LCD Shelf Label Market Research, 2032

The global LCD shelf label market was valued at $387.9 million in 2022, and is projected to reach $1.5 billion by 2032, growing at a CAGR of 14.5% from 2023 to 2032.

A liquid crystal display (LCD) shelf label, also known as an electronic shelf label (ESL) or digital shelf label (DSL), is a type of electronic display used in retail stores to show product information, pricing, and other relevant details on store shelves.

LCD shelf label consists of a small LCD screen, typically monochrome or color, embedded within a label or tag format. The labels are designed to be attached to store shelves or product displays, providing a clear and visible way to communicate information to customers.

LCD shelf label offers key features and functionalities that revolutionize retail operations. It enables dynamic pricing, allowing real-time price updates without manual effort. The label displays detailed product information, helping customers make informed choices. Promotions and offers can be highlighted on the label, attracting customer attention and driving sales. With centralized control, retailers can manage pricing across multiple stores simultaneously.

Segment Overview

The LCD shelf label market is segmented into component, display size, communication technology and store type.

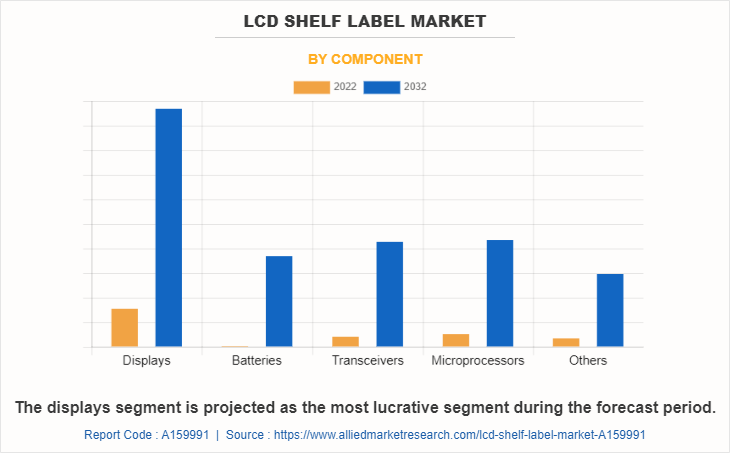

By component, the LCD shelf label market is divided into displays, batteries, transceivers, microprocessors, and others.

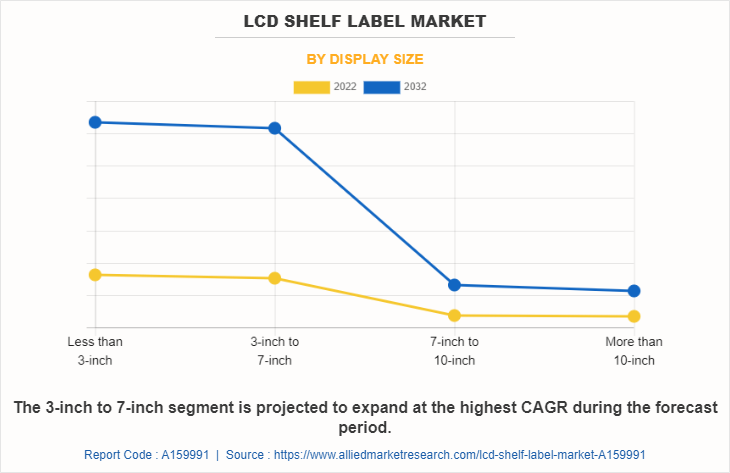

By display size, the LCD shelf label market size is categorized into less than 3-inch, 3-inch to 7-inch, 7-inch to 10-inch, and more than 10-inch.

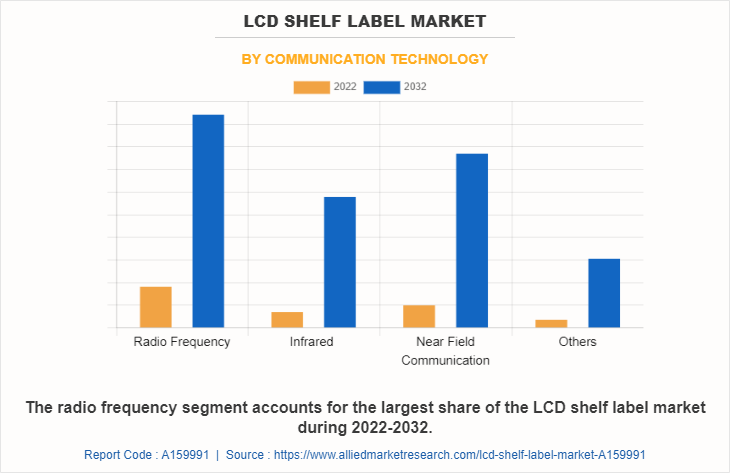

By communication technology, the LCD shelf label market is segmented into radio frequency, infrared, near field communication, and others.

