Lease Management Market Statistics, 2031

The global lease management market was valued at $4.6 billion in 2021, and is projected to reach $9 billion by 2031, growing at a CAGR of 6.9% from 2022 to 2031. The lease management industry is gaining significant popularity as the lease management systems helps to track your business performance regularly with real-time data availability. Lease management offers several advantages such as tenant applications & screening, maintenance, management & tracking, advertising & marketing, online payments, contract management, financial management, and others.

Lease management software is used to manage and maintain documentation such as financial documents, legal agreements, and lease data of leased-out premises or equipment, thereby simplifying the management of any residential or commercial property. In addition to centralizing lease document storage, the application aids leasing organizations in the management of property portfolios and the identification of high-and low-performing properties. Furthermore, it saves time and works well for storing and retrieving lease property information. Moreover, users can configure notification settings to receive or send email messages (to clients) when financial or legal agreements change, improving operational efficiency. These factors are anticipated to boost the lease management

Technologies such as the Internet of Things (IoT), cutting-edge new sensors, advanced analytics, software as a service (SaaS), and new development environments are currently gaining traction in the lease management market, enabling greater demand than ever before for enterprise integration and accelerating the adoption of lease management software across various real estate firms. Users can communicate on social media with the aid of the software's integrated solutions, which has an impact on project cooperation and space utilization. Furthermore, it is capable of storing sensor, monitoring, and smartphone data, making it possible to use it to automate facilities and guide operations.

However, the high cost of deploying these systems and the requirement for ongoing maintenance and enhancements provide a challenge for lease management managers. Software providers are required to update related applications in their customers' software due to a series of legal changes that influence leasing and contract management. For these regular updates, suppliers charge a premium to customers.

Emerging technologies, such as the Internet of Things (IoT), is seen as one of the most promising as they have the potential to revolutionize real estate management. The introduction of IoT will greatly simplify operations as lease data can be automatically collected and evaluated by sensors for the most efficient maintenance activities. The use of IoT will relieve a loT of the load on lease management systems and allow for more accurate results in a shorter amount of time. IoT is still in its infancy, but it has enormous growth potential in the future. As a result, as the IoT industry evolves, it will undoubtedly have an impact on the global lease management software market.

The key players profiled in this report include Lease Accelerator, Inc, CoStar Group, FORTUNE Media IP Limited, Trimble Inc., Nakisa, RealPage, Inc., Oracle Corporation, IBM, Innolux Corporation, and SAP.

