Legal Practice Management Software Market Research, 2032

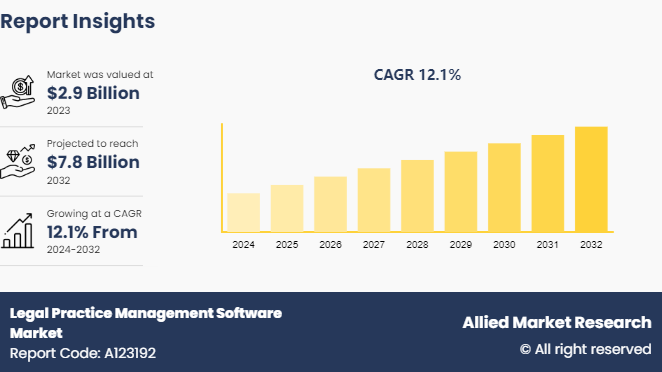

The global legal practice management software market was valued at $2.9 billion in 2023, and is projected to reach $7.8 Billion by 2032, growing at a CAGR of 12.1% from 2024 to 2032. Legal practice management software aims to enhance the efficiency, productivity, and overall effectiveness of legal professionals by automating routine tasks, centralizing information, and improving collaboration within law firms.

Market Introduction and Definition

The legal practice management software market refers to the sector within the software industry that focuses on providing specialized tools and solutions tailored to the unique needs of legal professionals and law firms. This market encompasses a wide range of software applications designed to streamline and optimize various aspects of legal practice, including case management, document management, time tracking, billing, client communication, and more. The legal practice management software market can address the specific challenges and requirements of the legal industry. Legal professionals face complex regulatory requirements, strict deadlines, and a high volume of documentation, making it essential to have specialized software that can help them manage their workload effectively. Legal practice management software offers features such as document automation, legal calendaring, conflict checking, and secure client portals to support the unique workflows and processes of law firms.

Key Takeaways

The legal practice management software market study covers 20 countries. The research includes a legal practice management software market size and segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major legal practice management software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights and legal practice management software market forecast.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

Legal practice management software driven by the exponential growth of data generated by businesses, individuals, and connected devices. The increasing digitization of processes and the rise of IoT devices have led to a massive influx of data, creating a need for advanced analytics tools and techniques to extract valuable insights. This data deluge serves as a primary driver for the adoption of legal practice management software, as organizations seek to leverage this wealth of information to gain a competitive edge, improve decision-making, and enhance operational efficiency. However, alongside the drivers, there are also significant restraints that organizations face when implementing legal practice management software. One of the key challenges is the complexity and volume of data, which can overwhelm traditional data processing systems and require significant investments in infrastructure and resources. Data privacy and security concerns also pose a major restraint, as organizations must ensure compliance with regulations and protect sensitive information from breaches and cyber threats. Additionally, the shortage of skilled data analysts and data scientists can hinder the effective implementation of legal practice management software initiatives, limiting the potential benefits that organizations can derive from their data assets. Despite these challenges, legal practice management software presents a wide range of opportunities for organizations across industries. By harnessing the power of legal practice management software, businesses can uncover valuable insights, trends, and patterns that can drive innovation, optimize processes, and enhance customer experiences. From predictive analytics to real-time decision-making, legal practice management software enables organizations to make data-driven decisions that lead to improved performance, increased revenue, and competitive advantage. Furthermore, the integration of advanced technologies such as machine learning and artificial intelligence with legal practice management software opens up new possibilities for automation, personalization, and scalability, paving the way for transformative changes in how businesses operate and compete in the digital age.

