Leak Detection Market Research, 2032

The Global Leak Detection Market was valued at $4.7 billion in 2022, and is projected to reach $8.2 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032.

The global market is expected to witness substantial growth during the forecast period. This growth is primarily driven by several key factors, including the aging of infrastructure and the need for regulatory compliance. Furthermore, the market is predicted to expand due to technological advancements and increasing awareness of environmental conservation. Additionally, the expansion of the Internet of Things (IoT) and remote monitoring, along with the development of smart cities, are anticipated to further boost the leak detection market growth projections.

Leak detection refers to the process of identifying and locating leaks within a system or structure, such as pipelines, tanks, or buildings to prevent loss of resources, environmental damage, or potential hazards. This involves utilizing various methods, including visual inspection, pressure testing, acoustic monitoring, and thermal imaging, to pinpoint the source of leaks accurately and efficiently. Effective leak detection plays a crucial role in maintaining safety, minimizing waste, and preserving the integrity of infrastructures across various industries.

Key Takeaways

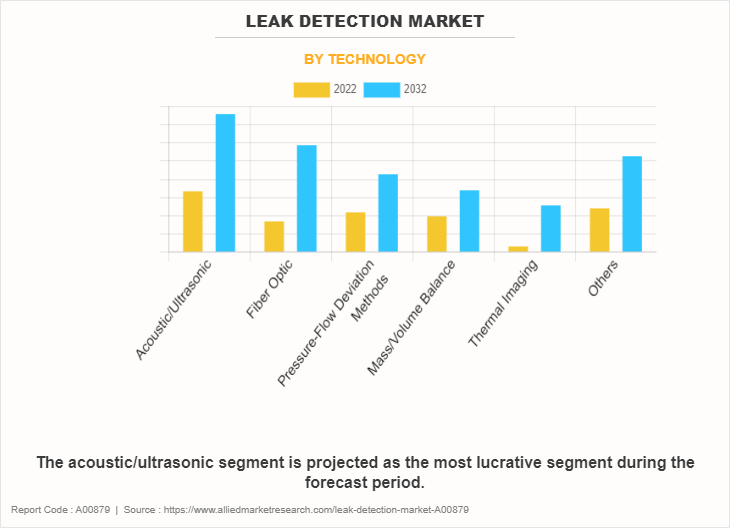

- By technology, the acoustic/ultrasound segment held the largest share of the leak detection market in 2022. However, the fiber optic segment is anticipated to grow at the fastest CAGR during the forecast period.

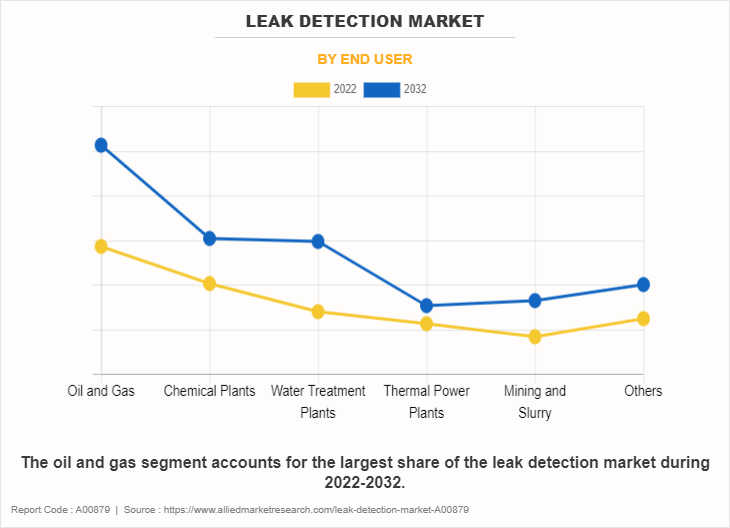

- By end user, the oil & gas segment held the largest share in the leak detection industry in 2022. However, the water treatment plants segment is anticipated to grow at the fastest CAGR during the forecast period.