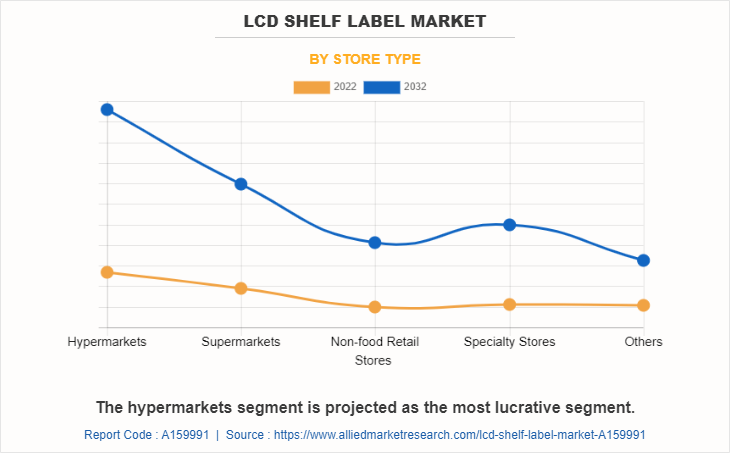

By store type, the LCD shelf label industry is classified into hypermarkets, supermarkets, non-food retail stores, specialty stores, and others.

By region, the LCD shelf label market is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific) and LAMEA (Latin America, Middle East, and Africa).

Country-wise, the U.S. acquired a prime market share in the North American region and is expected to grow at a significant CAGR during the forecast period of 2023-2032. This dominant position can be attributed to several key factors. Major retail chains such as Walmart, CVS Health, Amazon, Walgreens Boots Alliance, Costco, The Kroger Co., Albertsons Companies, and Target are among the largest in the country and contribute to the market's growth. The adoption of advanced technologies like battery-free solutions, as well as the integration of Industry 4.0, are anticipated to have a positive impact on the LCD shelf label market in North America.

In Europe, Germany emerged as the dominant player in terms of revenue share in the LCD shelf label market in 2022, and this trend is expected to continue during the forecast period. Germany's dominance in the European LCD shelf label market can be attributed to its innovative approach to retail technology and strong emphasis on automation. For instance, major German retailers like Metro AG have widely adopted Electronic Shelf Labels (ESL) systems to improve pricing accuracy, reduce operational costs, and enhance customer experience. The country's advanced infrastructure, favorable government policies, and the presence of leading technology providers in the retail sector have also contributed to Germany's leadership in the adoption of LCD shelf labels. As a result, the country's continued commitment to leveraging cutting-edge solutions in retail is expected to maintain its position as the dominant player in the market during the forecast period.

In the Asia-Pacific region, China is anticipated to become a prominent market for the LCD shelf label industry. The LCD shelf label market in China is experiencing a significant rise in adoption as retailers increasingly integrate smart store solutions. These solutions incorporate LCD shelf labels that seamlessly integrate with inventory systems, enabling automated price adjustments, reducing pricing errors, and optimizing operational efficiency. A notable example is JD.com, a leading e-commerce company in China, which has implemented LCD shelf labels in its unmanned convenience stores. These labels display product information and prices, helping customers make informed purchasing decisions. The integration of LCD shelf labels enhances the efficiency and convenience of shopping in these unmanned stores.

In the LAMEA region, Latin America dominated the LCD shelf label market share in terms of revenue in 2022. Major retail chains in Brazil, such as Grupo Pão de Açúcar or Carrefour Brazil, have been actively adopting LCD shelf label systems to streamline their pricing strategies, improve operational efficiency, and offer a more dynamic shopping experience to customers. This commitment to innovative retail technologies, coupled with a growing market and favorable economic conditions in the region, positions Latin America to maintain its dominance in the LCD shelf label market during the forecast period.

Retail digital transformation plays a vital role in fueling the LCD shelf label market growth. As the retail industry undergoes a significant digital shift, retailers are increasingly adopting LCD shelf labels to stay ahead in the competitive landscape and meet the changing demands of customers. With the aim of enhancing customer experiences and remaining relevant, retailers are embracing innovative technologies. LCD shelf labels are a key part of this transformation, as they enable retailers to create modern, connected store environments. By leveraging LCD shelf labels, retailers can seamlessly update pricing, display detailed product information, and effectively promote offers, ultimately providing customers a more engaging and personalized shopping experience. Retailers are embracing the convenience and versatility of digital price tags and touchscreen shelf labels to provide a modern and interactive shopping experience for their customers.

However, power consumption and battery life are significant restraints in the LCD shelf label market. LCD shelf labels rely on power to operate their displays, although they are designed to be energy-efficient, continuous usage can gradually drain the battery. Retailers must carefully plan for battery replacement or recharging to ensure uninterrupted operation of the labels. Managing battery life and optimizing power consumption becomes particularly challenging in environments where a large number of labels are deployed. Retailers need to develop strategies to efficiently handle power requirements, such as implementing power-saving features and closely monitoring battery levels. By doing so, they can mitigate potential disruptions caused by low battery levels and ensure the smooth functioning of LCD shelf labels in their stores.