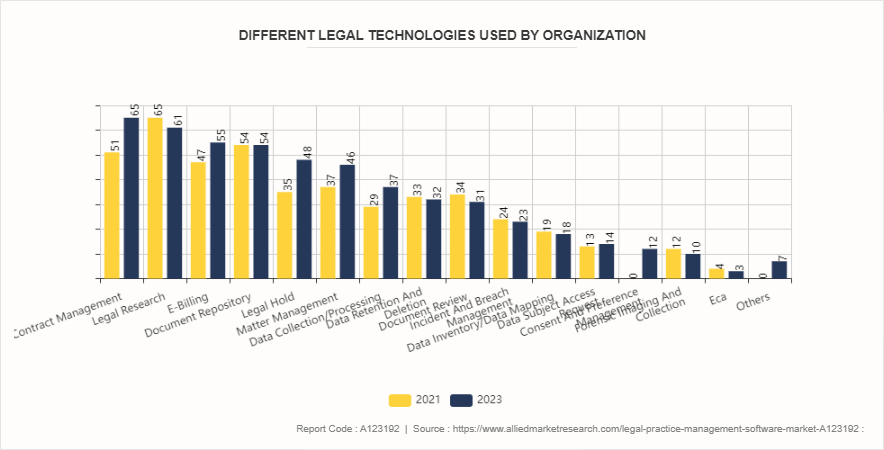

Legal Technology Used by Organization

With a notable growth of 14 points from 2021 to 2022, contract management has become the most often used legal technology software among departments. With this increase, it exceeds legal research technology, which was ranked first at 61 percent earlier. With more than half of participants integrating them into their procedures, e-billing and document repositories are also commonly used. A discernible trend towards utilizing cutting-edge technologies in legal operations is also indicated by the considerable rise in the deployment of data gathering and processing technologies. Even with these developments, less than one-third of participants still use some technologies, which suggests more areas in the legal tech space that might be investigated and employed.

Market Segmentation

The legal practice management software market is segmented into enterprise size, application, deployment mode and region. On the basis of deployment, the market is divided into on-premise and cloud. As per enterprise size, the market is divided into large enterprise and small and medium-sized enterprise. On the basis of application, the market is divided into case management, billing and invoicing, document management, time management and other. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The markets for law practice management software in the U.S. and the UK are expanding and becoming more innovative. Law companies in the UK are using technology frequently to improve client service and optimize operations. There is a broad spectrum of software available on the market that addresses the particular requirements of attorneys, such as tools for document management, time tracking, billing, and case management. In the UK market, cloud-based solutions are especially widespread since they enable legal firms to securely access their data from any location and enhance teamwork. Comparably, the US market for law practice management software is expanding, with a wide variety of software companies providing cutting-edge solutions to satisfy the intricate requirements of legal practices. The market is being driven by the growing need for legal firms to become more efficient and automated. Software features including client intake, matter management, billing, and reporting capabilities are in high demand. Another significant development in the U.S. industry is integration with other platforms and tools, like e-discovery software and legal research databases, which helps law firms increase efficiency by streamlining their workflows.

In April 2024, GoCardless, the bank payment company, expanded its partnership with Intuit QuickBooks, a leading financial management software, with two new launches. The fintech has now introduced a GoCardless app in the Intuit Quickbooks Marketplace in Australia and the United States, enabling more than 225, 000 QuickBooks users to tap into Direct Debit to help them reduce late payments and improve cash flow. By introducing GoCardless and its Direct Debit capabilities, Intuit QuickBooks small business users stand to gain greater control of their finances.

In March 2023, LawPay, the leading online payment solution for legal professionals, announced its new integration with leading legal accounting software, QuickBooks Online. The new integration allows small and medium-sized legal firms to automatically upload LawPay transaction data to QuickBooks Online. This integration gives LawPay users the ability to save time, increase operational productivity, and increase customer satisfaction.

In February 2020, Intuit ProConnect partnered with Karbon, to continue accelerating software capabilities for tax professionals. Karbon, a practice management solution and advanced work and communications platform, enables a collaborative place for accounting firms and professional services to manage workflows, communicate with teams and deliver exceptional client work in today’s digital workplace.

Industry Trends

In May 2023, SAP SE and Google Cloud announced an extensive expansion of their partnership, introducing a comprehensive open data offering designed to simplify data landscapes and unleash the power of business data. The offering enables customers to build an end-to-end data cloud that brings data from across the enterprise landscape using the SAP Datasphere solution together with Google’s data cloud, so businesses can view their entire data estates in real time and maximize value from their Google Cloud and SAP software investments.