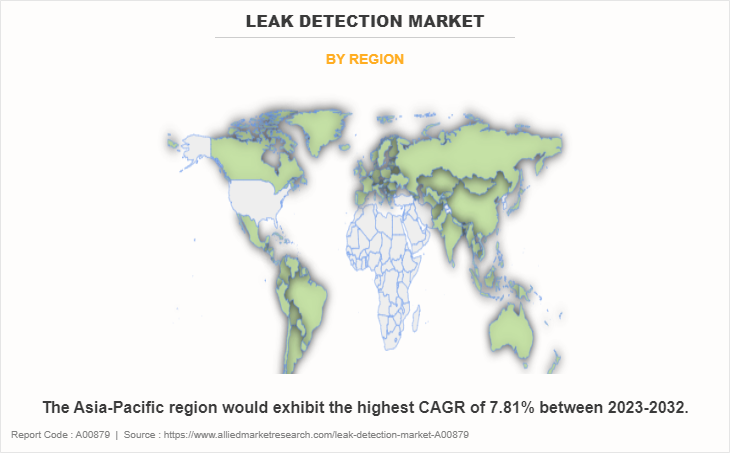

- Region-wise, North America held the largest market share in 2022. The U.S. dominates the leak detection market size by country in the North America region. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Market Dynamics

Growing need for advanced leak detection solutions in aging infrastructure

In sectors such as oil & gas, chemicals, and water management, outdated infrastructure presents a considerable threat, necessitating the adoption of advanced leak detection techniques. Pipelines, tanks, and distribution networks that have been operational for long periods of time are more susceptible to problems such as cracks, corrosion, and overall degradation, leading to potentially costly and hazardous leaks. For instance, a 2023 report from the American Society of Civil Engineers (ASCE) highlighted a substantial $2.6 trillion infrastructure shortfall in the U.S., with water and wastewater systems earning a D grade.

The leakage from pipes results in the wastage of billions of gallons of water annually, indicating the urgent requirement for effective leak detection. Similarly, aging pipelines in the oil & gas sector pose notable environmental and economic hazards. Advanced leak detection technologies enable the early detection of issues, minimizing harm and ensuring compliance with regulations. Proactive leak detection also protects workers in the chemical industry, where leaks can expose them to dangerous substances and release harmful chemicals into the surroundings. As industries prioritize safety, efficiency, and regulatory compliance, the demand for advanced leak detection technologies is anticipated to rise in the coming years.

Financial hurdles limiting the adoption of advanced leak detection systems

High initial costs associated with implementing advanced leak detection systems serve as a significant restraint in the market. For example, a 2023 article from Forbes discusses the challenges faced by small to medium-sized businesses in adopting sophisticated leak detection technologies due to budget constraints. These initial expenses include equipment procurement, installation, and integration, making it financially unaffordable for some organizations to invest in such solutions. Consequently, despite recognizing the importance of leak detection in ensuring operational safety and compliance, many companies are prevented from making the necessary investments, hindering market expansion.

IoT enhances leak detection with real-time monitoring, creating market opportunity

The expansion of Internet of Things (IoT) technology and remote monitoring capabilities offers a significant opportunity in the leak detection market by enabling real-time detection and proactive maintenance strategies. With IoT sensors deployed in pipelines, tanks, and other infrastructure, companies can swiftly identify leaks and potential issues before they escalate, reducing the risk of environmental damage and operational downtime. In addition, companies such as IBM have developed IoT-based solutions for leak detection. For instance, its Watson IoT platform utilizes AI and sensor data to identify irregularities in water distribution systems in real time. This integration of technology and proactive monitoring enhances operational efficiency as well as mitigates risks, making it an attractive opportunity for stakeholders in the leak detection market.

Segment Overview

The global market is analyzed by technology, end user, and region.

On the basis of technology, the leak detection market is segmented into acoustic/ultrasound, fiber optic, pressure-flow deviation methods, mass/volume balance, thermal imaging, and others. In 2022, the acoustic/ultrasound segment held the largest share of market due to its high sensitivity in detecting leaks and its ability to rapidly identify the location of a leak within various infrastructure systems.

On the basis of end user, the leak detection industry is segmented into oil and gas, chemical plants, water treatment plants, thermal power plants, mining and slurry, and others. In 2022, the oil and gas segment was the highest revenue generator in the leak detection industry, primarily due to the critical need for ensuring pipeline durability, preventing environmental pollution, and complying with stringent safety regulations in the sector.

On the basis of region, the leak detection market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, Chile, rest of Latin America ), and Middle East & Africa (UAE, Saudi Arabia, South Africa, rest of MEA). In 2022, North America held the largest market share in the leak detection industry due to stringent regulatory standards, aging infrastructure, and the presence of many oil and gas pipelines requiring advanced leak detection solutions.

