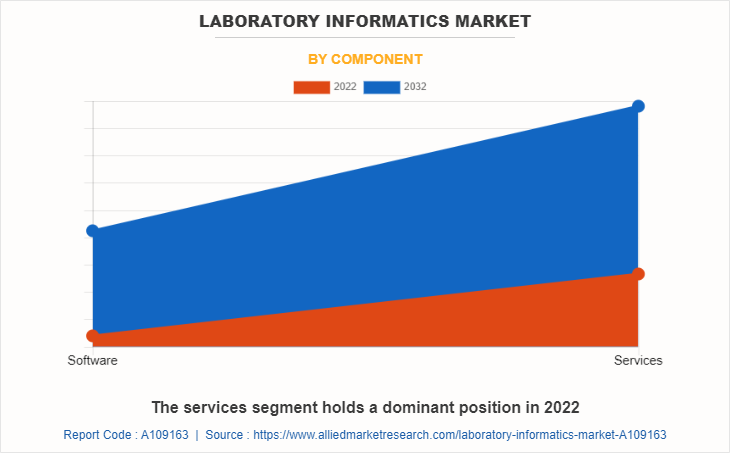

By Component

The services segment generated maximum revenue in 2022, owing to high number of people using various types of services provided in laboratory informatics such as training services, consultant service, and implementation services. The software segment is expected to witness the highest CAGR during the forecast period, owing to rise in demand for software and increase in awareness regarding the use of laboratory informatics software in developing countries such as China and India.

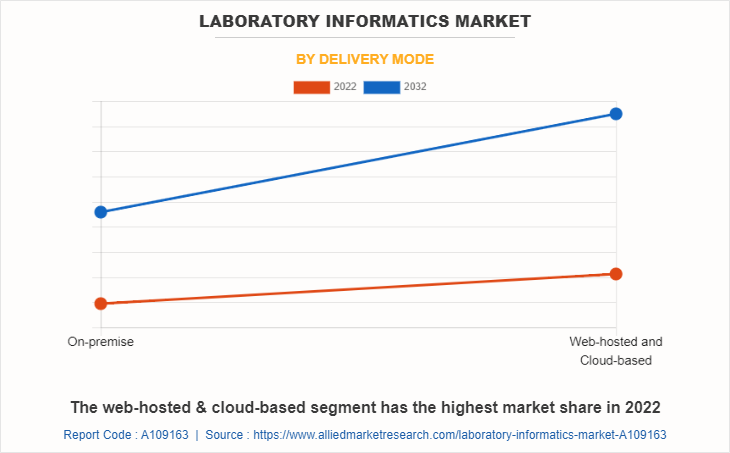

By Delivery Mode

The web-hosted & cloud-based segment generated maximum revenue in 2022, owing to rise in use & high availability of cloud-based software and benefits of web-hosted & cloud-based software such as offers more flexibility. The web-hosted & cloud-based segment is expected to witness the highest CAGR during the laboratory informatics market forecast period, owing to reduction in costs (requires a monthly cost to access the software, eliminates upfront costs for hardware & infrastructure as well as ongoing maintenance & support expenses) in comparison to on-premises (requires large upfront costs to buy software, hardware, and on-site servers).

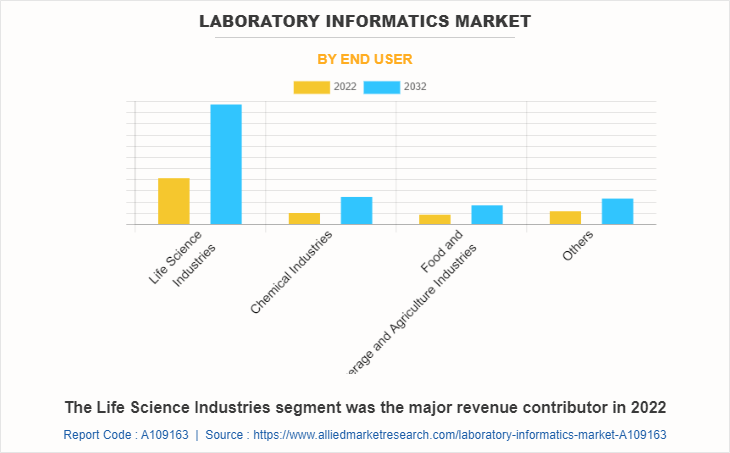

By End User

The life science industries segment generated maximum revenue in 2022, owing to high use of laboratory informatics software in the pharmaceutical & biotechnology companies and rise in prevalence of chronic diseases such as cancer, diabetes, and heart disease. The same segment is expected to witness the highest CAGR during the forecast period, owing to rise in the use of laboratory informatics software in life science industries for research and increase in the number of biobank & biorepositories and molecular diagnostics & clinical research laboratories which use laboratory informatics software.

