Landlord Insurance Market Research, 2032

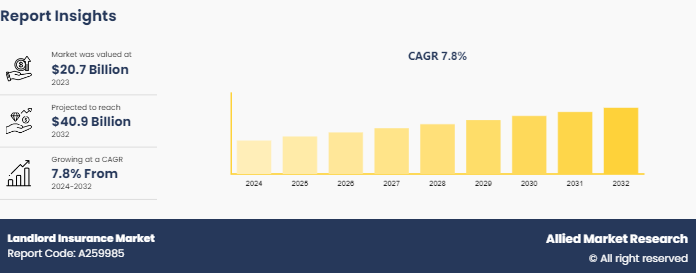

The global landlord insurance market was valued at $20.7 billion in 2023, and is projected to reach $40.9 billion by 2032, growing at a CAGR of 7.8% from 2024 to 2032.

This growth is driven by increasing awareness among landlords about the benefits of insurance coverage and the rising number of rental properties worldwide. Additionally, the market is expected to benefit from advancements in digital insurance platforms, which make it easier for landlords to access and manage their insurance policies.

Market Introduction and Definition

Landlord insurance is a specialized property insurance for rental property owners, covering various risks associated with renting out a property. It includes protection for property damage caused by natural disasters, fire, and vandalism; liability coverage for legal fees and medical costs if someone is injured on the property; compensation for lost rental income if the property becomes uninhabitable due to a covered event; and coverage for the landlord's personal property left on-site for tenant use. Optional add-ons can include rent default protection, legal expenses, flood insurance, and emergency repair services. This type of insurance is essential for protecting rental properties and ensuring financial security against a range of rental-related risks.

Key Takeaways

The landlord insurance industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major landlord insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends:

In November 2023, VIU by HUB, a digital brokerage subsidiary of Hub International Limited, has announced the launch of landlord insurance to cover investment rental properties and secondary homes. Consumers owning fewer than five homes can now shop for, compare quotes, and purchase a landlord insurance policy through VIU. This kind of policy covers homes that do not qualify for homeowners' insurance, such as secondary homes, rental properties and vacant homes undergoing repairs. In addition, the VIU platform can easily be embedded within the systems of partner businesses such as property management companies.

In February 2021, Kin, the insurance technology company changing home insurance through intuitive tech and affordable pricing, announced the launch of its landlord insurance plans which will debut in the Florida market. Kin’s landlord insurance applies to property owners who rent out their detached homes and townhouses. It also covers investors who rent their properties on Airbnb. This policy can cover all sources of damage to the physical structure of the home except those listed as exclusions. It also covers damage to other structures on property such as a garage or shed, personal property such as appliances, personal liability, and fair rental value.

Key Market Dynamics

The global landlord insurance market is experiencing growth due to several factors such as increase in natural disasters, surge in demand for rental housing, and rise in awareness regarding landlord insurance. However, the high cost of insurance, and lack of awareness restrain the development of the landlord insurance market. In addition, customization of bundled insurance products is projected to provide ample opportunities for the development of the landlord insurance market size during the forecast period.

The landlord insurance market growth is driven by the increase in demand for rental properties and the need for property owners to protect their investments. Leading players such as Allstate, State Farm, and Farmers Insurance offer comprehensive landlord insurance policies that cover property damage, liability protection, and loss of rental income. The rise in urbanization and housing costs has fueled the demand for rental properties, subsequently boosting the need for landlord insurance. In addition, the digitalization of the insurance sector has led to the development of online platforms and tools that simplify policy management and claims processing. The COVID-19 pandemic has also increased awareness of the importance of comprehensive insurance coverage, encouraging more landlords to adopt specialized insurance products to safeguard against potential financial losses and ensure the security of their rental investments.

PESTLE Overview: Global Landlord Insurance Market

The global landlord insurance market size is influenced by a different external factor encapsulated in a PESTLE analysis framework. Politically, the market is shaped by changes in property laws, rent control measures, and government initiatives promoting rental housing, which collectively impact the risk profiles and coverage needs of rental properties. Economically, the landlord insurance market share is driven by housing market trends, including property values and interest rates, as well as overall economic stability, which influences rental income and investment in rental properties. Socially, the increasing urbanization trend and demographic shifts, such as a growing number of single-person households, elevate the demand for rental properties and, consequently, landlord insurance and other landlord insurance offerings.

Technologically, digital transformation and insurtech innovations are revolutionizing landlord insurance revenues, providing advanced online platforms for policy management and claims processing, and leveraging AI and big data for enhanced risk assessment and underwriting. Legally, the market is affected by tenant protection laws and stringent insurance regulations that mandate comprehensive coverage and compliance, thereby influencing product offerings and market practices. Environmentally, the market faces challenges and opportunities from climate change and sustainability trends. The increasing frequency and severity of natural disasters due to climate change elevate property damage risks, leading to higher premiums and the necessity for more robust coverage and other landlord insurance options.

Simultaneously, the emphasis on sustainable and energy-efficient buildings can drive market growth, with insurers offering incentives for properties that adhere to environmental standards. Collectively, these factors contribute to the dynamic landscape of the global landlord insurance market, necessitating continuous adaptation and innovation from insurance providers to meet the evolving needs of landlords and mitigate emerging risks effectively. This comprehensive analysis underscores the complexity and interconnectivity of various influences shaping the growth and development of the landlord insurance market outlook globally.

