Land Survey Equipment Market Research: 2032

The Global Land Survey Equipment Market Size was valued at $10 billion in 2022, and is projected to reach $17.2 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. Land survey equipment is made from monitoring, inspection, and calculating land into specific measurement units such as distance, volume, and inclinations.

The land survey equipment market refers to tools for inspection & monitoring, volumetric calculations, and layout points across various industries such as construction, oil & gas, agriculture, mining, and disaster management. The land survey equipment tools include GNSS systems, total stations & theodolites, levels, 3D laser/laser scanners, and unmanned aerial vehicles, and others.

Market Dynamics

The land survey equipment market is mainly driven by urbanization and industrialization in developing countries. Major cities in developing countries, such as India, China, Brazil, Argentina, and South Africa, are rapidly expanding and building several new infrastructures in different parts of their respective countries. Several smart cities are being planned where land survey equipment is projected to play a very integral part in surveying at the initial planning stage.

For instance, governments in several developing nations, such as India, have planned new cities such as Dream City in Gujarat and New Kanpur, which would need surveying and inspection activities before planning and actual construction process. Therefore, these factors will drive the land survey equipment market growth during the forecast period. In addition, the use of drones for capturing images and videos has increased over the years. The operation of drones without human interference has made it popular to control them through computers or smartphones.

It is also used for surveying and surveillance in commercial and defense sectors. Videos and images captured are also used for research and planning purposes. Moreover, land survey equipment saves a lot of time in its application process and gives accurate output, owing to its data processing in software.

In addition, many local companies offer rental and leasing services on land equipment products, which restrict direct end-users from buying their own equipment. Leasing & renting land survey equipment is a cost-effective option and saves maintenance costs as some end-users need equipment for a limited time. In addition, the land survey equipment market is restricted, owing to a lack of skilled manpower and technical knowledge about operating equipment and its software.

However, the high initial cost and rental and leasing service providers for land survey equipment hamper the growth of the market. Moreover, data collection and upgraded data management systems using advanced software and equipment and technological advancements in land survey methods are expected to boost the land survey equipment market during the forecast period.

Segmental Overview

The land survey equipment market is segmented into Product, Industry, Application, and Region. By product, the market is categorized into GNSS systems, total stations & theodolites, levels, 3D Laser/Laser scanners, UAVs, pipe lasers, and others. On the basis of industry, the market is classified into construction, oil & gas, agriculture, mining, disaster management, and others. On the basis of application, the market is categorized into inspection & monitoring, volumetric calculations, and layout points. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

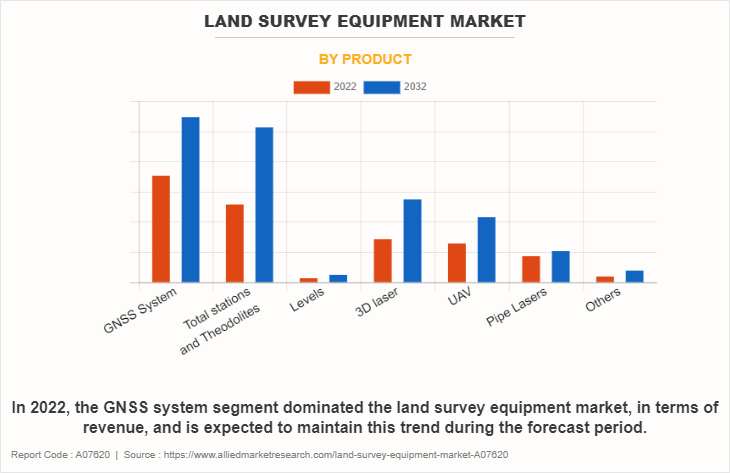

By Product:

The land survey equipment market is divided into GNSS systems, total stations & theodolites, levels, 3D Laser/Laser scanners, UAVs, pipe lasers, and others. In 2022, the GNSS system segment dominated the land survey equipment market, in terms of revenue, and is expected to maintain this trend during the forecast period. GNSS is a very powerful navigation system. It has a vast range of commercial applications such as ground mapping, machine control, port automation, agriculture, construction, marine, mining, surveying, and defense. GNSS technology is being rapidly adopted by the consumer market, owing to an increase in the range of products as they are easily integrated into smartphones. In addition, it provides accurate location & timing, and the system is very efficient to be used in airports for landing and takeoff regulation operations during bad weather.

