Life Science Analytics Software Market Research, 2032

The global life science analytics software market size was valued at $27 billion in 2022, and is projected to reach $77.4 billion by 2032, growing at a CAGR of 11.2% from 2023 to 2032. The growth of the life science analytics software market share is driven by increasing adoption of advanced technologies, such as big data analytics, machine learning, and artificial intelligence, within the life sciences industry, and escalating volume of data generated across various stages of drug development, clinical trials, and patient care which requires efficient analytics solutions to manage, process, and extract actionable intelligence from this wealth of information.

For instance, according to a 2022 report by National Library of Medicine, it was reported that healthcare has always generated huge amounts of data and nowadays, the introduction of electronic medical records, as well as the huge amount of data sent by various types of sensors or generated by patients in social media causes data streams to constantly witness growth. This rise in adoption of life science analytics software and rise in healthcare data is expected to contribute significantly to the market growth.

Key Takeaways

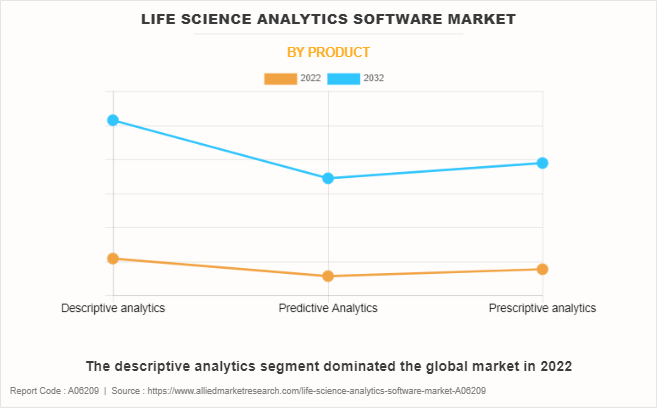

- By product, the descriptive analytics segment held the largest share in the life science analytics software market in 2022.

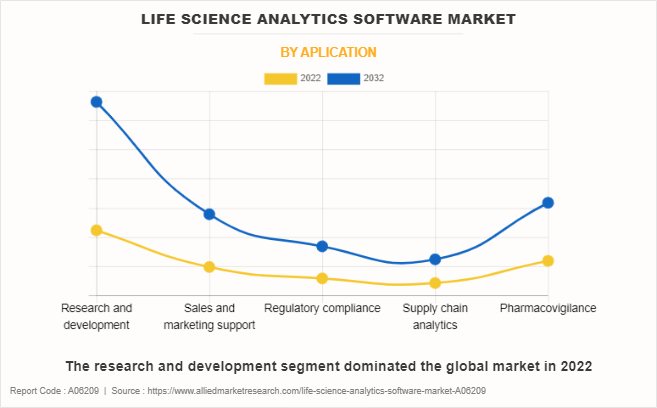

- By application, the research and development segment held the largest share in the life science analytics software market in 2022.

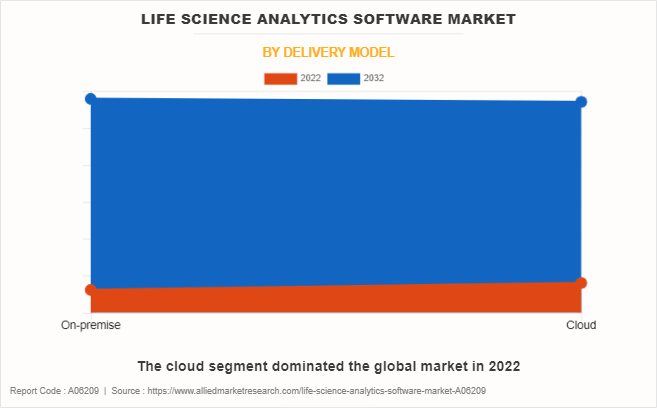

- By delivery model, the cloud segment held the largest share in the life science analytics software industry in 2022.