By Region

North America accounted for a major share of the laboratory informatics market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Thermo Fisher Scientific Inc., Agilent Technologies Inc., Waters Corporation, Illumina Inc., and CrelioHealth Inc.; availability of advanced healthcare facilities; and high healthcare infrastructure expenditure by the government organizations in the region drive the growth of the market.

Furthermore, availability of advanced healthcare system; increase in R&D activities; development of novel laboratory informatics software; and availability of newly launched on-premises laboratory informatics software in this region foster the growth of the market. In addition, the U.S. is anticipated to contribute a major share to the regional market and is expected to drive the growth of the laboratory informatics market throughout the forecast period. Moreover, presence of key players, increase in the number of patients suffering from cancer, rise in purchasing power, and high adoption rate of laboratory informatics software & services, drive the growth of the laboratory informatics market in North America.

Further, Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributable to rise in demand for lab automation, increase in R&D activities for drug discovery, as well as increase in purchasing power of populated countries, such as China and India. Furthermore, the market growth in this region is attributable to factors such as technological advancements in laboratory informatics software, increase in per capita spending, rise in awareness regarding the use of laboratory informatics software in labs in developing countries. In addition, increase in government initiatives for improving healthcare infrastructure is expected to drive the growth of the laboratory informatics market size in Asia-Pacific during the forecast period. For instance, in India, the government has implemented the Clinical Establishments (Registration and Regulation) Act, which mandates the use of LIMS in all clinical laboratories. Similarly, the Chinese Government is promoting the use of LIMS through its ‘Medical Equipment Management and Quality Management System’ initiative.

Competition Analysis

Competitive analysis and profiles of the major players in the laboratory informatics market, such as Agilent Technologies Inc.; CrelioHealth Inc.; Illumina Inc.; LabLynx, Inc; LabWare, Inc; McKesson Corporation; PerkinElmer, Inc.; STARLIMS Corporation; Thermo Fisher Scientific Inc.; and Waters Corporation are provided in the report.

What are the Recent Developments in Laboratory Informatics Market?

There are some important players in the market such as Agilent Technologies Inc.; LabWare, Inc.; Waters Corporation; STARLIMS Corporation; and PerkinElmer, Inc who have adopted acquisition, collaboration, expansion, partnership, and product launch as their key developmental strategies to improve their product portfolio.

- Recent Acquisition in the Laboratory Informatics Industry

In March 2022, LabWare Holdings announced that it has signed a definitive agreement to acquire CompassRed, a visionary data analytics company named in Inc. magazine's fastest growing companies list for the past two consecutive years from 2022. The acquisition will result in a dedicated LabWare Data Analytics Innovation Center to be deployed to LabWare's global customer base.

In February 2022, Agilent Technologies Inc. announced that it has adopted advanced artificial intelligence (AI) technology, which is developed by Virtual Control, an AI and machine learning software developer that creates innovative analysis solutions in lab testing. With the acquisition, Agilent obtained the software and other assets associated with ACIES.

In July 2021, Francisco Partners, a leading global investment firm that specializes in partnering with technology businesses, announced that it has signed a definitive agreement to acquire the STARLIMS informatics product suite and related business assets from Abbott, a global healthcare company with leading businesses and products in diagnostics, medical devices, nutritional, and branded generic medicines.

- Recent Collaboration in the Laboratory Informatics Market

In April 2022, Scitara, an innovator company in laboratory digital transformation announced a collaboration with PerkinElmer. The move will support the integration of the PerkinElmer Signals Research Suite informatics platform, which provides seamless, end-to-end scientific data and workflow management, with laboratory instruments, applications, and resources via the Scitara Scientific Integration Platform SIP. The Scitara SIP provides a universal connectivity solution in a cloud-native infrastructure that allows scientific laboratories using the PerkinElmer Signals platform to realize the full benefits of digital transformation. The combination of technologies facilitates a fully connected laboratory with standard data integrity, data mobility, system flexibility, and user reconfigurability.