Market Segmentation

The landlord insurance market opportunity is segmented into type, application, distribution mode, and region. On the basis of type, the market is divided into landlord liability insurance, landlord buildings insurance, landlord contents insurance, loss of rent insurance, tenant default insurance, accidental damage insurance, alternative accommodation insurance, unoccupied property insurance, and legal expenses insurance. As per the application, the market is bifurcated into Residential and Commercial. On the basis of distribution mode, the market is categorized into Online and Offline. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The landlord insurance market forecast in North America, especially in the U.S., is robust and well-developed, driven by several key factors. The high rate of urbanization and a significant population of renters contribute to a strong demand for rental properties, thus bolstering the need for comprehensive landlord insurance. The U.S. rental market, characterized by its diverse housing options, from single-family homes to large apartment complexes, necessitates varied and tailored insurance products to meet the specific needs of different property types.

Regulatory frameworks in North America, particularly in the U.S. and Canada, play a crucial role in shaping the landlord insurance market. State-specific regulations and tenant protection laws require landlords to maintain comprehensive coverage to mitigate risks associated with property damage, liability, and loss of rental income and landlord insurance claims. These legal requirements ensure that landlords are adequately protected against potential financial losses and legal disputes, further driving the demand for landlord insurance. The sheer size and diversity of the market create opportunities for insurance providers to offer specialized solutions tailored to different segments and niches.

In May 2023, Property maintenance platform Tapi collaborated with digital insurer Open to launch a landlord’s house insurance policy specifically aimed at rental properties managed by real estate agencies. The policy, which is a first of its kind in New Zealand, allows property managers to digitally manage almost all claims up to $10, 000 on behalf of their landlords. The partnership sees Open powering the insurance offering and tech as well as end-to-end from quote to claim. The insurance policy, which is fully integrated into Tapi’s property maintenance software, will be underwritten by Tower.

In May 2023, Leading property maintenance software company, Tapi, has partnered with digital insurance company, Open, to launch its own Landlord’s House Insurance designed specifically for rental properties managed by real estate agencies. In addition, it allows property managers to digitally submit and manage almost all claims of up to $10, 000 on behalf of their landlords.

Competitive Landscape

The major players operating in the landlord insurance market include AXA S.A., Allianz SE, NRMA Insurance, QBE Insurance, Halifax, State Farm, and Safeco. Other players in the landlord insurance market include Travelers Insurance, AAMI, GEICO., and others.

Recent Key Strategies and Developments

In September 2023, SiteMinder launched its industry-leading platform on mobile, to give accommodation providers the power to execute their property’s revenue management strategy and mitigate real-time risks, free from their desk. The mobile app represents the first phase of the delivery of SiteMinder’s smart platform, set to launch later this year, and a key milestone in SiteMinder’s mission to make sophisticated revenue management accessible to every hotel in the world.

In March 2024, Sure, the insurance technology leader that unlocks the potential of digital insurance, partnered with Landlord Studio, a specialist rental accounting and management platform, to help close the protection gap for renters and landlords. Using Sure's insurance infrastructure technology, Landlord Studio can now extend value-added coverage to both sides of the landlord-tenant relationship by embedding home warranty protection and renters' insurance directly in the Landlord Studio platform.

Key Sources Referred

National Association of Realtors (NAR)

National Apartment Association (NAA)

The European Insurance Federation (EI)

The Association of British Insurers (ABI)

Asia Insurance Federation (AIF)

The General Insurance Association of Japan (GIAJ)

The International Association of Insurance Supervisors (IAIS)

The Organisation for Economic Co-operation and Development (OECD)

Report Coverage & Deliverables

The landlord insurance market report provides detailed insights into market trends, size, growth drivers, and competitive landscape. It covers the evolving demand for landlord policies across various regions and deployment modes.

Type Insights

Landlord insurance typically covers property damage, liability protection, and loss of rental income. These types offer landlords comprehensive coverage options to protect their investments.

Application Insights

The landlord insurance market share is primarily driven by residential rental properties, including single-family homes, multi-family units, and apartments. Commercial properties also contribute to demand.

Deployment Mode Insights

Traditional insurance through brokers and the increasing use of digital platforms are key modes contributing to the landlord insurance market growth.

Regional Insights

The North American region leads the market, followed by Europe, with growing opportunities in Asia-Pacific due to rising rental markets.

Key Companies & Market Share Insights

Notable players like Allstate, State Farm, and Liberty Mutual significantly contribute to the overall landlord insurance market value.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the landlord insurance market segments, current trends, estimations, and dynamics of the landlord insurance market analysis from 2023 to 2032 to identify the prevailing landlord insurance market opportunities.

The study provides an in-depth analysis of the landlord insurance market forecast along with the current trends and future estimations to explain the imminent investment pockets.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the landlord insurance market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global landlord insurance market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global landlord insurance market trends, key players, market segments, application areas, and market growth strategies.

Landlord Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 40.9 Billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 150 |

| By Type |

|

| By Application |

|

| By Deployment Mode |

|

| By Region |

|

| Key Market Players | QBE Insurance, NRMA Insurance, State Farm, AXA S.A., AAMI, Travelers Insurance, Allianz SE, Halifax, GEICO, Safeco |

The landlord insurance Market is estimated to grow at a CAGR of 7.8% from 2024 to 2032.

The landlord insurance Market is projected to reach $40.9 billion by 2032.

The landlord insurance Market is expected to witness notable growth due to increasing awareness among landlords about the benefits of insurance coverage and the rising number of rental properties worldwide.

The key players profiled in the report include AXA S.A., Allianz SE, NRMA Insurance, QBE Insurance, Halifax, State Farm, Safeco, Travelers Insurance, AAMI, and GEICO.

The key growth strategies of landlord insurance Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...