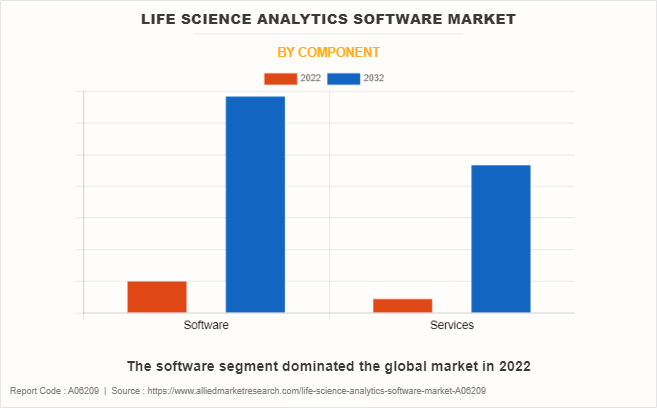

- By component, the software segment held the largest share in the life science analytics software industry in 2022.

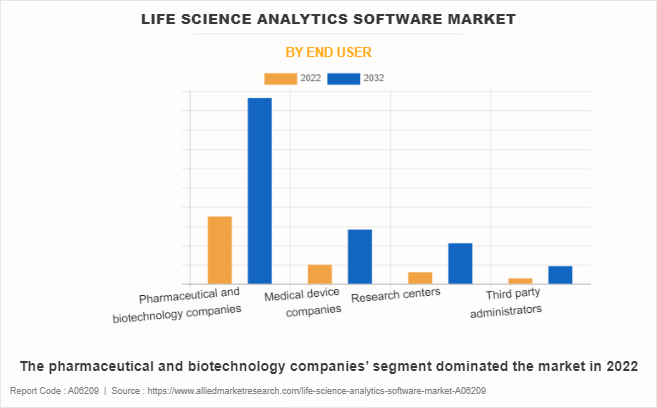

- By end user, the pharmaceutical and biotechnology companies segment is expected to show the fastest market growth during the Life Science Analytics Software Market forecast period.

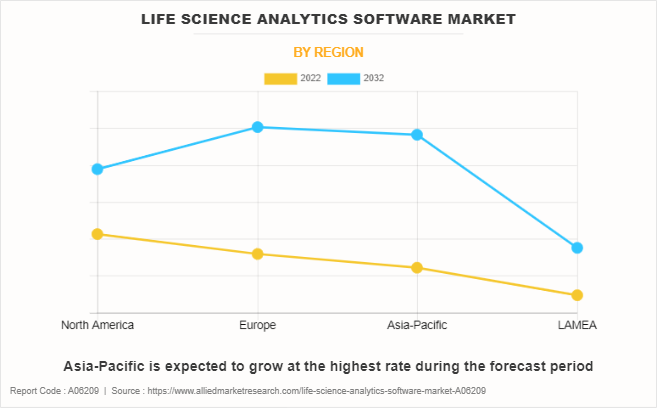

- Region-wise, North America held the largest market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Life science analytics software is a specialized tool designed to analyze and interpret complex biological and healthcare data, providing valuable insights for researchers, clinicians, and pharmaceutical companies. This software leverages advanced data analytics, machine learning, and artificial intelligence algorithms to process vast amounts of information from diverse sources such as genomics, clinical trials, and electronic health records. By extracting meaningful patterns and correlations, life science analytics software assists in identifying potential drug targets, predicting patient outcomes, and optimizing clinical trial designs. It plays a crucial role in accelerating drug discovery, improving personalized medicine approaches, and enhancing overall healthcare decision-making. The integration of these analytics solutions fosters a data-driven approach in the life sciences, ultimately contributing to advancements in medical research and the development of more effective and targeted treatments.

Life Science Analytics Software Market Dynamics

Growth in trend of digitization in healthcare industry and rise in adoption of life science analytics software by pharmaceutical and biotechnology companies are the key factors driving the growth of the market. The healthcare industry is experiencing a significant transformation driven by the growing trend of digitization, and this shift is significantly propelling the life science analytics software market size. The adoption of digital technologies in healthcare has revolutionized patient care, data management, and operational efficiency. With the widespread implementation of electronic health records (EHRs), healthcare organizations are accumulating vast amounts of patient data. Life science analytics software plays a pivotal role in harnessing this data by providing advanced analytics, predictive modeling, and business intelligence tools. These software solutions enable healthcare professionals and life science researchers to derive valuable insights from the massive datasets, aiding in personalized medicine, drug discovery, and clinical decision-making. For instance, according to a 2022 report by the National Library of Medicine, it was reported that proper use of the patient data will allow healthcare organizations to support clinical decision-making, disease surveillance, and public health management. Thus, the growing trend of digitization in the healthcare industry is expected to drive the Life Science Analytics Software Market growth.