The expansion of e-commerce and omnichannel retailing presents a significant LCD shelf label market opportunity. With the continuous growth of the e-commerce sector, integrating LCD shelf labels with online platforms becomes crucial. By synchronizing prices and product information across physical stores and online channels, retailers can ensure a seamless and consistent shopping experience for customers. This integration allows retailers to streamline their omnichannel operations, enabling customers to access accurate and up-to-date information regardless of whether they shop online or in-store. LCD shelf labels play a vital role in bridging the gap between physical and digital retail, creating a unified and enhanced shopping experience across various channels.

Top Impacting Factors

Enhanced pricing accuracy and operational efficiency are driving factors in the LCD shelf label market, ensuring accurate prices and streamlining retail operations for improved customer satisfaction and productivity. However, the market growth might be hindered by initial investment costs required for hardware and infrastructure, posing challenges, particularly for smaller retailers. On the other hand, data-driven insights obtained from LCD shelf labels present promising opportunities for retailers, enabling them to gain valuable information on customer behavior and pricing trends, leading to informed decision-making and business growth.

Competitive Analysis

The LCD shelf label market outlook report highlights the highly competitive nature of the LCD shelf label market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing market demands. The competitive environment in this market is expected to increase as innovations, product launches, partnerships, and contract strategies adopted by key vendors increase. Competitive analysis and profiles of the major LCD shelf label market players that have been provided in the report include RECHI Retail System Solutions Limited, SES-imagotag, Zkong, Hanshow Technology, ZhSunyco, Highlight, ACLAS, Diebold Nixdorf, Incorporated., Samsung Electro-Mechanics Co Ltd., and Displaydata Limited.

Key Developments/ Strategies

According to the latest LCD shelf label market forecast, SES-imagotag, Zkong, Samsung Electro-Mechanics Co Ltd., Diebold Nixdorf, and Displaydata Limited are the top players in the LCD shelf label market. Top market players have adopted various strategies, such as innovations, product launches, partnerships, and contract to expand their foothold in the LCD shelf label market.

In July 2023, ZKONG launched its 10.1. Zkong Dual Screen LCD Digital Signage. The sparkle dual Screen presents different contents on two sides at the same time and is supported by the rich templates library & multi-screen co-display, as the new product enables imagination to be a reality.

In July 2022, Displaydata announced the rollout of Electronic Shelf Labels with partner Delfi in Globus Baumarkt stores across Germany. These electronic shelf labels not only offer the convenience of displaying and updating prices digitally but also enable the company to optimize price adjustments on the labels, opening up new opportunities for enhanced efficiency and pricing strategies.

In April 2021, SES-imagotag has been given a contract to deploy its VUSION Retail IoT Cloud platform, which includes electronic shelf labeling technology, in numerous Walmart Canada stores across the country.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lcd shelf label market analysis from 2022 to 2032 to identify the prevailing lcd shelf label market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lcd shelf label market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lcd shelf label market trends, key players, market segments, application areas, and market growth strategies.

LCD shelf label Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.5 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 423 |

| By component |

|

| By display size |

|

| By communication technology |

|

| By store type |

|

| By Region |

|

| Key Market Players | Diebold Nixdorf, Incorporated., Highlight Manufacturing Corp., Ltd, RECHI Retail System Solutions Limited, Zkong, Samsung Electro-Mechanics Co Ltd., SES-imagotag SA, Displaydata Limited, ZhSunyco, ACLAS (Xiamen Pinnacle Electrical Co., Ltd), Hanshow Technology |

Analyst Review

The LCD shelf label market is projected to depict prominent growth during the forecast period, owing to various factors, such as the increasing demand for real-time pricing updates and accurate product information, the need for automation and efficiency in retail operations, and the growing adoption of digital transformation in the retail industry. LCD shelf labels provide retailers with the ability to instantly update prices and product details, reducing manual labor and improving operational efficiency. They also enhance customer experience by enabling accurate and dynamic pricing, allowing customers to make informed purchasing decisions. With the rising focus on sustainability and cost savings, LCD shelf labels offer a greener and more cost-effective alternative to traditional paper-based labels.

The Asia-Pacific LCD shelf label market is expected to experience growth at the highest CAGR during the forecast period, due to the high presence of retail giants with higher customer interest, and the rapid digitalization of the retail industry in the region. This digital transformation trend, coupled with the region's strong retail ecosystem and customer demand, positions the Asia-Pacific LCD shelf label market for substantial growth potential in the forecast period.

The LCD shelf label market is expected to grow at a CAGR of 14.54% from 2023-2032.

Retail the leading application of LCD shelf label market.

North America is the largest regional market for LCD shelf labels.

The industry size of LCD shelf label is estimated to be $387.87 million in 2022.

The top companies to hold the market share in LCD shelf label are SES-imagotag, Zkong, Samsung Electro-Mechanics Co Ltd., Diebold Nixdorf, and Displaydata Limited.

Loading Table Of Content...

Loading Research Methodology...