In March 2023, SAP SE announced key data innovations and partnerships that give customers access to mission-critical data, enabling faster time to insights and better business decision-making. SAP announced the SAP® Datasphere solution, the next generation of its data management portfolio, which gives customers easy access to business-ready data across the data landscape. SAP also introduced strategic partnerships with industry-leading data and AI companies – Collibra NV, Confluent Inc., Databricks Inc. and DataRobot Inc. – to enrich SAP Datasphere and allow organizations to create a unified data architecture that securely combines SAP software data and non-SAP data.

For instance, in May 2021, ON24 launched its ON24 Big data analysis would also be available in the Japanese language, starting with ON24 Webcast Elite. This demonstrates the company’s efforts to strengthen its market position in Asia-Pacific. This functionality is expected to empower ON24 Webcast Elite to provide a more user-friendly user interface to Japanese consumers for easily creating on-demand and live digital experiences with analytics and reporting.

Competitive Landscape

The major players operating in the legal practice management software industry include Abacus Data Systems, Thomson Reuters Elite, LexisNexis, Smokeball, Clio, Rocket Matter, DPS Software, BHL Software Pty., Ltd., CloudLex, Intuit, Inc. and so on.

Recent Key Strategies and Developments

In February 2024, Legal Soft, a leading virtual legal staffing company partnered with Clio, the world’s most robust legal technology platform. Legal Soft is at the forefront of virtual legal staffing, revolutionizing the way legal professionals connect and collaborate. With a commitment to leveraging cutting-edge technology and ensuring unparalleled client satisfaction, Legal Soft has cemented its position as a leader in the legal industry. The synergy between Legal Soft's innovative approaches and Clio's groundbreaking legal technologies has culminated in a strategic partnership.

In April 2021, Intuit ProConnect, from Intuit Inc., partnered with Practice Ignition (PI) to increase productivity for tax professionals. Practice Ignition, an automated proposal and payment management software that eliminates administrative tasks, will work in tandem with Intuit professional tax products, allowing for a better end-to-end workflow for tax professionals.

In August 2020, Bill.com, a leading provider of cloud-based software that simplifies, digitizes, and automates complex back-office financial operations for small and mid-sized businesses, extended its long-standing partnership with Intuit Inc., the makers of QuickBooks Online Advanced, TurboTax and Mint. The enhanced partnership will add advanced bill payment and workflow automation capabilities for QuickBooks Online Advanced customers as part of Intuit’s application ecosystem, in addition to continued support for the Simple Bill Pay service in QuickBooks Online.

In August 2021, Uptime Legal Systems, a leading provider of technology and cloud services to law firms, partnered with Clio, a leading provider of law practice management software. Uptime Legal has been providing cloud and practice management solutions to hundreds of law firms for over a decade.

Key Sources Referred

Jdsupra.com

Legalmart.com

Legalitprofessional.com

Acc.com

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the legal practice management software market size, segments, current trends, estimations, and dynamics of the legal practice management software market analysis from 2024 to 2032 to identify the prevailing legal practice management software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the legal practice management software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global legal practice management software market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the legal practice management software industry and legal practice management software market forecast

- The report includes the analysis of the regional as well as global legal practice management software market trends, key players, market segments, application areas, and legal practice management software market growth strategies.

Legal Practice Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.8 Billion |

| Growth Rate | CAGR of 12.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 324 |

| By Deployment Mode |

|

| By Application |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Thomson Reuters Elite, intuit, inc., DPS Software, CloudLex, BHL Software Pty., Ltd., Smokeball, Rocket Matter, LexisNexis, clio holdings, llc, Abacus Data Systems |

The legal practice management software market was valued at $2.9 billion in 2023 and is estimated to reach $7.8 billion by 2032, exhibiting a CAGR of 12.1% from 2024 to 2032.

Increasing demand for efficient and streamlined legal operations and growing adoption of cloud-based solutions for remote access and collaboration are the upcoming trends of Legal Practice Management Software Market in the globe.

Expansion of the legal industry globally, creating a larger market for software solutions is the leading application of Legal Practice Management Software Market.

North America is the largest regional market for Legal Practice Management Software in 2023.

Abacus Data Systems, Thomson Reuters Elite, LexisNexis, Smokeball, Clio, Rocket Matter, DPS Software, BHL Software Pty., Ltd., CloudLex, Intuit, Inc. are the top companies to hold the market share in Legal Practice Management Software.

Loading Table Of Content...