The surge in the adoption of life science analytics software by pharmaceutical and biotechnology companies has emerged as a pivotal driver propelling the growth of the life science analytics software market share. Pharmaceutical and biotechnology companies use life science analytics software for optimizing research and development processes. These advanced analytical tools empower organizations to gain actionable insights from vast datasets, aiding in the identification of potential drug candidates, biomarkers, and therapeutic targets. The life science analytics software capabilities extend beyond data analysis, facilitating evidence-based decision-making, risk assessment, and resource allocation throughout the drug development lifecycle. This results in streamlined workflows, accelerated drug discovery and development procedures, and increased overall operational efficiency. For instance, Thermo Fisher Scientific Inc. provides Watson LIMS, a bioanalytical testing software that plays a critical role in drug development. The software provides vital pharmacokinetic, pharmacodynamic, and immunogenicity data on a potential therapeutic. Thus, the high adoption of life science analytics software is expected to drive the growth of the life science analytics software market.

However, high cost of life science analytics software is expected to restrain the growth of the market. The considerable expense involved in acquiring, implementing, and maintaining these sophisticated analytical tools poses a formidable challenge for organizations operating in the life sciences industry. The need for cutting-edge technologies, robust infrastructure, and skilled personnel adds to the overall cost, making it a substantial investment for companies of varying sizes. Small and medium-sized enterprises may find it financially challenging to adopt such software, potentially limiting their ability to harness the benefits of advanced analytics for research and development. As a result, the life science analytics software market might face resistance in achieving widespread adoption, hindering its potential growth.

In addition, the rapid technological advancements in life science analytics software have emerged as a significant opportunity for growth in the life science analytics software market. The advancement of cutting-edge technologies, such as artificial intelligence (AI), machine learning, and big data analytics, has revolutionized the landscape of life sciences, providing important insights and transforming the way data is collected, processed, and utilized. These advancements enable life science analytics software to analyze vast and complex datasets with remarkable precision, uncovering patterns, trends, and correlations that were previously challenging to identify. Thus, the technological advancement in life science analytics software is expected to present significant growth opportunity in the market.

Life Science Analytics Software Market Segmental Overview

The life science analytics software market is segmented on the basis of product, application, delivery model, component, end user, and region. By product, it is divided into descriptive analytics, prescriptive analytics and predictive analytics. On the basis of application, it is classified into research & development, sales & marketing support, regulatory compliance, supply chain analytics and pharmacovigilance. On the basis of delivery model, it is bifurcated into on-premise and cloud. By component, it is segmented into software and services. By end user, it is segmented into pharmaceutical & biotechnology companies, medical device companies, research centers and third-party administrators (TPAS). Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

On the basis of product, the life science analytics software market is categorized into descriptive analytics, prescriptive analytics, and predictive analytics. The descriptive analytics segment dominated the global market in 2022 owing to high adoption of descriptive analytics by healthcare facilities for analyzing patient data.

By Application

On the basis of application, the market is categorized into research & development, sales & marketing support, regulatory compliance, supply chain analytics and pharmacovigilance. The research and development segment dominated the global market in 2022 owing to high demand of life science analytics software to analyze the large amount of data produced during the research and development in the healthcare industry.

By Delivery Model

On the basis of delivery model, the market is categorized into on-premise and cloud. The cloud segment dominated the global market in 2022. This is attributed to the growth in trend of cloud-based services as it requires less investment in infrastructure to maintain IT system for the analytical service.

By Component

On the basis of component, the market is categorized into software and services. The software segment dominated the global market in 2022. This is attributed to growth in trend of technological advancement such as integration of artificial intelligence in the analytical software.

By End User

On the basis of end user, the market is categorized into pharmaceutical & biotechnology companies, medical device companies, research centers, and third-party administrators (TPAS). The pharmaceutical and biotechnology companies segment dominated the market in 2022, owing to high adoption of the life science analytics software by pharmaceutical and biotechnology companies to streamline drug discovery and development process.