Moreover, major players such as Stonex, and Trimble Inc., are adopting various strategies such as product launches and acquisitions to sustain the intense competition. For instance, in September 2023, Trimble launched the new Trimble R580 Global Navigation Satellite System (GNSS) receiver, the next generation in its portfolio of Trimble ProPoint GNSS positioning engine-enabled receivers. The system’s survey-grade GNSS performance enables professionals in surveying, mapping, Geographic Information Systems (GIS), civil construction, and utilities to capture centimeter-level positioning and boost productivity quickly and easily in the field. Such strategies are expected to boost the GNSS systems segment during the forecast period.

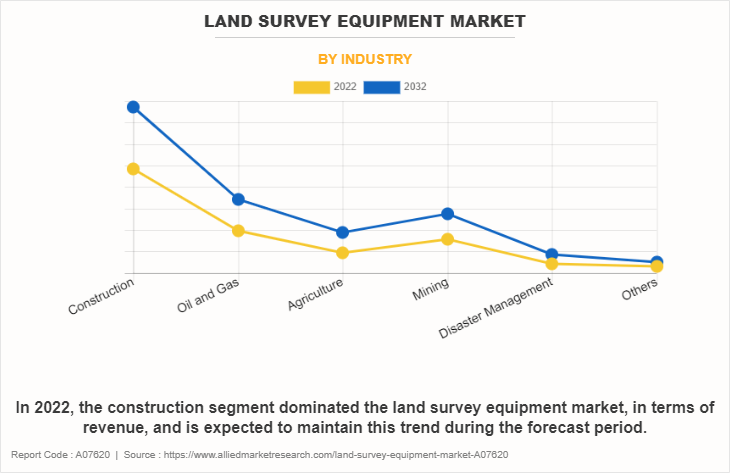

By Industry:

The land survey equipment market is classified into construction, oil & gas, agriculture, mining, disaster management, and others. In 2022, the construction segment dominated the land survey equipment market, in terms of revenue, and is expected to maintain this trend during the forecast period. The rise in urbanization and increase in industrialization in developing countries has led to a surge in construction activities. Therefore, surveying lands and preparing layouts have become easy, owing to land surveying equipment. In addition, drones are very handy and are used to monitor construction processes or inspect inventories and supplies without being physically present at the site. They are also used for photography and videography of constructed sites for further use in marketing and sales.

For instance, PCL Construction, a Denver-based construction company has been using drones for more than 3 years in its construction projects to enhance jobsite communication, overlay design documents with installed work for visual verification, perform volumetric analysis, verify grades, and provide historical documentation. Similarly, Windover Construction, a construction company, uses drones to prepare 3D models of projects on its jobsites, which are further displayed on computers through software. Such ease of use is expected to boost the operation of land survey equipment in construction activities during the forecast period.

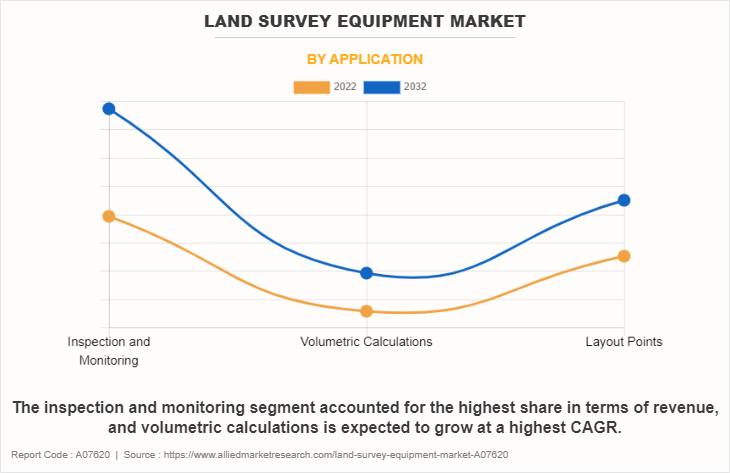

By Application:

The land survey equipment market is divided into inspection & monitoring, volumetric calculations, and layout points. There has been a trend to inspect construction, agricultural, and mining sites using GNSS, total stations & theodolite, 3D scanners, and levels for accurate inspection. In addition, remotely monitoring construction, agricultural, and mining activities saves time and energy. For instance, in October 2023, DJI, a Chinese company launched the DJI Zenmuse L2, which is a highly integrated LiDAR system.

The DJI Zenmuse L2 marks a new era of 3D data acquisition with a reliable and cost-effective LiDAR system for aerial platforms used by land surveyors, electricity inspectors, and forestry professionals. It provides real-time 3D data, efficiently capturing the details of complex structures, and delivering highly accurate reconstructed models. Such strategies adopted by the manufacturers are expected to boost the land survey equipment market during the forecast period.

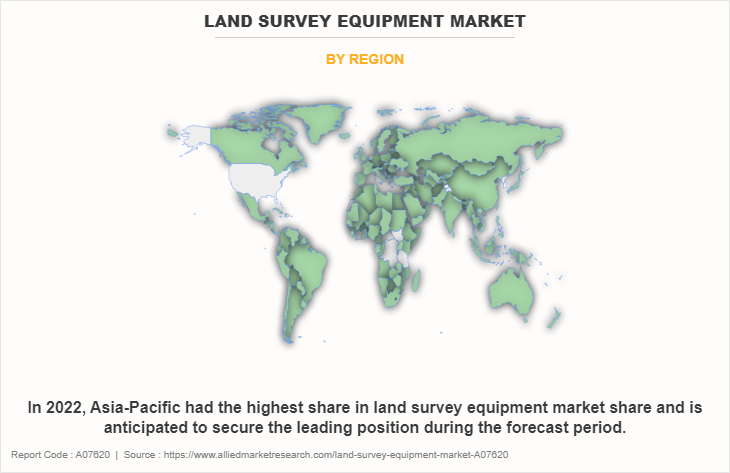

By Region:

The land survey equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific had the highest land survey equipment market share and is anticipated to secure the leading position during the forecast period, due to extensive demand in the construction segment. Countries, such as China, India, and South Korea, are rapidly urbanizing and industrializing. A lot of new construction activities are taking place. China is one of the most valued construction markets in Asia-Pacific, and its construction expenditure is expected to increase every year until 2030, owing to a rise in income levels and rapid urbanization & industrialization.

There are 100 smart cities planned in India that are targeted to be completed by 2025. Similarly, 12 smart cities are being planned in China that are expected to be completed by 2023. In addition, defense industries are using drones and GNSS systems on a large scale. Further, the mining industry is using total stations and 3D lasers for surveillance and inspection. Such factors are expected to boost the land survey equipment market growth in Asia-Pacific during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the land survey equipment end-user, such as Hi-Target, Hudaco Industries Limited, Kolida Instrument Co., Ltd., Robert Bosch GmbH, Shanghai Huace Navigation Technology Ltd. (CHC Navigation), Stonex, Suzhou Foif Co., Ltd., Topcon Corporation, and Trimble Inc. are provided in this report. There are some important players in the market such as Hi-Target, Stonex, and Trimble Inc. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the land survey equipment market.

Some examples of product launches in the market

In March 2021, Stonex launched the R20 total station for any work in construction, cadastral, mapping, and staking, through a user-friendly interface. it offers optimum performance up to 5000 m with the prism and 1000 m or 600 m reflectorless. The entire R20 range is equipped with a high-performance, illuminated reticle telescope that provides the best quality of observation.