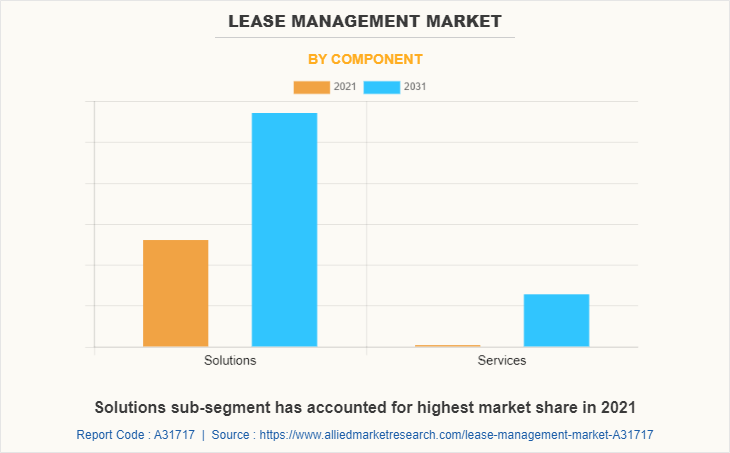

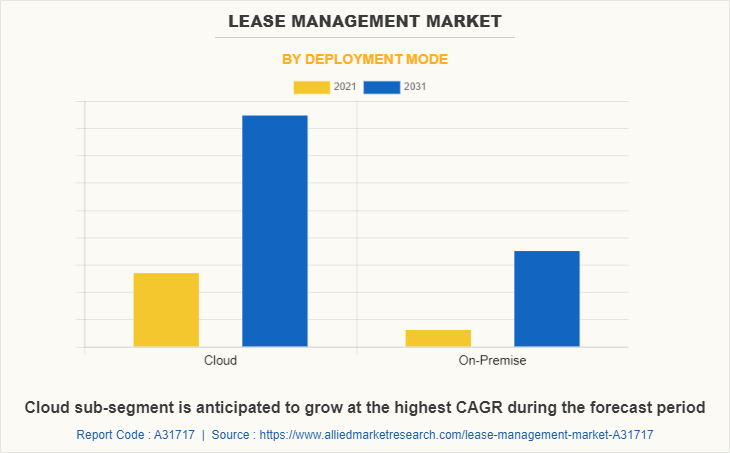

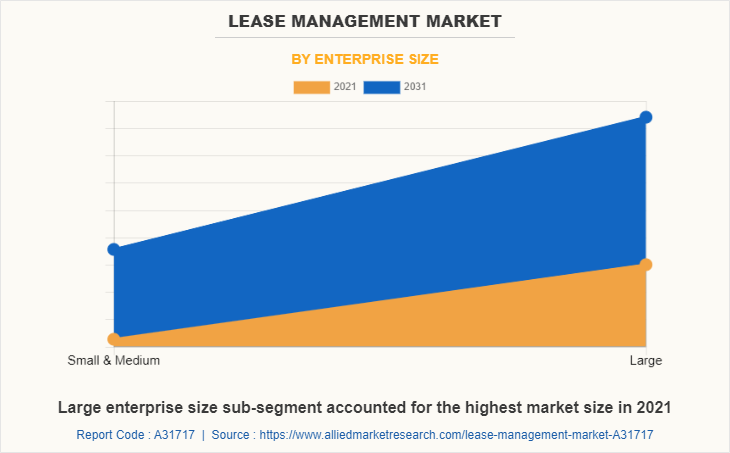

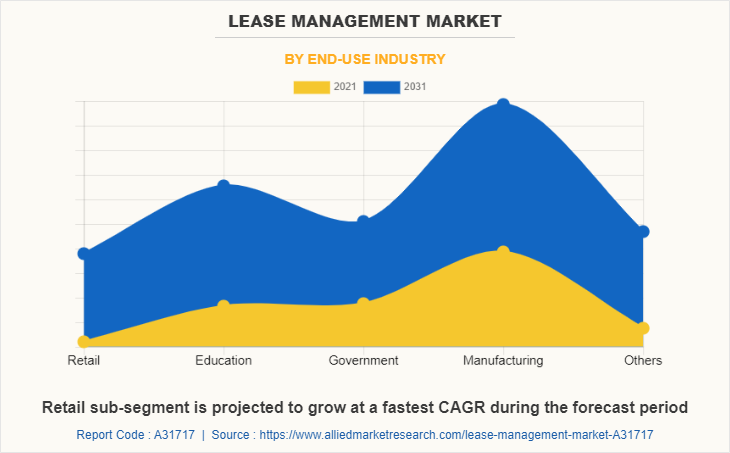

The global lease management market is segmented on the basis of component, deployment mode, enterprise size, end-use industry, and region. By component, the market is sub-segmented into solutions and services. By deployment, the market is classified into on-premise and cloud. By enterprise, the market is classified into large enterprises and small & medium enterprises. By end-use, the market is classified into retail, education, government, manufacturing, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The lease management market is segmented into Component, Deployment Mode, Enterprise Size and End-use Industry.

By component, segment is further classified into solutions and services. The services sub-segment dominated the market in 2021. To govern data efficiently and deliver business insights, the services component offers end-to-end optimal solutions to the company, which is anticipated to drive the services sub-segment market throughout the projected time. In addition, lease obligations are becoming more complex, which increases the need for comprehensive leasing management services for reporting. During the forecast period, these are expected to be the key variables influencing market size for lease management.

The cloud sub-segment is anticipated to be the fastest-growing in the market during the forecast period. The growth of the cloud sub-segment can be attributed to consumers' shifting preferences from traditional on-premise lease management to web-sourced leasing services. The benefits associated with cloud deployments, such as computerization, concurrent access to leasing information, flexibility, cost-effectiveness, and additional services, are contributing to the increased demand for cloud solutions. Furthermore, the advantages of cloud deployments, such as flexibility, cost-efficiency, automation, real-time access to leasing data, and other services, are contributing to the increased demand for cloud solutions.

The large enterprise is the dominant sub-segment that has accounted for the highest revenue share. A large organization's operational activities can flow more smoothly with the aid of lease management. The desire of major companies to have their leasing portfolio managed professionally is rising along with the adoption of lease management by large businesses. During the forecast period, the large enterprise sub-segment is predicted to boost the lease management market share.

By end-use industry, the manufacturing sub-segment has accounted for the highest lease management market size in 2021, and the retail sub-segment is estimated to be the fastest-growing sub-segment. The lease management software is mostly used in manufacturing units as the manufacturing industry works on leases and contracts among all the dealers, and all transactions must be monitored in minute detail. These are expected to be the major factors influencing the size of the lease management market during the forecast period as well.

By region, North America dominated the global lease managementmarket in 2021 and the Asia-Pacific region is anticipated to show the fastest growth during the forecast period. The North America region has established economies (U.S. and Canada), giving it an advantage over other regions in terms of utilizing a highly developed platform for managing key lease resources. The region's dominance is largely due to its early adoption of lease management technologies. An increase in investment by the majority of companies to set up operational flow within the region is expected to drive the regional market during the forecast period. Companies are concentrating their efforts on the development of advanced lease management software.