By Region

The life science analytics software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market share in terms of revenue in 2022. The growth in this region is mainly attributed to the strong presence of key players and higher adoption of life science analytics software by healthcare facilities. Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributed to rise in prevalence of chronic diseases and surge in research and pharmaceutical companies in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the life science analytics software market, such as SAS Institute Inc., Oracle Corporation, Accenture, Cognizant, Wipro Limited, MaxisIT, Inc., Take Solutions, ExlService Holdings, Inc., Tibco Software Inc, and IQVIA. Major players have adopted product launch, acquisition, and collaboration as a key developmental strategy to improve the product portfolio and gain a strong foothold in the life science analytics software market.

Recent Developments in the Life Science Analytics Software Market

- In October 2021, ExlService Holdings, Inc. announced the launch of a new omnichannel Patient Engagement Platform, which uses real-world patient data and powerful analytics to drive highly personalized care management programs for health plans and self-insured employers. Leveraging AI to analyze patient behaviors and inform a series of patient engagement escalations designed to encourage adherence with value-based guidelines, the new platform is designed to optimize the care management process.

- In December 2021, ExlService Holdings, Inc. announced the acquisition of Clairvoyant, a global data, AI, and cloud services firm. The acquisition strengthens EXL's capabilities by adding additional expertise in data engineering and cloud enablement, further supporting its clients in insurance, healthcare, banking and financial services, and retail.

- In February 2022, Accenture and Astellas Pharma Inc. announced a collaboration to create a cloud-based core IT platform that serves as the foundation for an advanced, data-driven management model for Astellas Pharma Inc.'s global operations.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the life science analytics software market analysis from 2022 to 2032 to identify the prevailing life science analytics software market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the life science analytics software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global life science analytics software market trends, key players, market segments, application areas, and market growth strategies.

Life Science Analytics Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 77.4 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 219 |

| By Product |

|

| By Aplication |

|

| By Delivery Model |

|

| By Component |

|

| By End User |

|

| By Region |

|

| Key Market Players | Oracle Corporation, Cognizant, TIBCO Software Inc., Take Solutions Limited, ExlService Holdings, Inc., SAS Institute Inc., MaxisIT Incorporated, IQVIA, Accenture, Wipro Limited |

Analyst Review

The life science IT market is experiencing robust growth, driven by increase in demand for advanced analytical tools and solutions in the life sciences industry. Rise in technological advancements and increasing complexities in the life sciences industry have propelled the demand for innovative IT solutions. The integration of artificial intelligence, big data analytics, and machine learning has not only streamlined R&D processes but has also enhanced operational efficiency across the entire value chain. The shift towards cloudbased platforms and the adoption of digital technologies in areas such as precision medicine, genomics, and personalized healthcare are redefining the industry's approach to data management and analysis. The ongoing emphasis on regulatory compliance, data security, and interoperability further signifies the critical role of IT in facilitating seamless collaboration and information exchange within the life sciences ecosystem. Region-wise, North America continues to dominate the life science IT market, owing to the presence of major key players, coupled with substantial investments in R&D in life sciences industry. However, the Asia-Pacific region is witnessing growth, driven by rapid growth in life sciences industry, owing to favorable government initiatives supporting growth and innovation in the information technology sector, and increase in awareness of the benefits of life sciences analytical software in drug discovery and development.

Growth in trend of cloud-based services and growth in trend of technological advancement such as integration of artificial intelligence in the analytical software are few upcoming trends of Life Science Analytics Software Market

The research and development segment dominated the global market in 2022

North America is the largest regional market for Life Science Analytics Software Market

The global life science analytics software market size was valued at $27 billion in 2022, and is projected to reach $77.4 billion by 2032, growing at a CAGR of 11.2% from 2023 to 2032.

SAS Institute Inc., Oracle Corporation, and IQVIA, Inc. are the top companies to hold the market share in Life Science Analytics Software Market

There are 10 companies profiled in the Life Science Analytics Software Market

Data privacy and security concerns is the major restraints of Life Science Analytics Software Market

Asia Pacific is the fastest regional market in the Life Science Analytics Software Market

Loading Table Of Content...

Loading Research Methodology...