In September 2022, Stonex launched the X120GO SLAM Laser Scanner. The system has a 360° rotating head, which can generate a 360°x270° point cloud coverage. Combined with the industry-level SLAM algorithm, it can obtain high-precision three-dimensional point cloud data of the surrounding environment without light and GPS. Equipped with three 5MP cameras to generate a 200°FOV horizontal and 100°FOV vertical, capable of synchronously obtaining texture information and producing color point clouds and partial panoramic images.

In July 2022, Hi-Target launched a real-time-kinematic (RTK) GNSS receiver that has an eye for visual positioning. The pocket-sized vRTK GNSS RTK System is equipped with professional dual cameras to enable non-contact image surveying. It also has an advanced inertial measurement unit (IMU).

In March 2022, Shanghai Huace Navigation Technology Ltd. launched the i83 IMU-RTK GNSS Receiver. The i83 is the most universal GNSS system which is used for surveying construction projects.

In March 2023, Stonex launched the R180 Robotic Total Station. The R180 is a highly accurate and fast Android robotic station. It features a rotation speed of 180°/sec and an EDM accuracy of 1 mm + 1 ppm, with a range of up to 1000 m without a prism. The R180 is available in two versions, 0.5 and 1 second.

Expansion in the market

In October 2020, Topcon expanded its business and opened a factory for advanced optical components. It led to a rise in the production capacity of optical components.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging land survey equipment market trends and dynamics.

- In-depth land survey equipment market analysis is conducted by constructing market estimations for the key market segments between 2022 and 2032.

- Extensive analysis of the land survey equipment market outlook is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The land survey equipment market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within the land survey equipment market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the land survey equipment industry.

Land Survey Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.2 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 279 |

| By Product |

|

| By Industry |

|

| By Application |

|

| By Region |

|

| Key Market Players | Trimble Inc., Hexagon AB, Stonex srl, SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD, Hi-Target, TOPCON CORPORATION, SUZHOU FOIF CO LTD., HUDACO INDUSTRIES LIMITED (V.I INSTRUMENTS), GUANGDONG KOLIDA INSTRUMENT CO., LTD, Robert Bosch GmbH (CST/Berger) |

Analyst Review

The land survey equipment market is mainly driven by urbanization and industrialization in developing countries. In addition, the increase of drones and other UAVs acts as a driver to the land survey equipment market. Moreover, accuracy in data collection and time-saving processes also help in the growth of the market.

However, the lack of skilled manpower and knowledge about advanced technology and software acts as a restraint to the land survey equipment market. In addition, rental and leasing services also restrict sales of new land equipment. On the contrary, a rise in data collection and its management for documentation and research and technological advancement in land survey methods is expected to boost the land survey equipment market during the forecast period.

Major companies in the market have adopted strategies, such as acquisition, business expansion, and product launch, to offer better services to customers in the land survey equipment market. For instance, in November 2022, Stonex launched the XVS vSLAM 3D Scanner. The system uses a technology based on the integration of high-resolution images, inertial systems, and a complex algorithm capturing a scenario with XVS, a 3D model will be generated through photogrammetric techniques. Such strategies adopted by the manufacturers are expected to boost the land survey equipment market growth.

The land survey equipment market was valued at $9,995.40 million in 2022 and is estimated to reach $17,154.10 million by 2032, exhibiting a CAGR of 5.6% from 2023 to 2032.

The base year considered in the global Land Survey Equipment market market report is 2022.

Inspection and monitoring is the leading application of the Land Survey Equipment Market.

Asia-Pacific is the largest regional market for Land Survey Equipment.

The increase in demand for drone usage is the upcoming trend of the Land Survey Equipment Market in the world.

Hi-Target, Hudaco Industries Limited, Kolida Instrument Co., Ltd., Robert Bosch GmbH, Shanghai Huace Navigation Technology Ltd. (CHC Navigation), Stonex, Suzhou Foif Co., Ltd., Topcon Corporation, and Trimble Inc. are the top companies to hold the market share in Land Survey Equipment.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where the leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...

Loading Research Methodology...