Top Impacting Factors -

Increasing Demand for Automation

Businesses are increasingly adopting automated lease management software to streamline lease tracking, payments, compliance, and renewals, reducing manual errors and improving efficiency. Such factors drive the growth of the lease management market.

Regulatory Compliance and Lease Accounting Standards

Changing lease accounting standards, such as IFRS 16 and ASC 842, require organizations to manage their leases more effectively, driving the need for advanced lease management solutions.

Growth of Real Estate and Property Leasing

The expansion of the real estate and property leasing sectors, especially in urban areas, has significantly boosted demand for efficient lease management systems to handle complex lease portfolios.

Rising Adoption of Cloud-Based Solutions

The shift towards cloud-based lease management platforms is growing due to their flexibility, scalability, and ease of access, which are critical for organizations with multiple leased assets across locations.

Cost Optimization and Operational Efficiency

Organizations are focusing on cost optimization and operational efficiency, prompting the need for lease management systems that help track lease expenses and identify cost-saving opportunities that drive the growth of the lease management market.

Impact of Digital Transformation

The ongoing digital transformation across industries is leading to the integration of AI, machine learning, and IoT in lease management, offering enhanced analytics, predictive maintenance, and automated workflows.

Remote Work and Hybrid Models

The rise of remote work and hybrid models has impacted corporate real estate needs, leading companies to reevaluate lease management practices, especially for office spaces and corporate assets such factors drive lease management market growth.

Impact of COVID-19

- The recent outbreak of the COVID-19 pandemic had a significant impact on global economic growth. The lease management software integrates all facility management data, allowing the organization to work remotely without disrupting operations. The surge in trend of working from home is expected to be the most powerful driving force in the global lease management market during the pandemic.

- Companies in the lease accounting and management software industry are increasing knowledge about their platforms by delivering new solutions as a result of the pandemic, making lease administration for offices, retail outlets, and warehouses more complex.

- During the COVID-19 recession, businesses focused on developing new technologies to provide clients with cost-effective and timely solutions.

- For instance, in March 2021, RealPage, a company that provides real estate analytics and software, introduced a new virtual tour solution for apartments that includes on-demand tours with a live agent. Potential renters can use this solution to explore interactive content related to the property, such as aerial views, floorplans, 3D walk-throughs, interactive site maps, amenities, and other points of interest. As a result, the coronavirus outbreak is expected to accelerate the adoption of property management technologies thereby facilitating lease management market size in the upcoming years.

Key Benefits for Stakeholders

- The report provides an exclusive and comprehensive analysis of the global lease management market trends along with the lease management market forecast.

- The report elucidates the lease management market opportunity along with key drivers and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the lease management market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims at market dynamics, trends, and developments affecting the lease management market growth.

Lease Management Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 302 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | SAP, CoStar Realty Information, Inc., ibm corporation, RAAMP, LLC., Oracle Corporation, Appfolio, Trimble, Yardi Systems, Inc., LeaseAccelerator, Inc., RealPage, Inc. |

Analyst Review

The growing demand for lease management software as a service (SaaS) model is expected to drive growth in the global lease management market during the forecast period. With the help of lease management, the workflow of the organizations and lease property data can be tracked, which helps in the enhancement of the organizations’ business. These attributes are estimated to fuel the market growth of lease management due to their reliability, quick inspection, data tracking, property management, tenant screening, and many other features. However, a lack of knowledge regarding leasing management software and higher implementation costs for the program in enterprises are limiting market growth in the majority of the world. On the hand, contrary, excessive usage of cloud services' software as a service, makes it possible to browse different web platforms in a budget. The market is expected to grow more quickly due to the rise in demand for smart building initiatives. All these factors have contributed to the global lease management market growth in recent years.

Among the analyzed regions, North America is expected to be the fastest growing during the forecast period followed by Asia-Pacific, Europe, and LAMEA. Numerous businesses are establishing operations in this region and investing in the operational flow. The market is expanding as a result of businesses' use of advanced lease management software.

An increase in the demand for leasing management software as a service (SaaS) models is the latest trend in the market. This is because the majority of software companies are eager to use the cloud to run their products. Additionally, it is predicted that new technical developments in lease management services will create tremendous business opportunities.

The lease management market has a wide range of applications in the manufacturing and retail sectors.

North America is the largest regional market for the lease management market.

The lease management market is estimated to reach $8.9 billion by 2031.

Lease Accelerator, Inc, CoStar Group, and SAP are the major players in the lease management market to hold the highest market share.

Loading Table Of Content...