In North America, the U.S. holds the highest market share in the leak detection market. This dominance can be attributed to the extensive network of aging oil and gas infrastructure that requires rigorous monitoring and maintenance. The U.S. has a vast network of pipelines covering millions of miles, and regulatory bodies such as PHMSA (Pipeline and Hazardous Materials Safety Administration) impose strict regulations to ensure pipeline integrity. For example, the Keystone pipeline leaks, which have underscored the need for advanced leak detection technologies to prevent environmental disasters and ensure operational safety.

Germany leads the leak detection market in Europe, driven by its robust industrial sector, stringent environmental regulations, and commitment to sustainability. The country is home to a significant number of chemical manufacturing plants and has a dense network of pipelines for natural gas and oil, necessitating high standards for leak detection to prevent industrial accidents and environmental pollution. For example, the German government's action towards reducing greenhouse gas emissions and preventing industrial accidents has amplified the demand for leak detection solutions in the region.

China dominates the market in the Asia-Pacific region, due to its rapid industrial growth, extensive urbanization, and the government's focus on environmental protection and safety. China has the largest network of pipelines in Asia, including the West-East Gas Pipeline, requiring advanced leak detection systems to monitor and prevent leaks. The country's ongoing infrastructure projects, such as the expansion of its natural gas pipeline network to meet its increasing energy demands, further fuel the demand for advanced leak detection technologies.

Brazil stands out as the highest shareholder in Latin America for its leak detection market share, primarily due to its large oil and gas sector, including offshore oil fields and an extensive network of pipelines across the country. Petrobras, the state-controlled oil company, has invested in leak detection technologies following oil spills and pipeline leaks to mitigate environmental impacts and comply with regulatory requirements. The country's effort to enhance the safety and efficiency of its oil and gas operations significantly contributes to the leak detection growth projections.

Saudi Arabia leads the market in the Middle East & Africa region, owing to its position as one of the world's largest oil producers and exporters. The country has an extensive network of pipelines transporting oil and gas across vast desert areas, making leak detection a critical aspect of its energy sector. Saudi Aramco, the national petroleum and natural gas company, utilizes advanced leak detection systems to monitor its infrastructure, ensuring operational integrity and environmental protection in the face of harsh geographic and climatic conditions.

Transitioning from the macro scale of national infrastructure in Saudi Arabia to the micro scale of residential and commercial properties, the importance of leak solutions remains universally acknowledged. These technologies not only safeguard the oil and gas sectors' critical pipelines but also extend their protective benefits to homes and businesses, demonstrating the versatile application and critical need for advanced leak detection across various environments. The growing integration of leak solutions within residential and commercial spaces has significantly enhanced safety and efficiency, particularly through the adoption of leak detection automatic shut off valves. These valves, alongside leak detector alarm systems, provide a comprehensive approach to managing potential water damage risks. With the ability to automatically halt water flow at the first sign of a leak and alert occupants with an audible alarm, these technologies combine to offer a robust defense against the costly and damaging effects of water leaks.

Top Impacting Factors

The growth of the leak detection market is significantly influenced by several factors. Stringent environmental regulations and increasing concerns regarding resource conservation drive the demand for advanced leak detection technologies across various industries. Also, rise in infrastructure development projects globally, along with the growing adoption of smart technologies, promotes the integration of innovative leak detection solutions; thereby enhancing the market growth. However, challenges persist, in the form of high initial investment costs and the complexity of implementing sophisticated detection systems, which pose barriers to adoption, particularly for smaller enterprises. Nonetheless, advancements in IoT, AI, and remote monitoring offer promising opportunities for enhancing detection capabilities and proactive maintenance strategies, highlighting the dynamic nature of market.

Competitive Analysis

The leak detection market report highlights the highly competitive nature of market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing market demands. The competitive environment in this market is expected to increase as product launches, and partnership kind of strategies adopted by key vendors increase. Competitive analysis and profiles of the major market players that have been provided in the report include Honeywell International Inc., Siemens AG, Schneider Electric SE, FLIR Systems Inc., Emerson Electric Co., Pentair PLC, Pure Technologies Ltd., Sensit Technologies LLC, Bridger Photonics, Inc., and Perma-Pipe International Holdings, Inc.