- Recent Expansion in the Laboratory Informatics Industry

In January 2022, Waters Corporation announced that it is expanding its waters connect informatics software platform to support customers analyzing food & environmental samples with Waters’ tandem quadrupole mass spectrometers. The new MS Quan application for waters connect allows laboratories screening large numbers of samples, or quantifying hundreds of small molecule components & contaminants in a single run, a more efficient means of processing & reviewing data and identifying batch-to-batch variations.

- Recent Partnership in the Laboratory Informatics Market

In June 2023, STARLIMS and INFOCOM (a well-established publicly traded company engaged in the provision of IT solutions and information communication services) announced that they have entered into a strategic partnership. They aim to combine comprehensive presence of INFOCOM in the business solutions space and their in-depth understanding of the industries with STARLIMS’ Informatics technology and solutions to grow their market presence in Japan.

In August 2021, CTI Clinical Trial and Consulting Services (CTI), a global, full-service contract research organization (CRO) announced its partnership with LabWare, Inc. CTI is working to expand laboratory services to support rare disease, cell, and gene therapy research across all regions of the globe, with a flagship lab being built in Cincinnati, Ohio (covering the Americas).

- Recent Product Launch in the Laboratory Informatics Market

In October 2022, STARLIMS announced the release of STARLIMS Technology Platform v12.4 (TP v12.4). This new release is available as an upgrade to all STARLIMS v10 – v12 customers. This release of Technology Platform is a maintenance release that is focused on improving the performance of HTML5 systems as well as delivering numerous fixes mostly in server and HTML5 runtimes.

In March 2022, PerkinElmer, Inc. announced V21 of its ChemDraw software featuring the ability to import, animate, and share 3D chemical structures natively in the Microsoft PowerPoint application with one click. The key enhancement helps chemists create more intelligent research reports quickly & easily, improving information sharing & collaboration and supporting real-time decision making.

In June 2020, LabWare, Inc. announced the production release of LabWare 8. LabWare 8 is the foundation for the company’s unique Enterprise Laboratory Platform which brings together the capabilities of a Laboratory Information Management System (LIMS) and an Electronic Laboratory Notebook (ELN) in a single comprehensive solution. LabWare 8 is the most adaptable and functionally complete LIMS system and offers a proven solution for all size laboratory.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the laboratory informatics market analysis from 2022 to 2032 to identify the prevailing laboratory informatics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the laboratory informatics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global laboratory informatics market trends, key players, market segments, application areas, and market growth strategies.

Laboratory Informatics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.5 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Type |

|

| By Component |

|

| By Delivery Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | Waters Corporation, McKesson Corporation., CrelioHealth Inc., PerkinElmer, Inc, Starlims Corporation, LabLynx, Inc., Agilent Technologies Inc., Illumina Inc., Thermo Fisher Scientific Inc. , LabWare, Inc. |

Analyst Review

Laboratory informatics refers to the application of information technology, software, and data management techniques in laboratory settings to enhance overall work efficiency and productivity. According to the insights of the CXOs, rise in R&D regarding cancer & various diseases and growth in use of laboratory informatics software to comply with stringent government regulations increase its demand, thereby driving the growth of laboratory informatics market.

As per the perspectives of CXOs, the factors which fuel the growth of the global laboratory informatics market include surge in large-scale implementation of laboratory information management systems in various industries and increase in the number of samples generated for research & analysis, due to rise in the number of life-threatening diseases across the globe. The laboratory informatics software help healthcare organizations to manage their laboratory operations more efficiently, ensuring better patient care. However, the high cost of the laboratory software is the major challenge faced by the laboratory informatics market.

North America garnered the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to high adoption of laboratory informatics software & services, availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure.

The laboratory informatics market size was valued at $3,531.27 million in 2022.

The rapid technological advancements in molecular genomics & genetic testing and rise in the demand for lab automation are the upcoming trends of Laboratory Informatics Market in the world.

The laboratory information management system (LIMS) is the leading segment of Laboratory Informatics Market.

North America is the largest regional market for Laboratory Informatics

The forecast period for Laboratory Informatics Market is 2023 to 2032.

Illumina Inc., Thermo Fisher Scientific Inc., Agilent Technologies Inc., Waters Corporation, PerkinElmer, Inc. are the top companies to hold the market share in Laboratory Informatics.

The laboratory informatics market is estimated to reach $8,530.77 million by 2032.

Yes, competitive analysis is included in Laboratory Informatics Market.

Loading Table Of Content...

Loading Research Methodology...