Recent Developments in Leak Detection Industry

According to the latest leak detection market overview, Honeywell International Inc. leads the market share by company, followed closely by Siemens AG, Schneider Electric SE, FLIR Systems Inc., Emerson Electric Co. The leading companies are adopting strategies such as product launch and product expansion to strengthen their market position in market.

In October 2021, Honeywell launched two new Bluetooth-connected gas detectors, Searchline Excel™ Plus and Excel™ Edge. These devices, designed to work in adverse weather conditions like fog, rain, and snow, use advanced optics and infrared technology for continuous monitoring of dangerous gases at industrial sites, enhancing safety for workers in the oil and gas, petrochemical, and chemical industries. With Bluetooth connectivity, these detectors allow for easier maintenance and calibration, ensuring reliable gas detection over long distances and in poor visibility, supporting both short and long-range monitoring applications.

In November 2021, Schneider Electric and Prisma Photonics announced a partnership to provide services to oil and gas pipeline owners and operators to prevent accidental and malicious activity by providing real-time intelligence and precise monitoring of oil and gas infrastructure. As a result, customers can drive efficiency and sustainability through energy and resource loss avoidance.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the leak detection market analysis from 2022 to 2032 to identify market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the leak detection market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global leak detection market trends, key players, market segments, application areas, and market growth strategies.

Leak Detection Market, by Technology Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.2 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Sensit Technologies LLC, Pure Technologies Ltd., Bridger Photonics, Inc., Schneider Electric SE., Perma-Pipe International Holdings, Inc., Honeywell International Inc., Pentair PLC, FLIR Systems Inc., Emerson Electric Co., Siemens AG |

Analyst Review

The leak detection market is an essential component of the global infrastructure, ensuring safety and operational efficiency in various industries, including oil & gas, water management, chemicals, and more. This market's significance has grown over the years due to rise in awareness about the environmental impact of leaks, stringent regulatory standards, and the critical need to prevent industrial accidents and minimize operational disruptions.

The leak detection market has been driven by several factors, including technological advancements. Innovations in sensors, software algorithms, and connectivity technologies have significantly improved leak detection capabilities, allowing for real-time monitoring, precise localization of leaks, and even predictive maintenance capabilities. The adoption of Internet of Things (IoT) technologies has further enhanced the efficiency and effectiveness of leak detection solutions, enabling remote monitoring and management of pipelines and storage facilities across vast geographical areas.

Stringent environmental and safety regulations globally have also played a crucial role in the market growth. Governments and regulatory bodies have imposed strict guidelines and standards for industries to follow, necessitating the adoption of advanced leak detection systems. These regulations aim to mitigate the environmental impact of industrial leaks, safeguard public health, and ensure the safety of workers and communities surrounding industrial sites.

The leak detection market is segmented on the basis of technology, end user, and region. Different industries utilize various technologies such as acoustic/ultrasound detection, fiber optic sensors, pressure-flow deviation methods, mass/volume balance techniques, thermal imaging, and others. Each technology offers specific advantages and is chosen based on the application's requirements, the nature of the fluid or gas being monitored, and the environmental conditions of the deployment site.

The end user areas for leak detection technologies are diverse, including oil and gas, chemical plants, water treatment plants, thermal power plants, mining and slurry, and others. Among these, the oil & gas sector is one of the largest and essential. Aging infrastructure, the risk of environmental pollution, and the high cost of leaks have driven the adoption of leak detection solutions in this sector. Water management is another significant area, where the focus is on reducing non-revenue water losses due to leaks in aging municipal water systems. The chemical industry, thermal power plants, and mining are other sectors where leak detection plays a crucial role in ensuring operational safety and environmental protection.

Region-wise, North America has been a leader in the adoption of leak detection technologies, driven by a mature oil & gas industry, stringent regulatory standards, and technological innovation. However, Asia-Pacific is expected to witness significant growth, fueled by rapid industrialization, expanding infrastructure, and increasing environmental awareness.

The industry size of Leak Detection is estimated to be $4,738.0 million in 2022.

The Leak Detection Market is expected to grow at a CAGR of 5.64% during the period of 2023 to 2032.

The leading application of the Leak Detection Market is in the oil and gas industry.

North America currently holds the largest market share for Leak Detection, Asia Pacific is projected to experience the highest growth in the coming years.

The top companies holding significant market share in the leak detection industry include Honeywell International Inc., Siemens AG, Schneider Electric SE, FLIR Systems Inc., Emerson Electric Co.

Loading Table Of Content...

Loading Research Methodology...